Tesla’s Pivot to China Saved Musk. It Also Binds Him to Beijing.

When Elon Musk unveiled the first Chinese-made Teslas in Shanghai in 2020, he went off script and started dancing. Peeling off his jacket, he flung it across the stage in a partial striptease.

Mr. Musk had reason to celebrate. A few years earlier, with Tesla on the brink of failure, he had bet on China, which offered cheap parts and capable workers — and which needed Tesla as an anchor to jump-start its fledgling electric vehicle industry.

For Chinese leaders, the prize was a Tesla factory on domestic soil. Mr. Musk would build one in Shanghai that would become a flagship, accounting for over half of Tesla’s global deliveries and the bulk of its profits.

Mr. Musk initially seemed to have the upper hand in the relationship, securing concessions from China that were rarely offered to foreign businesspeople. But in a stark shift, Tesla is now increasingly in trouble and losing its edge over Chinese competitors in the very market he helped create. Tesla’s China pivot has also tethered Mr. Musk to Beijing in a way that is drawing scrutiny from U.S. policymakers.

Interviews with former Tesla employees, diplomats and policymakers reveal how Mr. Musk built an unusually symbiotic relationship with Beijing, profiting from the Chinese government’s largess even as he reaped subsidies in the United States.

As Mr. Musk explored building the factory in Shanghai, Chinese leaders agreed to a crucial policy change on national emissions regulations, following lobbying by Tesla that was not previously reported. That change directly benefited Tesla, bringing in an estimated hundreds of millions of dollars in profits as China production took off, The New York Times found.

Mr. Musk also gained unusual access to senior leaders. He worked closely with a top Shanghai official who is now the premier, Li Qiang. The Shanghai factory went up at lightning speed and without a local partner, a first for a foreign auto company in China.

Mr. Musk, who has insinuated that American workers are lazy, got employees accustomed to long hours, without the strong protections that have led U.S. and European regulators to scrutinize Tesla and unions to target it for organizing. After a Tesla worker in Shanghai was crushed to death last year, a report citing safety gaps was taken offline.

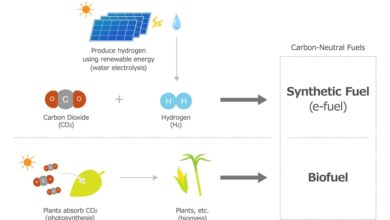

And he got the emissions policy. Modeled after a California program that has been a boon for Tesla, the policy awards automakers credits for making clean cars. To lobby for the regulatory change, Tesla teamed up with California environmentalists, who were trying to clean up China’s soupy skies.

China helped make Tesla the most valuable car company in the world. But Tesla’s success there also forced homegrown brands to innovate. China is now churning out cheap but well-made electric cars, as the Chinese leader Xi Jinping aims to transform the country into an “automotive power.” Chinese automakers like BYD and SAIC are pushing into Europe, threatening established carmakers like Volkswagen, Renault and Stellantis. Detroit is also scrambling to keep pace.

“There’s Before Tesla and After Tesla,” said Michael Dunne, an auto consultant and a former General Motors executive in Asia, about the company’s effect on Chinese industry. “Tesla was the rainmaker.”

‘Kind of Pro-China’

Mr. Musk is now treading a fine line. He has sounded the alarm about Chinese rivals, even as he remains reliant on the Chinese market and supply chain and repeats Beijing’s geopolitical talking points.

He warned in January that unless the Chinese auto brands were blocked by trade barriers, they would “pretty much demolish most other car companies in the world.” Earlier this month, Tesla’s share price plunged following lagging China sales, causing him to lose the title of richest man in the world.

The company is so ensconced in China that Mr. Musk cannot easily extricate himself, should he ever want to. Teslas cost significantly less to make in Shanghai than elsewhere, a key saving when the company is in a price war with its competitors.

