2024 M&A trends and expectations in fintech and payments

In the world of payments, mergers and acquisitions (M&A), along with external funding rounds, have undergone a rapid shift – especially in the past 12 months. This change has showcased a new phase of market movements that will likely be remembered as a key part of the story surrounding post-COVID-19 fintech and payment firms. In this article, we aim to look back at the recent M&A and funding trends within the payments ecosystem – in our view, these are likely to continue throughout 2024. Additionally, we will make a few predictions for the future of M&A activity in the payments industry, based on our exposure to different deals and the analysis of those in our in-house database.

Overview of M&A trends in the past 12 months

2023 was a year of wild fluctuation when it came to global deal-making across all industries. Across all sectors, worldwide M&A volume and value fell 6% and 17% respectively, compared to 2022. This was the slowest full-year period for M&A in ten years. All markets struggled, especially in the first half of the year, but Europe and Asia fared off worse compared to the US.

Global drops in M&A activity can largely be attributed to the tech sector, which saw a 51% reduction in M&A volumes YoY. Mega-deals (exceeding values of USD 5 billion) were the ones that experienced the slowest year. This has rung true across the payments industry, save for a few notable deals, such as the acquisitions of Shift4 Payments and, more recently, the proposed acquisition of Discover. Mid-market deals are now the focal point of M&A activity in the payments industry. This is expected to continue throughout the remainder of 2024, and it can be attributed to the turbulences of today’s global economy.

