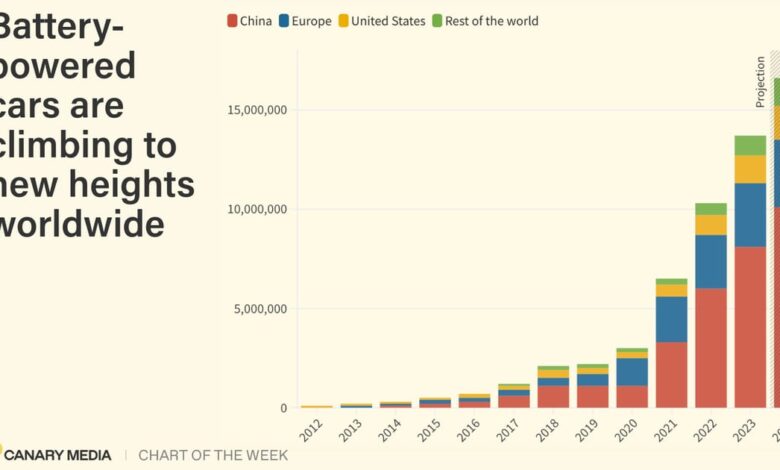

Chart: One-in-five new cars sold this year will be…

Europe, the next-biggest market for EVs, is both far smaller in sales volume than China and much more sluggish in terms of growth. The IEA forecasts that automakers will sell 3.4 million new EVs and PHEVs this year in Europe, up just 6 percent from last year’s total. In the U.S., the third-biggest EV market, sales are expected to rise by about 20 percent this year, to 1.7 million units. EV sales are set to grow at the fastest clip in emerging markets, where IEA anticipates 1.4 million vehicles will be purchased this year, powered by buyers in Southeast Asia and Brazil.

The new forecast comes as the global auto market struggles to be reborn.

U.S. auto giants like Ford and GM have seen slower-than-expected EV sales in recent months, leading them to reassess and delay some production plans. EV pioneer Tesla is also having a hard time as competition heats up; Chinese automaker BYD overtook it last year as the biggest EV maker on the planet. At the same time, South Korea’s Hyundai and Kia are seeing their U.S. EV sales take off, and Volkswagen just reported strong growth in EV orders in Europe and EV deliveries in China for Q1 of this year. Meanwhile, Toyota, the biggest overall automaker in the world, has stubbornly refused to embrace fully electric vehicles — a bet that has been heavily criticized by climate advocates but that has paid off financially as car buyers flock to PHEVs and traditional hybrid vehicles.

It’s easy to get caught up in the day-to-day messiness of the transitioning auto industry, but if you take a step back, the long-term trend is clear. More than one-fifth of the vehicles sold worldwide will be an EV or a PHEV this year. In 2018, just about 2 percent of cars sold fit into this category.

That’s incredible growth over a short period of time. Now the world just needs to sustain that pace until every new car is battery-powered.