On Capitol Hill, lawmakers are studying his ties to China and how he balances Tesla with his other endeavors. SpaceX, another company he owns, has lucrative Pentagon contracts and boasts near total control of the world’s satellite internet through its Starlink network. He also owns the social media platform X, which China has used for disinformation campaigns.

“Elon Musk has deep financial exposure to China — including his plant in Shanghai,” said Sen. Mark Warner, a Democrat who chairs the Senate Intelligence Committee.

It’s not clear whether Beijing has sought to exert leverage over Mr. Musk, but leaders have levers they could pull. Last year, several Chinese localities banned Teslas from sensitive areas, prompting the automaker to emphasize that all Chinese data is held locally. And in February, after the Commerce Department announced an investigation into data retention by Chinese electric vehicles, the Global Times, a Communist Party newspaper, warned that Chinese consumers could retaliate against Tesla.

Mr. Musk has taken China’s side in several international disputes. He has made China’s case for why it should control Taiwan, the self-governed island democracy that has resisted Beijing’s claims. (Taiwan is now building an alternative to Starlink, in part because of concerns about Mr. Musk’s ties.)

Mr. Musk has reportedly argued that there are two sides to repression in Xinjiang, home to the predominantly Muslim Uyghurs. In 2021, as other companies were pulling back from Xinjiang, Tesla unveiled a charging line ending there, which it called the Tesla Silk Road, after the historic route that has been revived by Mr. Xi in a campaign for global influence. The company has a similar charging line to Tibet.

Tesla, SpaceX and Mr. Musk did not reply to a detailed list of questions and findings. At The New York Times’s DealBook Summit on Nov. 29, Mr. Musk said that “every car company” relies in part on the Chinese market. He also dismissed concerns surrounding SpaceX and Starlink, saying they did not operate in China and that his companies should not be conflated.

But in an online conversation with two members of Congress in July, he was more direct. He acknowledged having “some vested interests” in China, and described himself as “kind of pro-China.”

Tesla’s First Big Win in China

In California, Tesla has enjoyed strong regulatory support. Since 2008, when it unveiled its first car, the company has earned cash under the state’s emissions mandate by selling credits to automakers that could not meet pollution targets. Those credits were worth $3.71 billion by late 2023, according to Gov. Gavin Newsom’s office.

Mr. Musk has downplayed Tesla’s reliance on government help, but Alberto Ayala, a former emissions regulator for California, said that the policy helped Tesla survive when it was struggling. “That is what kept the company afloat.”

Another former state regulator, Craig Segall, said that Tesla lobbied extensively on the emissions regulations, seeking to skew them in a way that enriched Tesla.

In China, the company aimed to recreate California’s lucrative policy.

As California built ties with China, several groups were championing an emissions mandate as a cure for its pollution. Among the policy’s enthusiasts was then-Gov. Jerry Brown, who saw electric vehicles as a potential area of cooperation. Environmentalists were on board as well.

In 2014, as Mr. Musk talked about setting up a factory in China, Tesla joined the groups in pushing for a change.

Grace Tao, a Tesla lobbyist, met with people at the Innovation Center for Energy and Transportation, an environmental nonprofit based in Los Angeles and Beijing. The group, also known as iCET, had approached Tesla. They talked about working together on an emissions mandate in the country, according to notes taken by the nonprofit and shared with The Times.

“They needed that to be successful in China,” Feng An, iCET’s executive director, said about Tesla. But Chinese officials were initially skeptical, he added, because the policy would effectively require traditional automakers to subsidize E.V. companies like Tesla.

His group helped plan meetings with Ken Morgan, then a U.S.-based Tesla lobbyist, according to event materials and emails obtained by The Times. In 2015, Mr. Morgan met with officials in three Chinese cities, touting how California’s emissions mandate had helped spur E.V. production. (Ms. Tao and Mr. Morgan, who recently left Tesla, did not respond to questions.)

Local officials were keen to persuade Tesla to build a factory in their cities. That interest could “potentially be leveraged” to promote a mandate, Maya Ben Dror, who worked for iCET at the time, wrote in an email to Mr. Morgan.

