2 Millionaire-Maker Fintech Stocks

When done right, investing in fintech stocks can be very profitable. These businesses combine the huge addressable markets of finance with the rapid growth rates of tech.

If you’re looking for high-upside fintech stocks capable of turning thousands into millions, the two picks below are for you.

This is one of the best ways to bet on the rise of Bitcoin

Bitcoin has been one of the best investments of all time. Since January 2009, the cryptocurrency is up by more than 100,000,000%. A $1 investment would now be worth more than $1 million. Annualized, Bitcoin’s price has risen by roughly 150% per year.

Of course, most of Bitcoin’s performance was accrued over its initial years of trading. More recently, it still has posted incredible returns, but the pace has slowed. Over the past three years, for instance, Bitcoin has risen 80%.

There may still be plenty of long term upside to go for Bitcoin, but now that the crypto space has reached some level of maturity, what is the best way to profit? Your best bet may be a stock like Block (NYSE: SQ).

You might know Block by its former name, Square. The company initially billed itself primarily as a payment processing company. Last year, more than 4 million merchants used its Square architecture to accept payments from customers. That count includes scores of small business owners accepting payments for the first time, but also established brands operating hundreds of storefronts.

In 2021, the company changed its name to Block to reflect its growing focus on blockchain technologies including Bitcoin. For example, merchants can now accept payment in a variety of cryptocurrencies. Meanwhile, using the company’s peer-to-peer money platform, Cash App, millions of people can buy, sell, and transfer cryptocurrencies at any time. The company is now selling several billions of dollars in Bitcoin to customers every quarter.

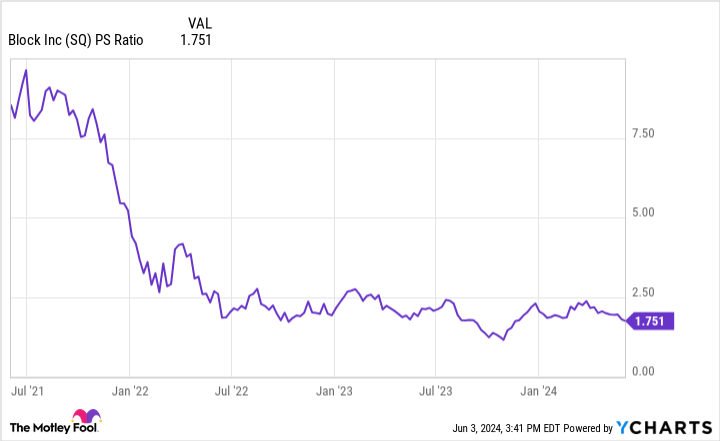

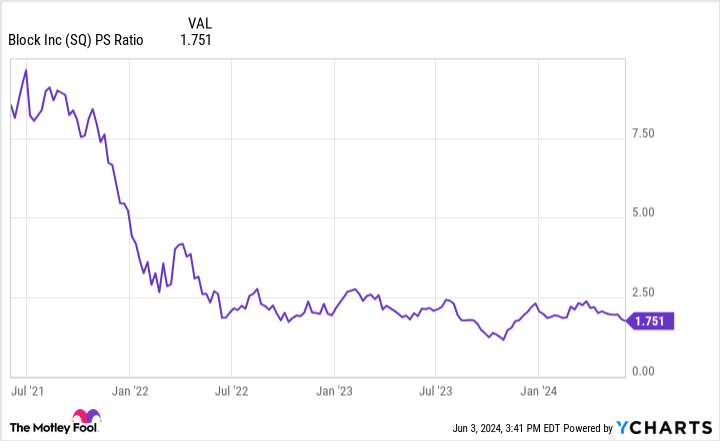

If you believe in Bitcoin long-term, it’s hard not to be a fan of Block. It has two major payment platforms — Square for traditional merchants and Cash App for everyday consumers — with a front-row seat to the rise of crypto usage. Right now, shares trade at a price-to-sales ratio of 1.75. That’s an attractive valuation for a company that grew revenue by nearly 20% last quarter with a 35% gross profit margin.

This fintech stock is backed by billionaire investors including Warren Buffett

Block’s current market cap is just $40 billion, giving it plenty of room for long-term growth. The next stock on the list has a valuation of $540 billion. You may think it doesn’t have as much upside, and it’s true — it’ll be harder for Visa (NYSE: V) to quadruple in size than it will be for Block. But it’s still one of the best fintech stocks out there, and there’s a good chance the company surpasses the $1 trillion valuation mark in the years to come.

Visa is simply one of the best kinds of businesses to own. That’s because it benefits from network effects. Network effects describe how a company’s product or service can grow in value as more people use it. Social media is a great example. As more people use a certain social media platform, the platform becomes more valuable, attracting yet more users, which delivers yet more value.

Visa’s situation is much the same. Merchants want to accept payment methods that customers have on hand. Customers, meanwhile, want to use payment methods that merchants accept. It is this dynamic that has created natural consolidation in the credit card and debit card markets. According data compiled by Statista, Visa has an astounding 61% market share for payment cards in the U.S. Just three companies control the remainder of the market.

This dominant market share has given Visa impressive pricing power at scale. That pricing power combined with an asset-light business model generates a gross profit margin of around 80%, with a return on equity of roughly 45%. Those are incredible figures for a $540 billion business.

Despite double-digit annual sales growth, Visa stock trades at just 30 times earnings. That may seem high until you compare that to the S&P 500, which trades at 27.5 times earnings. Paying a small premium for such an impressive business seems like a no-brainer for long-term investors. Visa won’t turn thousands into millions as fast as Block stock, but it’s a strong blue chip stock that can be added to any portfolio that has a decent chance of making millions over a decades-long holding period.

Should you invest $1,000 in Block right now?

Before you buy stock in Block, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Block wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Ryan Vanzo has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin, Block, and Visa. The Motley Fool has a disclosure policy.

2 Millionaire-Maker Fintech Stocks was originally published by The Motley Fool