3 Best Fintech Stocks to Buy in May 2024, According to Analysts

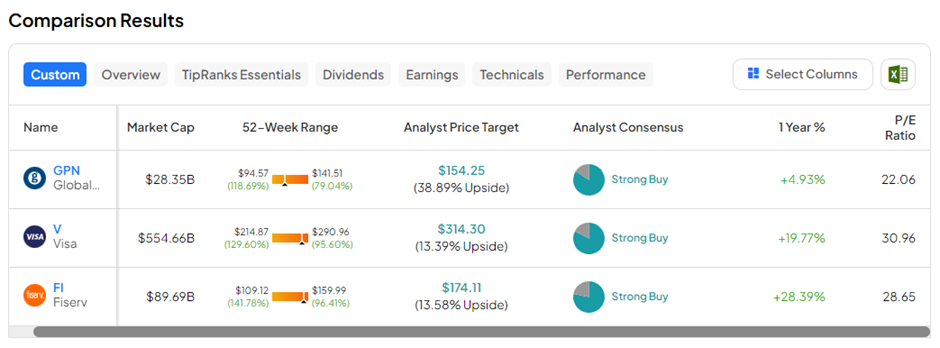

Global Payments (NYSE:GPN), Visa (NYSE:V), and Fiserv (NYSE:FI) are the 3 Best Fintech Stocks to buy in May 2024, as per Wall Street analysts. We leveraged the TipRanks Stock Screener tool to discover the fintech companies that analysts are bullish about. The financial technology or fintech sector encompasses a broad range of businesses, including payment processing, digital banking, lending, financial software, and financial services.

The fintech sector is set to witness higher momentum in 2024 with the expectation of interest rate cuts later this year. More and more people are switching from traditional banking and lending services to technologically advanced financing solutions to cater to their financial needs. Moreover, with the advent of artificial intelligence (AI)-led technology, the ease and efficiency of fintech platforms have improved considerably. Also, consumers are becoming more familiar with digital currencies, giving more scope for the growth of fintech platforms. With this background in mind, let’s delve deeper into the three companies.

#1 Global Payments (NYSE:GPN)

Global Payments offers payment technology and software solutions to merchants, issuers, and consumers. GPN’s services encompass card, electronic, check, and digital-based payments across the U.S. and international markets. The company boasts over 4 million payment customers in more than 100 countries, processing over 66 billion transactions each year. GPN also pays a regular quarterly dividend of $0.25 per share, reflecting a yield of 0.9%. Further, the company’s board has authorized a $2 billion stock buyback plan.

In Q1 FY24, GPN’s adjusted earnings per share (EPS) rose 8% year-over-year to $2.59 and also topped analysts’ consensus of $2.57. Meanwhile, adjusted net revenue grew 7% year-over-year to $2.18 billion. Based on the continued momentum, GPN expects 2024 adjusted net revenue growth in the range of 6% to 7%. Also, adjusted EPS is projected to grow by 11% to 12%.

Importantly, GPN is trading at a forward P/E or price-to-earnings (non-GAAP) of 9.52x, lower than the sector average of 10.56x and also below its own five-year average of 18.94x, indicating that the stock is currently undervalued and has further room to grow.

Is GPN a Good Stock to Buy?

With 21 Buys and four Hold ratings, GPN stock has a Strong Buy consensus rating on TipRanks. The average Global Payments price target of $154.25 implies 38.9% upside potential from current levels. In the past year, GPN shares have gained 4.1%.

#2 Visa Inc. (NYSE:V)

Multinational payment card services provider Visa needs no introduction. The company does not issue credit cards or loans. Instead it facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards, and prepaid cards. Visa pays a regular cash dividend of $0.52 per share, representing a yield of 0.7%.

In Q2 FY24, Visa handily beat consensus estimates on both the top and bottom lines. Compared to the prior-year quarter, payments volume grew 8%, cross-border volume surged 16%, and processed transactions increased 11%. In the three months ending March 31, Visa repurchased shares worth $2.7 billion and has $23.6 billion remaining in its authorized repurchase program.

