Is Rivian Stock a Buy?

2024 has been a year of transition for the electric vehicle (EV) industry. Sales are still growing, but the rate of expanding sales has slowed noticeably. That’s led many EV makers to throttle plans to increase production as well as the number of new models being offered.

Stocks in the industry have taken a beating as a result. Rivian Automotive (NASDAQ: RIVN) has thus far been relatively successful in building a customer base and ramping up production. But the company doesn’t plan to sell more EVs this year compared to 2023. That disappointed investors and Rivian shares have plunged by more than 60% so far this year. Yet that could be just what long-term investors want if the company is able to successfully execute recently announced expansion plans.

Rivian predicts what EV buyers will want

But that road to successful execution won’t be easy, and achieving its goals comes with many risks. First and foremost, the company needs to balance its available cash with the need to invest in its future. Rivian recently told investors how it planned to navigate that difficult path.

It wasn’t a surprise when Rivian officially introduced its R2 vehicle platform in March. The company has long planned its next-generation platform to be a smaller, and less expensive, vehicle.

The new R2 SUV is expected to cost about $30,000 less than Rivian’s R1S. The $45,000 base price should expand its potential market. The new product won’t sacrifice some of what has already attracted buyers to the brand, either. It will accelerate from zero to 60 miles per hour in under three seconds, and should provide a range of more than 300 miles on a single battery charge. But R2 shipments won’t start until 2026, and that’s where the risk lies for an investment in Rivian.

Cash is in focus

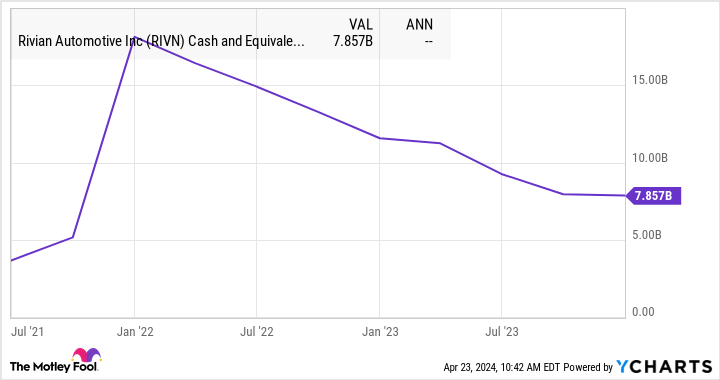

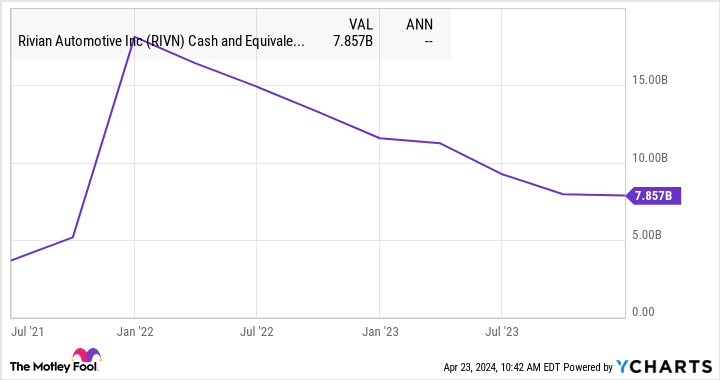

Management did a good job of building a large amount of cash from early investors in this capital-intensive industry. But that cash pile has been dwindling quickly.

It should also be noted that when including short-term investments and access to funds under its revolving credit facility, Rivian finished 2023 with over $10 billion in total liquidity.

Rivian has recognized that its balance sheet needs to be a big focus. Management has said it will now focus on gross profit and cost efficiencies. To that end, it made a strategic change when it announced the R2 model.

Rivian will now slow the pace of investments in a new Georgia manufacturing facility and instead initially build the R2 at its existing plant in Illinois. That is estimated to save $2.25 billion in capital expenditures in the near term.

Who should buy Rivian stock?

Longer-term, Rivian will need its R2 model — and future R3 crossover SUV — to be hits with EV buyers. Investors who believe in the brand and see good potential for that could be investing in Rivian now that the stock is hovering near all-time lows.

Rivian notably also has electric delivery vans that will help bring in revenue and utilize existing production capacity. That’s a way to keep expenses from ballooning as equipment gets utilized even if consumer sales slump.

But investors should allocate any investment appropriately. Rivian has a real chance of ultimately failing as a business. For those that want exposure to a riskier investment, though, now may be a good time to buy some Rivian stock.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Howard Smith has positions in Rivian Automotive. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Rivian Stock a Buy? was originally published by The Motley Fool