Chinese electric vehicle suppliers prefer tech tieups, shun ‘risky’ JVs | Economy & Policy News

China is the largest cell and battery manufacturer in the world. Its companies have explored a possible entry to India but did not proceed due to stringent FDI norms for companies from China

Surajeet Das Gupta New Delhi

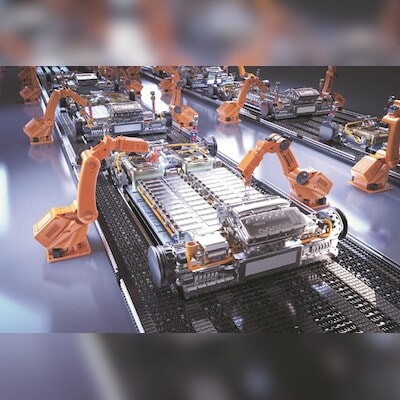

Chinese suppliers for electric vehicle (EV) companies in India, especially of lithium ion battery cells which account for 35-40 per cent of the cost, find technology tie-ups more attractive than a joint venture with a local player owing to the government’s stringent FDI rules.

A senior executive of an EV company which is planning to set up a lithium cell battery plant said Chinese companies are ready ‘to give you technology for which they receive technical fees paid upfront, royalty fees, commissions and installations by manpower and raw material cost’.

Click here to follow our WhatsApp channel

The executive said that these various heads provided substantial income to the companies with no downside from JV risks.

The concerns are similar to those in the mobile device space where Chinese companies have shown no interest in coming through a JV model.

Apple’s contract partners, for instance, received initial clearance for 12 of their vendors from the Ministry of Electronics and Information Technology so that they were allowed to go for a joint venture partner and set up facilities in the country.

However, the experiment did not work as Chinese vendors were not willing to enter even a 50-50 JV. This prompted Apple to look for suppliers in Japan, South Korea, Taiwan and home-grown players like the Tatas.

China is the largest cell and battery manufacturer in the world. Its companies have explored a possible entry to India but did not proceed due to stringent FDI norms for companies from China.

But Kolkata-based Exide Industries has signed up a long term technical collaboration with Chinese battery giant SVOLT to make lithium ion cell manufacturing in India.

Hyundai and Kia have recently signed up with Exide to localize EV battery production in India.

The Tatas are also setting up a lithium ion battery plant with an initial capacity of 20 KWH with an investment of Rs 13,000 crore.

Ola Electric is also expected to roll out its cells from its factory in Tami Nadu very soon with an initial capacity of 5KWH.

The government has hinted at some possible tweaking of its FDI stance with Chinese companies after the general elections.

It has cleared the infusion of a 35 per cent stake in JSW MG Motors in which Chinese auto company SAIC Motors was earlier a 100 per cent stake holder.

Subscribe To Insights

Key stories on business-standard.com are available to premium subscribers only.

Already a BS Premium subscriber?LOGIN NOW

MONTHLY₹9/day

₹249

Renews automatically

Select

SMART ANNUAL₹5/day

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

Select

Select