For Q3 FY24, Visa expects net revenue growth of low double-digits and EPS growth in the high end of low double-digits as compared to the prior year period. Visa trades at a forward P/E (non-GAAP) of 27.81x, higher than the sector average but lower than its own five-year average of 31.72x, reflecting the potential for further growth.

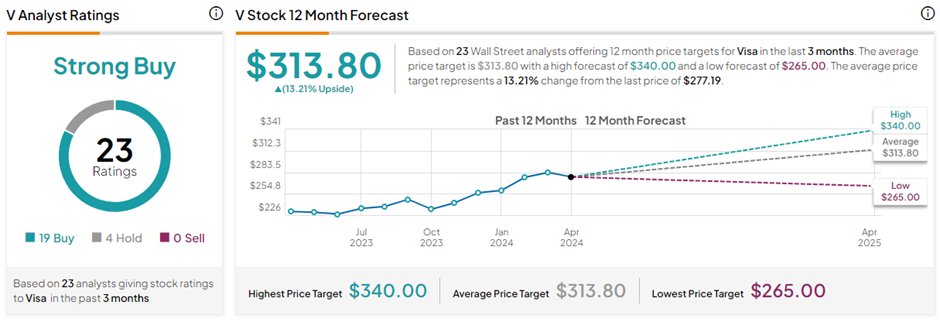

Is Visa Stock a Buy or Sell?

V stock commands a Strong Buy consensus rating on TipRanks based on 19 Buys versus four Hold ratings. The average Visa price target of $313.80 implies 13.2% upside potential from current levels. In the past year, V shares have gained 18.8%.

#3 Fiserv Inc. (NYSE:FI)

Fiserv is an American multinational company providing account processing, digital banking, card issuer processing, network services, payments, e-commerce, and merchant acquiring and processing services. Fiserv boasts more than 6 million merchant locations globally, 10,000 financial institution clients, and processes more than 25,000 financial transactions per second at peak.

In Q1 FY24, adjusted EPS rose 19% year-over-year to $1.88 and also beat the consensus. Further, revenue grew 7% year-over-year to $4.88 billion, marginally beating estimates. Meanwhile, organic revenue jumped 20% to $5.04 billion. The company undertook stock buybacks worth $1.5 billion in the quarter.

For the full-year Fiscal 2024, Fiserv guided for organic revenue growth of 15% to 17% while raising the adjusted EPS guidance to $8.60 to $8.75.

Fiserv trades at a forward P/E (non-GAAP) of 17.60x, which is higher than the sector average but lower than its own five-year average of 19.91x, signaling further growth potential.

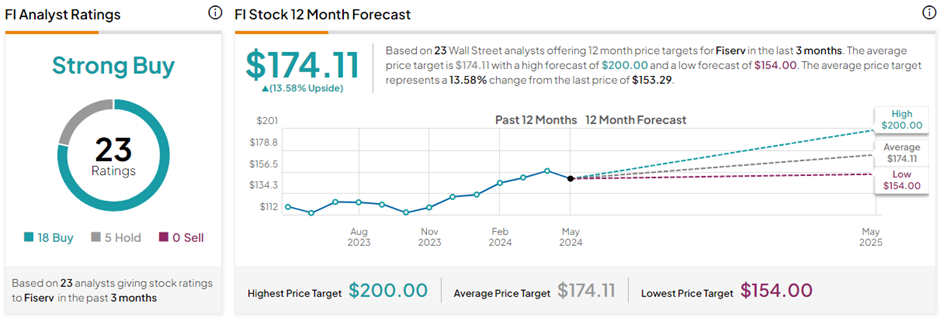

What is the Price Target for Fiserv?

The average Fiserv price target of $174.11 implies 13.6% upside potential from current levels. Also, FI stock has a Strong Buy consensus rating on TipRanks, backed by 18 Buys and five Hold ratings. FI shares have gained 28.4% in the past year.

Key Takeaways

The fintech sector could see massive growth when customer retail spending improves with easing macro pressures. Investors can consider the aforementioned three fintech stocks to diversify their portfolios and boost their returns.