Motorsports properties envision the competitive future of electric and hybrid vehicles

NASCAR Holdings’ IMSA series already uses hybrid technology, but the company’s primary stock car series is still researching potential changes to how its cars are powered.getty images

Motorsports properties such as NASCAR, IndyCar and Formula 1 are trying to keep up with shifting demand for fully electric and hybrid vehicles as they envision how the technologies could work their way into race cars and in turn provide the research and marketing opportunities carmakers covet.

The trick in moving forward lock-step with the auto industry, however, is balancing change while still delivering the competition — and sounds — that racing fans want.

Spurred by global concerns about climate change and the spellbinding stock market success of Tesla, legacy car companies around the world have poured hundreds of billions of dollars into electric vehicles over the last decade.

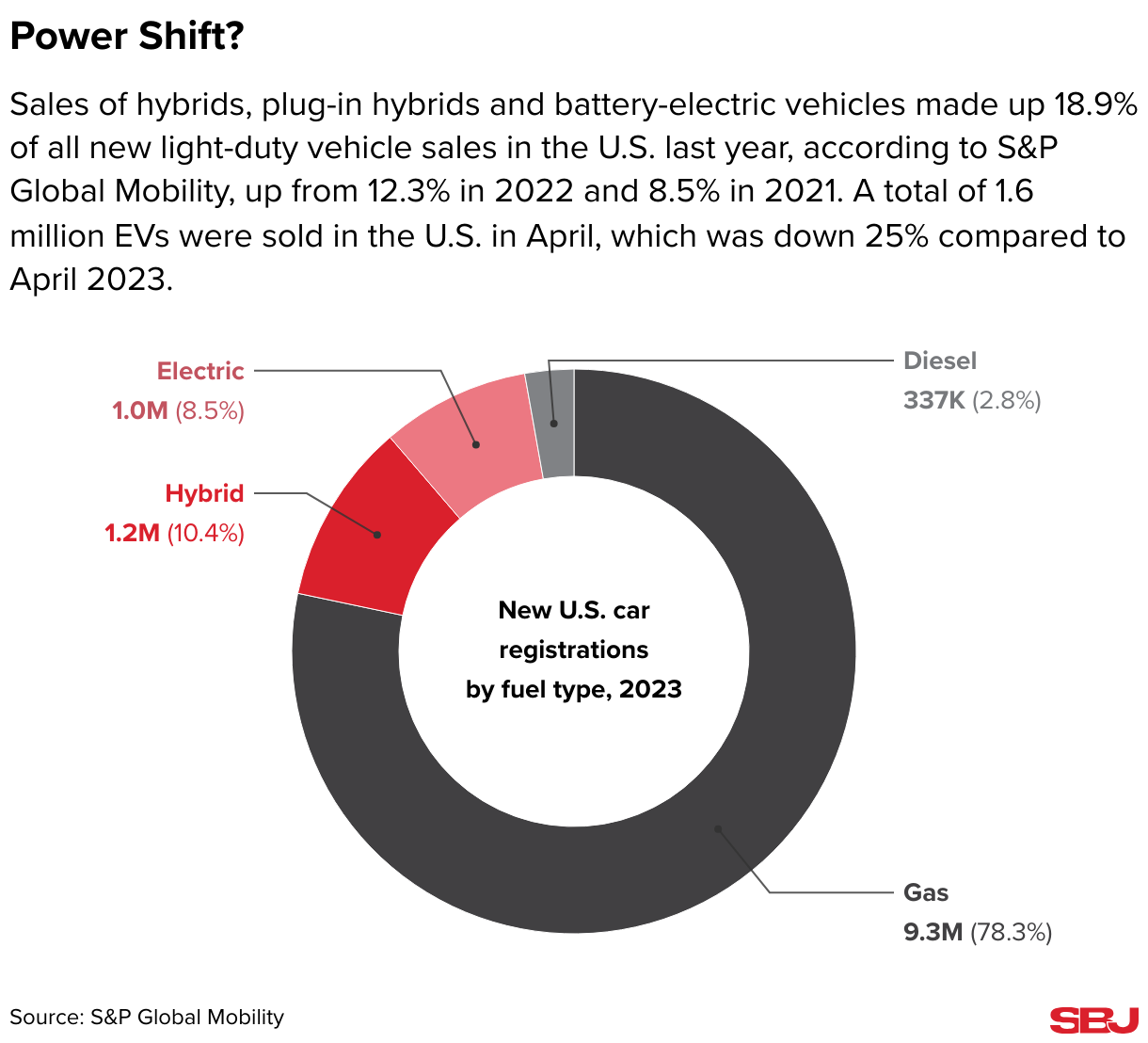

But since the start of 2023, growth for EVs has slowed while sales of hybrid cars, which use both electricity and gasoline, have spiked. Hybrid sales rose 43% in the first three months of 2024, while EV sales were up 2.7% during the same period, The Wall Street Journal reported. Research firm S&P Global Mobility said that last year 1.2 million new hybrid cars were registered compared to 1 million EVs (see chart).

Fully electric vehicles are expected to reach a market share of 12.4% in the U.S. this year, according to J.D. Power, which revised its original estimate down by 0.8% because of factors such as manufacturing delays, production cuts and slowing adoption rates in numerous states. Still, that figure was at 7.6% in 2023 and is expected to hit 50% in 2031.

Signs of trouble with the EV transition are not hard to find. Ford announced in early April that it was delaying production of its all-electric SUV and pickup truck and would instead roll out hybrid versions of all its models by 2030. Tesla laid off 10% of its staff and slashed prices globally on many of its models in April, while its stock has been down as much as 40% this year. In March, EV car registrations were down 11.3% in Europe, according to the European Automobile Manufacturers’ Association.

