Paramount Faces a Mountain of Questions

Paramount’s cloudy future

The boardroom intrigue at Paramount Global — the drama that has gripped the corporate world — just got messier.

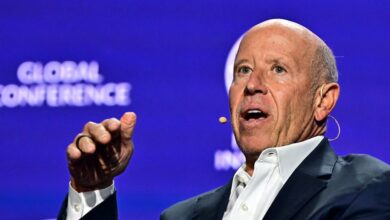

Bob Bakish is out as C.E.O., replaced by three subordinates who will form an “office of the C.E.O.” His departure caps a year of rising tension between him and Shari Redstone, Paramount’s controlling shareholder, who is pushing for a deal with David Ellison’s Skydance.

Bakish’s exit removed an executive who didn’t support that transaction, but it doesn’t resolve all of the big questions hanging over the company’s future.

Why Bakish was pushed out: Redstone picked the low-profile company veteran to lead Paramount after years of internal strife, but they still ended up clashing.

Bakish oversaw big changes at the company, including the creation of the Paramount+ streaming platform and acquiring Pluto TV, a free, ad-supported video service. But critics say Paramount was too late to streaming, leaving it undersized and far behind rivals in approaching profitability. Bad deal-making, they add, didn’t help: “Yellowstone,” its most-watched show, streams on NBCUniversal’s Peacock, and Bakish didn’t sell trophy assets like Showtime and BET when suitors offering billions came knocking.

He also expressed reservations about the Skydance deal; Puck reports that Bakish actively held talks with a potential rival bidder, Apollo Global Management.

Bakish is still getting a handsome send-off, with a severance package that is expected to total $50.6 million. He took home about $149 million in compensation from 2017 to 2023, according to The Wall Street Journal.

There are plenty of unresolved questions facing Paramount:

-

What would a final Paramount-Skydance deal look like? Skydance has sweetened its bid to include a $3 billion cash infusion and an offer to give Paramount shareholders a bigger stake in the combined company than initially proposed.

-

Will the F.C.C. weigh in on the deal? That could depend on how big of a stake Paramount and Skydance shareholders own in the combined company.

-

Will non-Redstone investors get to vote on a Skydance deal? That would help allay concerns that Redstone is getting a sweetheart deal — but Skydance hasn’t yet agreed to that.

-

How will Paramount handle Mario Gabelli? The investment manager’s firm owns the same kind of super-voting shares that Redstone does, and has been critical of the Skydance proposal. If non-Redstone shareholders are allowed to vote on a deal, will he be given a say that reflects the size of his voting stake?

-

Will Sony and Apollo make a formal bid? The two have discussed a joint takeover approach. But if they’re still interested, when will they actually propose an offer? (The exclusivity period for Skydance’s talks with Paramount expires on Friday but could be extended.)

HERE’S WHAT’S HAPPENING

WeWork strikes a bankruptcy deal that doesn’t involve its co-founder. The embattled co-working company agreed to a transaction that would give it about $450 million and help it exit Chapter 11 protection. The news is a blow to Adam Neumann, the former WeWork C.E.O. who had sought to buy the company, but who faced opposition from the company and its lenders.

NBCUniversal is reportedly poised to bid $2.5 billion a year for N.B.A. broadcast rights. The Comcast-owned broadcaster is seeking a package of regular-season and playoff games to air on its broadcast network and its Peacock streaming service, The Wall Street Journal reports. It’s hoping to take the rights away from TNT, one of the N.B.A.’s longest-running partners — but whose parent company, Warner Bros. Discovery, is paying off billions in debt.

HSBC’s chief executive is stepping down. Noel Quinn will retire as the head of Europe’s biggest bank after leading the lender as it was caught up in heightened tensions between the United States and China, pro-democracy protests in Hong Kong and the coronavirus pandemic. Under him, HSBC also fought off an attempt by its biggest shareholder, the Chinese insurer Ping An, to explore a breakup.

The Fed and the new normal

Stocks may have rebounded in recent days, but the specter of high interest rates sticking throughout the summer and even past Election Day is hanging over the market.

Wall Street will get its next set of indicators tomorrow at the conclusion of the Fed’s latest rate-setting meeting.

The central bank is widely expected to keep its prime lending rate unchanged. Investors expect that the Fed will keep it at 5.25 to 5.5 percent, a multidecade high, as inflation remains stuck well above its 2 percent target. Stubbornly high inflation “is the new normal” that will keep the Fed on pause, Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, said in a research note on Friday.

(In contrast, the markets expect the European Central Bank to cut rates in June after inflation data this morning showed consumer prices have moderated much closer to its 2 percent target.)

The Fed and Wall Street are unclear what the “new normal” looks like. Policymakers are trying to land at what economists call a “neutral” interest rate, or a cost of lending that enables sustainable growth without causing inflation to spike.

