0.99% APR: Another Reason Why The Tesla Model Y Is The ‘Smart’ Buy If You Want A New EV

“I’m completely upside down on this car,” a Kia EV6 owner told me yesterday as we chatted about the Tesla Cybertruck I was driving. “How do we get out of these?” BMW i3 owners keep saying in a Facebook group that I frequent, in reference to their cars’ plummeting values. So does it make sense to buy an EV today knowing that, in three years, it will likely only be worth only 49% of what you bought it for? Maybe, maybe not. But one vehicle that seems like a good buy today is the Tesla Model Y, especially if you have to finance it. Because Tesla is now offering 0.99% APR.

Used Car Prices Have Been Dropping, And You Can Thank Tesla For That

In our article “Why Used Electric Vehicle Prices Are Plummeting And Why Used EVs Will Probably Get Even Cheaper,” we cited a number of reasons for enormous EV depreciation, with my colleague Matt Hardigree writing:

![]()

So why are EVs faring worse than their gas-powered counterparts? Here’s a good list of reasons:

- Well-maintained, a gas-powered vehicle maintains most of its same capability over its lifespan whereas the batteries in electric cars, currently, offer less value over time. [Ed Note: This was definitely the case with early lithium ion-powered EVs like Nissan Leafs and BMW i3s, but newer EVs aren’t expected to see nearly as much battery degradation over their lifespans. -DT].

- Many electric cars are luxury cars, which already face higher depreciation.

- Whispers: Infrastructure

- David Tracy.

- The best-selling EVs over the last few years have been Teslas.

- Tesla has continually and consistently lowered prices, causing the value of used Teslas to drop in turn.

- David Tracy.

- Tesla’s price drops have created a price war that’s caused other automakers to lower their prices.

- EV sales are rising and, eventually, most of those vehicles will become used cars.

I don’t want to understate the importance of infrastructure in deterring non-EV owners from entering the space, nor do I want to downplay that second bullet about luxury cars, but if we’re being honest: Tesla is the big reasons for EV price drops. Cox Automotive says the same in a recent report on transaction prices:

The market’s general EV price decline has been led in part by the two most popular EVs in the U.S. – the Tesla Model 3 and Model Y. Transaction prices for the Model Y last month, estimated at $49,363, were the lowest on record and were lower versus February 2023 by 16.2%. Model 3 transaction prices last month, at $43,614, were lower year over year by 12% and near the lowest level on record. High incentives and discounts on most models also continue to play a major role in lower EV prices.

That Model Y transaction price is lower than the average transaction price for an EV in 2024, which is $52,000 in the U.S. according to Cox Automotive.

Tesla Isn’t Just Competing On Base Price, Now There’s 0.99% APR

But Tesla isn’t just competing on base-price, it’s also now competing on APR (which is an indicator of how expensive it is to borrow money, accounting for interest and fees). The typical APR in the U.S. is about 6-ish percent for someone buying a new car with excellent credit and about 8 percent if that same person were buying used, per Experian. Tesla is now offering 0.99 percent.

