1 Artificial Intelligence (AI) Stock to Buy Now and Hold Forever

One common theme among highly successful businesses is that they are constantly innovating. Microsoft (NASDAQ: MSFT) was founded nearly half a century ago. In that time, the company has evolved dramatically since revolutionizing personal computing.

Today, Microsoft operates across a variety of end markets, including cloud computing, social media, gaming, and of course, artificial intelligence (AI).

Although investors have myriad opportunities to invest in these areas, I’d argue that Microsoft is one of the few opportunities that actually succeeds in all the markets in which it operates. Moreover, as the AI revolution spells a new chapter in Microsoft’s life cycle, I think the company is positioned to continue its dominant run.

An ecosystem unlike any other

I’d wager that when you think of Microsoft, your first inkling is to affiliate the company with its Windows operating system. While this was the spark that ignited Microsoft’s magical run throughout the 1990s, the company has made a lot of interesting moves since then.

In the mid-2000s, Microsoft pursued a number of high-profile acquisitions that were meant to diversify the business. The company dolled out billions for services such as Skype and Yammer — both of which used to complement Microsoft’s existing productivity tools in the Office suite.

However, in more recent years, Microsoft has transitioned from personal computing to more of a cloud operation. Although this has served Microsoft well, a new story is beginning to unfold as AI proliferates throughout Microsoft’s ecosystem.

A long-term story that’s just beginning

One of the things that makes Microsoft so compelling is the company’s constant pursuit of growth. In other words, Microsoft doesn’t rest on its laurels. Rather, the company has consistently shown that it uses robust cash reserves to bolster existing product lines.

In the midst of AI euphoria, Microsoft sent shock waves throughout the tech sector following a multibillion-dollar investment in OpenAI — the start-up behind ChatGPT. Since partnering with OpenAI, Microsoft has integrated ChatGPT throughout many applications.

For example, ChatGPT can now be leveraged in Microsoft Office tools such as Word, Excel, and Teams. Additionally, users can leverage ChatGPT on Microsoft’s social media platform, LinkedIn. Furthermore, the company’s Azure cloud infrastructure is arguably the most lucrative opportunity for Microsoft’s AI ambitions.

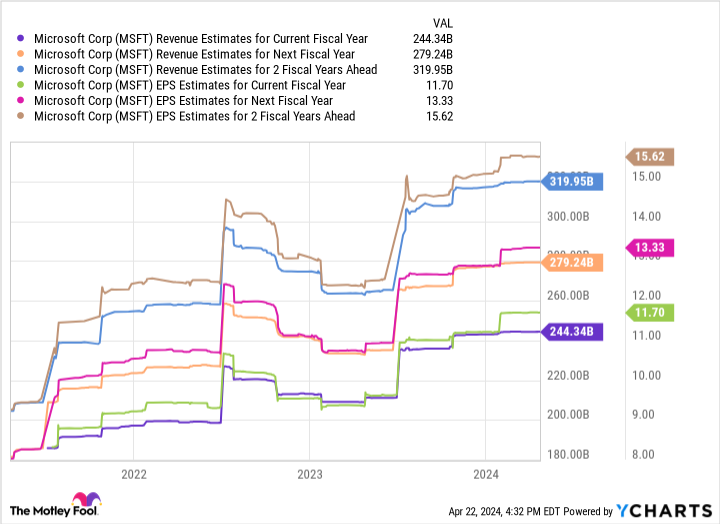

I’m not the only one bullish on Microsoft’s prospects. The chart illustrates consensus estimates among Wall Street analysts for Microsoft’s revenue and earnings over the next few years.

With sales and profits expected to continue growing, I think long-term investors should be encouraged by Microsoft’s moves in the AI space and optimistic about the impacts this technology can have on the company in the long run.

Microsoft’s future looks bright

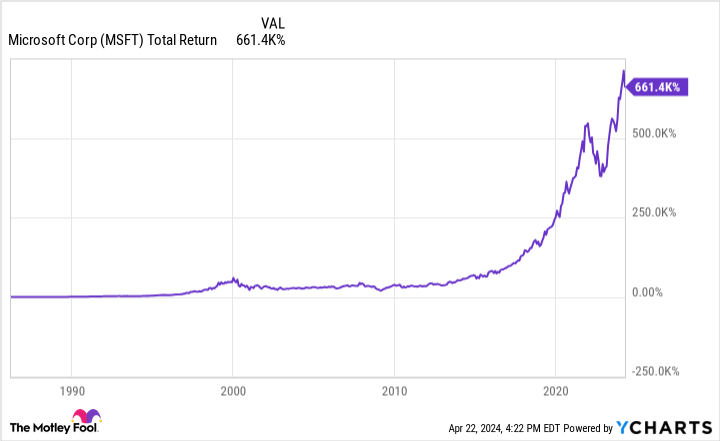

The chart illustrates Microsoft’s total return since going public. The main idea here is that investors who have held the stock over the last few decades have been handsomely rewarded.

That said, I understand that holding on to a stock for that many years is easier said than done. Moreover, at a price-to-earnings (P/E) ratio of 36.2, Microsoft stock has gotten a bit pricey.

Nevertheless, the reason I see Microsoft as such a generational opportunity is because I think it is a stock that you can own forever. The company provides investors with a high degree of exposure to many different end markets. The diversification of Microsoft’s business is truly unparalleled.

But with that said, investors must exercise patience because it will take years before the company begins to scale and generate meaningful growth in any particular segment.

As the AI narrative continues to play out, I think Microsoft is one of the best-positioned enterprises to benefit from long-term secular tailwinds.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 22, 2024

Adam Spatacco has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Artificial Intelligence (AI) Stock to Buy Now and Hold Forever was originally published by The Motley Fool