Fintech Quavo Fraud & Disputes Unveils Major Feature Release to Reduce Assignment Volumes and Enhance Automation for Improved User Experience and Program Autonomy

EAST LANSING, Mich., April 30, 2024 /PRNewswire/ — Quavo Fraud & Disputes, the industry-leading provider of automated dispute SaaS solutions tailored for issuing financial institutions, announces the release of QFD® Version 24.01. The cloud-based platform leads the way in claim work automation, boosting efficiency with innovative automated solutions. This latest iteration reaffirms Quavo’s commitment to revolutionizing the claim process for issuers by introducing features designed to enhance operational efficiency.

Key features of QFD® Version 24.01:

1: Minimizing Touch Through Automation

QFD’s automated capabilities have been expanded to minimize redundant tasks, optimize work routing, and automatically write off disputed transactions without recovery rights once the final resolution date has passed. The job will remove the need to work tens of thousands of assignments based on client preferences and risk appetite. This enhancement streamlines operations, enabling faster task completion and accelerating claim resolution and time savings. Investigators can now concentrate on critical, analytical tasks.

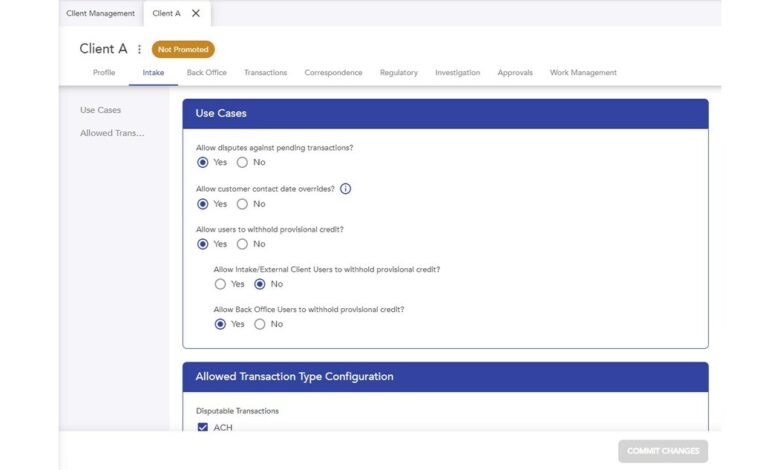

2: Taking Control of Your Program

The Configuration App has been launched to improve client experience and autonomy. This application permits clients to manage their system settings independently, reducing dependency on external support and enabling clients to test and experiment. Clients can configure over 45 settings, including automated thresholds, manager approval scenarios, and regulation protection features, allowing tailored configurations that align with their unique needs.

“QFD® Version 24.01 introduces numerous features designed to streamline the system, reducing assignment volumes and allowing users to concentrate on critical tasks,” said CTO and co-founder David Chmielewski. “With new configuration settings and an interactive portal for immediate viewing and adjustments, this release incorporates valuable user feedback, including the reintroduction of rich text in notes.”

3: Enhance Notes Tool for Better User Experience

The reintroduced Notes tool fosters seamless communication among claim intake specialists, investigators, and account holders. Serving as essential records, case notes capture details, observations, and actions throughout investigations. The enhanced notes tool supports consistency in investigative methods and procedures, ensuring transparency for accountability and supporting audits or reviews.

“The improved Notes tool streamlines the quality and coaching process by increasing the accuracy and efficiency of agents’ work, and both leaders and quality analysts have a better understanding of the case,” said Quavo’s Disputes Resolution Expert (DRE) Workforce Manager, Nikki Labno.

Committed to excellence and client-centricity, Quavo continues to redefine automated dispute resolution, setting industry benchmarks with each release.

About Quavo, Inc.

Quavo is the world’s leading provider of automated dispute management solutions for issuing banks and financial organizations. Quavo’s premier SaaS platform, QFD® (Quavo Fraud & Disputes), can automate the entire dispute lifecycle, from intake through investigation, chargeback recovery, and resolution. Combine QFD® with our back-office investigation team, DRE™ (Dispute Resolution Experts), for a partial or fully outsourced fraud and dispute processing solution. For more information about Quavo, visit www.quavo.com

Media Contact

Julia Lum

Marketing Communications Specialist

[email protected]

SOURCE Quavo, Inc.