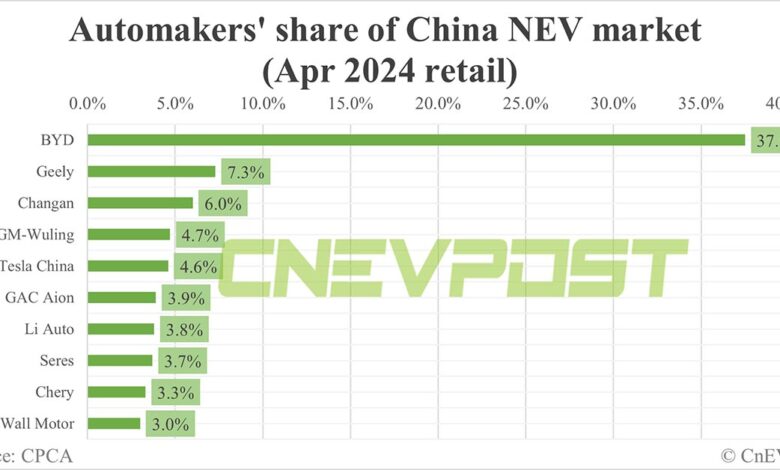

Automakers’ share of China NEV market in Apr: BYD tops with 37.5%, Tesla 5th with 4.6%

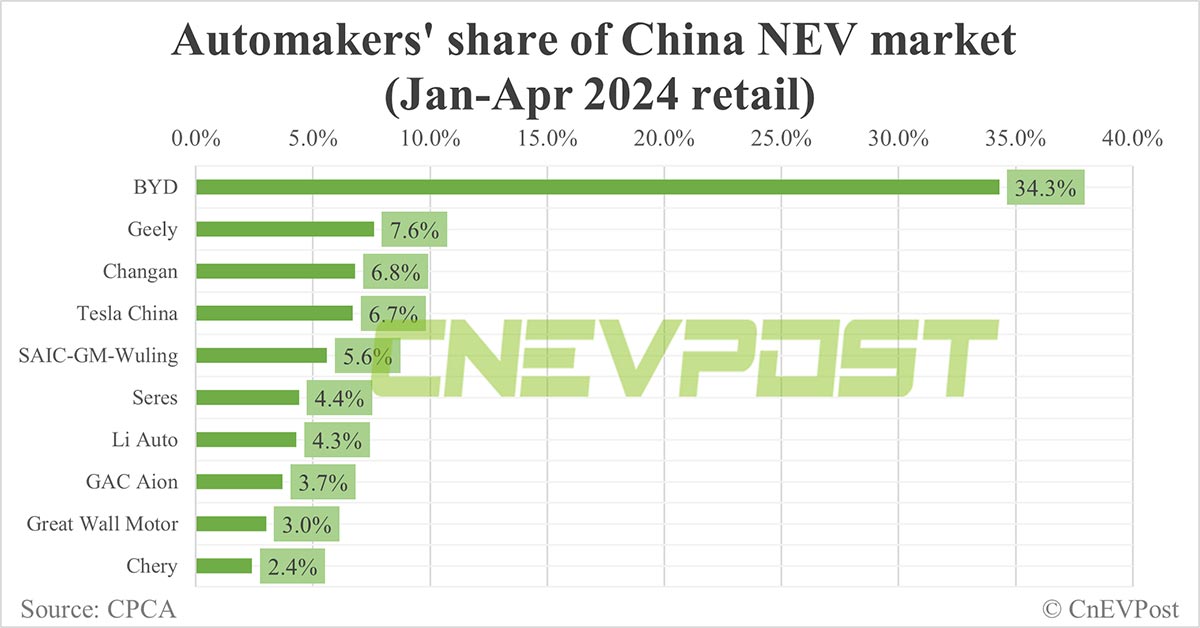

In the January-April period, BYD came in first in China’s NEV market with a 34.3 percent share, while Tesla was No. 4 with a 6.7 percent share.

BYD (HKG: 1211, OTCMKTS: BYDDY) continued to dominate China’s new energy vehicle (NEV) market in April, with Tesla (NASDAQ: TSLA) dropping in its ranking.

BYD’s retail sales of passenger NEVs in China totaled 254,131 units in April, giving it the No. 1 spot in the NEV market with a 37.5 percent share, according to a ranking released today by the China Passenger Car Association (CPCA).

The NEV maker was the only one with a share of more than 30 percent, with retail sales up 31.1 percent year-on-year.

BYD released figures earlier this month showing it sold 313,245 NEVs in April, up 48.96 percent from a year earlier and up 3.57 percent from March. The figures are wholesale sales and include both passenger cars and commercial vehicles.

