How Data Analytics Drive Next-Generation Business Financing

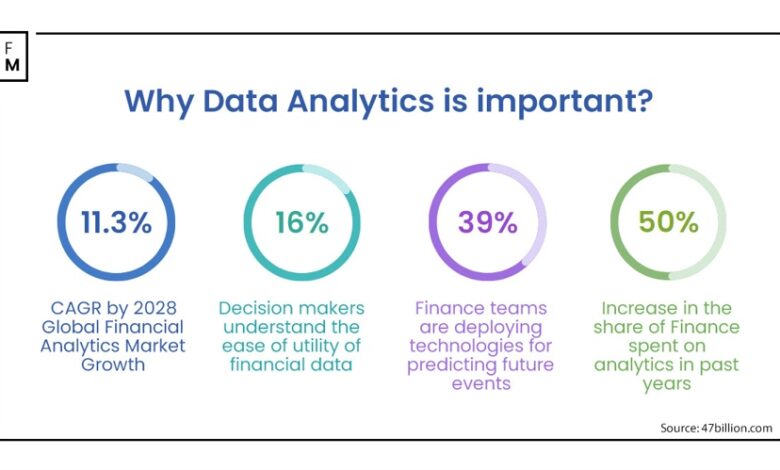

I’ve been in fintech for a number of years, and one thing

has become increasingly clear: the role of data analytics in finance is not

just growing, it’s completely revolutionising how we make lending decisions.

Traditional lending models rely on static data that is often outdated and

generic, but we are now afforded the ability to be increasingly granular when

making financial decisions.

However, while lots of data is great, we need to understand

how to effectively translate this data, action it, and embed it into a better

customer experience. Our revenue-based

finance (RBF) business model relies on a seamless customer journey, so it’s

particularly important to me that we get this right across the business,

especially when handling diverse financial requirements, from smaller loans to

significant investments.

Traditional credit models often view businesses through a

black-and-white lens, primarily relying on credit scores and financial

accounts. In contrast, data analytics offers a more nuanced and informative

approach. We’re now able to look beyond mere numbers, considering factors like

seasonality and recent performance trends. It’s about creating a full picture

of a business’s health and potential, rather than just ticking boxes.

This is particularly important in sectors such as

e-commerce, which is where we initially invested predominantly. When tackling a

concept like seasonality, traditional analysis of balance

sheets or inventory during off-peak seasons can be misleading. Looking at, and

cross-referencing, a range of different data points allows us to

delve deep into the cyclic nature of e-commerce sales and infer correlations

with other inputs such as marketing spend or a specific campaign or event,

identifying peak periods and contextualising performance.

For example, we have financed many e-commerce companies

that typically display low revenue in certain months. However, a detailed

analysis of their historical stock and marketing activities often reveals

significant sales surges during expected key periods, such as Black Friday.

Interestingly, we also observe less predictable spikes. For

example, one of our clients aligns their stock and marketing expenditure with

major global music festivals. They typically experience a notable increase in

revenue about two weeks before these festivals start. This holistic approach

allows us to recognise distinct patterns and tailor our financing to each

business.

Speed, Access, and Flexibility as the Three Pillars of

Modern Financing

Data without action is just that: data. The success of

modern financing, and RBF in particular, can be defined by three key pillars: speed,

access, and flexibility, and data analytics

plays a huge role in this. Data moves at incredible speeds, and it’s the

ability to process and respond to this data in real-time that can elevate a

lender’s product offering.

The advent of cloud computing and open banking has

drastically changed access, allowing vast amounts of data to be processed

almost instantaneously. This real-time access offers unparalleled

flexibility in adjusting offers and funding support based on a company’s

day-to-day performance. AI and machine learning

(read: Large Language Models) will be a pivotal part of business financing in

the future.

The vision will develop tools that can synthesise vast

amounts of data into comprehensible, actionable insights. Imagine being able to

feed financial data into an AI model and receive instant analysis on a

company’s financial health, risks, and opportunities. This is where we are

headed, a future where data analytics not only support but enhance every

aspect of business financing.

I’ve seen first-hand the power of data analytics in

real-time decision-making. We had a repeat customer who hit a rough patch, and

our tools flagged this financial downturn, meaning we could communicate with

them on the fly, adjusting our approach to lending while maintaining full

transparency. This is the kind of agility that data analytics enables, a far

cry from traditional models where assessments could be outdated by months if

not years.

The Problem with Data

Of course, data analysis does come with its own challenges.

One significant hurdle for us is managing data duplication and ensuring its

reliability. In the world of global finance, where we deal with multiple

currencies and languages, data interpretation becomes complex. Take, for

instance, our operations across the UK and Australia.

When we refresh data at midnight in the UK, it’s already

midday in Australia.

This time difference can split a single business day’s data across two days,

complicating our analysis and decision-making process. Then there’s the fact that the sheer volume

of data we handle doesn’t automatically translate to effective decision-making.

Without wanting to sound like a broken record, it’s not just

about collecting vast amounts of data; it’s about converting this data

into an easily interpretable format that informs sound financial decisions.

The information needs to be not only accurate and up-to-date but also presented in a way

that is comprehensible and actionable; there’s a real problem with the

standardisation of data if it is collected from multiple sources.

