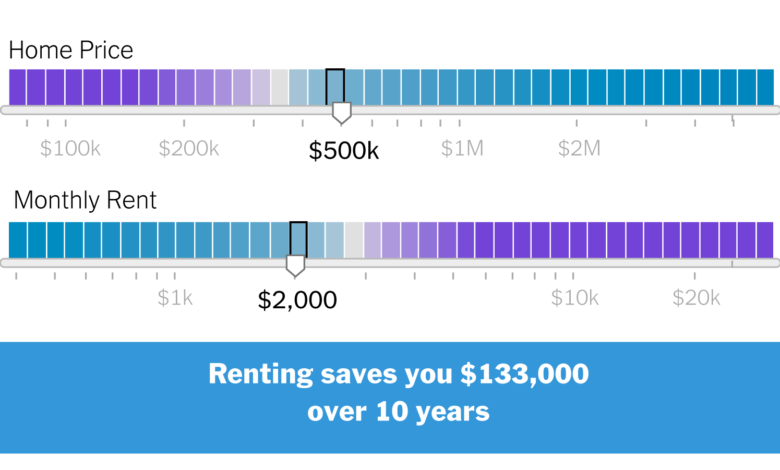

Is It Better to Rent or Buy?

These are the costs on top of rent, such as the fee you pay to a broker and the opportunity cost on your security deposit. But these expenses typically have a negligible impact.

Methodology

The calculator keeps a running tally of the most common expenses of owning and renting. It also takes into account something known as opportunity cost — for example, the return you could have earned by investing your money. (Instead of spending it on a down payment, for example.)

The calculator assumes that the profit you would have made in your investments would be taxed as long-term capital gains and adjusts the bottom line accordingly. The calculator tabulates opportunity costs for all parts of buying and renting. All figures are in current dollars.

Tax law regarding deductions can have a significant effect on the relative benefits of buying. The calculator assumes that the house-related tax provisions in the Tax Cuts and Jobs Act of 2017 will expire after 2025, as written into law. Congress might, however, extend the cuts in their original form, or extend and modify them. You can use the toggle to see how your results may vary if the tax cuts are renewed in full, to get a sense of how big the tax impact might be on your decision.

Buying

Initial costs are the costs you incur when you go to the closing for the home you are purchasing. This includes the down payment and other fees.

Recurring costs are expenses you will have to pay monthly or yearly in owning your home. These include mortgage payments; condo fees (or other community living fees); maintenance and renovation costs; property taxes; and homeowner’s insurance. A few items are tax deductible, up to a point: Property taxes; the interest part of the mortgage payment; and, in some cases, a portion of the common charges.

The resulting tax savings are accounted for in the buying total. If your house-related deductions are similar to or smaller than the standard deduction, you’ll get little or no relative tax savings from buying. If your house-related deductions are large enough to make itemizing worthwhile, we only count as savings the amount above the standard deduction.

Opportunity costs are calculated for the initial purchase costs and for the recurring costs. That will give you an idea of how much you could have made if you had invested your money instead of buying your home.

Net proceeds is the amount of money you receive from the sale of your home minus the closing costs, which includes the broker’s commission and other fees, the remaining principal balance that you pay to your mortgage bank and any tax you have to pay on profit that exceeds your capital gains exclusion. If your total is negative, it means you have done very well: You made enough of a profit that it covered not only the cost of your home, but also all of your recurring expenses.

Renting

Initial costs include the rent security deposit and, if applicable, the broker’s fee.

Recurring costs include the monthly rent and the cost of renter’s insurance.

Opportunity costs are calculated each year for both your initial costs and your recurring costs.

Net proceeds include the return of the rental security deposit, which typically occurs at the end of a lease.