This morning, the market was pricing in a single rate cut this year, down from the January consensus forecast of six — meaning a neutral rate of around 5 percent by year-end.

On the hawkish end: Raphael Bostic, the Atlanta Fed president, has warned that a rate increase cannot be ruled out “if inflation stalls out or even starts moving in the opposite direction, away from our target.”

The Fed made its last rate move in July. A lengthy pause usually suggests stability, but it can produce a shock. “While Fed pauses are typically supportive of stocks, long periods of ‘higher for longer’ can end poorly, with some part of the economy ultimately stressed, as with emerging markets in 1997, tech stocks in 2001 and housing/banking in 2007,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, wrote in a client note on Monday.

The most vulnerable, she added, would be “low-end consumers, small businesses dependent on credit and commercial real estate owners.”

Politics is a wild card. Goldman Sachs economists see two cuts this year, in July and November. But that’s only if inflation begins to ease in the coming months. Their worst-case forecast: Inflation stays elevated, and no rate cuts this year or next.

The culprit: protectionism. “While it is still very uncertain how much tariffs could increase after the election, our analysis of the effect of tariffs on consumer prices suggests that some proposals could have a large impact,” Jan Hatzius, chief economist at Goldman Sachs, wrote in a research note on Monday.

Campus turmoil spreads

Tensions on U.S. college campuses rose overnight, with protesters at Columbia occupying a school building. On the West Coast, the police arrested students on Monday night at California State Polytechnic University, Humboldt.

The focus is again on Columbia. Students seized Hamilton Hall, a building with a history of student takeovers, and unfurled banners and chanted “free Palestine.” That appears to have raised the stakes in the weekslong unrest.

The university’s embattled president has rejected demands to divest from Israel. Nemat Shafik offered to invest in education and health in Gaza, but the school refused to sell Columbia’s investments in companies doing business in Israel — a principal demand of the protesters.

Meanwhile, some Jewish students have filed a breach of contract case against Columbia, saying that they are unable to receive their education because they feel unsafe on campus.

“Divestment” differs from campus to campus. At Yale and Harvard, students want the schools to cut ties with weapons manufacturers. At Columbia, the demands are broader, extending to companies linked to Israel. That would include Alphabet and Amazon, which count the Israeli government as cloud-computing customers, and Airbnb.

Columbia has a $13.6 billion endowment, but analysts don’t see calls to divest as a risk to the companies’ share prices, or to Israel.

For the latest on the campus protests, follow The Times’s coverage here.

Crypto’s big stars are on the offensive

Today brings another reminder of the crypto industry’s recent troubles, as Changpeng Zhao, the former C.E.O. of the exchange Binance, is set to be sentenced in federal court after pleading guilty last year to a violation of money laundering rules.

But that, and the collapse of FTX, have done little to dampen the sector’s optimism, as crypto companies escalate their fight against regulators to keep taking the industry mainstream.

Zhao is already planning his comeback. The crypto mogul will most likely face only a few years in prison, if any, and the $50 million fine he paid has barely dented what Forbes estimates is a $33 billion fortune. He still has strong links with top tech entrepreneurs and investors. (He has been in touch with Sam Altman of OpenAI, among others.)

Zhao has also been planning a next act that could include investing in artificial intelligence, biotech and more.

And the crypto industry is pushing back hard against regulators. Companies are increasingly suing the S.E.C. before it takes them to court, a strategy that began last year with the exchange Coinbase.

A half-dozen such lawsuits are now underway nationwide. “Crypto is pushing back in whatever way we can,” Kristin Smith, the C.E.O. of the Blockchain Association, an industry group, told DealBook.

Texas has become a hub for those legal fights. The Blockchain Association this month sued the S.E.C. in federal court over its new definition of “broker,” one of several crypto cases against the agency in the state.

The lawsuits come after some big wins for crypto last year, notably a victory for Grayscale Investments over the S.E.C. that led the agency to approve the first Bitcoin exchange-traded funds in January

A new suit accuses the S.E.C. of unfairly seeking to oversee the ether crypto token. The software company Consensys sued the agency last week, accusing it of seeking to regulate the world’s second-biggest cryptocurrency by market capitalization despite it being widely considered a commodity, not a security. (The S.E.C., which declined to comment, hasn’t officially ruled one way or the other.)

THE SPEED READ

Deals

-

Some of the biggest investors in Glencore reportedly believe that the commodities giant shouldn’t spin off its coal business, throwing a major strategic initiative into question. (Bloomberg)

-

Goldman Sachs is said to be in talks to offload its General Motors credit card program to Barclays as the Wall Street bank pares down its consumer-facing business. (WSJ)

Policy

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.