2 Unstoppable Artificial Intelligence (AI) Growth Stocks You Can Buy and Hold for the Next Decade

To generate robust returns in the stock market over many years, you’ll need to find businesses with strong competitive positions and excellent long-term growth prospects.

To assist you with your search for these fortune builders, here are two elite enterprises that are set to profit from perhaps the most powerful growth trend of all: artificial intelligence (AI).

1. Arm Holdings

From the smallest sensors to the largest supercomputers, Arm Holdings (NASDAQ: ARM) provides the underlying technological architecture upon which billions of its customers’ products are built. With the artificial intelligence (AI) boom sparking a semiconductor renaissance, Arm’s chip design business is flourishing.

Arm’s semiconductor designs help to power some of the most popular devices and computing tools on the planet. Apple uses Arm’s chip technology in its iPhone and Macs. Nvidia‘s new Blackwell accelerated-computing platform includes Arm-based processors. And Microsoft is working with Arm to develop custom-designed general computing chips for use in massive cloud-data centers.

These partnerships are fueling Arm’s growth. The British chip architect’s revenue surged by 47% year over year to $928 million in the fourth quarter. Its free cash flow, in turn, grew by 40% to $637 million.

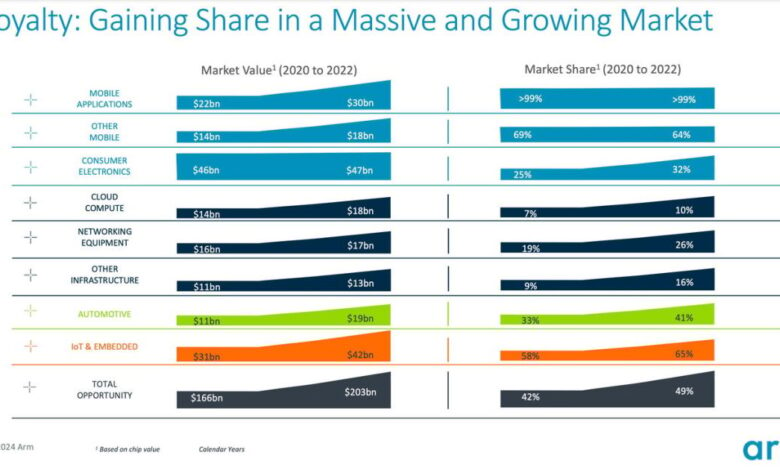

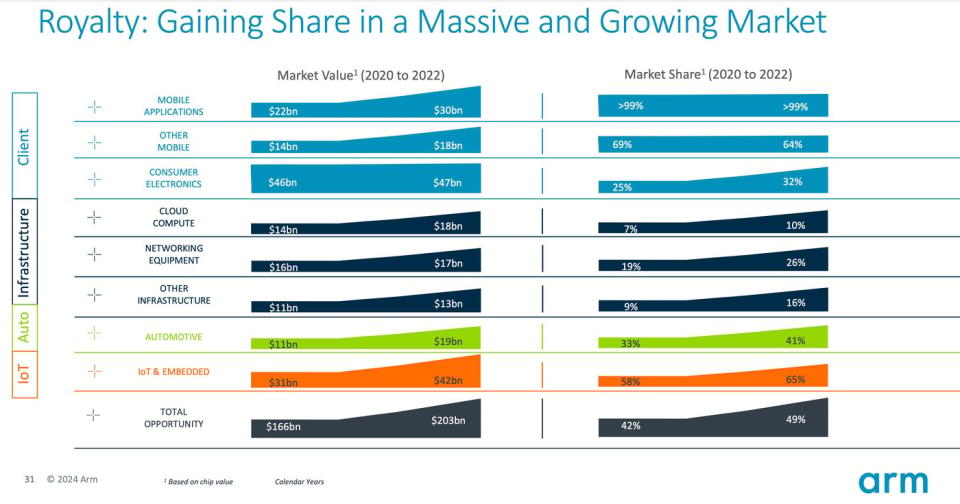

Plenty of growth lies ahead. Arm’s power-efficient chip designs are winning market share in rapidly expanding markets, such as cloud computing, the Internet of Things (IoT), and automotive technology.

AI is likely to be the company’s most powerful growth driver in the coming decade. “From the most complex AI cloud applications to the smallest edge devices, AI on Arm is everywhere,” CEO Rene Haas and Chief Financial Officer Jason Child wrote in a letter to share owners.

2. Palantir Technologies

The world is a volatile place. Rising geopolitical tensions have government agencies turning to Palantir Technologies (NYSE: PLTR) for data-analysis. At the same time, corporations are rushing to implement Palantir’s powerful AI tools.

Palantir helps its clients harvest actionable insights from disparate sources of data. The analytics-software specialist has long served U.S. defense and intelligence agencies. The U.S. Army, for example, is working with Palantir to build AI-powered ground stations that collect and integrate information from an array of terrestrial and air- and space-based sensors.

Companies are also showing a keen interest in Palantir’s AI services. The software star’s new Artificial Intelligence Platform (AIP) combines secure access to state-of-the-art AI models with real-time data aggregation and analysis tools.

Palantir conducted 660 hands-on “bootcamps” in Q1 to give businesses a chance to see how AIP can benefit their specific operations. The strategy is working. Palantir’s U.S. commercial revenue leaped 40% year over year to $150 million, driven by a 69% jump in customers to 262.

Moreover, Palantir’s strong ties to the defense sector continue to bear fruit. Its government revenue rose by 16% to $335 million. “There is basically no conflict in the world where Western allies are involved, and the stakes are life and death, where Palantir is not the first call,” CEO Alex Karp said during a conference call with analysts on May 6.

Notably, Palantir is growing more profitable as it scales its revenue base. Its adjusted-operating profits soared by 81% to $226 million. That marked the company’s sixth straight quarter of adjusted-operating margin expansion.

With its powerful AI solutions proving popular among both businesses and government agencies, Palantir has a long runway for further expansion still ahead. And with its profits growing quickly along with its client base, long-term investors who buy this AI leader’s shares today should be well rewarded.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Unstoppable Artificial Intelligence (AI) Growth Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool