1 Vanguard Index Fund Up 1,310% in 20 Years to Buy for the Artificial Intelligence (AI) Bull Market

The Vanguard Information Technology ETF (NYSEMKT: VGT) returned 1,310% over the last two decades, compounding at 14.1% annually. By comparison, the S&P 500 (SNPINDEX: ^GSPC) returned 599% during the same period, compounding at 10.2% annually.

Put differently, $100 invested monthly in the Vanguard ETF would be worth about $132,000 today, while the same amount invested in an S&P 500 index fund would be worth just $78,000. The discrepancy between those figures reflects the long-term outperformance of the information technology sector, a pattern that could continue as artificial intelligence supercharges the global economy.

Indeed, generative AI has been the driving force behind the current S&P 500 bull market, and it could continue driving the market higher as more businesses monetize the technology. The Vanguard Information Technology ETF is a proven market beater that could help investors capitalize as the artificial intelligence boom unfolds.

Artificial intelligence could lead the information technology sector to another decade of outperformance

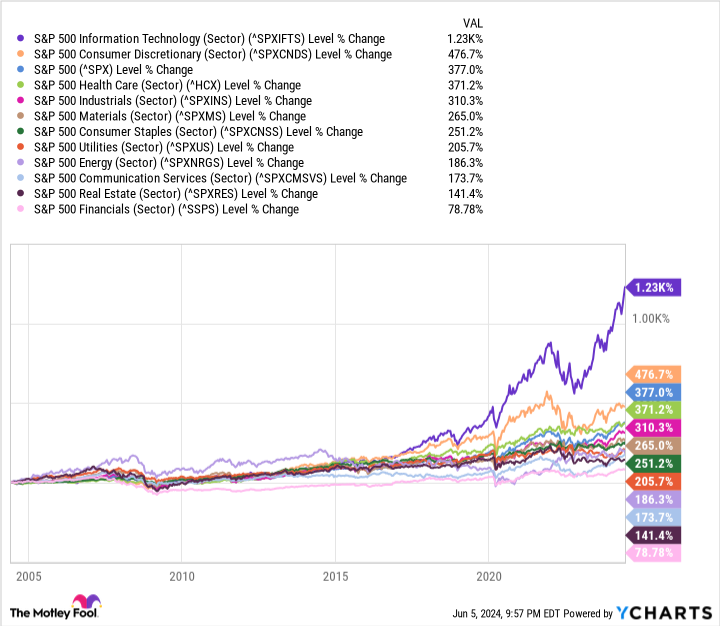

The S&P 500 is divided into 11 stock market sectors by the Global Industry Classification Standard. Among those sectors, information technology was the best performer over the last 10 years and 20 years. It was also the only sector to beat the S&P 500 during the last decade, and it was one of just two sectors to outperform during the last two decades.

The chart below shows the tremendous outperformance of the information technology sector since June 2004.

During the last two decades, technology stocks have benefited from several tailwinds that can broadly be described as digital transformation. I am talking about the adoption of cloud computing, cybersecurity, e-commerce, mobile devices, social media, and streaming services. Those secular trends led to superior returns from the information technology sector, and artificial intelligence (AI) looks like the next tailwind.

Spending across AI hardware, software, and services is expected to increase at 37% annually through 2030. Companies in virtually every sector and industry will use AI to generate revenue, reduce costs, or some combination of the two. But the technology companies that enable AI — the chipmakers that design hardware, the cloud companies that provide infrastructure and platform services, and the software vendors that blend AI into finished products — should be some of the biggest winners.

The Vanguard Information Technology ETF can help invetors capitalize on artificial intelligence

The Vanguard Information Technology ETF tracks 313 technology stocks that can be grouped into three broad categories: (1) internet services and infrastructure companies, (2) technology consulting, hardware, and equipment providers, and (3) semiconductor and semiconductor equipment manufacturers.

The 10 largest holdings in the Vanguard Information Technology ETF are listed by weight below.

-

Microsoft: 17.3%

-

Apple: 15.3%

-

Nvidia: 11.9%

-

Broadcom: 4.4%

-

Salesforce: 2.1%

-

Advanced Micro Devices: 1.9%

-

Adobe: 1.6%

-

Cisco Systems: 1.5

-

Accenture: 1.4%

-

Oracle: 1.4%

Many of the companies listed above are well positioned to benefit from artificial intelligence. For instance, Microsoft provides AI cloud services, Nvidia is the market leader in AI chips, and Salesforce is layering AI into its software.

The last item of consequence is the expense ratio. The Vanguard Information Technology ETF carries a low expense ratio of 0.1%, meaning the annual fees will total $1 for every $1,000 invested in the index fund. The average expense ratio of similar funds is 0.98%, according to Vanguard.

In closing, I have one warning for potential investors. The Vanguard Information Technology ETF is an excellent way to capitalize on technology trends like artificial intelligence, but its highly concentrated composition — five stocks constitute 50% of the fund by weight — is a source of risk. Best case scenario, it leads to transient volatility. Worst case scenario, the heavily weighted stocks perform so poorly that the index fund actually underperforms.

In light of that risk, investors should treat the Vanguard Information Technology ETF as part of a diversified portfolio, meaning it should be owned alongside other stocks and/or index funds, especially an S&P 500 index fund. Additionally, I would personally keep my position in the Vanguard Information Technology ETF relatively small, meaning no more than 10% of my portfolio.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $750,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Trevor Jennewine has positions in Adobe and Nvidia. The Motley Fool has positions in and recommends Accenture Plc, Adobe, Advanced Micro Devices, Apple, Cisco Systems, Microsoft, Nvidia, Oracle, and Salesforce. The Motley Fool recommends Broadcom and recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard Index Fund Up 1,310% in 20 Years to Buy for the Artificial Intelligence (AI) Bull Market was originally published by The Motley Fool