New Year, New Fintech Trends

Posted January 26, 2024

This content first appeared in the January 2024 Fintech newsletter. If you’d like more commentary and analysis about news and trends from the a16z Fintech team, you can subscribe here.

New year, new trends

Marc Andrusko

We closed out 2023 by sharing some of the big ideas we’re looking out for in fintech this year, including the rise of the developer as buyer in financial services, how financial professional services will be supercharged by software, and why AI will push Latin American SMBs to go digital.

Things have moved fast since then. As 2024 kicks firmly into gear, we’re keeping our eyes on some interesting stats and observations that may yield bigger developments down the line. Here are 4 things that stood out to us this month:

AI in Personal Finance

As part of Plaid’s most recent Fintech Effect Report, released late last year, the financial technology platform released some interesting data around where consumers are most likely to adopt AI solutions in their financial lives.

The report found that:

- Most consumers (53% of respondents) hoped AI could assist them with money challenges, saying “cutting bill spending and negotiating lower rates” were among the top things they wanted AI to help them with.

- Around half of those polled wanted AI’s help with “customer service issues (51%), budgeting advice (50%), and managing subscriptions (50%).”

- Younger generations were more open to AI solutions with roughly 60-65% of Millennials and Gen Z believing that the technology had potential.

While finding and managing new investment opportunities was notably absent from the response data, the above results start to sound awfully close to a world in which personal financial management runs on autopilot. The only caveat to this is that over 75% of certain populations surveyed by Plaid (notably Gen Xers) say they want to be able to review any AI-generated decisions around their finances. This suggests that at least in the near term, we’re likely to continue to see more copilots than fully autonomous agents serving consumer needs.

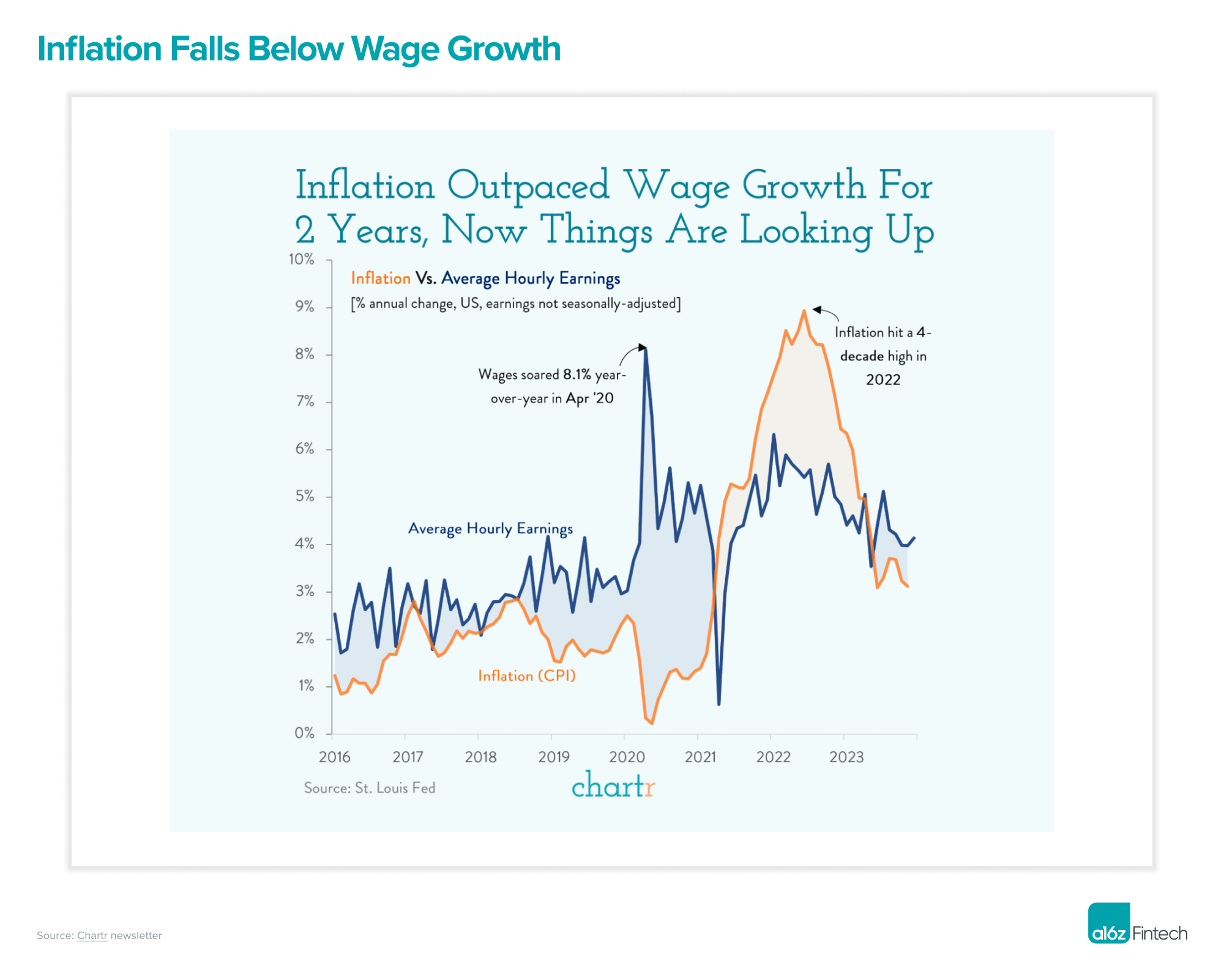

Improvements in the Macro Economy

The January jobs report revealed a healthier labor market than many were expecting, with the U.S. economy adding 216k jobs (vs. an estimated 170k jobs). Unemployment held steady at 3.7% (vs. 3.8% consensus). Perhaps more notably, wage growth continued to outpace inflation, resulting in sustained “real” wage gains for 6 consecutive months, a trend that reversed 2+ years of the average consumer losing purchasing power.

