The Impacts of the EU’s AI Act on Generative AI Deployment in Financial Services

2

By Danny Butvinik, Chief Data Scientist, NICE Actimize

As technological advancement meets regulatory-compliance imperatives, financial institutions face a pivotal question: How can they harness generative artificial intelligence (GenAI) to enhance innovation, efficiency and customer experience while adhering to strict governance and compliance standards?

This question becomes even more pressing in light of the European Union’s (EU’s) Artificial Intelligence Act (AI Act), a groundbreaking piece of legislation designed to steer the development and application of AI within a framework that ensures safety, transparency and the protection of individual rights.

GenAI, with its capacity to create content that mirrors human creativity, has introduced a new frontier within the financial sector. The technology carries the potential to transform the financial-services landscape, from personalizing banking services to advancing fraud-detection algorithms. Furthering its impact, GenAI is increasingly utilized in designing personalized investment strategies for clients, adapting in real-time to market conditions and individual financial goals. This tailored approach helps institutions deliver more value, fostering deeper client engagement and loyalty.

Additionally, in compliance monitoring, these technologies are instrumental in interpreting vast transaction-data volumes and flagging anomalies that suggest compliance breaches or unethical practices. This proactive detection is crucial to maintaining the integrity of financial operations and ensuring they meet regulatory standards.

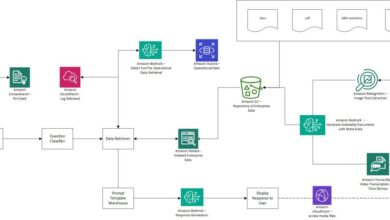

The innovative use of AI in regulatory compliance extends beyond transaction monitoring. AI is revolutionizing the automation of compliance processes, significantly reducing the time and human effort required for data reconciliation and regulatory reporting. These automated systems can detect compliance failures in real-time, allowing financial institutions to respond swiftly to potential violations. This enhances accuracy and mitigates the risks associated with human errors, leading to a more robust regulatory-compliance framework.

Looking ahead, the evolution of GenAI is set to introduce even more sophisticated capabilities. The next generation of AI systems will likely incorporate advanced predictive analytics capable of identifying potential financial crimes before they occur. Moreover, these systems may offer more personalization for customer services, adapting dynamically to user preferences and shifting market conditions, offering unprecedented service customization and responsiveness.

GenAI is also reshaping customer interactions at financial institutions. AI-driven solutions, such as chatbots and virtual assistants, handle complex inquiries 24/7, improving customer satisfaction by enhancing accessibility and reducing wait times.

The ethical considerations surrounding GenAI are profound and multifaceted. As AI systems become more integral to financial operations, ensuring these systems are free from biases and operate transparently becomes paramount. Financial institutions must prioritize the development of artificial intelligence that adheres to ethical standards and is understandable and accountable to both users and regulators. This commitment to ethical AI will help build trust and foster a broader acceptance of AI technologies in sensitive financial contexts.

This transformative power comes with other challenges. The deployment of GenAI in the financial sector carries significant ethical and operational risks. One prominent issue is data-privacy management, whereby AI systems must handle sensitive customer information with the utmost security to prevent breaches. Additionally, the rise of AI-enabled financial crimes, such as synthetic identity fraud and sophisticated phishing schemes, poses new challenges for existing security frameworks. Recent incidents have shown that even advanced systems can be susceptible to novel attack vectors, making continuous updates and monitoring essential for maintaining security integrity.

The risks associated with GenAI, such as sophisticated phishing attempts, deepfakes and other forms of financial-crime fraud, alongside security and data-privacy concerns, raise significant ethical and operational questions. The worst-case scenarios—data-privacy breaches leading to reputational damage and security breaches resulting in financial loss—highlight the critical need for a balanced approach. Financial institutions must embrace change and innovation within robust regulatory frameworks, ethical guidelines and cybersecurity measures. This approach is about mitigating risks and seizing the opportunities that GenAI presents while working within regulatory and ethical boundaries to enhance security, ensure compliance and improve efficiency without sacrificing ethical standards.

The EU’s AI Act emerges as a beacon in this landscape, setting the stage for a balanced integration of AI technologies in the financial sector. By categorizing AI applications into risk-based tiers and mandating compliance with strict regulations on transparency, data quality and human oversight, the Act aims to foster an environment in which innovation can flourish harmoniously with societal safety and ethical considerations. However, it is crucial to acknowledge the concerns about its potential dampening effects on innovation, emphasizing the importance of a nuanced and informed approach to navigating the Act’s requirements.

The EU’s AI Act categorizes AI systems into different risk levels, which has significant implications for financial institutions in the United Kingdom, especially those engaging in cross-border services. Compliance with these regulations requires substantial investments in technology and expertise, potentially increasing operational costs. However, these regulations also catalyze the adoption of cutting-edge technologies that ensure transparency and fairness, ultimately fostering consumer trust. By promoting a safer technological environment, the AI Act protects individual rights and supports the long-term stability of financial markets.

Financial institutions must align their AI systems with operational-integrity principles to ensure compliance with high standards, especially in high-risk applications such as credit scoring and fraud detection. These AI applications should be fair, unbiased, protective of customer data and capable of maintaining trust within financial services. Furthermore, aligning AI practices with the AI Act’s standards is crucial for fostering international collaboration and adopting best practices in AI governance and ethics in a globalized context.

As financial institutions look to the future to meet the objectives of compliance and alignment, partnerships with experts who are deeply versed in the technological and regulatory aspects of GenAI become invaluable. With these informed relationships, financial institutions can leverage the full potential of GenAI, ensure that they remain at the forefront of the industry and deliver secure, compliant and innovative services that meet their customers’ evolving needs. In this journey, the ultimate goal is to embrace the transformative power of GenAI, fostering an era of financial services that is not only technologically advanced but also ethically grounded and regulation-compliant.

Across the industry, several leaders have set benchmarks for successfully integrating AI within regulatory frameworks. A notable example is a major European bank that implemented an AI-driven fraud-detection system in line with the AI Act’s standards, significantly reducing false positives and enhancing customer trust. These case studies underscore the practical benefits of strategic AI investments, showing how they can lead to competitive advantages and ensure compliance.

The intersection of generative AI and financial services is poised for rapid growth, driven by both technological advancements and evolving regulatory landscapes. Financial institutions must be proactive and stay informed of regulatory changes and emerging technologies. Strategic partnerships with tech innovators and adherence to ethical AI use will be crucial for thriving in this new era. Institutions that prioritize customer trust and transparent practices will lead the market in deploying AI solutions that are not only innovative but also socially responsible and compliant.