1 Phenomenal Artificial Intelligence (AI) Stock to Buy Hand Over Fist

Taiwan Semiconductor is a crucial supplier in artificial intelligence.

Finding solid artificial intelligence (AI) investments doesn’t necessarily mean picking a software company with the best technology. Instead, choosing a company like Taiwan Semiconductor Manufacturing (TSM -0.37%) that’s supplying the lion’s share of chips used in the hardware that creates AI models is also a great pick.

When investing in a company like Taiwan Semiconductor, also known as TSMC, you don’t have to pick a winner since it will benefit regardless of which of its customers succeed. As a result, I think it’s a stock that investors should be buying hand over fist right now.

TSMC is working on its next product already

TSMC is the world’s largest contract chip manufacturer. It doesn’t sell its chips out on the open market; instead, it is a foundry for companies that need chips. Sometimes, these clients are competitors, like Nvidia and Advanced Micro Devices. This neutral position is key to the TSMC investment thesis, allowing it to benefit from the rising tide of AI.

The company became one of the top chipmakers in the world thanks to its culture of innovation. Recently, it launched full-scale production of its 3-nanometer chips, which accounted for 9% of revenue in the first quarter.

However, just because TSMC has world-leading technology doesn’t mean it’s resting. The company is already developing 2nm chips (the lower the number, the better) that can be configured to be more powerful, more efficient, or a combination of both compared to their 3nm counterparts.

Management expects 2nm chips to reach volume production sometime in 2025, and the demand is already high. Compared to 3nm and 5nm chip launches, management expects the demand for its 2nm chips within two years of launch to be greater than either of those product lines.

This is huge news for investors and supports two other bold predictions by management. First, the company believes its artificial intelligence (AI) related products will have a compound annual growth rate (CAGR) of 50% for the next five years and that AI products will make up around 20% of total revenue by then.

Second, management told investors in January 2022 that it expects revenue to have a CAGR between 15% and 20% for the next several years. It reiterated this guidance when discussing 2024 expectations, and the launch of products like 2nm chips supports this goal.

Taiwan Semiconductor is at the top of the chip market for a reason, and I’m a buyer for that reason alone. However, buying a stock based on a narrative alone could be a recipe for disaster. It also needs to be purchased at a reasonable price.

The stock isn’t cheap, but it’s not overpriced, either

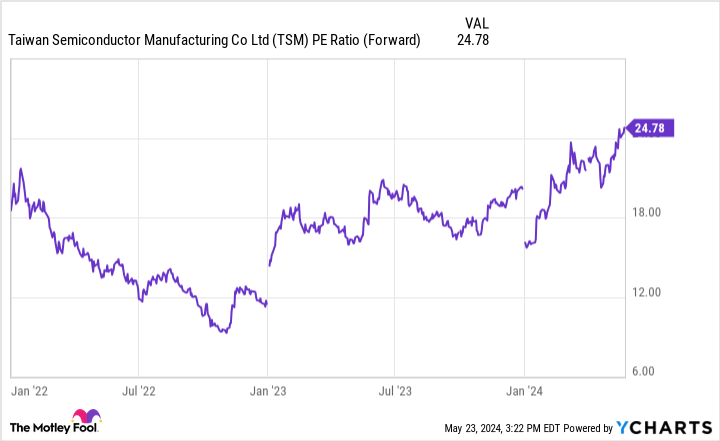

Because TSMC is a profitable company undergoing significant business changes, I’ll use its forward price-to-earnings (P/E) ratio. This method has its drawbacks, but the benefits far outweigh them.

TSM PE ratio (forward) data by YCharts.

The stock is trading at nearly 25 times forward earnings, the highest it has been in some time. But when you compare it to stocks like Nvidia (38 times forward earnings) and AMD (45 times forward earnings), it doesn’t seem so expensive.

Compared to the S&P 500‘s forward P/E of 21.6, TSMC trades at a slight premium. However, it earned this because the company has excellent prospects and top-notch execution.

I think Taiwan Semiconductor is a strong buy right now, and investors should use any weakness in the price as an opportunity to scoop up a top pick in AI.

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.