Nvidia and Microsoft: Mizuho Chooses the Best AI Stocks to Buy in May

Artificial intelligence, especially the newer generative AI technology, made a splash when it hit the scene, and we’re still watching to see just how the waves will break. In the tech world, innovators and companies are working to adapt and incorporate AI into their businesses – but for investors, the question is, how to cash in?

The top analysts at investment firm Mizuho are working to answer that question, and to give a set of concrete recommendations on the best AI stocks to buy in this month of May. And, their answers shouldn’t surprise us; they see market-leading companies reaping solid gains from AI, building on the combination of their existing positions, their existing work in AI, and the potential profits going forward.

Specifically, the analysts are recommending Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT), two of the largest companies on Wall Street, each valued at more than $2 trillion by market cap. These are big names in the tech world, leaders in their niches, and they have proven records for generating profits and returns. Let’s take a closer look at them, through Mizuho’s lens, to find out what investors can expect for the months to come.

Nvidia

We’ll start with Nvidia, the fast-rising leader of the semiconductor chip industry. Nvidia’s stock has gained an amazing 222% over the past year and become one of just four Wall Street firms valued at more than $2 trillion. Nvidia’s sustained gains have come on the back of its dominance in the realm of AI-capable processor chips. The company invented the GPU chip back in 1999, as a high-end processor aimed at the graphics-intensive computer gaming market. The chips proved adaptable and became popular with professional graphic designers. More recently, Nvidia’s GPUs found widespread use in the data center industry and in AI applications.

The close link between Nvidia and AI tech is illustrated by the company that brought us the current generative AI wave, OpenAI. The AI company is an important customer for Nvidia, and just last month, the two companies publicized Nvidia’s release of the new DGX H200 chip to OpenAI. The H200 is Nvidia’s successor product to the successful H100 AI supercomputer chip and represents a substantial increase in high-performance computing capacity.

Nvidia’s business is much wider than just OpenAI, however. The company has collaborations with both Google and Amazon, providing AI-capable hardware to support Google’s open language models and Amazon’s popular AWS subscription cloud. The company released multiple AI-capable products in its last fiscal quarter and provides support for the US government’s National Artificial Intelligence Research Resource program. Nvidia is pursuing its AI business through multiple lines, ensuring that the company does not depend on just one customer.

On the financial side, Nvidia realized $22.1 billion in revenue during its last reported quarter, fiscal 4Q24. That figure was a company record, beating the forecast by $1.55 billion, and representing year-over-year growth of 265%. Of the total, $18.4 billion came from the AI-related data center segment, a figure that made up 83% of the total. The data center business was up 409% from the prior year.

These strong revenues led to strong earnings, with a quarterly non-GAAP EPS result of $5.16. The EPS was up 486% year-over-year and was 52 cents per share better than had been anticipated.

For Mizuho’s 5-star analyst Vijay Rakesh, Nvidia presents a series of strong opportunities, and has high potential to outperform its competition.

“NVDA remains the primary AI/data center accelerator player with strong 90%+ market share, well ahead of main competitors AMD, which is ramping MI300, and Intel, which is shipping Gaudi2/ramping Gaudi3. AI server penetration remains a rather small portion of the overall server market at we believe just ~1% in 2023, with expectations for AI server penetration to potentially reach 11% by 2027E. We believe NVDA should maintain its strong share position as the market leader following the launch of B100 later this year, driving 2.5-6x performance improvements with ASPs up just 25-30% over H100, as NVDA sees Gen AI as a $100T market with greenfield projects from customers driving $250B of investments per year, as well as $250B of brownfield investments,” Rakesh opined.

Rakesh goes on to give NVDA shares a Buy rating, with a $1,000 price target that implies a one-year upside potential of ~13%. (To watch Rakesh’s track record, click here)

Overall, it’s clear that Mizuho’s upbeat rating is no outlier – Nvidia stock has picked up 41 recent analyst reviews, including 39 Buys and 2 Holds, for a Strong Buy consensus rating. The stock is selling for $887.89, and its $1,005.59 average target price suggests it will gain 13% in the year ahead. (See NVDA stock forecast)

Microsoft

Next up is Microsoft, currently the largest publicly trading company on Wall Street, with a market cap of $3 trillion. Microsoft has a 50-year history in the computing business, and has become one of the world’s iconic brands.

