2 Artificial Intelligence (AI) Companies That Could Follow Nvidia’s Lead and Split Their Stock

These shares are getting awfully pricey after massive runs.

Stock splits generate a lot of buzz in the investing world, especially among the amateur crowd. You probably already know that a split doesn’t affect the company’s underlying value — if you have one share worth $100 and the company executes a 10-for-1 split, you would have 10 shares worth $10 each for the same $100 value.

However, there are some advantages to shrinking per-share prices. For example, it’s easier for smaller investors to accumulate a position. Let’s say you put $300 into an account monthly; it’s easier to accumulate a position in a stock selling for $100 than $2,000. The announcements also draw attention to the company, which is potentially of help.

Nvidia is the latest big tech company to announce a split (its second in the past three years). The stock split 10-for-1 last week after an incredible run over the previous few years, as shown below. But Nvidia isn’t the only company with a swelling stock price. The artificial intelligence (AI) boom sent several other stocks to all-time highs.

Could one of these below be next to split their stock?

Super Micro Computer

Let’s look first at Super Micro Computer (SMCI 3.82%), which trades above $750 per share. This is well below its 52-week high of $1,229 but well above the 52-week low price of $213. Supermicro (as its known) is a nuts-and-bolts play in the AI sector, as its server, storage, and networking hardware are critical to data centers, edge computing, and more.

The intense customer demand, primarily driven by AI, caused revenue and operating income to skyrocket recently, as shown below.

SMCI Revenue (TTM) data by YCharts

The company’s latest quarter saw 200% year-over-year sales growth to $3.9 billion, and Supermicro expects intense growth to continue next quarter with a forecast of $5.1 billion to $5.5 billion. The great thing about this sales growth is that Supermicro is doing it profitably, as you can see by the rising operating income in the chart above. Data center growth is a tailwind that should last for years (check out this article for details).

If the stock price stays high, the company could move to split the stock — potentially soon.

ServiceNow

Companies are turning to automation like never before. Automating tasks is critical to efficiency, which is paramount in the hyper-competitive business world. With the Now Platform provided by ServiceNow (NOW 1.78%), customers get virtual customer service agents, process automation, and AI-based issue detection, routing, and problem-solving solutions.

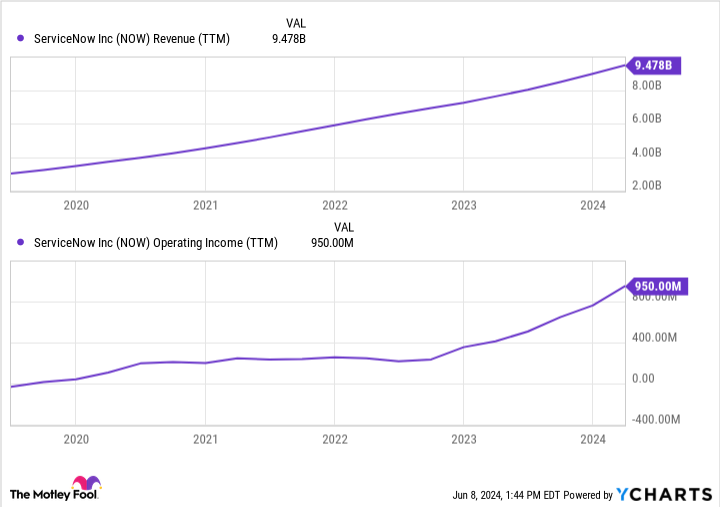

ServiceNow has an expanding customer base of over 8,100, including 85% of the Fortune 500. This includes nearly 2,000 large customers that spend an average of $4.6 million each with ServiceNow annually. The company also boasts a 98% renewal rate. Like Supermicro, ServiceNow’s sales and operating profits are soaring, as shown below.

NOW Revenue (TTM) data by YCharts

The $9.5 billion in trailing-12-month sales above include $2.6 billion in the first quarter, a 24% increase over the prior year. ServiceNow’s stock price has followed suit and trades near $700 per share. If the stock remains elevated, ServiceNow could follow other tech companies and consider a split.

In the grand scheme of the stock market, stock splits aren’t very consequential. They best serve investors by keeping most stocks trading within the same relative range. It would complicate things if all companies did what Berkshire Hathaway did; its stock trades for over $600,000 per share after decades of growth without splitting (although investors can still buy the Class B shares much more cheaply).

Still, stock splits garner attention, open the market up to smaller investors, and create fun topics of conversation. Nvidia is the latest titan to split; more could soon follow.

Bradley Guichard has positions in Nvidia. The Motley Fool has positions in and recommends Berkshire Hathaway, Nvidia, and ServiceNow. The Motley Fool has a disclosure policy.