Dallas Real Estate Fintech Backflip Raises $15M in Series A Round » Dallas Innovates

COO Jake Rome (left) and CEO Josh Ernst are co-founders of Backflip. [Photo: Backflip]

Backflip, a Dallas-based all-in-one real estate and financial technology platform for real estate entrepreneurs, announced a $15 million Series A funding raise led by FirstMark Capital, early investors in category-defining platforms Airbnb, Shopify, and Pinterest.

“Backflip is not just about flipping houses; it’s about flipping the script on the why, how, and what it means to be a real estate entrepreneur,” Backflip CEO Josh Ernst said in a statement. “Over 400,000 homes are flipped every year in the U.S. and growing. Our mission is to help everyone access the funding and tools they need to participate. We put information, support, and capital products designed for entrepreneurs in the hands of more individuals in an industry that has historically had too many barriers to successfully starting and scaling. In doing so, we’re empowering our members to rejuvenate communities one modernized home at a time.”

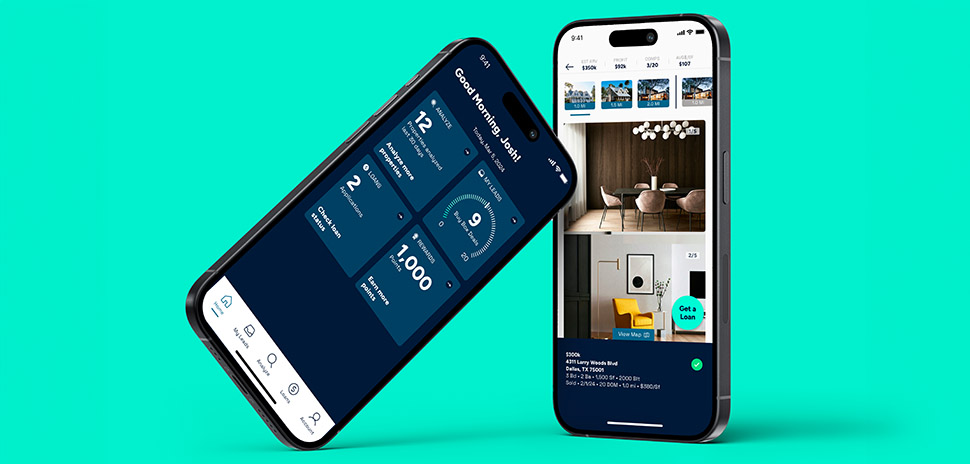

Image: Backflip

Previous investors Vertical Venture Partners, LiveOak Venture Partners, Revel Partners, ECMC, the real estate company Crow Holdings, and angels Greg Waldorf, Rob Barber, Gregg Freishtat, CEOs and former board members at Zillow, Attom Data, and GreenSky, respectively, also participated in the round, Backflip said.

The round comes after Backflip said it crossed $10 million in net revenue run rate—”reaching near profitability.”

Founded in 2020, Backflip said it grew its revenue run rate five times year-over-year in 2023 despite housing market headwinds, with members analyzing an average of $5 billion in properties each month on the platform.

What the Backflip platform does

Backflip said it’s driving “the future of real estate entrepreneurship” via an end-to-end platform serving a like-minded community. Its purpose-built technology and capital solutions enable members to efficiently manage their investment pipelines, secure funding, and grow their real estate investment business, Backflip said.

Backflip said it enables individual entrepreneurs to revitalize the housing market through the acquisition and renovation of single-family homes, and has funded more than 900 homes to date. The company said members have realized an average gross profit of $82,000 per property on the platform, and typically repay their loans in six months.

The company said its approach and underwriting processes are designed to achieve investment-grade credit ratings and have led to a track record of “exceptional loan performance.”

Backflip’s platform offers what it calls “a seamless experience” via its mobile and desktop apps, granting members access to relevant real-time data to make informed decisions while on the move or from their desk. The Backflip app—which it said has been referred to as an “analyst in your pocket”—helps members source, track, comp, and evaluate potential investments in addition to securing project financing through Backflip.

“We’re thrilled to lead Backflip’s Series A to continue the work of building the financial operating system for this integral but overlooked part of the real estate value chain,” Adam Nelson, managing director at FirstMark, said in a statement. “The Backflip team has combined deep product empathy, technology and capital formation to build a 10x better product for their members.”

Launched ‘MyLeads’ feature in 2023

Last August, Backflip launched My Leads, an AI-enabled property sourcing feature that leverages artificial intelligence to act as a deal analysis assistant. That move came a month after the company announced it had expanded to 41 new U.S. markets.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.