The Paypers global partnerships analysis Q1 2024: Banking and Fintech

Open Banking and Embedded Finance

Open Banking and Embedded Finance have gained popularity in the last couple of years across several geographical regions around the world. By relying on secure and efficient networks, both Open Banking and Embedded Finance are expected to bring improved and innovative solutions to the banking industry.

During Q1 2024, several partnerships were centered around the adoption and development of Open Banking and Embedded Finance, as multiple companies and financial institutions aimed to get a more detailed picture of customers’ financial situation and strengthen their overall fraud prevention strategy.

For example, FIS announced its collaboration with Open Banking provider Banked in order to launch new capabilities for businesses across the globe. At the beginning of March 2024, Socure partnered with Trustly to provide onboarding processes, as well as Open Banking payment methods for global merchants, while Neonomics and Bislab collaborated to improve Embedded Finance. Around the same time, allpay was appointed as the supplier of Crown Commercial Service’s Open Banking and Fund Administration & Disbursement Services Dynamic Purchasing Systems.

Europe

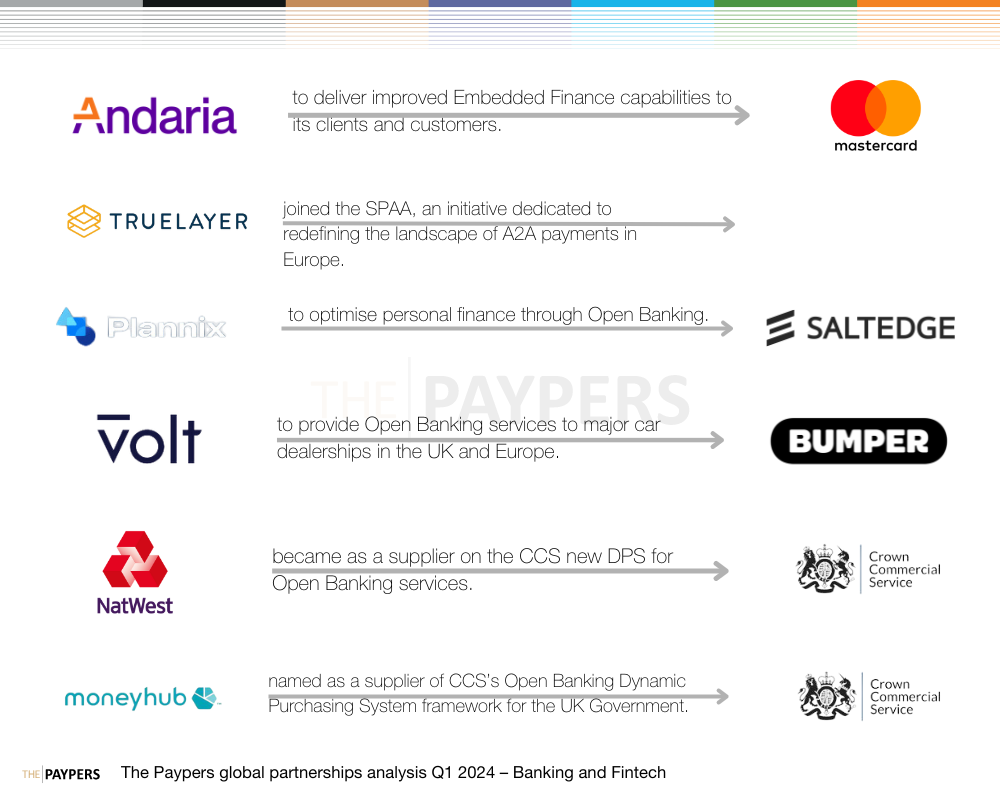

One of the first partnerships announced during Q1 2024 was the one between Andaria and Mastercard, as the companies focused on delivering Embedded Finance capabilities to Malta-based customers. During the same period, Truelayer joined the SPAA, an initiative focused on optimising A2A payments in Europe, while Italy-based Plannix collaborated with Salt Edge to improve personal finance through the use of Open Banking.

The month of February 2024 began with the partnership between Volt and Bumper, which aimed to provide Open Banking to major car dealerships in the UK and Europe, followed by the announcement made by NatWest as it became a supplier on the Crown Commercial Service’s (CCS) Dynamic Purchasing System (DPS) for Open Banking services.

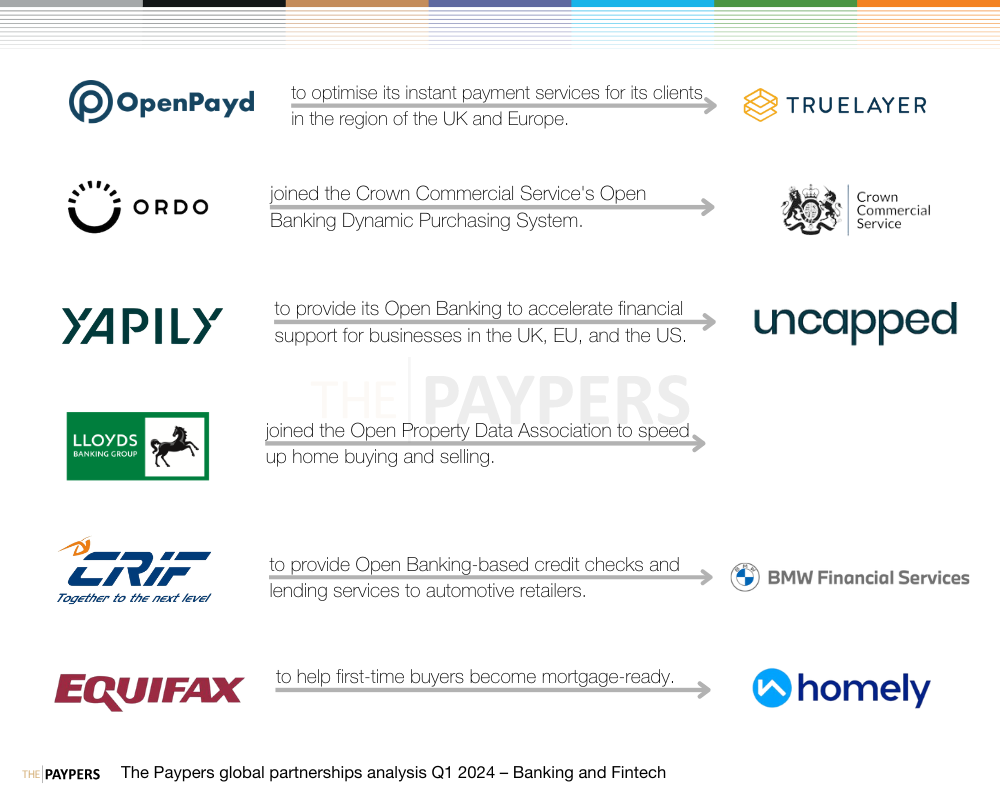

Other companies in the region of the UK that focused on Open Baking include Moneyhub, which was also named a CCS’s Open Banking Dynamic Purchasing System framework for the local government, as well as Open Payd and TrueLayer, which focused on optimising the first’s instant payment solutions. Furthermore, Ordo joined the CCS’s Open Banking DPS in the same month, as Yapily and Uncapped partnered to accelerate secure financial support for businesses in the EU, the UK, and the US.

The announcement that Lloyds Banking Group joined the Open Property Data Association was made at the beginning of March 2024, alongside the partnership between CRIF and BMW Financial Services, which focused on providing Open Banking-based credit checks and lending services to automotive retailers. Around the same period, Equifax announced its collaboration with Homely, aiming to optimise how first-time buyers became mortgage-ready.

The Americas

The month of January 2024 began with two important partnerships for Flinks, both focused on the implementation and development of Open Banking in the region of Canada. The first collaboration, with Everlink and FirstOntario, provides the latter’s customers with Open Banking solutions. The other one, with Central 1, aimed to enable financial data exchange for credit unions.

Around the same time, Belvo and Nequi forged an Open Finance agreement in Colombia, while US-based Grasshopper partnered with Pocketbook and Treasury Prime to accelerate the development of the SME community through Embedded Banking later in March 2024.

APAC and MENA

Q1 2024 saw multiple important partnerships across the APAC and MENA regions, including the collaboration between PayTabs Groups and Fintech Galaxy, which focused on the process of optimising GCC’s fintech space with payment orchestration and Open Banking solutions. Fintech Galaxy announced another strategic deal later in February 2024, integrating its solutions with Bud Financial to offer customers in the MENA region Open Banking and AI-powered tools.

The month of March began with the partnership between Tarabut and Bahrain-based fintech BENEFIT, as both companies focused on launching a consent authentication method that streamlines Bahrain’s Open Banking ecosystem, as well as the strategic collaboration between SAVIS and Konsentus, which aims to support Open Banking in Vietnam.

Digitalisation/Development

As the overall banking and fintech landscape experiences a digital change, financial institutions focus on accelerating their process of digitalisation in order to meet the risen customer requirements, as well as the overall need for improved solutions and tools.

Temenos, for example, engaged in numerous partnerships during Q1 2024. One of the first collaborations of the company was with UK-based customer lifecycle management company Wealth Dynamix, which focuses on making the latter available on the Temenos Exchange platform. Temenos also partnered with Nagarro to accelerate the development of banking services in Romania and Poland.

Moving its focus to the Americas, Temenos collaborated with Deloitte US to accelerate the platform modernisation of local banks in the cloud. Temenos also announced its partnership with Segura Bank at the beginning of February 2024, aiming to launch a new digital bank, as well as a strategic deal with Commerce Bank, seeing the financial institution adopt its loan origination service.

Temenos has multiple partnerships across the APAC and MENA regions as well, including the deal that enables the Vietnam International Bank to implement its core banking solution on the cloud, in collaboration with AWS and ITSS. Later in March, Temenos partnered with Metrobank to allow the FI to leverage its Temenos Wealth solution, as well as its incorporation with the Cooperative Bank of Oromia, which launched the CooApp and CooAPP Alhuda on the Temenos Digital (Infinity). In the same month, Temenos partnered with InCountry to provide secure data residency for the Temenos Banking Cloud.

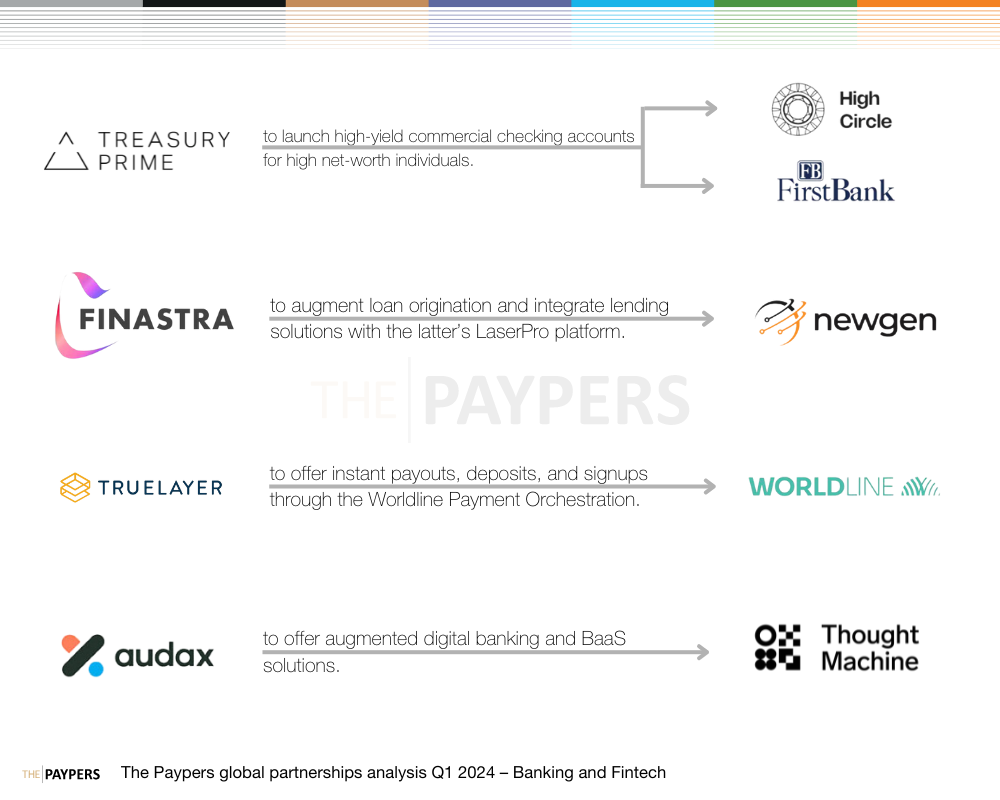

High Circle, First Bank, and Treasury Prime also teamed up to launch high-yield commercial checking accounts for high-net-worth individuals around the world, while Finastra’s LaserPro integrated Newgen’s loan origination during the same month. Still focusing on global developments, TrueLayer partnered with Worldline to offer instant payouts, deposits, and signups through the Worldline Payment Orchestration. At the same time, StanChart’s audax collaborated with Through Machine to provide augmented digital banking and BaaS solutions to clients and customers.

Europe

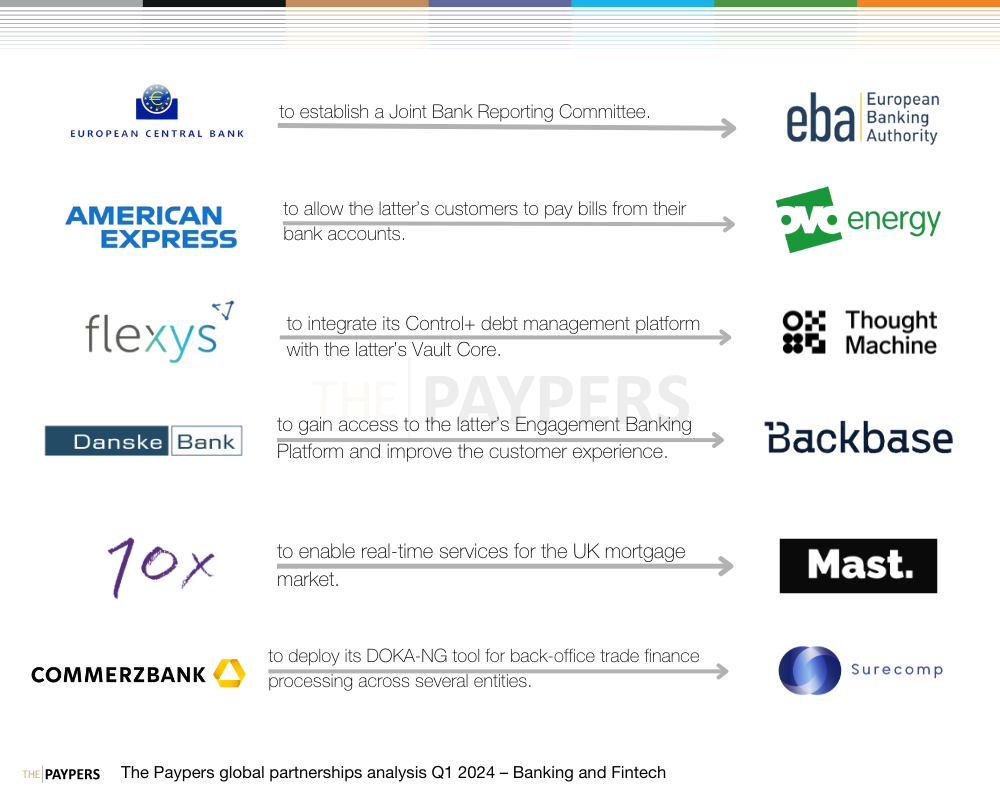

The European landscape saw multiple strategic deals and collaborations that focused on digitalisation, expansion, and acceleration of growth processes. One of the more important partnerships announced across the region of Europe was between the ECB and EBA, which saw the financial institutions focus on improving the overall banking industry data reporting, as well as establishing a Joint Bank Reporting Committee.

Among the first partnerships announced across the region, American Express and OVO Energy now allow customers to pay bills from their bank accounts. Later in the same month, Flexys collaborated with Through Machine to integrate its Control+ debt management platform with the latter’s Vault Core, while Danske Bank partnered with Bankbase to leverage its Engagement Banking Platform and improve the customer experience.

In January 2024, 10x partnered with Mast to enable real-time services for the UK mortgage market, as Token.io joined the SPAA scheme later in the same month. February 2024 began with the collaboration between Commerzbank AG and Surecomp, which aimed to deploy its DOKA-NG tool for back-office trade finance processing across several entities, as well as the strategic deal between Orange and BNP Paribas, which signed multiple agreements that defined the terms of the collaboration.

Froda announced its partnership with Visa, planning to optimise the lending processes for SMEs across Europe later in Q1 2024, followed by Landsbankinn, which integrated with CBA to use its IBAS BGF for the reduction of false positives.

The Americas

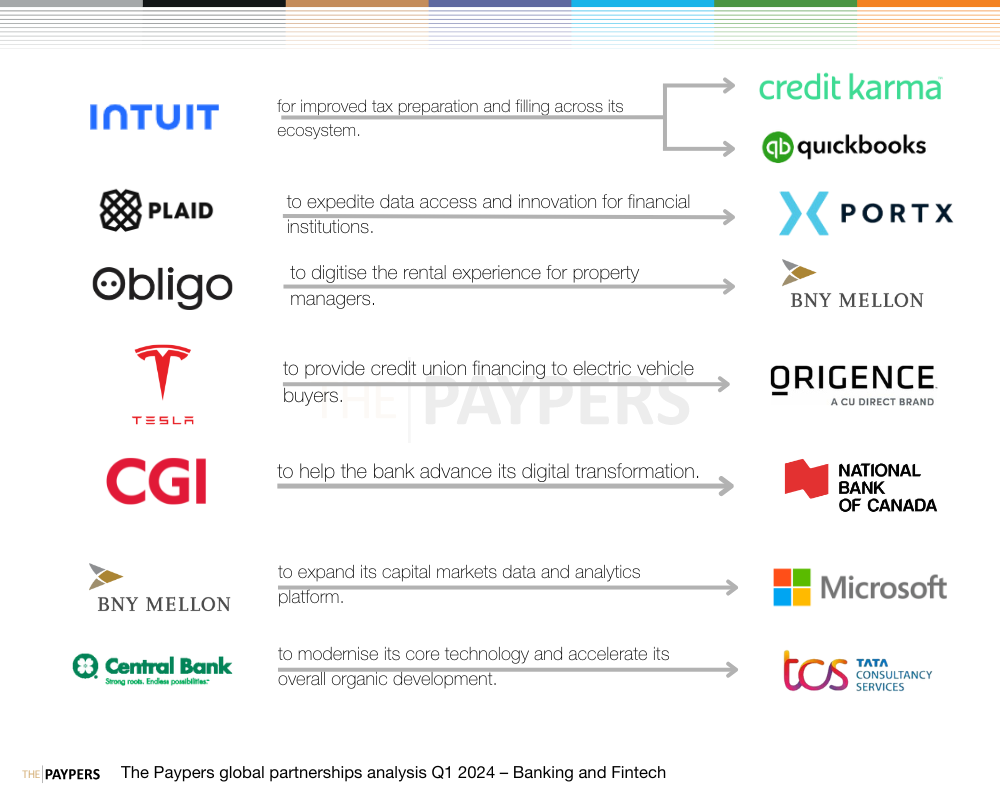

One of the first announcements made across Q1 2024 in the region of the Americas was by Intuit TurboTax which was included in Credit Karma and QuickBooks to provide improved tax preparation and filling across its ecosystem. Later in the same period, Plaid collaborated with PortX to expedite data access and optimised solutions for FIs, while Obligo partnered with BNY Mellon to digitise the rental experience for property managers.

Tesla also announced an important deal in January, as the company partnered with Origence to provide credit union financing to electric vehicle buyers. CGI also signed a service agreement with the National Bank of Canada later in the same month, as the financial institutions were expected to focus on another ten years of partnership.

BNY Mellon launched its collaboration with Microsoft at the beginning of February 2024, as both companies focused on expanding their capital markets data and analytics platform. Later in March 2024, Central Bank US partnered with TCS to modernise its core technology and accelerate the overall organic development of its business.

APAC and MENA

Qatar-based Ooredoo announced its partnership with Commercial Bank at the beginning of January 2024, aiming to launch a direct debit solution through the CBQ Mobile App, for secure and efficient bill payments. Among the companies that started collaborating in the same month was Tonik, which entered the SME lending requirements in the region of the Philippines, as well as UnionBank of the Philippines, which selected Informatica’s Master Data Management SaaS solution for its development process.

The month of February started with the partnership between the Commercial Bank of Kuwait and Network International, which focused on augmenting its digital banking and payment transformation. Furthermore, AI Baraka Bank collaborated with Mastercard to introduce a range of digital payment services in Egypt, while Finastra partnered with SYSTEX to provide a comprehensive and secure treasury solutions offering to banks based in the region of Taiwan.

Card payments innovation

During Q1 2024, multiple banks and financial institutions focused on developing and incorporating new technologies, as well as aiming to deliver optimised payment methods to meet the needs of their customers and sector-specific business requirements. An example is represented by the partnership between Volopa and Yapily, which aims to provide an improved payment experience for finance teams through the use of Open Banking technology. In a highly demanding landscape, banks also prioritised the process of delivering sustainable solutions that adapt to several schemes and meet the regulatory requirements of the industry as well.

The Americas

APAC and MENA

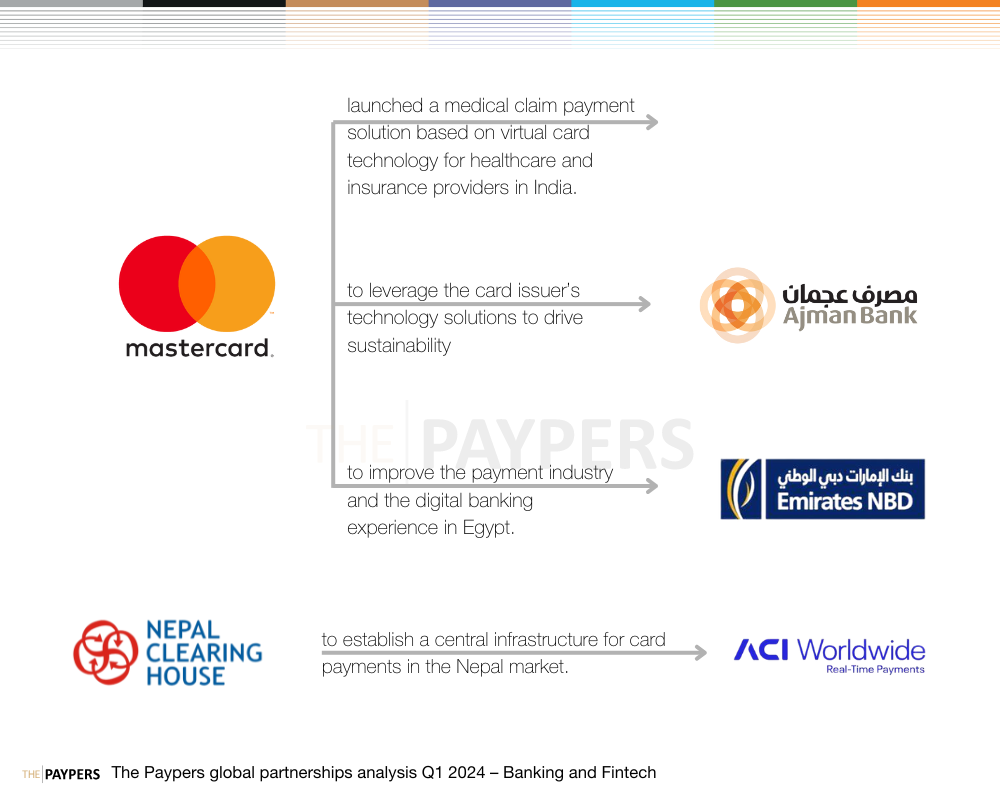

Throughout Q1 2024, Mastercard engaged in a series of partnerships that focused on card payments innovation. The first one was announced in January 2024, when the company launched a medical claim payment solution that was based on virtual card technology for several healthcare and insurance providers in the region of India. At the beginning of February, the card issuer collaborated with UAE-based Ajman Bank to drive sustainability, a partnership followed by Mastercard’s strategic deal with Emirates NBD-Egypt, which aims to improve the payment landscape and the overall digital banking experience in the region.

Still in February, Nepal Clearing House announced its partnership with ACI Worldwide to establish a central infrastructure for card payments in the region of Nepal.

Financial crime and fraud prevention

Multiple financial institutions, banks, and enterprises had several collaborations to develop improved fraud prevention capabilities, as financial crime and online threads have evolved in the last couple of years. In addition, as fraudsters still represent a challenging thread for companies and customers alike, banks chose to focus on multiple aspects of the industry, such as ensuring their compliance with KYC and AML standards, implementing AI capabilities, optimising customer identification processes, and improving their onboarding procedures, in a common effort to combat identity thefts and fraudulent activities.

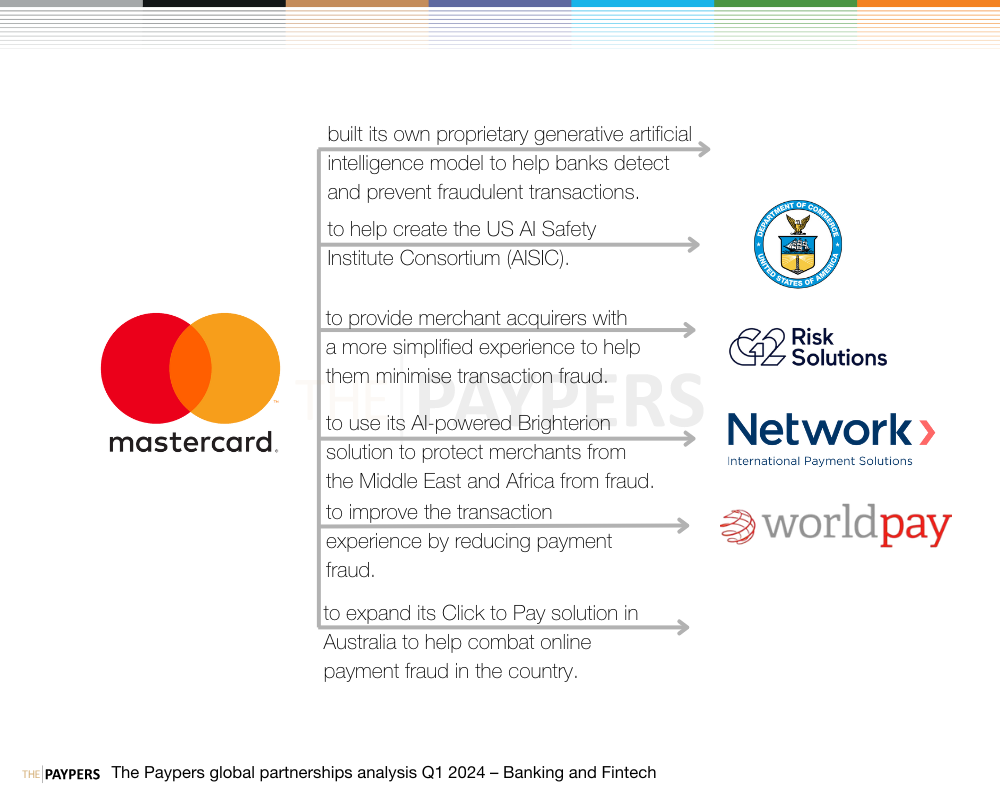

During Q1 2024, Mastercard focused on fraud prevention and financial crime detection developments, announcing multiple partnerships across several different geographical areas around the world. At the beginning of February 2024, Mastercard joined the generative AI race in the fraud management market, while also partnering with the US Department of Commerce to help the development of AISIC later in the same month.

In March, the company announced its collaboration with G2 Risk Solutions to provide merchant acquirers with a simplified experience and optimise the way they minimise transaction fraud. Moreover, it partnered with Network International to protect merchants from the Middle East and Africa from fraud. In addition, Worldpay signed a strategic deal with Mastercard to improve the transaction experience of customers by reducing payment fraud, an announcement that was followed by Mastercard expanding its Click to Pay solutions in Australia.

Among other partnerships that focus on the development of fraud prevention capabilities around the world is the one between Finastra and Databricks, which aims to provide additional tools for customers to remain protected. There is also the partnership between Satchel and Napier, focused on the integration of the latter’s AML platform. Later in February, IDEMIA became a Microsoft Entra Verified ID partner for remote onboarding processes.

Sumsub announced its partnership with Chainalysis in the middle of March, both companies focusing on optimising compliance and monitoring capabilities for digital assets clients. Around the same period, Ibanly tapped Sumsub’s verification platform, as Google joined GASA to fight and stop online scams.

At the end of the same month, three important partnerships focused on mitigating fraud, risks, and online threads. FIS collaborated with Stratyfy to improve its SecurLOCK card fraud management solution, as Plaid announced its strategic deal with Sandbox Banking and RealPage to ensure a more secure customer experience. Furthermore, HID partnered with Santander International to offer an improved client authentication process.

Europe

Across the European landscape, financial institutions prioritised the process of meeting the needs, preferences, and expectations of their clients, while also focusing on remaining compliant with the regulatory requirements of the local industries. One of the first deals signed in Q1 2024 was between TrueLayer and Tiger Brokers, at the end of January, as the latter chose TrueLayer’s Signup+ product to streamline customer onboarding.

In February, SEON became part of the AWS ISV Accelerate Programme, as Facephi’s solutions were made available on the Temenos Exchange platform. In addition, OneID signed a strategic deal with payment verification solution provider SurePay in order to augment business in combating online fraud.

US-based A2A platform Form3 announced the launch of an optimised APP fraud prevention solution, which was powered by Feedzai. With the focus remaining on fraud prevention capabilities, IDEMIA entered a collaboration with Qualcomm Technologies to support the secure offering of CBDC payment adoption processes.

The Americas

Across the American space, companies, banks, and FIs continue to optimise their overall strategies of delivering secure fraud detection capabilities, as well as improving the way they fight and mitigate fraud. The overall focus is set on providing customers with a secure and efficient experience while keeping their data and information protected at the same time. One of the first partnerships that were announced across the geographic area was between the National Australian Bank and Microsoft, aiming to provide a free cyber assessment tool to help Aussie small businesses prepare for and recover from a cyber-attack.

Canada-based account onboarding fintech company thirdstream extended its collaboration with Thales in order to modernise the in-person identity verification process in the region, as RentRedi also expanded its integration with Plaid to provide advanced features to its tenant screening offerings.

Moreover, Flagright and MUWE announced their partnership that focuses on improving digital payment security in LATAM, while Exeter Finance tapped into US-based identity verification provider Socure to leverage its suite of solutions.

In order to deliver a more secure data-sharing experience for consumers across more than 800 financial institutions, MX decided to partner with Jack Henry. Later, EQ Bank collaborated with Trulioo to offer the latter identity document and biometric verification capabilities, a strategic deal that was followed by the partnership between Detected and Visa, which prioritised the optimisation of SMB onboarding processes for customers in the US and Canada.

APAC and MENA

Fraud management, fraud detection, and fraud prevention offerings represent an important step in the strategy of keeping fraud, financial crime, and other online threats from emerging and affecting the privacy and development of companies and clients alike.

One of the first collaborations that happened in the APAC region was between the UK and Japan, two governments that focus on strengthening their commitment to cybersecurity and keeping individuals secure in an ever-evolving market. Around the same time, Ingenico announced its collaboration with Cybersource to allow clients to benefit from secure and efficient unified commerce solutions, while Emirates NBD partnered with Silent Eight to automate alert disposition.

The beginning of March was marked by AsiaVerify’s partnership with Visa, which focuses on improving digital payments and banking customer experiences in the region of Asia Pacific. In addition, Uqudo collaborated with Tamara to optimise identity verification for BNPL transactions, while FOMO Pay signed a strategic deal with Bottomline to improve the latter’s overall compliance and cash management capabilities. The same month, Fingerprints partnered with Thales and Garanti BBVA to launch a biometric payment card for customers in the region of Turkey.

CBDC, crypto, and Web3

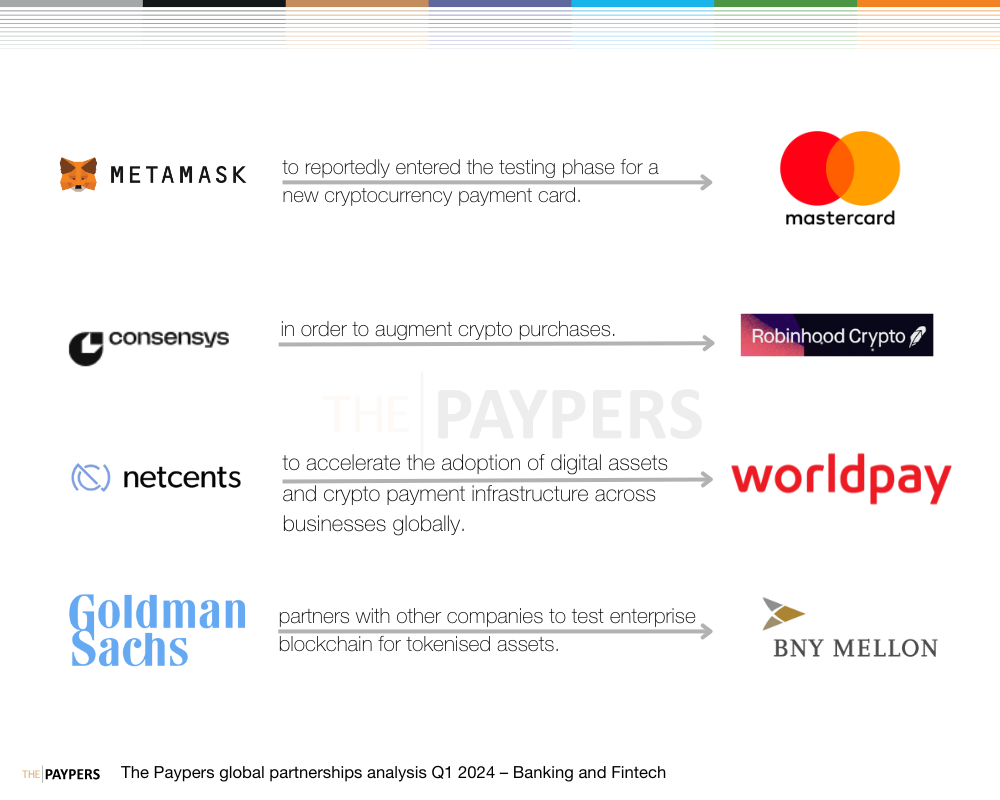

The industry saw several developments and partnerships that focused on CBDCs and stablecoins, as well as overall wide interest in cryptocurrency, Web3, and tokenised deposit markets. Included in this list is the collaboration between Metamask and Mastercard which prioritised the process of entering a testing phase for a new cryptocurrency payment card.

Among the banks and financial institutions that focus on developing on a global scale are also Consensys and Robinhood Markets, which launched an integration of Robinhood Connect with MetaMask to augment crypto purchases. In addition, NetCents and Worldpay accelerated the adoption of digital assets and crypto payment infrastructure across businesses globally, while Goldman Sachs, BNY Mellon, and other FIs started to test enterprise blockchains for tokenised assets.

Europe

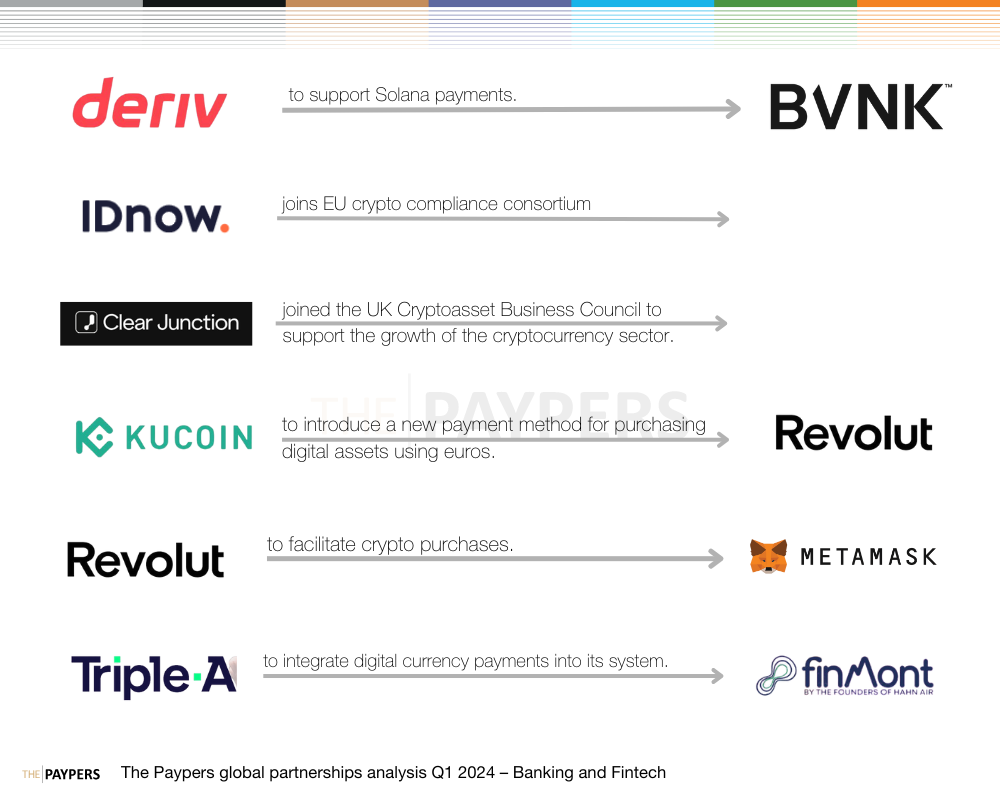

In January, Deriv announced its partnership with BVNK in order to support Solana payments. Later in the next month, Germany-based identity-proofing platform IDnow entered a consortium of five partners that focuses on making crypto assets compliant with new EU regulations.

The European landscape saw several collaborations in March, starting with the announcement that Clear Junction has joined the UK Cryptoasset Business Council to support the growth of the cryptocurrency sector. In addition, KuCoin tapped into Revolut’s suite of solutions to streamline euro-to-crypto purchases for customers on the continent, days before the latter launched Revolut Ramp, a crypto offering in the UK and EEA, and partnered with custodial wallet MetaMask to facilitate crypto purchases. Later in Q1 2024, global payment orchestration platform FinMont announced its partnership with Singapore-based digital currency payment institution Triple-A, to integrate digital currency payments into its system.

APAC and MENA

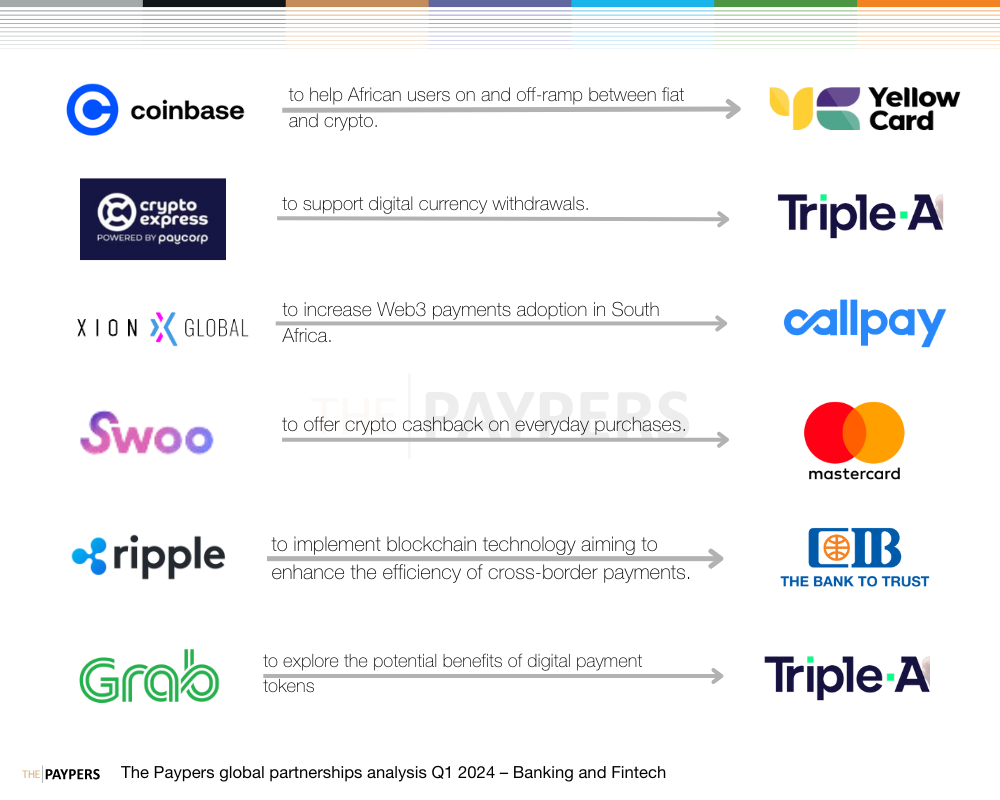

Cryptocurrency exchange Coinbase partnered with Yellow Card to optimise how African users switch between on and off-ramp fiat and crypto at the beginning of Q1 2024. This announcement was followed by the collaboration between Paycorp and Triple-A, which focused on supporting digital currency withdrawals.

The month of February began with the deal signed between Xion Global and Callpay, which aimed to forge South African payments partnerships and increase Web3 payments adoption. Swoo also announced its partnership with Mastercard in the same month, to offer crypto cashback on everyday purchases, followed by the collaboration between Ripple and the Commercial International Bank, which focuses on implementing blockchain technology and optimising the efficiency of cross-border payments. In March, Triple-A enabled digital currency top-ups on Grab through a strategic agreement.

Conclusions

As several banks, FIs, companies, and firms focused on developing in certain verticals of the industry, multiple partnerships and strategic agreements occurred during Q1 2024.

The industry saw a combined focus from banks and companies, multiple partnerships prioritising the process of digitalisation, as strategic deals and collaborations can be leveraged to build credibility and trust, reduce development costs, as well as deliver new suite tools and expand businesses across several markets. In addition, Open Banking and Embedded Finance implementation represented a clear priority for several banks around the world, as well as the implementation of cryptocurrencies, safe alternative payment methods, and fraud prevention capabilities.

Therefore, institutions remain focused on keeping a constant lookout for optimised and new solutions that can be developed to meet the needs, preferences, and demands of customers in an ever-evolving market, while also prioritising the process of remaining compliant with the regulatory requirements and laws that might differ depending on the industry.

In order to access more information on the global developments that emerged during Q1 2024, be sure to follow The Paypers Global Quarterly Analysis series. This also includes partnerships, acquisitions, and contributions surrounding the investments and M&As that took place during this period.

About Sînziana Albu

Sînziana is a Junior News Editor with a keen focus on fintech, payments, and digital identity. With a passion for unravelling the complexities of the rapidly evolving technological landscape, Sînziana is dedicated to delivering insightful news that keeps her readers informed.

Sînziana is a Junior News Editor with a keen focus on fintech, payments, and digital identity. With a passion for unravelling the complexities of the rapidly evolving technological landscape, Sînziana is dedicated to delivering insightful news that keeps her readers informed.