2 of the Best Artificial Intelligence (AI) Stocks to Buy in 2024

Chips are the building blocks of AI. Why not own two of the best companies selling them?

Artificial intelligence (AI) is a complex and rapidly growing tech sector, with investors jockeying for the proper AI exposure in their portfolios. One thing is clear: Cutting-edge computer chips have become the de facto building blocks of AI. They are needed (in mass quantities) to power these powerful AI operations.

When it comes to picking AI stocks, there have been some clear winners, as well as some stocks that haven’t caught fire the way one might have expected. AI is still in the early chapters of its story, which means there is still plenty of uncertainties, but also plenty of opportunities to find stocks that will utilize the need for AI to outperform over time.

Here are three AI stocks investors should consider buying and holding because of the powerful AI tailwinds expected to benefit them.

1. Nvidia: This chip leader continues to defy expectations

AI chip powerhouse Nvidia (NVDA 5.16%) isn’t the most creative choice for this list, but the numbers matter most, and Nvidia has them in spades. Nvidia’s cutting-edge graphics processing units (GPUs) and AI-focused software stack have emerged as the go-to option for big technology companies investing billions of dollars to build data centers to handle AI’s computing demands. Some analysts estimate that Nvidia controls as much as 90% of the AI chip market.

To underline this, look at how Nivida’s revenue has grown over the past 18 months:

NVDA Revenue (Quarterly YoY Growth) data by YCharts

Nvidia’s $22.6 billion in data center revenue in Q1 is almost as much as the company generated in total revenue for all of fiscal year 2023 (ending Jan. 29, 2023). That is a massive uptick in just 24 months. And the stock price has followed; shares are up 585% over the past three years.

However, the show might not be over. CEO Jensen Huang said he believes that AI will require another $2 trillion in data center spending, which could mean Nvidia enjoys these tailwinds for years. Shares trade at a forward P/E of 42 today. That’s very attractive if Nvidia can live up to analysts’ estimates, which call for 38% annual earnings growth over the next three to five years.

2. AMD: Second place doesn’t seem so bad

Assuming AI becomes as big a deal as it seems, the most significant risk to a company like Nvidia is that it cedes AI chip market share to competitors. Who is most likely to challenge Nvidia? Look no further than Advanced Micro Devices (AMD 3.86%), or AMD. It might not seem like a worthy opponent — the chip company made $2.3 billion in data center sales in Q1, a fraction of Nvidia’s. However, those figures were up 80% year over year, which shows signs of life, mainly due to demand for AMD’s MI300 accelerator chips, which compete with Nvidia.

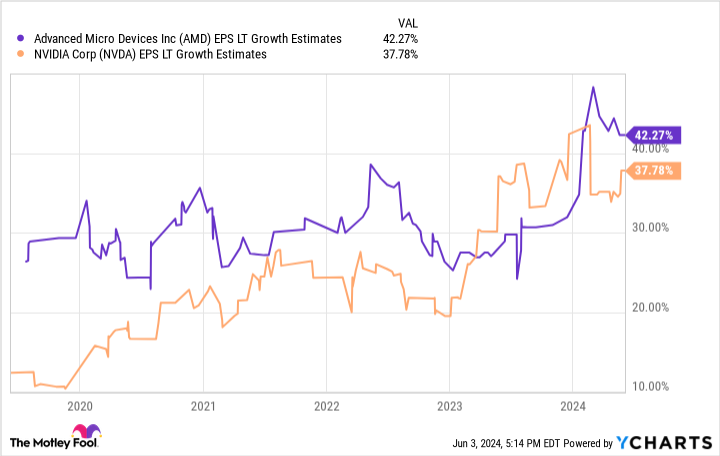

AMD also has a footprint outside of data centers. For example, AI-enabled personal computers could represent a significant growth opportunity. AMD’s Ryzen 8000 Series processor chips helped post an 85% year-over-year Q1 increase in AMD’s Client segment. The great thing about AMD is that it doesn’t have to knock Nvidia off the mountain to perform well for investors. The company could grow like wildfire due to AI. Analysts believe AMD’s earnings will grow by 42% annually over the next three to five years, potentially exceeding Nvidia’s bottom-line growth!

AMD EPS LT Growth Estimates data by YCharts

Meanwhile, AMD is a fraction of Nvidia’s size at a $263 billion market cap. Shares trade at a forward P/E of 49, which is an excellent value for AMD if it can meet analysts’ expectations.

One might argue that there is even more upside if AMD can meaningfully dent Nvidia’s AI chip dominance over the coming years. AMD might be second place today, but it could be a top investment if things go well.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.