These 2 Fintech Stocks Are Set to Soar in 2024 and Beyond

This pair of fintech stocks is being underestimated by the market.

The stocks of leading fintech companies Block (SQ -2.28%) and Paypal (PYPL 0.34%) have been on rollercoaster rides the past few years. However, both stocks are set up to have strong years in 2024 and should be solid performers in the years to come.

Block

Block is best known for its Square ecosystem, which was first designed to allow sellers to accept credit and debit card payments from their phones or tablets, but has since evolved into an entire product suite for retailers. The company also owns Cash App, which is known for its free peer-to-peer payment network but which has also expanded into other services.

The company has shifted its focus in recent years from revenue growth to profitable growth. Block is looking to achieve the Rule of 40 metric by 2026. This metric is when a company’s revenue growth rate and profit margin are 40% or above, and demonstrates that a company is growing responsibly. For its Rule of 40 calculation, Block is using adjusted operating margin. Its adjusted operating income excludes interest income, taxes, one-time charges, and some non-cash amortization items.

Image source: Getty Images.

Block is looking to expand its Square seller business by simplifying its pricing and improving its customer onboarding experience, including having more formal multi-year contracts for larger sellers. It has also been targeting specific industries with products specifically designed for those verticals, such as Square for Franchises. It’s also added artificial intelligence (AI) features to help sellers automate operations and speed up workflows.

On the Cash App side, the company is looking to move upmarket to become the primary bank for households earning up to $150,000. Part of its strategy will be to cater to families, and to take advantage of the social nature of the app. Block also plans to offer more services such as free overdraft coverage, yield on savings balances, and automatic paycheck distributions to attract customers. It plans to integrate more commerce tools into its platform, such as the buy now, pay later Afterpay feature and merchant discovery.

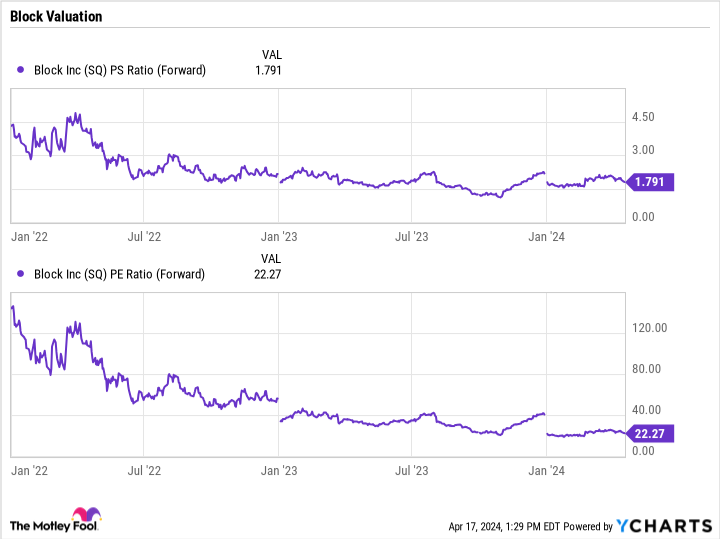

Trading at about 22 times forward earnings and less than 2 times sales, Block looks attractively priced for a fast-growing company that is becoming increasingly profitable.

SQ PS Ratio (Forward) data by YCharts. P/S = price-to-sales.

PayPal

PayPal is best known for its namesake payment platform, but the company also owns the popular Venmo app and Braintree.

Braintree, which is an unbranded payment backend used by e-commerce merchants, has been the big revenue growth driver for the company in recent years. However, the service was priced aggressively to get established with customers and take share. With product innovations, PayPal management now feels that it has the best offering in the marketplace and that it can price more to value. It is now more focused on profitable growth and believes it will see improved margins as well.

The company is also set to use AI to help improve and drive growth. It introduced a number of new innovative AI-enabled features earlier this year, including features revolving around improving customer engagement and personalization.

One of the company’s biggest new offerings is Fastlane. Fastlane saves users’ information and lets them check out with one tap, without needing a username or password or having to share a credit card with different merchants. This makes the shopping and checkout process much easier for customers, while it leads to more sales for merchants using the product.

Early results for Fastlane have been strong, and the offering could be a big growth driver for PayPal. It also shows the type of innovation the company can develop with the help of AI, which can lead to future growth as well.

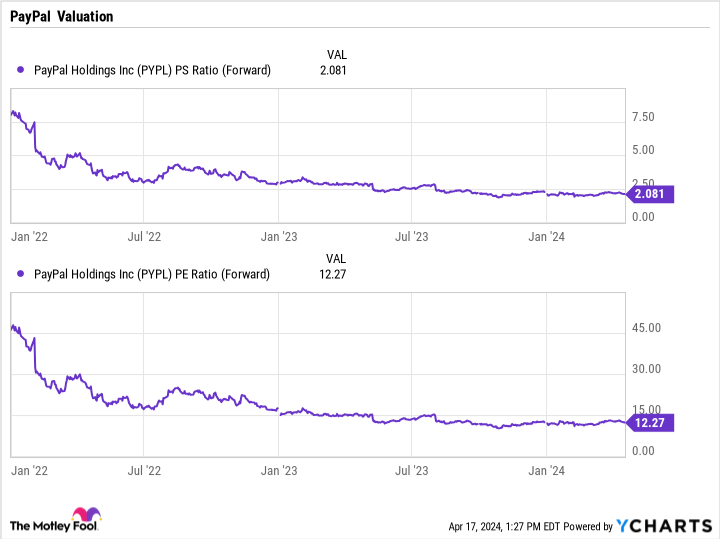

Trading at 2 times sales and a forward price-to-earnings ratio of about 12, PayPal’s stock is inexpensive for a company that looks poised to reaccelerate growth.

PYPL PS Ratio (Forward) data by YCharts.

Two solid stocks for the long term

Both Block and PayPal are attractively priced fintech stocks that look poised to have strong performances this year and beyond. Both are beginning to focus more on profitable growth and using AI technology to improve their offerings. AI is a big theme in the market, but the effect of AI in the fintech sector seems to be currently flying under the radar, making it an attractive time to buy Block and PayPal at current levels for the long term.

Geoffrey Seiler has positions in Block and PayPal. The Motley Fool has positions in and recommends Block and PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.