Rick Hendrick, owner of Hendrick Motorsports in NASCAR, has a unique point of view because he’s in racing and one of the largest car dealers in America. He told the Robb Report publication that his dealerships in Northern California have a waiting list for Lexus hybrid cars but have to “put big discounts” on Lexus EV cars.

“The customer is going to dictate what you build,” Hendrick told the publication. “I’ve been in the automobile business for almost 50 years, and you can’t force customers to buy what they don’t want. We were too aggressive with the EV market.”

Formula E, built on electric vehicle technology, remains bullish on the global future for EVs.getty images

Missed opportunities?

Ed Laukes, a former senior executive of Toyota Motor North America, said the rise in hybrids presents an opportunity for NASCAR to move away from its outdated engine technology and get its product back to being more relevant to carmakers. NASCAR uses an eight-cylinder gas engine that is not compatible with those used in the new cars that Americans drive, limiting the marketing potential of current manufacturers in the sport and making it more difficult to bring in additional ones, analysts say.

“Relevance to the industry has always been at the forefront for all the [carmakers in racing],” said Laukes, who consults for Joe Gibbs Racing. If NASCAR allowed the carmakers to soup up one of their road car engines into a NASCAR engine, “now you have relevance and you bring your cost way down because you’re already working on that type of driveline,” he added.

Laukes gave the example of Toyota being able to use a new twin turbo hybrid engine that is in road cars such as the Sequoia SUV, Land Cruiser SUV, 4Runner SUV and Tundra truck. “If you take that engine and figure out a way where you can modify the engine and still bring parity … then you’ve got something because now you’ve driven your cost into a quasi production engine and still have a great racing product.”

Car companies play outsized roles in racing relative to other sponsors. For example, Toyota was the biggest national TV advertiser during NASCAR races in 2023 at $3.8 million, according to iSpot.tv. NASCAR has been in discussions with Honda to persuade the Japanese giant to become its fourth manufacturer, joining Chevrolet, Toyota and Ford, and Laukes mentioned Hyundai as another brand that could see NASCAR as a viable marketing platform.

Prospective car companies have told NASCAR they will join only if NASCAR can offer a compelling narrative for consumers with hybrid cars or sustainable fuels, according to a person familiar with the matter. Teams also have started helping promote EVs when their manufacturer partners want them to. For example, Roush Fenway Keselowski’s corporate fleet of cars is comprised of hybrids and EVs from Ford.

Formula 1 has used hybrid engines since 2013 and aims to require cars to draw even more power from an electric battery by 2026.getty images

Getting on track

NASCAR Holdings, the parent company, also owns the IMSA sports car series, which already uses hybrid technology in its racing. NASCAR could switch to hybrid technology as soon as 2026 or 2027 if a new manufacturer joins, the person familiar with NASCAR’s thinking added. If a manufacturer doesn’t join during that time frame, NASCAR likely would have more time to facilitate any possible changeover to hybrid. NASCAR is testing EV, hybrid, hydrogen and sustainable-fuel technology at its research-and-development facility near Charlotte.

“All of us work in conjunction with NASCAR to figure out what that future powertrain is going to be,” said Paul Doleshal, group manager of motorsports at Toyota Motor North America. “There’s a lot of options right now and we’re probably going to do a lot of testing with different powertrain platforms to just understand what’s the best viable thing moving forward. We all want to have great competition. We understand that we need to provide some very strong competitive entertainment for the race fan, and we don’t want to impact that at all. So, you’re going to probably see some experimentation by all of us with different things just as we search for what that is.”

IndyCar was supposed to switch to a new hybrid system at the start of the 2024 season, but stakeholders agreed to postpone it until the middle of this year because not all of IndyCar’s teams were able to test the hybrid system during the offseason. Nonetheless, with the system slated to debut this summer just as hybrid road car sales grow dramatically, the series now believes its switch to hybrid has suddenly ended up well-timed.

“On one hand, we were late in putting out hybrid, and for Honda it was kind of a bridge strategy as they were moving more toward going fully electric, but now it’s looking like hybrid will be the place to land for some time from the point of view of the OEM industry,” said Mark Miles, president and CEO of Penske Entertainment. “It’s going to end up being fortuitous timing [for IndyCar].”

Honda said it is running ads in the series around its Accord hybrid and CR-V hybrid models. Honda also is advertising two of its new EVs, the Prologue and Acura ZDX.

IndyCar and F1 have shown that switching to hybrid power is not an easy equation. F1 has been using hybrid engines since 2014. But to reach even more ambitious sustainability targets, the series in 2026 plans to switch to a new set of regulations that will require the car to draw even more of its power off an electric battery. Yet just this month, a report from Motorsport.com emerged that F1 and its teams were having to rethink their 2026 regulations because simulations had shown the new rules made the car undrivable at speeds you’d expect from an F1 car.

Formula E is one series already fully committed to what it hopes still will be an electric revolution. Jeff Dodds, CEO of the London-based property, pointed out that EVs account for 85% of new cars sold in China, the world’s second-largest economy, a sign that sales aren’t flagging everywhere.

“We still see growth in EVs globally — we’ve probably seen a growth and performance that was going faster than what we expected for a period of time, so I’m not surprised it’s settled a bit,” said Dodds. “But as economic conditions improve, premium cost of production starts to come down a bit and people gain more confidence in the infrastructure, I think it’s in a good place. So I certainly don’t have any concerns that we will be able to achieve our growth plan based on any challenges in the EV market.”