3 Unstoppable Artificial Intelligence (AI) Stocks to Buy and Hold for Decades

Don’t get too cute: The best AI stocks have already risen to the top of Wall Street.

Long-term investors must think differently when evaluating stocks. Looking decades ahead is as much about preventing unnecessary risks and losses as it is about maximizing upside. Ideally, these investors strike a compromise somewhere in the middle.

Finding a middle ground is going to be your best bet when it comes to artificial intelligence (AI) stocks. Are you looking to ride AI to big-time portfolio gains over the coming decades? Your search should focus on the best long-term AI stocks. The best choices in this sector could be a few obscure companies no one is discussing … or they could be some obvious AI champions that have proven ability to be winners. It’s all a matter of what went into creating your investing thesis.

Here are three reasons why Microsoft (MSFT -0.16%), Amazon (AMZN -0.38%), and Alphabet (GOOG -1.35%) (GOOGL -1.28%) could be the best long-term AI stocks money can buy.

1. They own the cloud layer of the economy

There are huge technological challenges that go into developing and operating AI models. It takes many thousands of AI chips and it involves tremendous energy consumption. A single query on ChatGPT consumes an estimated 15 times more energy than a Google search.

That expense partly explains why ChatGPT developer OpenAI struck a partnership with Microsoft. While many companies can benefit from AI technology, only a few can afford to own and operate it. Most companies getting into this sector will ultimately pay to access AI technology instead of building it for themselves.

AI overlaps perfectly with cloud computing, where a few companies own and operate most of the world’s cloud resources. Microsoft, Amazon, and Alphabet own roughly 67% of the global cloud market. Today, most of the connected world runs on this infrastructure, which makes it perfect for distributing AI technology to the masses.

You’re already seeing these giant cloud companies weave AI products and services into the cloud. It just makes too much sense. Cloud dominance is a tremendous hurdle for other companies to overcome, and these three companies may continue to dominate the cloud and AI for years to come because of it.

2. Deep pockets gave them a massive head start in AI

It’s almost like these companies won the metaphorical lottery to become these enormous and powerful corporations, and then won again as AI emerged as a perfect fit in their existing business models. Again, the vast majority of companies cannot compete with the deep pockets Microsoft, Amazon, and Alphabet possess.

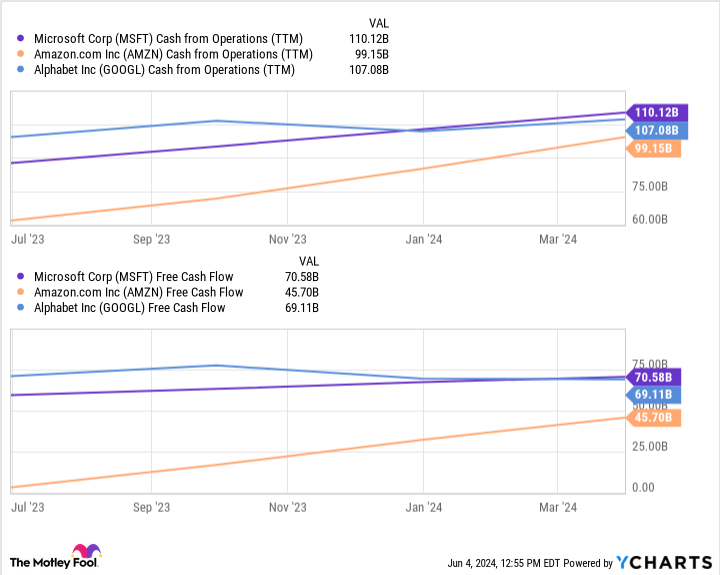

How much cash do these companies create? As it is, these three combined for over $184 billion in free cash flow over the past year alone. That’s discretionary cash profits these businesses have to spend as they please. Note that this includes capital expenditures and business investments like, for example, buying AI chips and building out data centers.

Back out those investments by looking at operating cash flow. These companies combined for over $300 billion in just one year!

MSFT Cash from Operations (TTM) data by YCharts

These companies operate hundreds of data centers worldwide and can afford to build many more to support AI demand. It’s an arms race that virtually nobody has a shot at coming in and winning from the outside. These companies are realistically competing only with each other.

3. Nvidia is only part of the AI equation and can eventually be replaced

Investors can’t forget about Nvidia (NVDA -0.09%), which has quickly become a potential AI rival in terms of size and scale to these companies. I’m not saying that Nvidia won’t be a fantastic investment and a significant player in AI over the coming decades.

But consider this food for thought: Chips are AI’s building blocks, but not AI itself. The chips are only part of the equation. So far, Nvidia has done a stellar job establishing itself as the de facto go-to supplier of AI chips.

Still, Nvidia depends on Microsoft, Amazon, and Alphabet to continue building their AI infrastructure using its chips. It’s unclear whether that will continue forever. Again, it’s easily possible that Nvidia will remain the leading player in AI chips for the foreseeable future. But it’s at least worth pondering whether these cash-flush technology giants will forever fork over billions of dollars to Nvidia.

They don’t have to switch to a competitor’s AI chip, like Advanced Micro Devices. Instead, Microsoft, Amazon, and Alphabet could design custom chips for their internal use, helping diversify their chip supply away from Nvidia as the predominant source. Custom chips wouldn’t be easy, but if any company can do it, it’d probably be these three.

So, do these big three cloud companies need Nvidia, or does Nvidia need them? This question has no clear answer today. However, the possibility of internal chip designs is enough to give Microsoft, Amazon, and Alphabet the nod as the top AI stock investors can hold decades into the future.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.