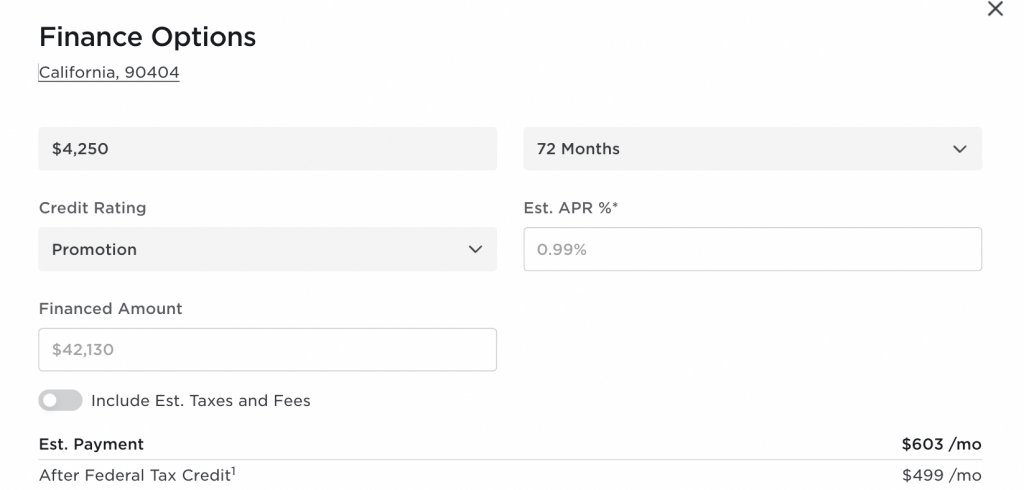

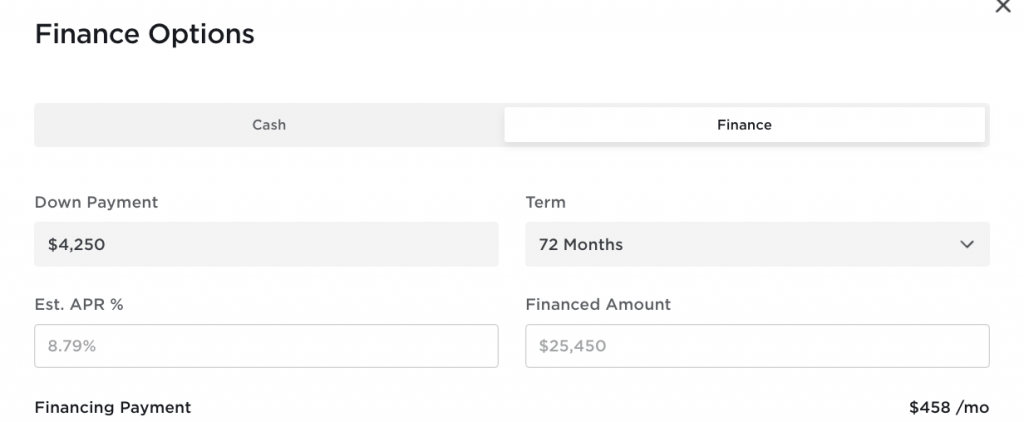

Here, you can see that, if you put 9% down ($4,250) on a new Model Y, you’ll pay about $500 a month over 72 months when you factor in the $7500 federal tax credit:

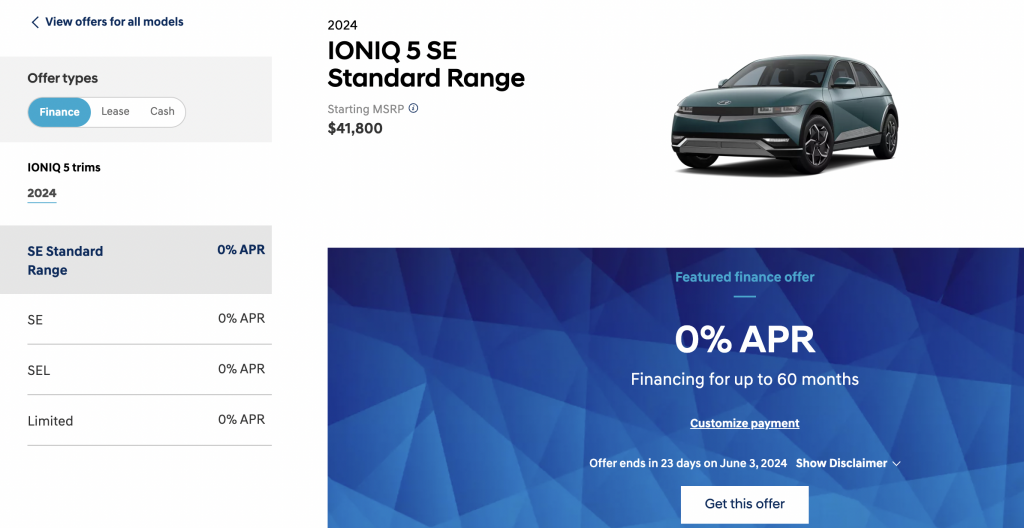

To be sure, Tesla isn’t the only company offering cheap loans. Check out this 0% for 60 months deal that Hyundai is offering on the Ioniq 5:

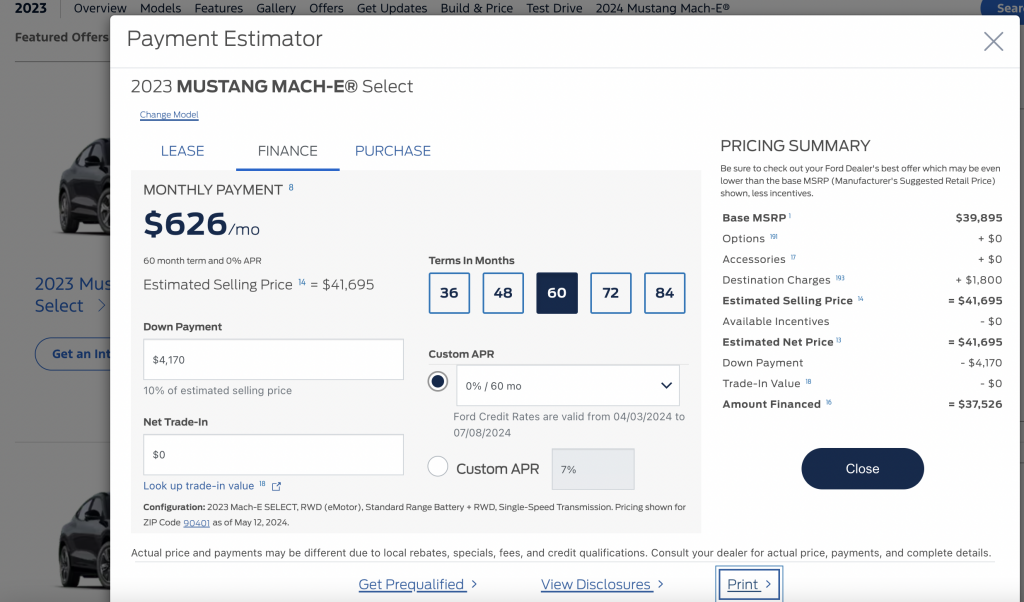

Ford, too, is offering 0% financing on outgoing 2023 Mach-Es:

Obviously, all of this is subject to credit approval, but I mean, damn. Low APRs in a high-interest rate economy. That’s the state of EVs today.

With growth slowing, this is a fiercely competitive space, and all these automakers offering incentives and low interest rates has been a way to try to win customers over from Tesla. Now with Tesla offering the same, and a product that is in many ways more compelling (primarily because of range superiority and the charging network), it’s going to be harder for others to compete. On paper, the Model Y seems like the smartest new-EV buy.

It’s Still Cheaper To Buy Used, But Only By A Little

I’m sure you read the intro of this article and started thinking that the smart move is to buy used, given the 49% value drop of a typical EV over the first three years. And in some cases that is defintiely true, but in the case of the Model Y, it might actually be smarter to buy new. It depends. In my local market, I’d be buying new.

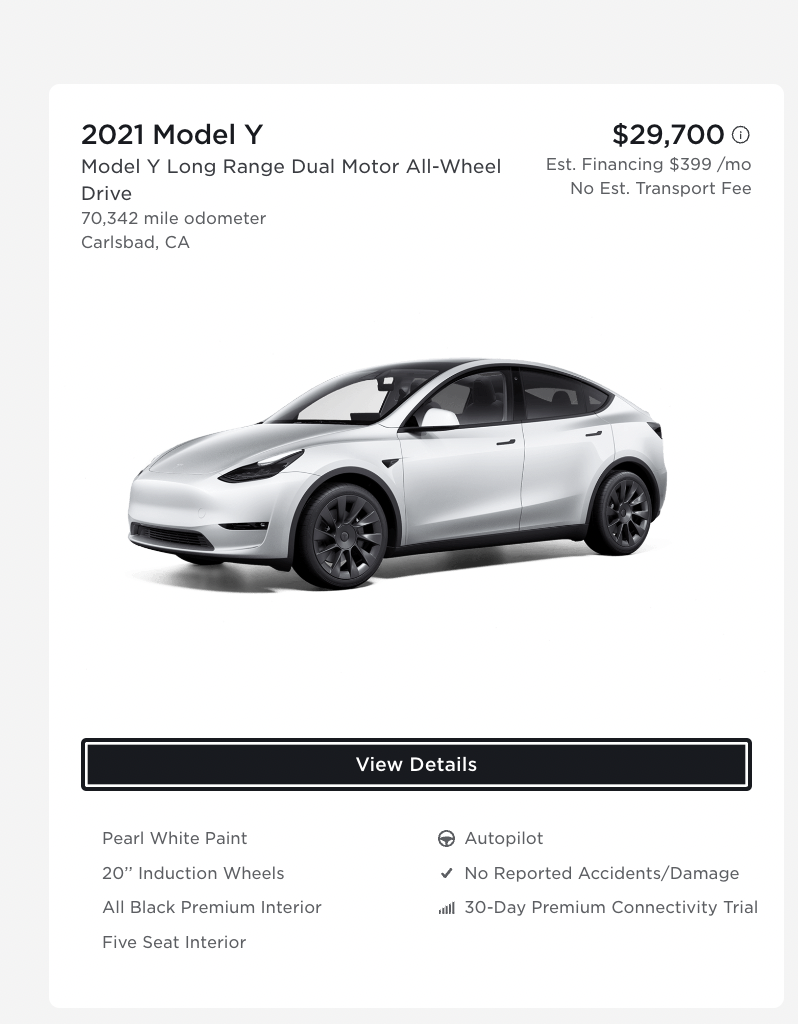

I hopped onto Tesla’s website, and check out the pre-owned Model Ys like the white one you see above listed for about $30,000. That’s quite a bit less than the $46,380 starting price on the Model Y. But let’s break things down a bit.