Dr. An said he took two groups of Chinese city officials to visit Tesla’s office in California, adding that neither Tesla nor Mr. Musk gave iCET any money. He and Dr. Ben Dror saw the emissions scheme as sound environmental policy.

The priorities of the environmentalists and Chinese officials often differed. In the West, clean transportation was seen as a “tree-hugging kind of issue, while in China it was from the start seen as an industrial issue,” said Ilaria Mazzocco, a senior fellow at the Center for Strategic and International Studies who studied the emissions policy discussions.

But as an innovative green business, Tesla checked both boxes.

In 2015, at a clean transportation conference in California, Chinese central government officials listened as a Tesla lobbyist laid out the reasons that Beijing should adopt an emissions mandate, said Yunshi Wang, an energy economist who organized the session.

“Obviously Tesla was all in,” said Mr. Wang, director of the China Center for Energy and Transportation at the University of California, Davis.

The emissions mandate eventually appealed to the officials, too. The existing government subsidy system was rife with fraud. The mandate was more efficient and would save the government money.

In 2017, China adopted the policy.

It was Tesla’s first big win there.

Tesla’s Factory Goes Up at Record Speed

Mr. Musk did not want to share ownership of Tesla’s factory with a Chinese company, as was required at the time. So in 2018 officials revoked the rule for all foreign electric car companies. The change was Tesla’s second big win.

Soon after, Shanghai beat out other cities competing for Tesla’s factory. Mr. Li, then Shanghai’s top leader, became a key ally. He had visited Tesla in California, on a trip that also included a meeting with Governor Brown, Mr. Xi and others about climate cooperation.

Mr. Musk proposed constructing the factory in two years, state media reported. Mr. Li countered that they could do it in one — a goal that his government met.

“This was even faster than China speed,” said Tu Le, who heads the consultancy Sino Auto Insights, adding that Mr. Li’s help was key: “How quickly things happened points to his tacit approval of everything.”

Government officials used “very creative yet cautious approaches” to bend policy to Tesla’s wishes, Ms. Tao told Yicai Global, a Chinese media outlet, adding that she was “deeply impressed.”

At least twice, Mr. Musk and his team were allowed to drive Teslas into Zhongnanhai, the Communist Party leadership’s walled compound in Beijing.

Under Mr. Li’s watch, state-run banks offered Tesla over 11 billion yuan ($1.5 billion) in low-interest loans. The deal was so generous that Huang Yonghe, a senior official with a government-owned auto industry group, recalled one government minister balking at it.

“He said the Shanghai leaders were unbelievable — giving away the entire investment without Tesla having to spend a penny,” Mr. Huang said in an interview.

But Mr. Huang said the deal made sense for the banks.

He had long been impressed by Tesla, at one point importing a car and disassembling it to study how it worked. Like Mr. Li, he had visited the Tesla factory in Fremont, Calif., which had struck him as chaotic but promising.

China could improve on it, he thought, yielding an efficient foreign factory that would serve as a “catfish,” an aggressive creature that makes other fish swim faster.

Tesla also created a market for Chinese suppliers, saying recently that 95 percent of components used in the Shanghai factory are locally sourced.

One key supplier is a once-obscure battery company. In the United States, Tesla had a partnership with Panasonic, but in China it switched to mainly using batteries from CATL, which built a factory near Tesla’s. Today, buoyed in part by Tesla’s business, CATL is the world’s largest battery maker.

Another supplier, LK Group, developed enormous casting machines that can make an entire section of a car with Tesla’s help. The company’s founder, Liu Siong Song, told The Times in 2021 that LK planned to supply the machines to six Chinese companies.

That year, he said that he hoped the technology would “help our country’s automotive industry become bigger and stronger,” linking it to Mr. Xi’s “Chinese dream” of national resurgence.

Long Hours at Tesla’s Shanghai Plant

Before the Shanghai plant opened, Fremont was Mr. Musk’s principal factory. He sometimes slept on the factory floor to model the intensity he expected of his employees.