Without repeating the same point, the focus isn’t solely on gathering extensive data but rather on transforming it into a format that facilitates informed financial choices. Data accuracy and currency are essential, but equally critical is how it’s presented: clear and actionable. The challenge arises when data from various origins lacks standardization.

Open banking is a prime example of this; it’s incredible

that statements and accounts can be presented in so many different formats.

This process of translating raw data into meaningful insight is as crucial as

the data collection itself, and it’s a challenge we continuously strive to

perfect. The future of modern financing looks healthy.

As data points become ever more connected and automated,

there is a huge opportunity for lenders to enhance their decision-making

processes and offer more measured, sustainable, and tailored lending to

customers. The challenge, as outlined above, will be how we make sense of it

all.

I’ve been in fintech for a number of years, and one thing

has become increasingly clear: the role of data analytics in finance is not

just growing, it’s completely revolutionising how we make lending decisions.

Traditional lending models rely on static data that is often outdated and

generic, but we are now afforded the ability to be increasingly granular when

making financial decisions.

However, while lots of data is great, we need to understand

how to effectively translate this data, action it, and embed it into a better

customer experience. Our revenue-based

finance (RBF) business model relies on a seamless customer journey, so it’s

particularly important to me that we get this right across the business,

especially when handling diverse financial requirements, from smaller loans to

significant investments.

Traditional credit models often view businesses through a

black-and-white lens, primarily relying on credit scores and financial

accounts. In contrast, data analytics offers a more nuanced and informative

approach. We’re now able to look beyond mere numbers, considering factors like

seasonality and recent performance trends. It’s about creating a full picture

of a business’s health and potential, rather than just ticking boxes.

This is particularly important in sectors such as

e-commerce, which is where we initially invested predominantly. When tackling a

concept like seasonality, traditional analysis of balance

sheets or inventory during off-peak seasons can be misleading. Looking at, and

cross-referencing, a range of different data points allows us to

delve deep into the cyclic nature of e-commerce sales and infer correlations

with other inputs such as marketing spend or a specific campaign or event,

identifying peak periods and contextualising performance.

For example, we have financed many e-commerce companies

that typically display low revenue in certain months. However, a detailed

analysis of their historical stock and marketing activities often reveals

significant sales surges during expected key periods, such as Black Friday.

Interestingly, we also observe less predictable spikes. For

example, one of our clients aligns their stock and marketing expenditure with

major global music festivals. They typically experience a notable increase in

revenue about two weeks before these festivals start. This holistic approach

allows us to recognise distinct patterns and tailor our financing to each

business.

Speed, Access, and Flexibility as the Three Pillars of

Modern Financing

Data without action is just that: data. The success of

modern financing, and RBF in particular, can be defined by three key pillars: speed,

access, and flexibility, and data analytics

plays a huge role in this. Data moves at incredible speeds, and it’s the

ability to process and respond to this data in real-time that can elevate a

lender’s product offering.

The advent of cloud computing and open banking has

drastically changed access, allowing vast amounts of data to be processed

almost instantaneously. This real-time access offers unparalleled

flexibility in adjusting offers and funding support based on a company’s

day-to-day performance. AI and machine learning

(read: Large Language Models) will be a pivotal part of business financing in

the future.

The vision will develop tools that can synthesise vast

amounts of data into comprehensible, actionable insights. Imagine being able to

feed financial data into an AI model and receive instant analysis on a

company’s financial health, risks, and opportunities. This is where we are

headed, a future where data analytics not only support but enhance every

aspect of business financing.

I’ve seen first-hand the power of data analytics in

real-time decision-making. We had a repeat customer who hit a rough patch, and

our tools flagged this financial downturn, meaning we could communicate with

them on the fly, adjusting our approach to lending while maintaining full

transparency. This is the kind of agility that data analytics enables, a far

cry from traditional models where assessments could be outdated by months if

not years.

The Problem with Data

Of course, data analysis does come with its own challenges.

One significant hurdle for us is managing data duplication and ensuring its

reliability. In the world of global finance, where we deal with multiple

currencies and languages, data interpretation becomes complex. Take, for

instance, our operations across the UK and Australia.

When we refresh data at midnight in the UK, it’s already

midday in Australia.

This time difference can split a single business day’s data across two days,

complicating our analysis and decision-making process. Then there’s the fact that the sheer volume

of data we handle doesn’t automatically translate to effective decision-making.

Without wanting to sound like a broken record, it’s not just

about collecting vast amounts of data; it’s about converting this data

into an easily interpretable format that informs sound financial decisions.

The information needs to be not only accurate and up-to-date but also presented in a way

that is comprehensible and actionable; there’s a real problem with the

standardisation of data if it is collected from multiple sources.

Without repeating the same point, the focus isn’t solely on gathering extensive data but rather on transforming it into a format that facilitates informed financial choices. Data accuracy and currency are essential, but equally critical is how it’s presented: clear and actionable. The challenge arises when data from various origins lacks standardization.

Open banking is a prime example of this; it’s incredible

that statements and accounts can be presented in so many different formats.

This process of translating raw data into meaningful insight is as crucial as

the data collection itself, and it’s a challenge we continuously strive to

perfect. The future of modern financing looks healthy.

As data points become ever more connected and automated,

there is a huge opportunity for lenders to enhance their decision-making

processes and offer more measured, sustainable, and tailored lending to

customers. The challenge, as outlined above, will be how we make sense of it

all.