2 Beaten-Down Stocks to Buy Before They Go on a Bull Run

After delivering outstanding growth in 2023, semiconductor stocks have continued their impressive run this year as well, which is evident from the 12% gains clocked by the PHLX Semiconductor Sector index as of this writing. However, certain chip stocks have been left behind while the broader market has rallied impressively.

Shares of Skyworks Solutions (NASDAQ: SWKS) and Qorvo (NASDAQ: QRVO), two chipmakers that are known for supplying chips for Apple, have underperformed the semiconductor sector in 2024. Skyworks stock is down nearly 11% so far this year, while Qorvo has fallen 2%.

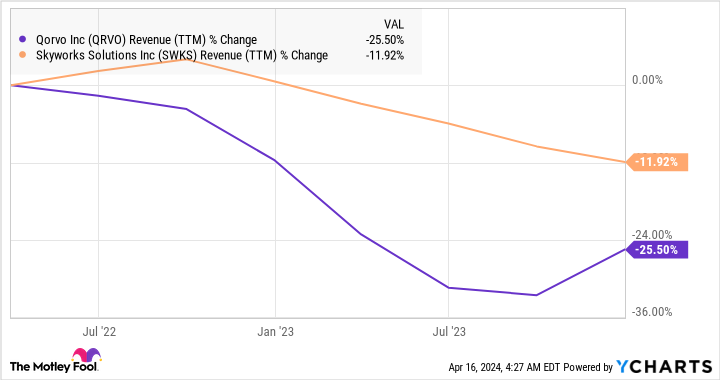

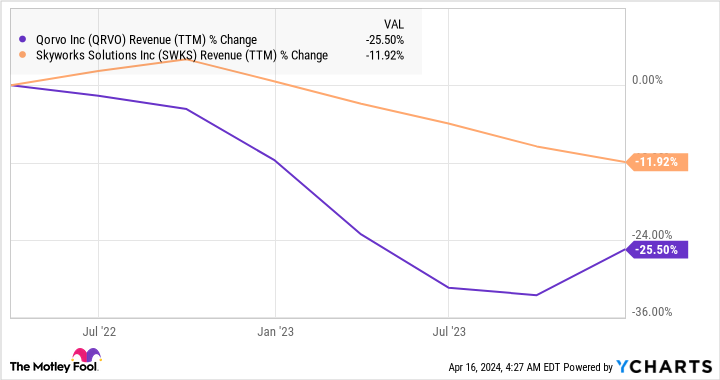

A big reason behind their underperformance is the weak performance of the smartphone market over the past couple of years. Both companies get a nice chunk of their revenue from selling smartphone chips, which explains why their top lines have been shrinking since the beginning of 2022.

However, the rough times that Skyworks and Qorvo have been facing could soon come to an end thanks to artificial intelligence (AI). Let’s look at how this fast-growing technology could give these companies a nice boost.

Smartphone sales are rising once again

According to market research firm IDC, global smartphone shipments fell 11.3% in 2022. This was followed by a 3% drop in 2023. The good news for smartphone original equipment manufacturers (OEMs) and chipmakers such as Qorvo and Skyworks is that the market has started growing once again. IDC estimates that global smartphone shipments grew nearly 8% year over year in the first quarter of 2024.

More importantly, the smartphone market is expected to grow 4% in 2024, followed by further growth in shipments over the next three years, according to Canalys. However, the AI factor indicates that the market’s recovery could be quicker. That’s because sales of AI-capable smartphones are expected to account for 5% of the overall market this year, compared to just 1% in 2023.

That indicates an estimated 59 million AI smartphones could be shipped in 2024 based on Canalys’ overall smartphone shipment forecast of 1.17 billion. The forecast says that AI-enabled smartphones could account for 45% of the global smartphone market in 2027. So, 562 million AI smartphones may be shipped after three years based on Canalys’ prediction of 1.25 billion overall smartphone shipments in 2027.

Even then, there would be a lot of room for sales of AI-capable smartphones to grow. J.P. Morgan analyst Samik Chatterjee points out that the advent of AI could drive a 5G-like upgrade cycle for smartphones. It is worth noting that Skyworks and Qorvo were enjoying healthy growth when the demand for 5G smartphones was booming.

Given that their customers have been quick to integrate AI-focused tools into their products, there is a good chance that Skyworks and Qorvo could start growing at a nice pace once again. Apple, for instance, has acquired 21 AI-focused start-ups since the beginning of 2017, and the company is reportedly looking to use that expertise to build AI capabilities into the iPhone and other products.

Supply chain rumors indicate that Apple could pack a more powerful neural engine in its next-generation iPhone to run AI and machine learning applications. Mark Gurman of Bloomberg is of the opinion that Apple has a large language model (LLM) that will allow it to run AI applications locally on the upcoming iPhone. Additionally, the company is reportedly looking to partner with the likes of OpenAI and Google as well to bring AI functionality to its devices.

Apple is the top customer for both Skyworks and Qorvo. While Skyworks gets a whopping 66% of its total revenue from selling chips to Apple, Qorvo relies on Apple for 37% of its sales. In December 2023, Dan Ives of Wedbush Securities estimated that 240 million iPhone users are waiting to upgrade to a newer device. The arrival of an AI-enabled iPhone could encourage these users to upgrade and exceed the 235 million units that Apple shipped last year, followed by further growth in subsequent years as AI smartphone adoption gains steam.

Moreover, Skyworks and Qorvo also supply chips to other smartphone OEMs such as Samsung, Xiaomi, and Vivo, among others, which means that they could take advantage of the secular growth of AI smartphones.

Qorvo and Skyworks look like solid buys right now

Both Skyworks and Qorvo are expected to deliver an ordinary financial performance in their current fiscal years. Skyworks’ revenue is expected to drop 6.7% in the ongoing fiscal 2024 to $4.45 billion, while earnings could shrink 19% to $6.89 per share. However, in fiscal 2025, analysts are projecting a 7.4% increase in revenue to $4.78 billion along with an 18% jump in earnings to $8.14 per share.

Similarly, Qorvo could clock 10% revenue growth in fiscal 2025 to $10.1 billion following a 5% increase in the current one. Moreover, its earnings growth is also expected to accelerate to 27% next year to $7.61 per share following a flat performance in the current year.

What’s more, investors are getting a good deal on both of these chip stocks. They have identical price-to-sales multiples of just over 3, lower than the U.S. technology sector’s average of 7.1. Moreover, their forward earnings multiples are also in the range of 14x to 15x, making them cheaper than the technology sector’s earnings multiple of almost 45x.

So, investors looking for a couple of beaten-down stocks that could take advantage of the proliferation of AI should consider both Qorvo and Skyworks Solutions as a potential improvement in their earnings power could send them on a bull run.

Should you invest $1,000 in Skyworks Solutions right now?

Before you buy stock in Skyworks Solutions, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Skyworks Solutions wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Qorvo and Skyworks Solutions. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Is Lifting the Smartphone Market: 2 Beaten-Down Stocks to Buy Before They Go on a Bull Run was originally published by The Motley Fool