Cybersecurity Stocks at an Intriguing Entry Point

The cybersecurity sector has had a rather rough start to earnings season

Subscribers to Chart of the Week received this commentary on Sunday, May 5.

At first glance, cybersecurity is a fruitful growth sector for investors to dig into. Because cyber threats are ubiquitous, a cybersecurity’s clientele can range from brick-and-mortar restaurants to a government defense contractor. Data breaches can happen to any anything with an internet connection; that’s why the global cybersecurity workforce contains roughly 4.7 million people. Malware, ransomware, and cloud intrusions all increased by sizable margins year-over-year. Factor in the proliferation of generative artificial intelligence (AI), and it’s all but certain cybersecurity will be on the bleeding edge of the tech sector for years to come.

With demand spiking and technological advancements improving by the day, it would seem to be smooth sailing for a sector that’s still, in the grand scheme of things, at the ground floor. However, the post-earnings reactions from a slew of cyber sector stalwarts this week points to a tricky area of the tech web that needs some untangling.

On May 3, Fortinet Inc (NASDAQ:FTNT) gapped lower by 9.7%, after the company forecasted second-quarter billings well below estimates. In other words, the cybersecurity playing field is quite crowded, and rivals’ market share is gaining. No fewer than 15 brokerages trimmed their price targets in response, the worst coming from HSBC to $54 from $57. Sector peer Cloudflare Inc (NYSE:NET) suffered a post-earnings bear gap of 16.4%, after the company’s bigger-than-expected first-quarter operating loss, with CEO Matthew Prince used the term “uncertain” at least five times on the call. Right on cue, 11 brokerages issued price-target cuts, the worst coming from Guggenheim to $50 from $56.

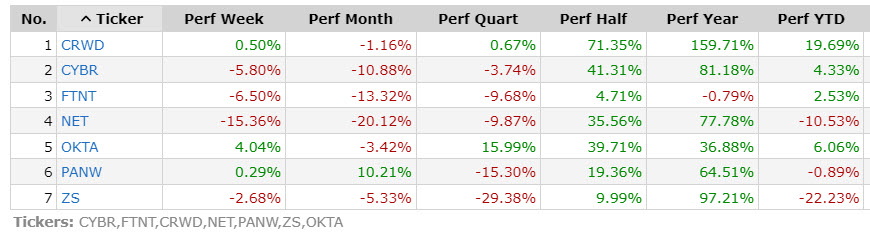

Small cap CyberArk Software Ltd (NASDAQ:CYBR) was also in the red Friday despite crushing its first-quarter earnings and revenue estimates, with two price-target cuts weighing. These drawdowns — and subsequent analyst reactions — come despite all three companies reporting overall top-line beats, respectively, for their current fiscal quarter. The post-earnings moves are impacting the other heavy hitters in the sector, with CrowdStrike Holdings Inc (NASDAQ:CRWD) and Okta Inc (NASDAQ:OKTA) only marginally higher despite the frenetic broad market rally, while Palo Alto Networks Inc (NASDAQ:PANW) and Zscaler Inc (NASDAQ:ZS) finished lower.

The scrambling of brokerages adjusting their price targets doesn’t necessarily indicate a shift in sentiment, more of a warning shot. In Wedbush’s price-target on Fortinet, the brokerage in coverage noted “we still believe the FTNT story will see a growth turnaround over the next six to 12 months, but clearly the company is navigating a choppy environment in the field.” Overall, of the seven stocks in focus in this article, only NET sports a single “sell” rating. With CrowdStrike, Okta, Palo Alto Networks, and Zscaler all set to report earnings in the next 30 trading days, don’t be surprised to see more shifts in targets, which could add additional selling pressure to the stocks.

The table above illustrates a technical backdrop that’s awfully similar to of lot of tech sectors right now; healthy year-over-year gains but a sudden sharp correction beginning in the second quarter. Friday could prove to be a leading indicator that the overcrowded and overbought sector is prime for a continued correction.

Or, if in the next month, a clear earnings season winner gains some separation from the pack, the sector can stabilize at an intriguing entry point. Regardless of outcome, the uncertainty around cybersecurity right now shows that despite the seemingly unrelenting opportunity within the sector, fundamentals matter and corrections come for everyone. It’s on contrarian investors to sniff them out and pounce on the discount.