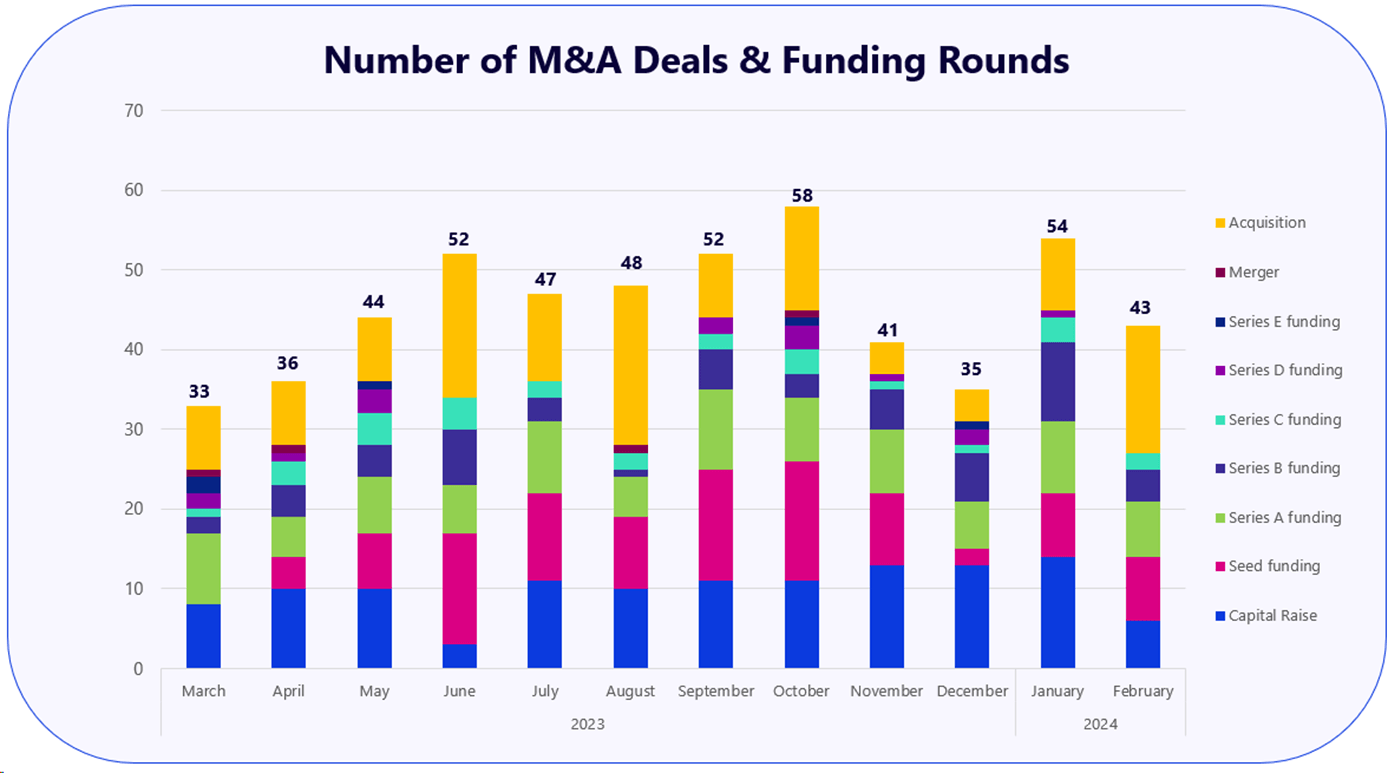

The monthly number of fintech and payment industry funding rounds across 2023 fluctuated considerably, but the year did not witness a significant, sustained rise or fall in dealmaking. The summer months witnessed high volumes of funding rounds and acquisitions. Despite this, more nascent companies looking to raise seed and Series A funding have seen the underlying value of their rounds drop considerably over the past year. In Q2 2023, the average Series A funding round fetched USD 25 million from investors. In Q4 2023, this has fallen to USD 18 million. However, there are signs that this will pick up again throughout 2024.

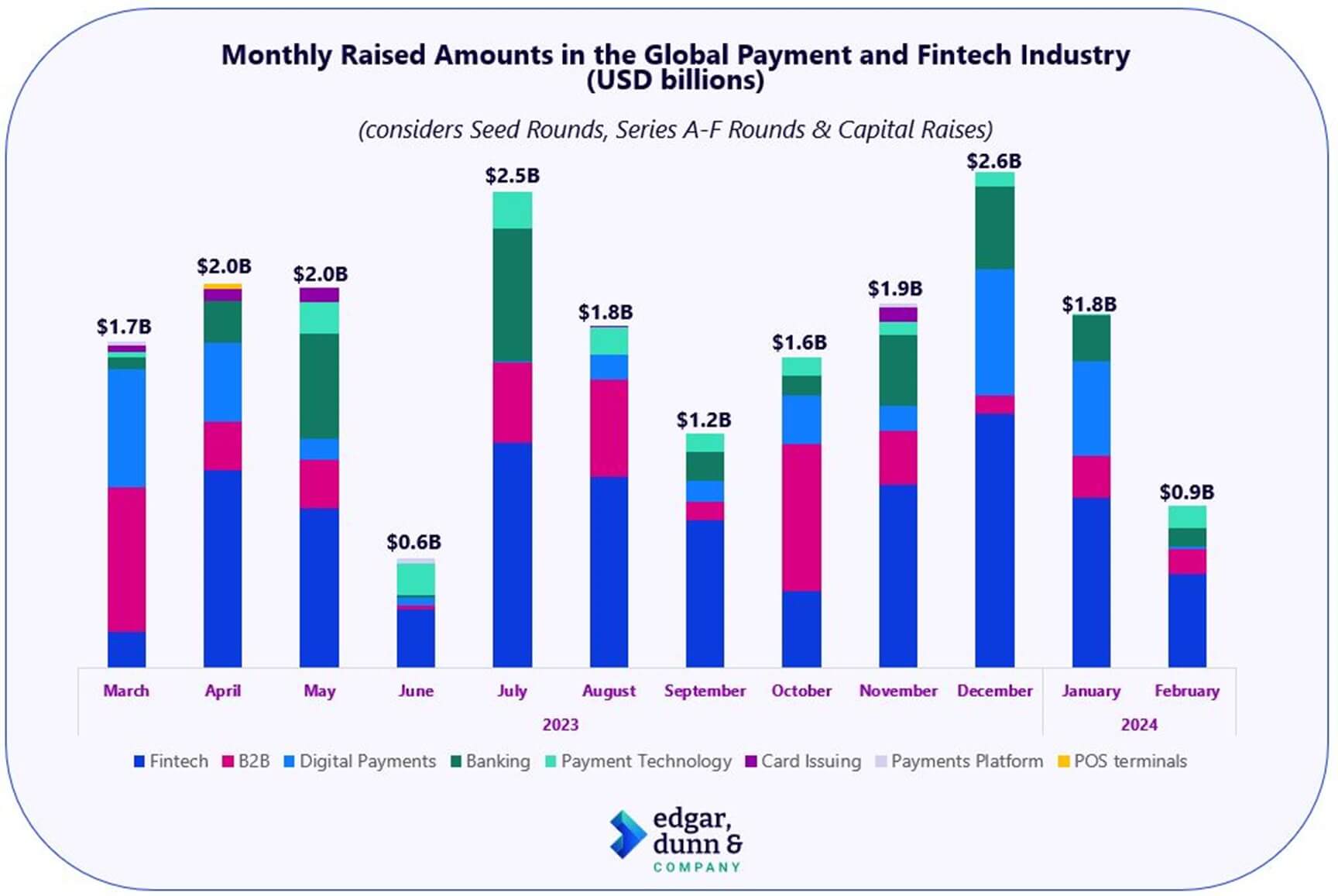

The focus of M&A deals is changing not just in terms of pure value and size, but also in terms of the inherent nature of the companies involved and receiving the funding. At EDC, we track all external funding deals made across the payments and fintech industries and carefully assign these activities to their most relevant and respective verticals. Investments into B2B payment firms have proportionally trended downwards, for instance, whilst other verticals fluctuate significantly between the months. The above graphic showcases the total funds raised across the ecosystem over the past 12 months, broken down by certain payment-related verticals (e.g., card issuing and POS terminals) in more detail.

