Fiverr Is My Top Artificial Intelligence (AI) Stock to Buy Now. Here’s Why.

The freelance services marketplace’s stock has taken a beating in the last three years, but the business just kept growing.

It’s easy to find artificial intelligence (AI) stocks nowadays. Any tech company worth its silicon salt is at least dabbling in basic machine learning and generative AI. Those that don’t offer AI tools of their own are putting computers to work on a whole new level. Close your eyes and point at a spot on a map of the Santa Clara Valley, and you’ll probably find six AI start-ups sharing a PO box.

But not every AI company can be a winner, and many of today’s aspiring experts will wind up busts in the long run. And even the proven technology winners can become overvalued, with most of their long-term growth prospects already priced into their stocks.

And that’s why I get downright excited when I find an actual AI player with an underpriced stock. That’s a rare breed indeed. So let me tell you why I can’t stop buying shares of Fiverr International (FVRR 3.74%).

Why is Fiverr’s stock so cheap?

Some folks think that the rise of AI tools will be the death of Fiverr’s creative and professional freelance services — and wasn’t remote work supposed to fade out at the end of the pandemic anyway?

The one-two punch of these pessimistic views has driven Fiverr’s stock down to the basement, and through a trapdoor in the foundation. At the bottom of that hole, Fiverr shares only found a shovel and clear instructions to keep digging. The stock now sits less than 9% above its (recently notched) all-time low and roughly 94% below the record high it set in early 2021.

How is the actual business doing, though?

It’s true that Fiverr’s revenue growth slowed down in 2022. Freelance service buyers of every stripe slowed down their spending as inflation surged, and Fiverr took a hit like many other businesses.

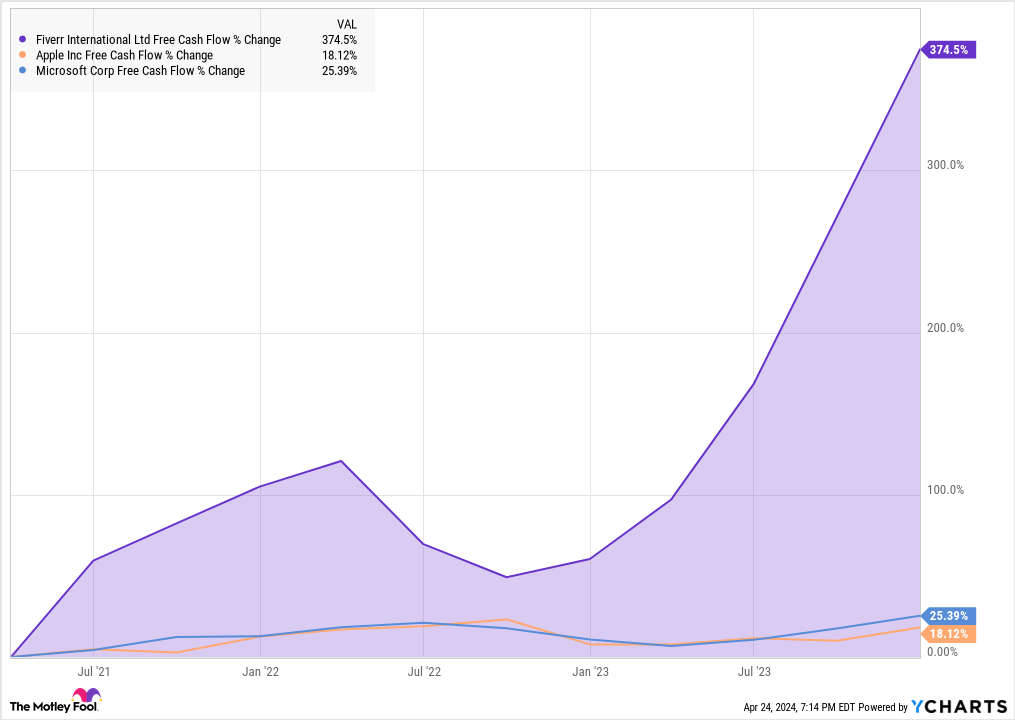

But its slowdown looks mild in the context of what befell other tech stocks in the same period. In fact, Fiverr’s business growth over the last three years made Apple (AAPL -0.35%) and Microsoft (MSFT 1.82%) look sluggish.

FVRR Revenue (TTM) data by YCharts.

Maybe you’d rather compare free cash flow instead of top-line growth. That’s cool, because Fiverr walks away with that trophy too.

FVRR Free Cash Flow data by YCharts.

Fiverr is a bargain-bin AI winner

Sure, it’s a bit unfair to compare these companies on a percentage-growth basis. Fiverr is much smaller than the tech titans, and it’s much harder to nearly quintuple your free cash flow when that metric is scaled in the tens of billions of dollars rather than tens of millions. The law of large numbers strikes again.

But that undeniable fact doesn’t take anything away from the fact that Fiverr is delivering proven growth and robust cash flows, long after many investors abandoned the former market darling.

But what of the threat of OpenAI’s ChatGPT and other generative AI tools? Yes, Fiverr may lose a few freelance connections as penny-pinching clients look for ways to avoid paying for talent. But those cost-cutters will soon find out that it takes human brains to make the most of these tempting AI tools. As the old truism in the computing world states: Garbage in, garbage out.

This helps explain why AI talent is one of Fiverr’s fastest-growing service categories these days. Service buyers need people who know how to make the most of those inherently uncreative machines.

“Overall, we estimate AI created a net positive impact of 4% to our business in 2023 as we see a category mix shift from simple services such as translation and voice-over to more complex services such as mobile app development, e-commerce management, or financial consulting,” CEO Micha Kaufman said in February’s fourth-quarter earnings call. “In 2023, complex services represented nearly one-third of our market base, a significant step-up from 2022.”

There you have it. Fiverr benefits directly from the generative AI race, its business growth is back on track after a temporary slowdown, and the company never stopped collecting cash profits hand over fist.

But the stock is priced for absolute disaster. That’s a big mistake, which is why Fiverr is first on my list every time I have fresh cash to invest. You should take a closer look at this price-to-value mismatch, and perhaps follow my lead. It’s hard to find a wealth-building bargain like Fiverr.

Anders Bylund has positions in Fiverr International. The Motley Fool has positions in and recommends Apple, Fiverr International, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.