Microsoft’s Earnings Results Show It’s Delivering on Its Artificial Intelligence (AI) Promise. But Is the Stock a Buy After Recent Gains?

When looking at companies outside of Nvidia that are seeing immediate benefits from artificial intelligence (AI), one company that stands out is Microsoft (NASDAQ: MSFT). And with its fiscal third-quarter results in the books, the software giant once again showed that it’s delivering on its AI vision.

Let’s look at how the company’s results are being driven by AI and whether that makes the stock a buy at current levels.

Leading the AI revolution

Through its large investment in OpenAI and its ChatGP chatbot, Microsoft has been at the forefront of pushing AI into the mainstream. The company has embraced the technology and has quickly employed it throughout its various offerings. So far, this bet is paying off, evidenced by its strong earnings results.

Azure, Microsoft’s cloud-computing business, was once again the biggest beneficiary of its AI initiatives. For its fiscal third quarter ended in March, Azure revenue climbed 31%. The company sees no slowdown in the business, forecasting fiscal Q4 Azure revenue growth of between 30% to 31% in constant currencies.

Azure’s strong growth is being led by its AI consumption business. Azure customers are only charged based on the resources they use, and usage has been skyrocketing from customers building their own AI solutions using the Azure platform. AI services added seven percentage points to Azure’s growth. This means the core Azure business grew a robust 24%.

Microsoft said that more than 65% of Fortune 500 companies now use Azure OpenAI services, while deals are also getting larger. It said Azure deals worth $100 million or more rose 80% year over year, while deals worth $10 million or more doubled. The company plans to invest heavily in infrastructure and AI in fiscal 2024 to meet increasing demand.

Cloud computing isn’t the only area where AI is helping drive growth for Microsoft as its AI assistants called Copilots are also gaining a lot of traction. Developer platform GitHub saw revenue soar 45% as more companies embraced its GitHub Copilot, which can complete coding or make suggestions as developers type. Microsoft said more than 90% of the Fortune 100 are now GitHub customers.

Microsoft 365, its suite of production tools that include Word and Excel, meanwhile, saw revenue grow 14%. The company said its Copilot for Microsoft 365 was seeing increased adoption across various industries. The company is even using AI to help propel growth at its employment-focused social media platform LinkedIn. It said new AI features helped lead to a 29% increase in LinkedIn Premium growth, while overall growth was 10%.

Is Microsoft a buy?

Microsoft’s results clearly show that the company is at the forefront of the AI revolution. While Azure is leading the way, Microsoft is benefiting from AI across most of its business lines. The company has taken the lead in AI and has created an early-mover advantage.

It will also be interesting to see what future applications Microsoft may apply AI to moving forward. On its earnings call, the company talked about making devices specifically for AI. But for me, what Microsoft does with AI in its gaming unit could be a game changer down the line. The next iteration of Xbox, while likely years away, could be a powerful growth driver as the company incorporates AI into games.

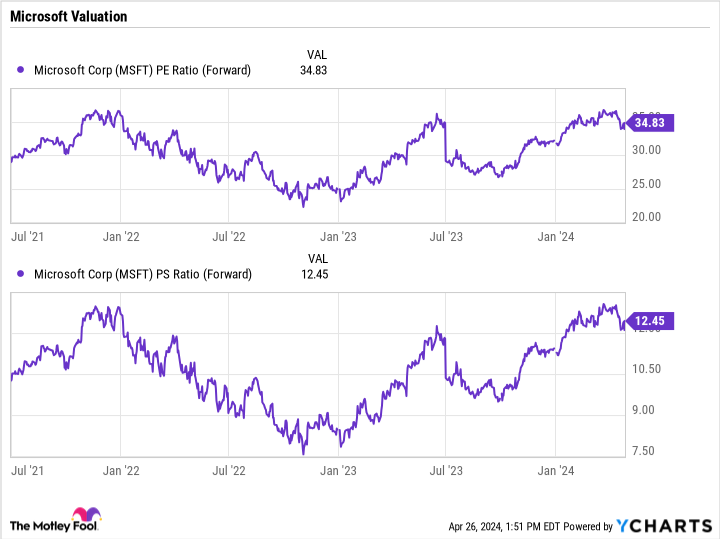

Given Microsoft’s current success and the opportunity in front of it, investors have bid up the stock strongly since the end of 2022. That has given the company a current valuation of around 35 times expected earnings and 12.5 times sales. For a company growing its overall revenue in the mid-teens, that’s not a cheap valuation. Note that Microsoft’s overall revenue grew 17% in its fiscal third quarter and is up 16% through the first nine months of the year.

MSFT PE Ratio (Forward) data by YCharts.

Microsoft has a bright future in front of it, but the stock looks pretty fully valued at the moment. The market can be volatile in the short run, so while I think the stock should work in the long term, I do think there could be better buying opportunities for the stock in the future. So, as a new money buyer, I’d be on the lookout for a price dip before jumping into the stock.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Microsoft’s Earnings Results Show It’s Delivering on Its Artificial Intelligence (AI) Promise. But Is the Stock a Buy After Recent Gains? was originally published by The Motley Fool