2 Artificial Intelligence (AI) Stocks to Buy Now, and 1 to Avoid Like the Plague

It’s clear that the shine is coming off of some AI stocks, while others remain solid long-term investments.

What’s happened to the artificial intelligence (AI) rally?

It’s the question many investors are asking — and for good reason. Shares of the hottest AI stocks, like Nvidia, cooled off in recent weeks.

Nevertheless, we must remember that holding through volatile, choppy markets is integral to the buy-and-hold strategy. Moreover, despite the current pessimism seeping into the market, the AI revolution is set to roll on for many years to come — meaning there are still great AI stocks out there.

Here are two that our panel of Motley Fool contributors think are worth considering and one they want to avoid.

Image source: Getty Images.

Microsoft stock is a safe port for AI investors seeking refuge from recent volatility

Jake Lerch (Microsoft): Sometimes it’s best to keep things simple. That’s why my best AI stock to own right now is Microsoft (MSFT 0.59%).

Sure, Microsoft’s stock isn’t likely to go parabolic if the AI rally once again picks up steam. However, what the stock lacks in sizzle, it makes up for in stability: It’s easy to sleep knowing you own Microsoft for the long term.

Even though Microsoft is moving full-speed ahead on AI, it’s far from a one-trick pony. The company has many business segments, such as gaming, enterprise and personal computing software, cloud services, and advertising. That diversification should comfort investors because the company relies on something other than just the growth of AI to fuel its revenue, profits, and cash flow.

In its most recent quarter (the three months ending on March 31, 2024), Microsoft generated $61.9 billion in revenue, up 17% from a year earlier. Crucially, about $8.4 billion was returned to shareholders through dividend payments and stock buybacks.

That means Microsoft investors are getting paid to wait while the volatility in the AI sector sorts itself out. That can’t be said for every AI stock, and it’s one of the big reasons investors should still consider Microsoft stock a buy now.

Surging profits make Amazon a bargain worth scooping up today

Justin Pope (Amazon): Amazon (AMZN -1.07%) seems like a no-brainer, table-pounding buy today. The technology giant is a key chess piece in the AI game moving forward thanks to its market leadership in cloud services with AWS. Amazon is integrating AI functions into AWS to make it a foundation for customers to build and run their AI models. That’s the 10-second elevator pitch. However, the company’s recent short-term performance underlines the stock’s value today.

The company just turned in stellar Q1 results. Trailing 12-month operating cash jumped 82% year over year to over $99 billion. Valuing the stock on earnings or free cash flow is tricky because Amazon stubbornly invests most of its profits to grow the business. Unlike Meta Platforms and Alphabet, there are no dividends here.

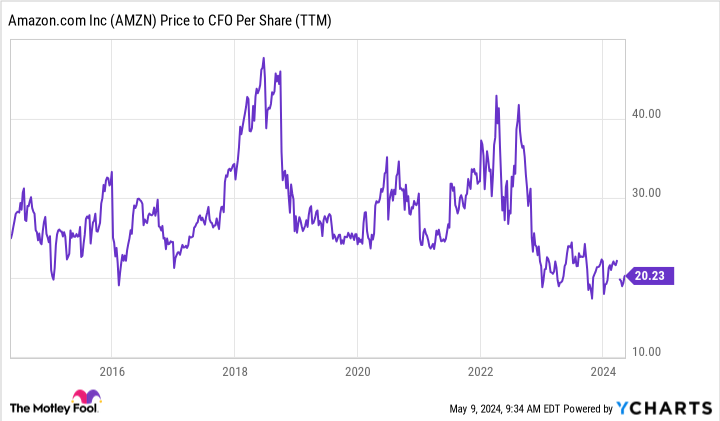

Looking at the stock versus its operating cash flow gives investors a true peek at Amazon’s value. As shown below, Amazon is now valued near its lowest multiple on operating cash flow in a decade despite the stock surging over 70% this past year.

AMZN Price to CFO Per Share (TTM) data by YCharts

Amazon’s magnificent rally might have plenty of juice left. The business is firing on all cylinders, and long-term investors get a diverse multiheaded monster packed with e-commerce, cloud, and advertising growth that keeps one industry from swaying the broader business. Buy Amazon confidently and hold for what should be stellar long-term returns.

AI-generated gains may not be enough to save this stock

Will Healy (C3.ai): At first glance, C3.ai (AI -1.73%) may look like a stock to buy. It develops AI-enhanced enterprise software that integrates with a company’s existing software infrastructure, putting it in the company of other fast-growing AI stocks.

Additionally, its price-to-sales (P/S) ratio has fallen below 10. While not “cheap,” it compares well to many other AI companies that continue to trade at elevated valuations.

However, investors can find significant problems when they examine the business more closely. For one, it expects to generate just over 35% of its fiscal 2024 revenue from oilfield services giant Baker Hughes. The current Baker Hughes contract expires in April 2025, meaning that revenue could soon disappear without a new agreement.

Moreover, C3.ai will likely remain in poor financial shape even if it continues its business relationship with Baker Hughes. In the first nine months of fiscal 2024, its $224 million in revenue rose by 15% versus the same year-ago period. This significantly lags many other AI stocks growing revenue at much faster rates.

Furthermore, its operating expenses for the period came in at $363 million, almost 1.5 times its revenue. This resulted in a net loss for the first three quarters of fiscal 2024 at $207 million.

Admittedly, it holds about $723 million in liquidity, indicating it can maintain this pace in the near term. Nonetheless, it is unclear whether the company will ever become profitable, and such conditions could explain why C3.ai stock has given back most of its 12-month gains.

Between the uncertainty of the Baker Hughes relationship and the massive financial losses, investors are probably better off deploying capital in other AI stocks.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, and Nvidia. Justin Pope has no position in any of the stocks mentioned. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.