External investment into AI in payments

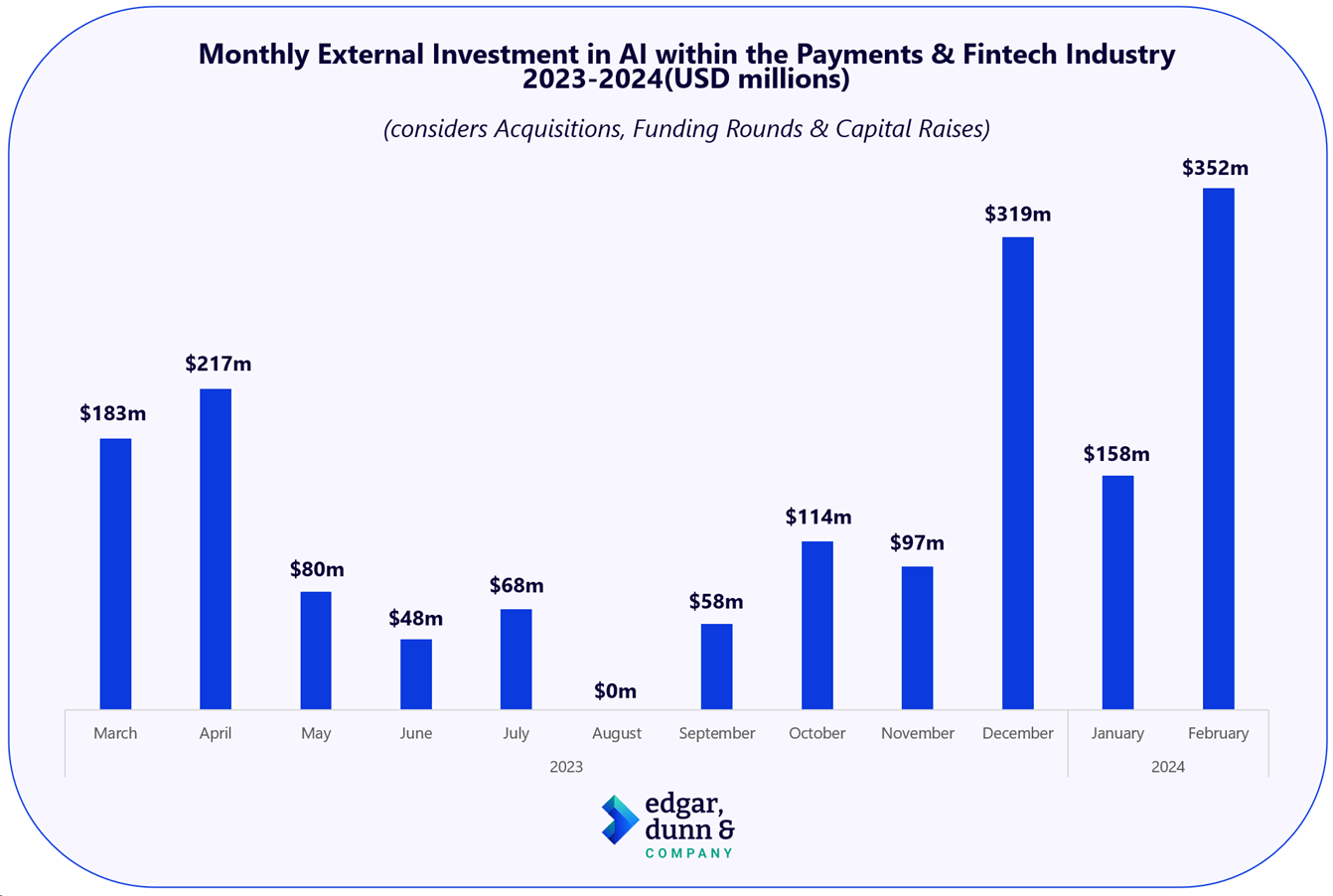

Within the payments and fintech industry, a vertical that has received significant attention in the past 12 months is artificial intelligence (AI). Since the use of Generative AI tools exploded beyond our periphery early last year, we have seen increasing amounts of external funding directed towards AI players and products in the payments industry.

