CRM, AVGO: 2 Impressive AI Stocks with Room to Run

The price of admission into the artificial intelligence (AI) trade has gone way up over the past year. Still, some tech stocks — like CRM and AVGO — are off their highs and still have upside potential. Therefore, let’s use TipRanks’ Comparison Tool to compare two AI mavericks that may make more sense to buy as others crowd around the dips of the high-flying chip plays.

Salesforce has been readying itself to capitalize on the multi-year AI boom, even before ChatGPT’s launch caused an AI investment frenzy. Back when investors couldn’t even begin to fathom how AI efforts would translate into earnings, Salesforce was advancing its Einstein AI to help clients take customer relations to the next level. Indeed, the entire customer relationship management (CRM) corner of the software scene stands to benefit greatly from AI’s predictive capabilities.

As investors look beyond generative AI to the potential to be had from predictive AI, I find Salesforce to be a potential beneficiary. Perhaps Salesforce is every bit as magnificent as some of the Magnificent Seven members when it comes to long-term AI potential. With shares recently correcting following news of its since fallen-through Informatica (NYSE:INFA) pursuit, I’m inclined to be that much more bullish on the stock.

Undoubtedly, quite a few mega-cap tech titans have acquired much smaller AI firms to improve their access to top AI talent. Such deals have mostly been met with praise. Whether we’re talking about Apple (NASDAQ:AAPL) and its acquisition of various AI startups (in Canada, France, and other international markets), it’s clear that M&A is an AI growth lever that firms should be eager to pull.

When it comes to Salesforce, though, the firm has a knack for inspiring “boos” from its investor base for its pursuit of pretty sizeable companies. Indeed, it seems like whenever Salesforce announces a sizeable deal for a public tech firm, the stock takes a beating due to the price tag.

Cloud data management firm Informatica had AI written all over it. And while the company is not too big, with a market cap of around $10 billion, investors were quick to punish CRM stock. Investors just don’t want to see large-scale deals from the firm anymore.

The deal is no longer happening, yet CRM stock has yet to regain all of the ground lost (shares fell over 7% after the deal talks) from the original announcement of the pursuit. I find the dip to be a fantastic buying opportunity, even though there remain some lingering worries that the company may still retain an appetite for a big acquisition.

At writing, CRM stock goes for 28.3 times forward price-to-earnings (P/E), much lower than its five-year average of around 47 times.

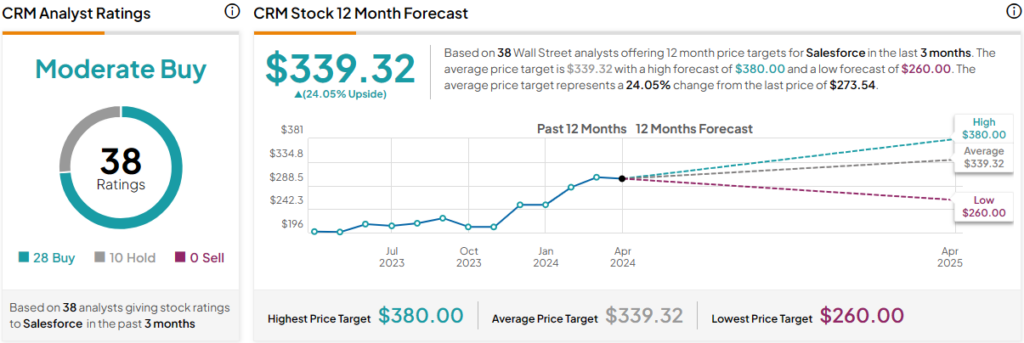

What Is the Price Target for CRM Stock?

CRM stock is a Moderate Buy, according to analysts, with 28 Buys and 10 Holds assigned in the past three months. The average CRM stock price target of $339.32 implies 24.05% upside potential.

Broadcom is another more affordable stock (relatively) to consider for AI exposure. Now down over 7% from its March peak, those seeking AI growth at a reasonable price (GARP) have many reasons to give the $617 billion chip giant a second look.

Undoubtedly, the latest dip doesn’t seem like all that great of a discount when you consider that shares have more than doubled in the past two years. That said, I view the semiconductor firm as a lesser-appreciated AI chip play with plenty of catalysts that could nudge it higher over the coming years. All considered, I’m staying bullish on AVGO stock.

Back in mid-March, Broadcom unveiled quite a bit of innovation during its big “Enabling AI Infrastructure” event. A handful of already bullish analysts, including those at TD Cowen who hiked their price target to $1,500.00 from $1,400.00, grew even more upbeat on the stock following the event.

As part of the big day, the company shone a bright light on new custom AI accelerators (XPUs)—the “X” is a placeholder representing a wide range of applications that the processing unit is tailored to tackle—and various AI-focused networking products. That’s some pretty exciting new stuff from the firm that the market took positively, at least until the ensuing tech sector volatility took hold.

Management also went as far as to say the firm is at an “inflection point” with its new AI tech. Indeed, analysts have taken note, but investors may have yet to, considering that the stock is still off its high.

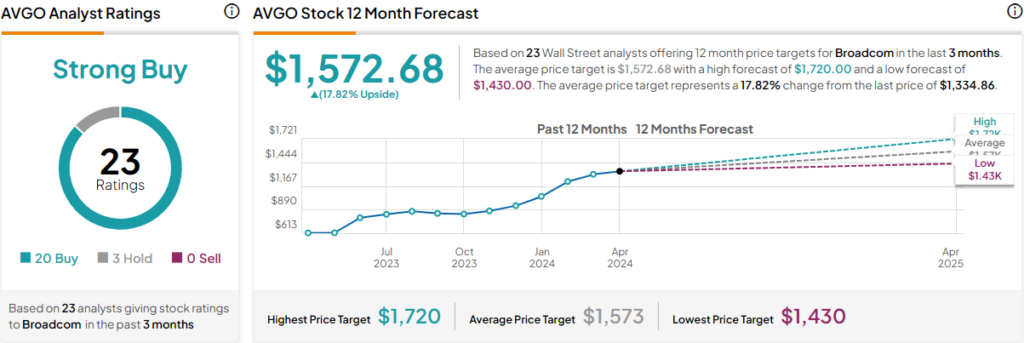

What Is the Price Target for AVGO Stock?

AVGO stock is a Strong Buy, according to analysts, with 20 Buys and three Holds assigned in the past three months. The average AVGO stock price target of $1,572.68 implies 17.8% upside potential.

The Bottom Line

Salesforce and Broadcom are two tech titans that I think could keep up with the Magnificent Seven members from here. Looking at the year-ahead price targets, both stocks have strong upside potential, with CRM having the edge (24.1% vs. 17.8% for AVGO) when it comes to the implied upside.