Microsoft hasn’t rested on its software laurels; the company was an early adopter in the AI field, recognizing the potential of the new technology and making judicious investments in AI development. Microsoft has been a major backer of OpenAI since 2019 and has put a total of $10 billion into the AI company. That investment has paid off handsomely for the software giant.

That can be seen clearly in some of Microsoft’s recent product updates and releases. The company has access to OpenAI’s development of generative AI and has been integrating AI into its own products. Notable among those integrations are the addition of AI tech to the Bing search engine, to improve the interface and the search results, and the company’s introduction of Copilot, an AI-powered online assistant that is integrated into the recent updates of Windows and Office.

The most important of Microsoft’s recent AI moves, however, involved its Azure cloud computing platform. Azure is a direct competitor to Amazon’s AWS and Google’s Cloud Platform and is available to users on the subscription mode. The service offers access to more than 20 cloud-based apps and tools, including a full portfolio of AI-powered applications and upgrades.

In its last quarterly report for the fiscal third quarter, Microsoft’s Intelligent Cloud segment, which includes Azure, was a strong driver of the company’s overall revenues, generating $26.7 billion in the quarter, a 21% year-over-year increase and making up 43% of the company’s total quarterly revenues.

The total top line for fiscal 3Q24 came to $61.9 billion. This figure beat the forecast by $1 billion and was up 17% year-over-year. Microsoft’s quarterly earnings came to $2.94 per share, beating expectations by 11 cents per share and growing 20% from the prior-year quarter.

Microsoft’s strong links to AI attracted Mizuho’s Gregg Moskowitz, who writes: “The pace of MSFT’s GenAI innovation remains stunning, and we see MSFT as the best positioned software vendor to capitalize on this rapidly emerging technology. Most notably, AI now represents 7 points of Azure revenue growth, with >65% of the Fortune 500 now using the Azure OpenAI Service. In addition, we expect at least a few billion dollars of cumulative incremental revenue from Microsoft 365 Copilot (GA since Nov. 1) by the end of FY25, and these are just two of the many AI monetization angles for MSFT (also GitHub, Security, Dynamics, Fabric, et. Al.)”

Quantifying his stance, the 5-star analyst gives MSFT a Buy rating and sets a price target of $450. That target suggests ~11% gain on the 12-month horizon. (To watch Moskowitz’s track record, click here)

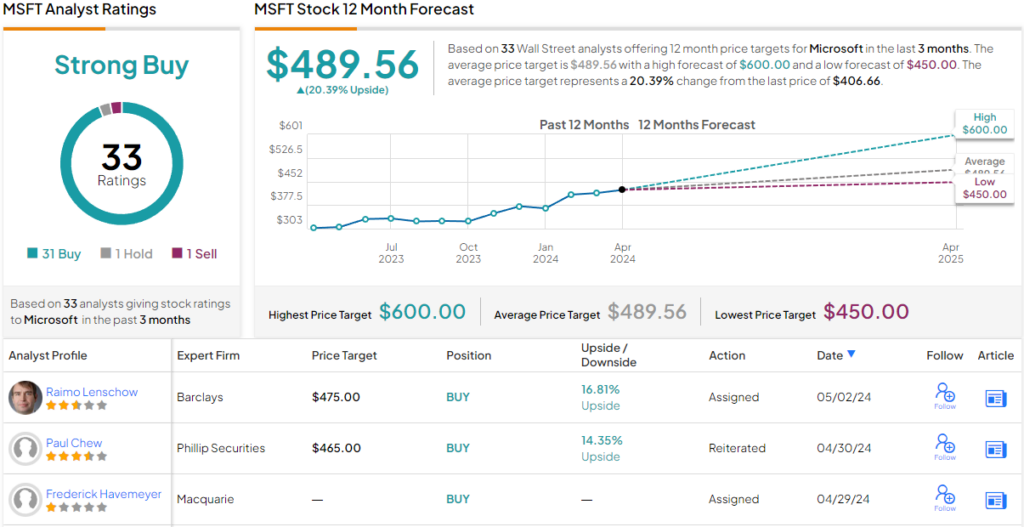

Unsurprisingly, Microsoft has earned a Strong Buy from the Street’s analyst consensus, a rating based on 33 recent recommendations. These include 31 Buys, and 1 each Hold and Sell. The stock’s $489.56 average price target is more bullish than the Mizuho view, implying a 20% one-year upside from the current share price of $406.66. (See MSFT stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.