March and April of 2023 were strong months for external funding directed towards the use of AI in the payments and fintech industries. This funding was largely awarded to conversational AI tools and how they can assist end users within the payment journey. The middle months of 2023 saw a dip in external AI funding, whilst the latter months and the beginning of 2024 experienced a fast increase to new heights. Within these two industries, this past February saw USD 352 million of external funding be directed towards AI initiatives. We believe funders and venture capitalists are waking up to the abundance of use cases that AI tools have within the payments ecosystem (beyond just a customer service chatbot) – and the startups that are building them.

Our M&A predictions for the remainder of 2024

At EDC, we conduct regular discussions with payment firms as well as investors who are engaged in M&A in some shape or form. It is apparent that many financial investors currently have large sums of available funds that were unused over the last 12 months. These funds will inevitably be deployed, especially as interest rates come down, and the fintech and payments industry is looking increasingly attractive again.

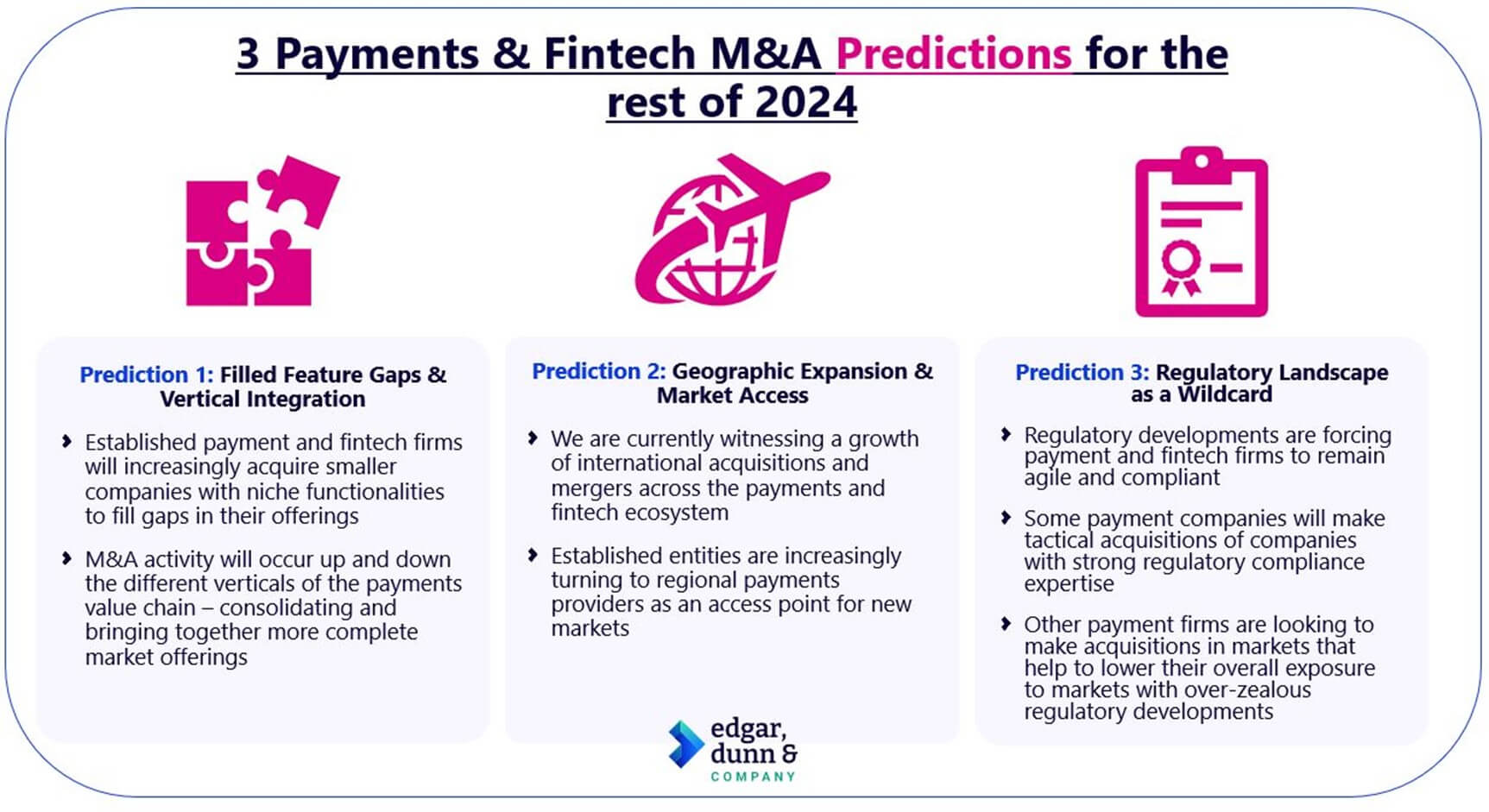

The underlying motivations to engage in M&A activity often fluctuate between firms. We have noticed these motivations shift in recent months and believe these predicate trends for the rest of 2024.

