Comtech Telecommunications Corp (CMTL) Reports Mixed Q2 FY2024 Results Amid Refinancing Efforts

-

Net Sales: Slight year-over-year increase to $134.2 million.

-

Gross Margin: Reported at 32.2%, down from 34.3% in Q2 FY2023.

-

Adjusted EBITDA: Grew 33% year-over-year to $15.1 million, margin at 11.3%.

-

GAAP Operating Income: Improved to $3.0 million from a loss of $0.8 million in Q2 FY2023.

-

Refinancing: A top priority, with strategic investments and lender negotiations underway.

-

Backlog: Remains healthy at approximately $680 million.

On March 18, 2024, Comtech Telecommunications Corp (NASDAQ:CMTL) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. Comtech, a provider of advanced communication solutions, operates primarily through two segments: Satellite and Space Communications and Terrestrial and Wireless Networks.

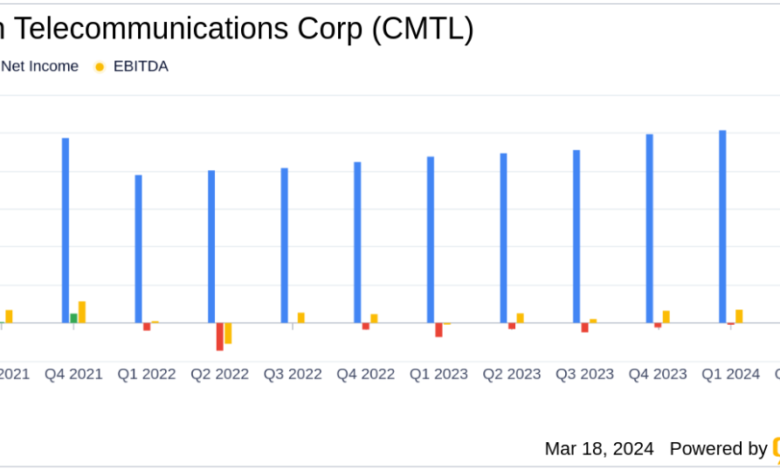

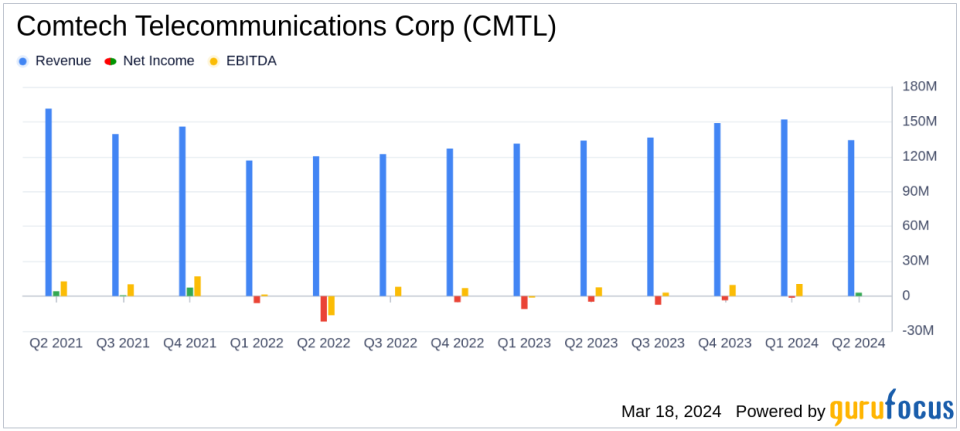

Despite a challenging operating environment, Comtech reported a slight increase in net sales to $134.2 million compared to $133.7 million in the same quarter of the previous year. However, this represents a sequential decline from $151.9 million in the first quarter of fiscal 2024. The gross margin for the quarter was 32.2%, a decrease from the 34.3% reported in the second quarter of fiscal 2023.

Adjusted EBITDA for the quarter was $15.1 million, a significant improvement from $11.3 million in the second quarter of fiscal 2023, reflecting the benefits of the One Comtech transformation and operational improvements. GAAP operating income also showed a positive trend, reporting at $3.0 million compared to a loss in the prior year’s quarter.

Segment Performance and Strategic Developments

The Satellite and Space Communications segment experienced a decrease in net sales and Adjusted EBITDA, primarily due to order delays and supply chain constraints. However, the Terrestrial & Wireless Networks segment reported strong performance with sequential growth and an increase in net sales year-over-year.

Key developments included a large multi-year Global Field Service Representative contract with the U.S. Army and an extension of NG-911 services for the State of Washington valued at $48.0 million over five years.

Financial Position and Outlook

Comtech’s balance sheet reflects ongoing efforts to strengthen its financial position, with strategic investments from shareholders and advanced negotiations with potential lenders to refinance the existing credit facility. The company’s leadership remains focused on the refinancing as a top priority and is optimistic about the future, targeting net sales and Adjusted EBITDA for fiscal year 2024 to be better than fiscal 2023.

Comtech’s interim CEO, John Ratigan, emphasized the company’s commitment to growth and profitability, stating:

“We have done, and will continue to put in, the hard work necessary to build a bigger, stronger, higher-performing business.”

For more detailed information, investors are invited to access a live webcast of the conference call from the Investor Relations section of the Comtech website or dial in directly.

Value investors and potential GuruFocus.com members may find Comtech’s ongoing transformation, strategic refinancing efforts, and solid backlog as indicators of the company’s potential for long-term growth and value creation.

Explore the complete 8-K earnings release (here) from Comtech Telecommunications Corp for further details.

This article first appeared on GuruFocus.