Why Shares of EV Stocks Nio, Li Auto, and XPeng Are Driving Higher This Week

Investors gave green flags to Chinese EV makers after they reported increases in vehicle deliveries.

Extending the rises they all enjoyed in the last full week of April, shares of electric vehicle (EV) makers Nio (NIO -0.36%), XPeng (XPEV -3.62%), and Li Auto (LI -3.38%) have all continued motoring significantly higher this week in contrast to the S&P 500 and Dow Jones Industrial Average, which are both inching toward minor gains.

As of the market’s close on Thursday, shares of Nio had risen 24.5% since the end of trading last Friday, while XPeng and Li Auto are up 19.19% and 15.7%, respectively.

Rising vehicle deliveries have investors feeling bullish

For all three companies, increasing customer demand for their EVs powered investors’ favorable sentiment this week. Nio reported 15,620 vehicle deliveries for April, representing a 134.6% year-over-year increase.

In addition to 8,817 premium smart electric SUVs, Nio delivered 6,803 premium smart electric sedans last month. The substantial growth in deliveries the company reported for April is especially noteworthy when juxtaposed with the more modest 14.3% year-over-year increase in deliveries Nio reported in March.

Delivering 9,393 EVs in April, XPeng also saw growth in demand, reporting a 33% increase in deliveries since the same period last year. Since the start of the year, XPeng has logged 31,214 EV deliveries, which represents a 23% increase over that which it reported in 2023. XPeng also reported progress in testing its advanced driver-assistance system (ADAS), XNGP, on highways in Germany — something the company expects will help it launch the ADAS system in other foreign markets.

Like its peers, Li Auto also enjoyed an increase in vehicle deliveries. Whereas the company delivered 25,681 vehicles in April of 2023, it delivered 25,787 vehicles last month. While the year-over-year comparison is not as substantial as its peers, investors are likely celebrating another achievement.

In its April delivery update, Li Auto reported that it has “delivered over 10,000 Li L7s in its first full month of deliveries, establishing the vehicle as a preferred choice among five-seat premium SUVs for Chinese families while marking the first time a Chinese branded five-seat SUV priced above RMB300,000 has achieved this monthly delivery milestone.”

Is now the time to hitch a ride with these EV companies?

With companies reporting increases in vehicle deliveries, it’s unsurprising that investors are motivated to hitch rides with these EV manufacturers. But it’s important for those wondering whether now’s the right time to park these EV stocks in their portfolio to kick the tires before clicking the buy button.

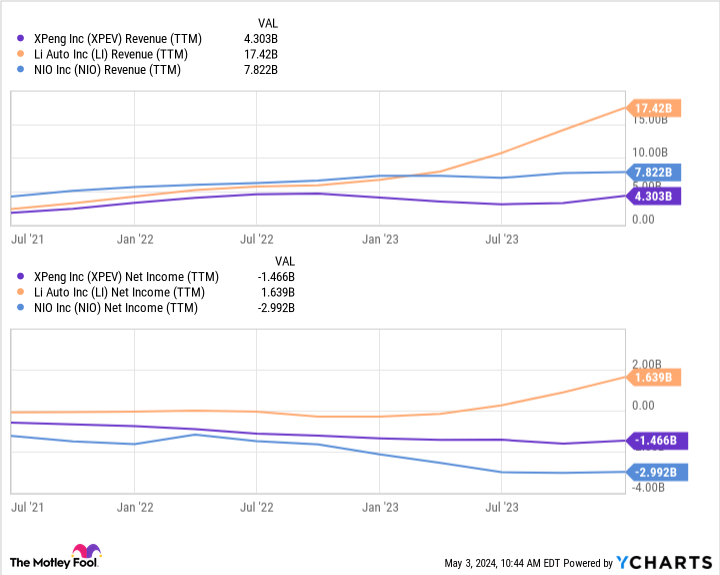

XPEV Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Nio, XPeng, and Li Auto have all succeeded in growing revenue over the past three years, but only Li Auto has turned the corner regarding profitability.

While the EV market in China may be burgeoning, this clearly doesn’t mean that all EV automakers are seeing positive results on their bottom lines — and there’s no certainty that they’ll ever see the bottoms of their income statements turn positive (or stay positive in the case of Li Auto). For this reason alone, prospective investors must appreciate the risks associated with these stocks and understand the speculative nature of these investments.

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nio. The Motley Fool has a disclosure policy.