Firstly, we believe that a wider scale of consolidation will occur across the payment ecosystem. Whilst this isn’t a new trend, we believe that it will take more of a focal point of M&A activity over the coming 12 months. Established payment and fintech firms are looking to fill gaps in their product propositions by acquiring smaller companies with complementary capabilities. Vertical integration can help streamline operations and reduce redundancies across the payment value chain. Ultimately, this often leads to cost savings that can be crucial in a tighter economic environment such as the one we are experiencing today.

Secondly, we anticipate that there will be a greater demand to make acquisitions in certain markets. Inevitably, during economic downturns, some markets still experience relative stability and even growth. Emerging markets, for instance, are witnessing profound rates of increasing digital penetration and financial accessibility that far offset wider economic headwinds. More established payment firms are looking to these markets as opportunities to make strategic acquisitions. Additionally, as the demand for cross-border payments increases each year, payment firms are looking to make acquisitions in new markets to bolster their cross-border capabilities.

Regulatory landscapes are set to continually evolve the payments ecosystem this year and onwards. These changing demands are driving payments businesses to conduct tactical M&A activities that help alleviate regulatory pressures. One example, that we explored in depth earlier this year, was that of China’s Ant Group. General, centralised scrutiny and regulatory changes are driving such businesses to make more international acquisitions to reduce the revenue impact of any future regulatory fluctuations. Frequently, payment firms under the regulatory microscope will acquire/be acquired/merge with a more regulation-abiding company to adjoin themselves with better practices. This is something we expect to increase in the coming year.

Conclusion

In conclusion, the payments industry has witnessed a significant shift in M&A activity over the past year, with a focus on mid-market deals and consolidation for feature gaps and vertical integration. Looking ahead, we expect further consolidation, a rise in M&A to access high-growth markets and bolster cross-border capabilities, and an increase in regulatory-driven M&A activity. As the payments ecosystem continues to evolve, these trends are poised to shape the remainder of 2024 and beyond.

This article was first published in ‘The Global Overview of Payments Providers 2024’, the most recent market overview and analysis of key payment providers in the B2B and B2C commerce payment ecosystem.

About authors

Volker is a Director at EDC and heads the European Acquiring Practice. Volker has provided consulting advice in payments for over 20 years, developing significant experience in digital financial services across different geographies. He has a deep expertise in strategy development, profitability improvement, strategic planning, financial modelling, and benchmarking.

Volker is a Director at EDC and heads the European Acquiring Practice. Volker has provided consulting advice in payments for over 20 years, developing significant experience in digital financial services across different geographies. He has a deep expertise in strategy development, profitability improvement, strategic planning, financial modelling, and benchmarking.

Euan Jones is an Associate Consultant at EDC. Since joining in 2021, Euan has completed a wide variety of consulting projects with EDC’s global client base. He is a core member of EDC’s M&A Advisory team and has gained deep knowledge into the latest deals and activities. Prior to joining EDC, Euan gained a Master’s degree in Physics.

Euan Jones is an Associate Consultant at EDC. Since joining in 2021, Euan has completed a wide variety of consulting projects with EDC’s global client base. He is a core member of EDC’s M&A Advisory team and has gained deep knowledge into the latest deals and activities. Prior to joining EDC, Euan gained a Master’s degree in Physics.

About Edgar, Dunn & Company

Edgar, Dunn & Company (EDC) is an independent global payments consultancy. The company is widely regarded as a trusted adviser, providing a full range of strategy consulting services, expertise, and market insights. EDC expertise includes M&A due diligence, legal and regulatory support across the payment ecosystem, fintech, mobilepayments, digitalisation of retail and corporate payments, and financial services.

Edgar, Dunn & Company (EDC) is an independent global payments consultancy. The company is widely regarded as a trusted adviser, providing a full range of strategy consulting services, expertise, and market insights. EDC expertise includes M&A due diligence, legal and regulatory support across the payment ecosystem, fintech, mobilepayments, digitalisation of retail and corporate payments, and financial services.