A Closer Look At Electric Vehicle (EV) Battery Production And Its Complexities As Automakers Miss Financial Forecasts – Rail, Road & Cycling

To print this article, all you need is to be registered or login on Mondaq.com.

The focus of this edition of the Automotive Industry Spotlight

is the mine-to-battery equation and the

‘green’ nature of EVs not being inherently

clear considering the greenhouse gas intensive nature

of battery manufacturing.

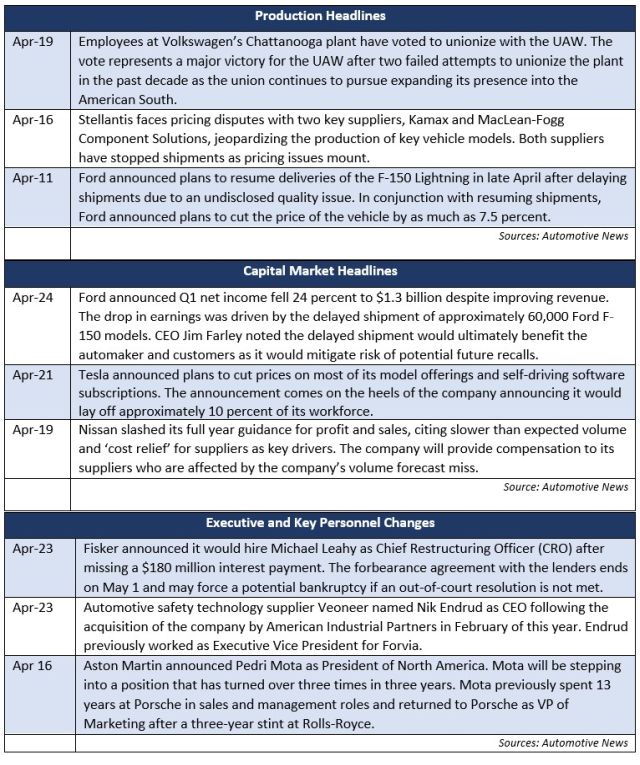

In industry news, Ford took a major hit on profitability

in the first quarter as it voluntarily delayed

deliveries of its F-150 models to solve production quality

issues. The International Union, United Automobile,

Aerospace and Agricultural Implement Workers of America (UAW) won a

major victory at Volkswagen’s Chattanooga

plant as its workers voted to

unionize. Nissan announced significant cuts to its

full year profitability and sales guidance, citing missed

forecasts for volume and voluntary payments to suppliers.

In regulatory news, Ford recalled 457,000 Broncos and

Mavericks due to vehicles stalling, per the National

Highway Traffic Safety Administration (NHTSA). Tesla

reached a settlement with the family of a fatal crash victim

involving their autopilot system. A bill introduced by 18

Republicans to undo Environmental Protection Agency (EPA) tailpipe

emission standards failed to receive the required

votes to avoid 2030 to 2032 EV-light vehicle sale

targets.

Industry Focus — The EV Battery Lifecycle

The rapid growth of EVs in the United States has placed

significant strain on the automotive supply chain and,

specifically, the sourcing of critical minerals for EV battery

development. Federal regulations have tightened requirements for

mineral sourcing for automakers, particularly as they apply to tax

credits for consumers purchasing EVs.

Changes in mineral sourcing requirements have led to significant

shifts in sourcing capabilities and industry ramp ups throughout

the automotive supply chain, presenting a significant remaining

hurdle for automakers hoping to achieve profitable EV business

units.

EV batteries and their assembly processes also still carry

significant carbon footprints from mineral extraction processes and

electricity sources. Significant questions remain on the resale and

recycle market for EV batteries — a key point for consumers

and automakers alike.

Where does my battery come from, and from what is it

made?