In China, workers were accustomed to long workweeks, a fact that Mr. Musk saw as an advantage.

The Shanghai plant’s schedule involves an unusual weekly change in shifts. According to two former employees, workers there pull four straight 12-hour day shifts, followed by two days of rest, before switching to four 12-hour night shifts. (Fremont employees typically work seven 12-hour shifts over two weeks.)

As the coronavirus pandemic spread in 2020, the Fremont factory was shuttered for nearly two months.

But the Shanghai plant closed for only about two weeks, helping Tesla turn a profit for the first time and causing Mr. Musk’s wealth to surge.

China has also offered Mr. Musk an escape from California’s strict labor protections.

During Shanghai’s 2022 lockdown, some Tesla workers slept on the factory floor. They were paid extra to continue working, but Tesla demanded six twelve-hour shifts in a row, the two workers said. (Employees who chose not to work were also paid, but less than their normal salary.)

Chinese workers “won’t even leave the factory,” Mr. Musk said at the time, speaking generally, adding, “whereas in America people are trying to avoid going to work at all.”

In Fremont, accidents have set off regulatory investigations. But in Shanghai, when the Tesla worker was crushed to death by machinery last year, a report published by city authorities citing safety gaps was taken down shortly after it went online.

The Shanghai government bureau that released the report did not respond to faxed questions.

‘May There Be Prosperity for All’

China’s vision of Tesla being a catfish for local electric vehicle brands has proved prescient. BYD, a top Chinese rival, overtook Tesla in worldwide sales late last year.

But China’s electric vehicle push has prompted anxiety in Europe. “When we decided to shift from thermic engines to E.V.s, we were late vis-à-vis China — I would say between five and seven years late,” said Bruno Le Maire, France’s finance minister.

In September the European Union started an inquiry into whether Chinese policies give electric vehicle brands there an unfair edge. Although Tesla is not technically under investigation, it could face tariffs on cars exported from China.

In the United States, the Biden administration pushed through the Inflation Reduction Act in an attempt to compete. The White House is now considering raising tariffs on Chinese electric vehicles, which are already at 25 percent.

California officials reject the idea that Tesla’s rise in China has been bad for the state. “It’s not really a zero-sum game,” said David Hochschild, chair of the California Energy Commission, who said he saw “robust growth” ahead in E.V.s for both sides.

But Shanghai has replaced Fremont as Tesla’s global export hub, sending more than 175,000 cars to Europe from China last year, according to Schmidt Automotive Research.

And while the Chinese emissions program brought in hundreds of millions of dollars in credits for Tesla, according to the market analysis company CRU Group, the price of credits is dropping because Chinese companies are manufacturing more electric cars.

“We have reached the tipping point,” said Lei Xing, an independent auto analyst focused on China.

Despite rising competition, Mr. Musk remains strong in the country.

In October 2022, Mr. Li, the former Shanghai leader, was promoted to the country’s No. 2 spot. Mr. Musk is also building a battery factory in Shanghai, which a state-owned research firm said last year would use CATL cells. When Mr. Musk traveled to China last May, the battery maker’s chairman welcomed him with a 16-course banquet. At his side for at least part of the trip was Ms. Tao, the lobbyist, who had risen to the post of vice president at Tesla. (CATL did not respond to questions.)

Even the plant Tesla is building in Nuevo León, Mexico, will use Chinese suppliers, several of whom the state governor has said will set up factories nearby.

Late last year, Mr. Musk attended an exclusive reception for Mr. Xi in San Francisco.

On Weibo, a Chinese social platform, Mr. Musk posted a photo of him shaking hands with the Chinese leader. “May there be prosperity for all,” he wrote.

Keith Bradsher, David A. Fahrenthold, Eric Lipton and James Wagner contributed reporting. Susan C. Beachy, Kitty Bennett and Kirsten Noyes contributed research.

Audio produced by Sarah Diamond.