1 Artificial Intelligence (AI) Stock, Down 30% From Its Highs, to Scoop Up Now

This has been a much different investing year than 2023. While it started off nearly the same, with practically any stock tied to artificial intelligence (AI) rising, some of the companies have been under greater scrutiny.

That’s exactly what happened to Snowflake (NYSE: SNOW), which is now down 30% from its 2024 highs, last reached at the end of February. Most of this sell-off happened one day after it reported results for its fiscal 2024’s fourth-quarter (ended Jan. 31) — and that will likely make investors more apprehensive about the company’s next results.

However, I think this sell-off was massively overdone, and it’s time to scoop up the stock before it has a chance to rebound.

Snowflake is a vital part of AI proliferation

Snowflake’s business centers around the data cloud, which is becoming increasingly necessary in today’s environment. Businesses are generating massive amounts of data, which is incredibly useful, as it can be used to feed artificial intelligence (AI) models. However, storing it and processing it can be challenging, especially when it isn’t in an organized structure.

With Snowflake’s product, users can efficiently store data across multiple cloud providers and use that information to feed models and applications. Furthermore, if a company has a useful data set, it can sell it on the Snowflake Marketplace to other companies trying to develop an AI model tailored toward a certain demographic.

All of this combines for a company that should thrive as AI models become more mainstream. However, the effect won’t be visible right away. If you look at where the largest demand is, it’s in AI hardware, like Nvidia‘s GPUs. Once the computing infrastructure gets set up, the next growth phase will affect companies that help produce AI models, which Snowflake falls underneath.

A few things to watch for in Q1 results

As a result, Snowflake investors should focus on the long-term prospects, not the short-term. However, investors weren’t happy with some announcements in Q4. Two announcements overshadowed a pretty successful Q4 for Snowflake.

First, longtime CEO Frank Slootman suddenly announced his retirement, and Sridhar Ramaswamy was named his replacement. While the market didn’t like this move, I think it’s great. Sridhar helped grow Google’s advertising wing from a $1.5 billion business to over $100 billion. Snowflake may not get that large, but he at least understands the roadmap from taking a successful business to a much larger one. Because of that, I think he’s the right man for the job.

In addition to the CEO change, Snowflake’s revenue outlook was a bit weaker than investors wanted to see. For Q1 (ended April 30), Snowflake expects between 26% and 27% product revenue growth. For fiscal 2025 (ending Jan. 31), it’s expecting 22% product revenue growth. That’s a pretty significant slowdown throughout the course of the year and much slower than fiscal year 2024’s 38% product revenue growth.

However, on Snowflake’s Q4 conference call, many analysts questioned management on how conservative this guidance was, and it became clear that they were guiding low so they didn’t set the stage for an earnings miss with new management at the helm.

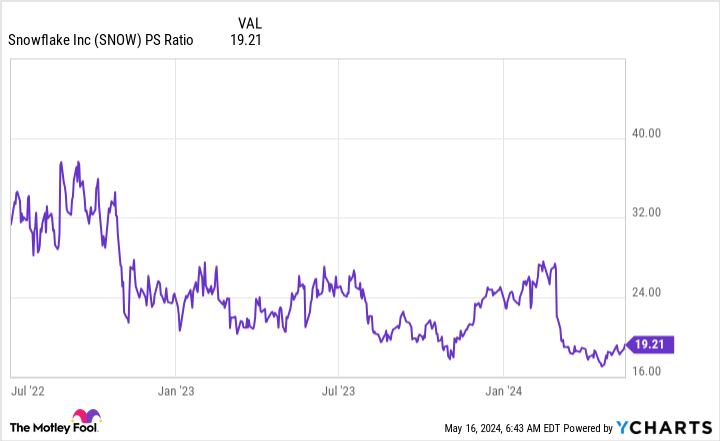

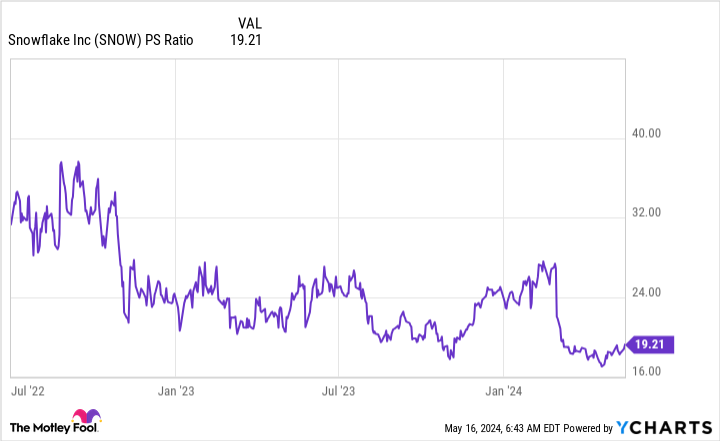

Overall, I think Snowflake is still in good shape, and the business will continue to grow at a healthy pace. Thanks to the sell-off, Snowflake’s stock is also the cheapest it has been in a while.

While 19.2 times sales isn’t cheap in a larger sense, it is historically cheap for Snowflake’s stock. The potential for Snowflake is still there; it’s just clouded by a new CEO and weaker guidance than expected.

When Snowflake announces Q1 results on May 22, I’d be surprised if they didn’t beat expectations. Wall Street expects this, as the average of 33 analysts projects $786 million in revenue. This isn’t the same as product revenue, and when you adjust out Q4’s professional service revenue from that figure ($36.6 million), you get an estimated $749 million in product revenue, which is at the high end of their guidance.

I think Snowflake’s results will be positively reacted to after May 22, which could send the stock skyrocketing. Investors should consider getting in now, as it’s a great entry point for a company with fantastic long-term prospects.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Keithen Drury has positions in Snowflake. The Motley Fool has positions in and recommends Nvidia and Snowflake. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock, Down 30% From Its Highs, to Scoop Up Now was originally published by The Motley Fool