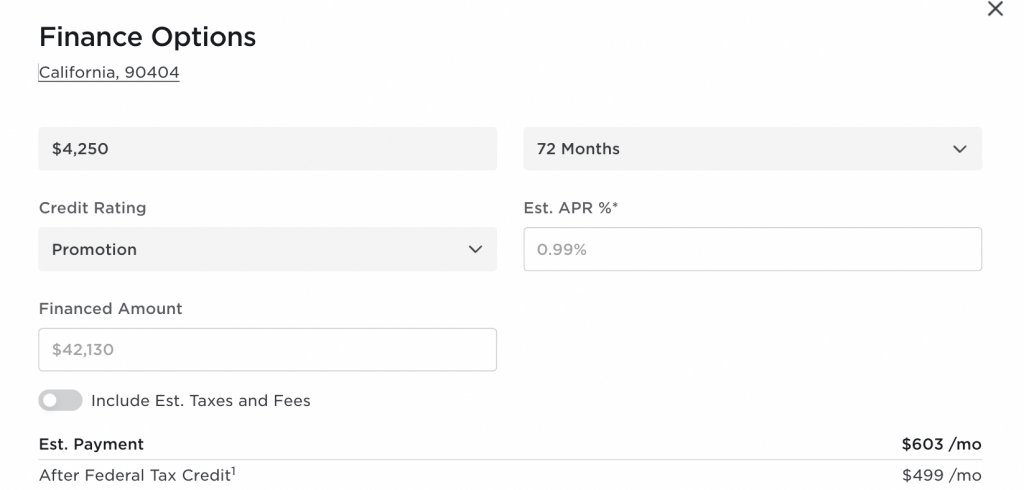

That used Model Y may cost only 29,700, but if we factor in the 8.79% APR, things start to get quite pricey. If you put $4,250 down, you’ll end up paying $7,389.34 in interest over the 72 month term, for a total cost of $37,089.34 (plus fees). Let’s compare that to the new Model Y.

Total cost is $46,380 (that includes the $1,010.71 destination charge). If you put the same $4,250 down, you’re now financing $42,130. At 0.99% interest, you’re going to end up paying $1,281.02 in interest for a total of $47,661.02. Subtract the $7,500 government incentive, and you’re at $40,161. That’s just $3000-ish more than the used Model Y, which has 70,000 miles on it. (By the way, if you’re curious how Tesla calculated the $499 a month figure, it’s $46,380 at 0.99 with $4250 down. That comes to $603 a month; the $7500 incentive, if you divide that by 72 months, comes to $104 a month, so lop $104 from $603 and you get $499).

To be sure, you may be able to find a better interest rate than 8.79 (that’s just the figure I took from Tesla’s own site), and if you shop around, you can probably find a Model Y for under $25,000, which would then make the car eligible for a $4,000 used EV rebate if your adjusted gross income is under $75,000 (for a single filer). So at that point, buying used would still be the smart move.

Still, while you can save money buying a used Model Y, the gap is closing. And depending upon what the depreciation vs. age curve looks like on a Model Y, it might be smarter to buy new, especially if you plan on trading up in a couple of years. There are lots fo factors to consider.

On Paper, The Model Y Is The Best EV Deal There Is

All I know is: The Model Y is an absolute slayer in the EV marketplace when it comes to value. When you factor in how compelling it is as an overall package, with its 320 miles of estimated range, its sup $40,000 asking price after federal incentive, and now 0.99% APR, it’s clearly the best car for the money on paper.

I say “on paper,” because this kind of thing is subjective. It’s the “smart buy,” sure, but I myself am about to pay Model Y money for a BMW i3, which is, on paper, an objectively worse car and thus a less “smart” purchase. But in reality – at least in my view — the i3 is a much, much more compelling machine. So, smart buys be damned: Buy the car you love. If that’s the Tesla Model Y, then you’re a lucky dog. Unless Elon announces another huge price cut in six months — then I’m sorry, your car just became that much less valuable.