The strength of the report has indicated to some that the economy may not be in need of stimulus in the way of rate cuts. In fact, the market is now pricing in the likelihood of cuts in March at only — at the time of this writing — 70% (which is down from 100% prior to the new employment data).

Regulatory Proposals

The Consumer Financial Protection Bureau (CFPB) proposed a new rule this month that would limit the amount banks and credit unions can charge in overdraft fees, and mandate significantly more transparent disclosures around what they cost and under what circumstances they are incurred.

According to the CFPB, the rule “would close an outdated loophole that exempts overdraft lending services from longstanding provisions of the Truth in Lending Act and other consumer financial protection laws. For decades, very large financial institutions have been able to issue highly profitable overdraft loans, which have garnered them billions of dollars in revenue annually. Under the proposal, large banks would be free to extend overdraft loans if they complied with longstanding lending laws, including disclosing any applicable interest rate. Alternatively, banks could charge a fee to recoup their costs at an established benchmark — as low as $3, or at a cost they calculate, if they show their cost data.”

The proposal, which the CFPB hopes to enact by October 2025, would directly jeopardize the ~$9 billion in annual overdraft revenue earned by financial institutions each year. As such, financial services industry lobbyists and trade organizations are already scrambling to prevent its passage.

Incumbent Activity

Q4 ‘23 bank earnings were fairly weak across the board. Several of the larger Wall Street banks owed substantial FDIC special assessment charges to fund the losses from the regional banking crisis last year, which complicated their earnings picture. Meanwhile, regional banks faced pressure to pay higher rates for deposits, with many of their customers abandoning them for the GSIBs (global systemically important banks) out of fear of further bank runs. (This is just one of many reasons we’re so excited to continue supporting ModernFi in their journey to build a radically better end-to-end deposit management platform for banks and credit unions!)

Going forward, banks cautioned against the potential for net interest margin contraction (i.e., lower lending revenues) if the Fed does go forward with an early 2024 rate cut.

Apple’s Payments Pressure

Seema Amble

As Apple continues to leverage its strength in owning distribution and act as a payments gatekeeper — iPhone, Apple Wallet, the App Store — it naturally faces regulatory tension around its position within the tech ecosystem. A few big pieces of news from this month show that while the pressure is up, Apple isn’t eager to loosen its influence on the payments landscape.

Earlier this month, the U.S. Supreme Court declined to hear the appeal from the Apple vs. Epic decision. The decision at the time, which we’ve discussed, was largely in favor of Apple, but did uphold that Apple had to allow app developers to “steer” their customers outside the App Store towards alternative payment options to pay for in-app purchases (e.g., pay on a website instead of in the App Store). Such payment methods could be cheaper and potentially avoid Apple’s 30% in-app toll charged to all developers.

After this Supreme Court announcement, which allows for in-app steering, Apple revised its U.S. App Store policy, stating that apps would still have to pay 27% to Apple, even if users paid outside the platform. Apple has similarly responded with such fees in other countries like the Netherlands and South Korea. From Apple’s perspective, it should be compensated for providing distribution via the App Store, and its policies protect consumers from unknown payment methods. For developers, however, this hefty “Apple Tax” can feel crushing to their own economics.

Epic, Spotify, and other app developers clearly voiced their objections, calling the move “outrageous.” Epic CEO Tim Sweeney pointed to this 27% fee, but also Apple’s actions to discourage third-party payments. For example, to offer an alternative payment option on their websites, developers must apply for permission from Apple and also offer in-app purchases through Apple’s billing system. Developers then need to certify to Apple that they have processes for handling billing complaints and that their payment options meet Apple’s standards. Apple has to also approve the wording to link out of the App Store, and users are faced with a full-screen warning that Apple’s protections don’t apply.

Also this month, Apple offered to open Apple Pay to third-party mobile wallet and payment services in Europe, in the face of EU antitrust pressure and the EU’s Digital Markets Act, a new law requiring online gatekeepers to open their systems to more competition. Third parties (e.g., banks, payments companies) can access the NFC functionality in an Apple phone to make contactless payments, and use Apple’s operating systems freely without necessarily routing the purchaser to Apple’s Wallet or Apple Pay.

What does all this mean for startups? The cat-and-mouse game will continue. The big platforms get regulatory and industry pressure to open up their platforms, and not to make it cost prohibitive for developers to distribute via them, but change will be slow to come. While the intent is to make it easier for developers to thrive, even if the platforms open themselves up and allow third-party payments development (e.g., tap to pay, mobile POS), it likely won’t come without more subtle restrictions, as Apple is doing now. And after all, Apple has consumer trust, which is difficult to break.

More From the Fintech Team