Fisker Closes New York Store Amid Transition to Dealer Partnerships Model

Written by Cláudio Afonso | Info@claudio-afonso.com | LinkedIn | X

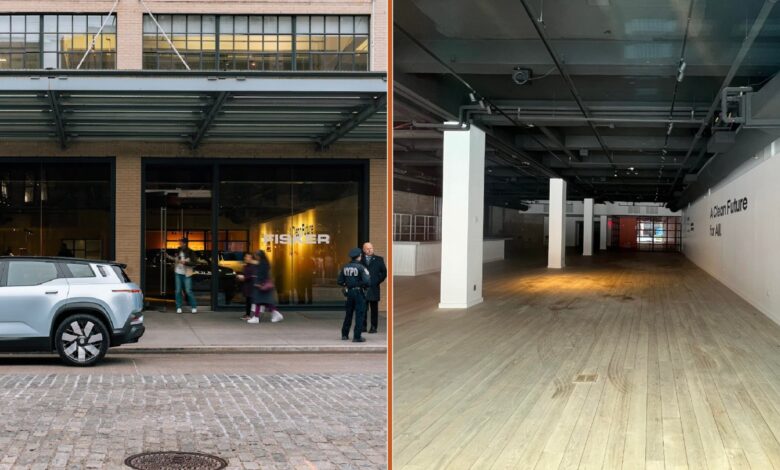

The electric vehicle (EV) startup Fisker has reportedly closed its showroom in New York this week as it transitions from direct sales to a dealer partnership model.

Located at 401 W. 14th Street, the Fisker store had been showcasing two units of its Ocean SUV until Thursday, which were removed on Friday — according to a Reddit User. Fisker did not immediately respond to a request for comment.

The store, known as Fisker Lounge by the company, opened in November 2023 and was Fisker’s inaugural retail space on the east coast, following the launch of the flagship showroom at The Grove in Los Angeles.

NEVER MISS AN UPDATE

In January, the company announced a business model shift from direct sales to customers to a dealer partnership model. One and a half months later, the EV startup said over 250 dealers in “North America and the rest of the world ” showed interest in selling its first production model Fisker Ocean.

Earlier this week, Fisker announced the addition of six dealer partners in the US bringing the number up to 12 as it continues to switch to dealer partnership model.

The company has now a total of 24 locations when adding the 12 dealers in Europe — nearly the triple from the 9 dealer locations the company was partnering with four weeks ago.

In the recently filed annual report, Fisker said that was “selecting its dealers based upon multiple criteria, including a dealer’s ability to deliver a high level of customer satisfaction”.

Two weeks ago, in mid-April, Fisker had announced new dealer partners in the U.S. and Europe having. As of today, Fisker has dealer partners in six European countries including Denmark, Austria, France, Germany, Norway, and Switzerland.

NEVER MISS AN UPDATE

Business insider reported earlier this week that Fisker technicians have been using parts from pre-production vehicles and existing inventory to repair some customers’ cars.

Facing a backlog of customer service requests and a shortage of available parts, Fisker employees have reportedly removed parts from what some refer to as “donor cars” which include pre-production and production vehicles stored in La Palma, California.

The first day of may marked the deadline for Fisker’s agreement with the investor as the startup engages in talks with automakers regarding a potential buyout to avert bankruptcy.

As per Fisker’s SEC filing, the investor agreed to temporarily forbear from demanding immediate redemption of the investment to the company from April 21 until today, May 1st.

In a recent SEC filing, the EV startup Fisker disclosed it missed an $8.4 million installment payment on March 29, violating its agreement with the investor triggering the right to demand immediate redemption of their investment to the company.

Fisker has recently withdrawn all financial and operational guidance for 2024 and appointed both Deutsche Bank and PJT Partners as financial advisors to explore strategic alternatives.

NEVER MISS AN UPDATE

Magna, the manufacturing partner, notified its workforce in Graz (Austria) last week that will reduce around 500 positions. With the production of the Fisker Ocean model halted for an undetermined time, Magna found itself compelled to implement substantial workforce reductions.

Fisker spent $904.9 million in cash in operating and investing activities during 2023 and saw its cash balance decrease by 411 million. The company disclosed its cash balance reduced from $736.5 million by the end of 2022 to $325.5 million on December 31, 2023.

Fisker received the delisting notice of its stock from the New York Stock Exchange on March 25 and started trading on the OTC market, where securities trade via a broker-dealer network.

Written by Cláudio Afonso | Info@claudio-afonso.com | LinkedIn | X