A vast majority of EVs worldwide are powered by lithium-ion

batteries, which are used for their high capacity and minimal

energy loss. A typical EV battery includes four key

minerals:

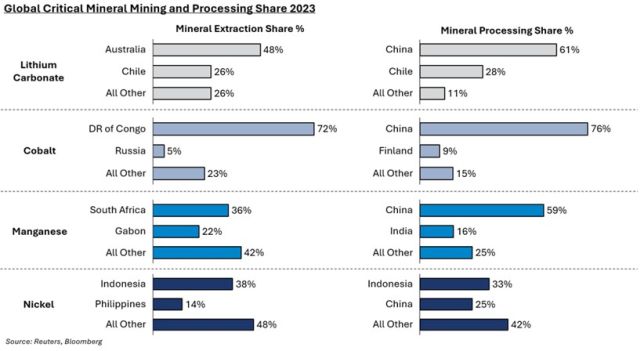

Supply chain considerations for automakers are conceptualized

under a ‘mine to battery’ roadmap. In its current form,

the mining and processing supply chain for lithium-ion batteries is

heavily globalized:

Recent legislation has put geopolitically-driven regulations in

place for critical mineral sourcing for use in EVs. In 2024, 40

percent of the value of “the critical minerals contained in

the battery must be extracted or processed in the United States or

a country with which the United States has a free trade agreement

or be recycled in North America” per the Inflation Reduction

Act. This would exclude minerals extracted or refined in China,

which currently controls a significant portion of the global

critical mineral refinement market. As a result, critical mineral

extraction has ramped up considerably in the United States and

Australia.

A greener footprint, but ‘end of life’

challenges remain

With the current state of mineral extraction, refinement and the

power sources fueling the U.S. electric grid, the

‘green’ nature of EVs is not inherently clear. Because

the process to manufacture EV batteries is more greenhouse gas

intensive than an internal combustion engine (ICE), a typical EV

requires a driver to drive between 15,000 and 25,000 miles before

net emissions benefits are realized. For the average American, this

is achieved in 18 to 36 months.

While recycling processes for EV batteries are still new and

remain labor intensive, some of the critical minerals in the

battery retain considerable value: Nickel and Cobalt can be

recovered at such a high rate out of ‘end of life’

batteries that they could considerably reduce the future demand for

mineral extraction. Safety concerns for dismantling lithium-ion

batteries at end of life — which is estimated to be 200,000

miles — are abundant; without proper oversight or care, the

batteries can catch fire and present significant danger to landfill

sites or recycling crews.

Cost burden remains, with no real end in

sight

While the environmental benefits of an EV are taking clearer

shape for consumers, cost challenges with the evolution in mineral

sourcing processes for batteries continue to take a toll on

automakers. The primary difference in the manufacturing cost

profile for EVs is the lithium-ion battery compared to a

traditional ICE. While the cost of an EV engine can vary based on

its composition of critical minerals, their cost compared to their

ICE counterparts varies materially. For a new Cadillac Escalade IQ

EV estimated cost per powertrain battery is approximately $22,500;

by contrast, a new Escalade ICE is estimated to cost approximately

$8,000. The cost difference to produce those batteries is

contributing to significant losses for domestic automakers; In

2023, Ford lost an estimated $40,525 per EV sold.

Mineral sourcing requirements, while designed to improve

longer-term supply chain prospects, will lead to continued near-

and mid-term cost challenges for automakers. With rapidly changing

supply chain sources for critical minerals and billions of dollars

committed to ramping up battery production domestically, the path

to profitability through streamlined lithium-ion battery

manufacturing remains steeply uphill.

Additional April insights are

included below.

Industry Update

March inventory levels ended at 2.58 million units, an

83,000-unit increase from February. Days’ supply closed at

47, approximately 7 percent above the five-year average. Inventory

at the Detroit 3 led the way for the U.S., with a 67,000-unit

increase in inventory, driven by an increase in light trucks.

Regulatory Landscape

Tesla Cybertruck Recall: The automaker

announced it would recall all of its 2024 model Cybertrucks

following reported issues that accelerator pads may dislodge and

become stuck in the car’s interior trim, cutting torque on

the accelerator and brake pads. The company has previously delayed

deliveries of the vehicle model due to issues with the accelerator

pedal.

NHTSA announces recall of 457,000 Ford

vehicles: Ford is recalling 457,000 Bronco Sport and

Maverick vehicles due to a defect in which the vehicles are unable

to start, or they stall when coming to a stop.

Bill to undo EPA tailpipe emission standards fails to

pass the Senate: The bill, introduced by Senator Mike

Crapo (R – Idaho) and co-sponsored by 17 Republicans, sought

to dismiss the final EPA policy towards tailpipe emission

standards. After intense negotiation with industry leaders, the EPA

settled on EVs to make up 30 to 56 percent of light-vehicle sales

by 2030 to 2032, where it had originally planned 67 percent. The

bill to undo the revised emission standard was voted down 52 to 46,

falling short of the 60 votes required to pass.

Originally published 30 April 2024

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.