2 Artificial Intelligence Stocks to Buy Hand Over Fist in May

Meta Platforms and Alphabet are stellar buys right now.

Artificial intelligence (AI) stocks are still must-owns right now. The industry is rapidly changing, and new technologies and initiatives are being announced daily. However, some of the best AI stocks aren’t the ones you’ve never heard of; they’ve been doing it for quite some time.

Among my top artificial intelligence picks that are also familiar names are Meta Platforms (META -1.73%) and Alphabet (GOOG 0.89%) (GOOGL 0.97%). Both companies have been involved with AI for some time, and both are working to implement it into their core offerings.

These are much more surefire investments than the latest and greatest AI companies, yet they can still provide excellent returns for shareholders.

Advertising is a core part of both businesses

Meta’s and Alphabet’s names don’t really convey what they do to investors. Meta Platforms used to be known as Facebook and owns other social media sites like WhatsApp and Instagram. Alphabet also changed its name from Google and has YouTube and the Android operating system under its umbrella. These two both changed their names to convey to investors that they aren’t just Facebook and Google; they’re much bigger.

Still, each company gets most of its business from the same industry: advertising. Without ads, neither company would be anything near what it is today.

| Company | Q1 Advertising Revenue | Percent of Total Revenue |

|---|---|---|

| Meta Platforms | $35.6 billion | 97.8% |

| Alphabet | $61.7 billion | 76.6% |

Data sources: Meta Platforms and Alphabet.

Advertising is about as old as any industry. However, how ads are delivered has changed dramatically. Thirty years ago, ads were plastered on billboards, newspapers, and TV screens. You can still see these types of ads everywhere, but they aren’t as impactful as targeted advertising.

Meta and Alphabet have strong data on their users, which allows them to pinpoint the ads that are most effective. For example, if you’re looking to renovate your deck, ads about vacations aren’t useful; home improvement store ads are.

However, understanding a consumer from a traditional standpoint has limitations, which is why Meta and Alphabet are heavily investing in artificial intelligence.

AI and advertising go hand in hand

AI has been around for a long time, but the latest buzz has been around a particular branch of AI: generative AI. This branch has allowed new technologies to be created, which are transforming any industry in which the tools are deployed.

Meta is using generative AI to create modular ads. When advertisers utilize this toolkit, they can change background images, automatically fit the ad to different screen sizes, and vary the text caption to suit the viewer. This keeps advertisements fresh and increases the chances of someone stopping to look at the ad when they may have scrolled past an ad from the same company previously.

Alphabet uses generative AI to match ads to what its users are seeking. It has also developed its in-house generative AI model, Gemini, into its Performance Max product, which is a set of guidelines Alphabet has created to ensure advertisers have a successful campaign. This product allows its users to constantly create ads that meet all Performance Max criteria.

These are just some of the ways Alphabet and Meta are incorporating AI into their products, but they are doing a lot more. But how does this translate into successful investments?

Both stocks are attractively priced

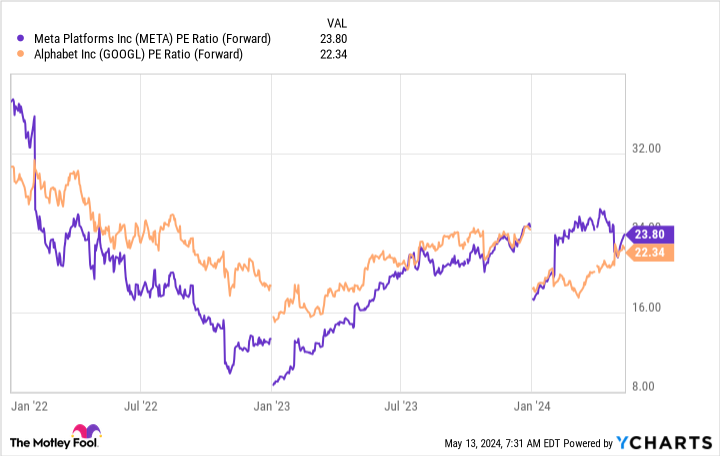

Despite their success, Alphabet and Meta Platforms don’t trade at much of a premium to the general market (measured by the S&P 500). The S&P 500 trades for around 20.7 times forward earnings, so these two don’t trade for much higher than that level.

META PE Ratio (Forward) data by YCharts

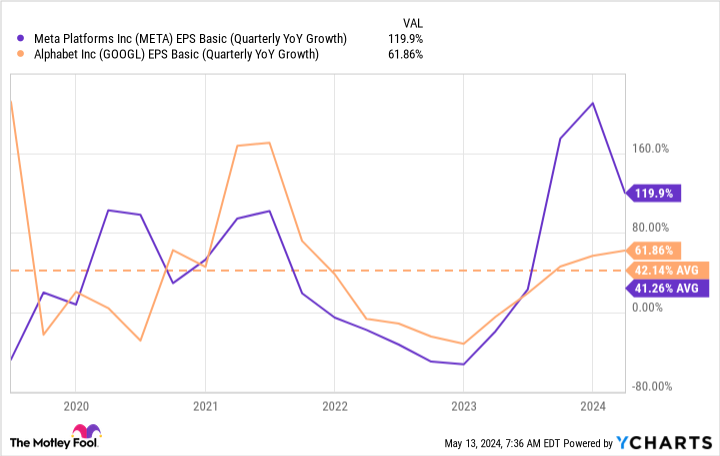

However, based on their earnings growth, Meta and Alphabet likely deserve a bit more of a premium. According to data collected by the NYU Stern School of Business, the average earnings growth for the S&P 500 as a whole is about 8.25% per year since 1960. However, Meta and Alphabet have provided far greater growth than that recently.

META EPS Basic (Quarterly YoY Growth) data by YCharts

With Meta and Alphabet growing much faster than average over the past five years, It’s safe to say that these two are much better than the average S&P 500 company. Throw in each company’s constant innovation, and they emerge as clear no-brainer buys in today’s market.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet and Meta Platforms. The Motley Fool has a disclosure policy.