1 Incredibly Cheap Artificial Intelligence (AI) Stock to Buy Before It Goes on a Bull Run

Investors can buy this steadily growing AI stock at an attractive valuation right now.

The proliferation of artificial intelligence (AI) technology has given many technology companies a boost over the past 18 months, and Opera (OPRA -0.67%) is one of them — share prices of the company, which is known for its mobile and personal computer (PC) browsers, have shot up 146% during this period.

However, there has been a sharp pullback in Opera stock more recently. The stock hit a 52-week high in mid-July last year, then lost more than 52% of its value since then. The company’s latest results for the first quarter of 2024 triggered another sell-off as investors seem concerned about Opera’s accelerating capital expenditure, a move that will put its bottom line under pressure this year.

For long-term investors, a closer look at Opera’s growth, valuation, and lucrative AI opportunity suggests that buying this tech stock could turn out to be a smart move. Let’s look at the reasons why.

Opera is growing steadily and is investing in the right area

Opera’s Q1 revenue increased 17% year over year to $101.9 million, while adjusted earnings were flat at $0.17 per share. The numbers edged past estimates, and Opera also raised its full-year revenue growth guidance to 16% from the earlier expectation of 15%.

However, it looks like Opera’s decision to raise its capital expenditure to $20.2 million last quarter from almost nothing in the year-ago period may have gotten investors worried that the company is spending too much money. But it is worth noting that this could be money well spent, as Opera is directing its resources toward building an AI cluster in Norway, powered by Nvidia‘s popular H100 chips.

Management points out that this AI cluster “will support the growth of Opera’s browsers and form the base of its future AI services.” Opera started operating its AI cluster in February this year, and it was quick to bring new AI-powered capabilities to its flagship browser just a month later.

Opera One, which is the company’s flagship browser, enables users to download large language models (LLMs) locally onto their computers. As a result, users will be able to run LLMs locally on their PCs and have control over their data. This is the latest in a series of AI-focused features that Opera has been bringing to its browsers in the past year, which also include allowing users to access popular chatbots such as ChatGPT right from the browser sidebar.

Opera’s move to integrate AI features into its offerings seems to be bearing fruit. The company is witnessing robust growth in the number of high-value customers across North America, Latin America, and Europe. As a result, the company’s annualized average revenue per user (ARPU) jumped an impressive 24% year over year in the first quarter to $1.34.

This metric could continue to move higher as Opera brings more AI-centric services to its customers through its recent investment. As a result, it wouldn’t be surprising to see Opera returning to earnings growth from next year following a decline in 2024 from 2023 levels of $1.86 per share.

OPRA EPS Estimates for Current Fiscal Year data by YCharts

The valuation makes the stock an enticing buy

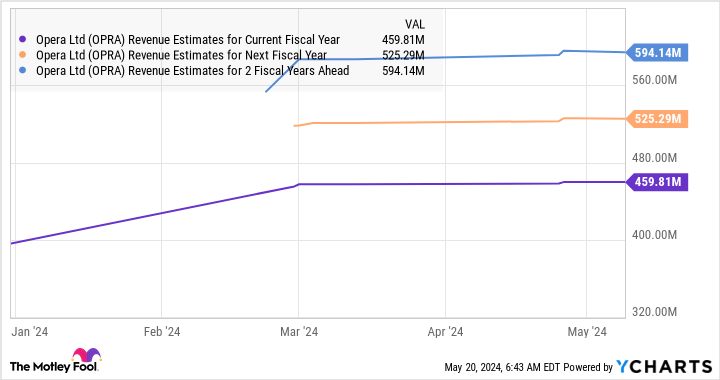

Opera currently trades at just 3 times sales. That’s well below the U.S. technology sector’s average price-to-sales ratio of 7.2, indicating that investors are getting a good deal on this stock right now. We have already seen that Opera’s bottom-line growth is set to accelerate going forward, and its revenue growth is also expected to remain solid.

OPRA Revenue Estimates for Current Fiscal Year data by YCharts

More importantly, Opera should be able to sustain healthy levels of growth for a long time to come as the market for internet browsers is expected to clock 17% annual growth through 2030 and generate $326 billion in annual revenue, according to Adroit Market Research. The integration of AI tools could help Opera capture a bigger share of this lucrative opportunity.

All this indicates why Opera stock carries a 12-month median price target of $20.50 as per six analysts covering the stock, which points toward a 55% jump from current levels. As such, investors should consider buying this AI stock before it goes on a bull run and becomes expensive thanks to a potential AI-driven acceleration in growth.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.