China’s passenger NEVs sold 674,000 units at retail in April, up 28.3 percent from a year ago but down 5.7 percent from March, CPCA data released yesterday showed.

Tesla’s retail sales in China in April were 31,421 units, down 21.4 percent from a year ago, and ranked No. 5 with a 4.6 percent share.

In the CPCA’s March retail sales rankings of NEVs released last month, Tesla was No. 2 with an 8.8 percent share, behind BYD’s 36.6 percent.

It’s worth noting that in China, NEVs include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles. BYD produces PHEVs and BEVs, while Tesla only produces BEVs.

Tesla sold 62,167 China-made vehicles in April, including 30,746 exported, according to CPCA data released yesterday.

Tesla has a factory in Shanghai that produces the Model 3sedan and Model Y crossover, both for deliveries to local customers and as an export hub for it.

Tesla’s pattern is to produce cars for export in the first half of the quarter and for the local market in the second half, it previously said.

Geely’s retail sales of NEVs in April were up 76.3 percent at 49,155 units, placing it at No. 2 with a 7.3 percent share.

Changan Automobile’s NEV retail sales in April were up 119 percent to 40,507 units, placing it 3rd with a 6 percent share.

In the January-April period, BYD’s NEV retail sales were 840,137 units, up 19.6 percent year-on-year, and ranked No. 1 with a 34.3 percent share.

Geely’s NEV retail sales for the period were 186,607 units, up 121.1 percent year-on-year, and ranked second with a 7.6 percent share.

Changan’s retail sales of NEVs in January-April were 167,354 units, up 111.4 percent year-on-year, and ranked No. 3 with a 6.8 percent share.

Tesla’s retail sales in China in the January-April period were 163,841 units, down 7.6 percent year-on-year, and ranked No. 4 with a 6.7 percent share.

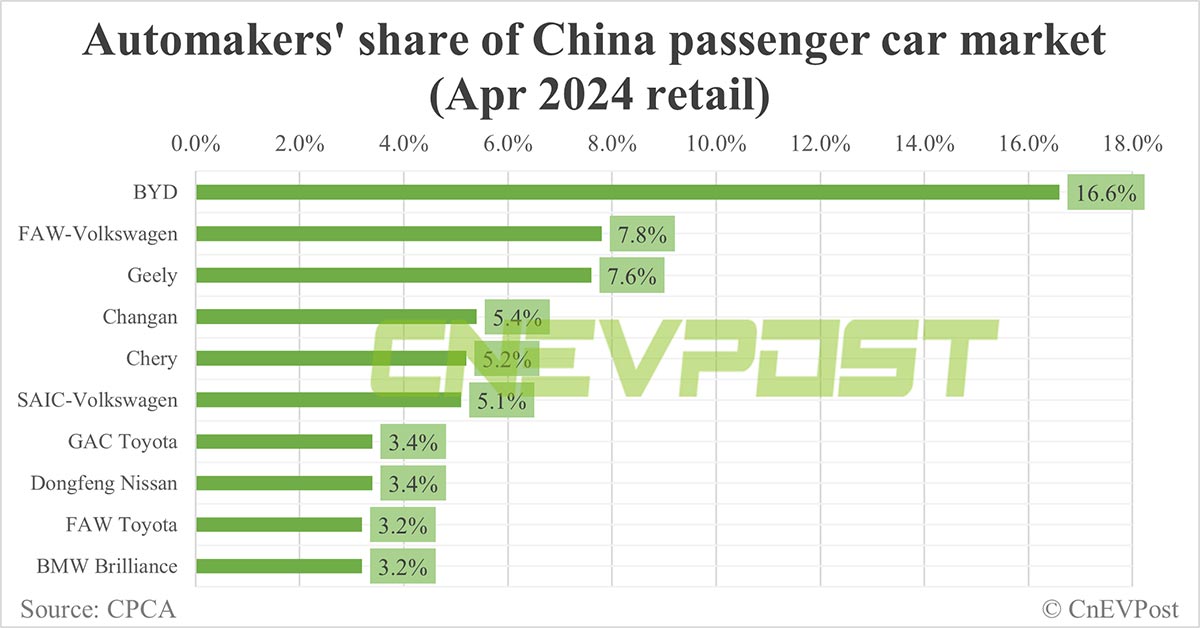

In the overall passenger car market, which includes traditional fuel vehicles, BYD was No. 1 in the retail rankings with a 16.6 percent share in April.

FAW-Volkswagen sold 119,032 units at retail in April, down 15.6 percent year-on-year, and ranked No. 2 with a 7.8 percent share.

Geely had retail sales of 115,723 units in April, up 31.2 percent year-on-year, to take 3rd place with a 7.6 percent share.

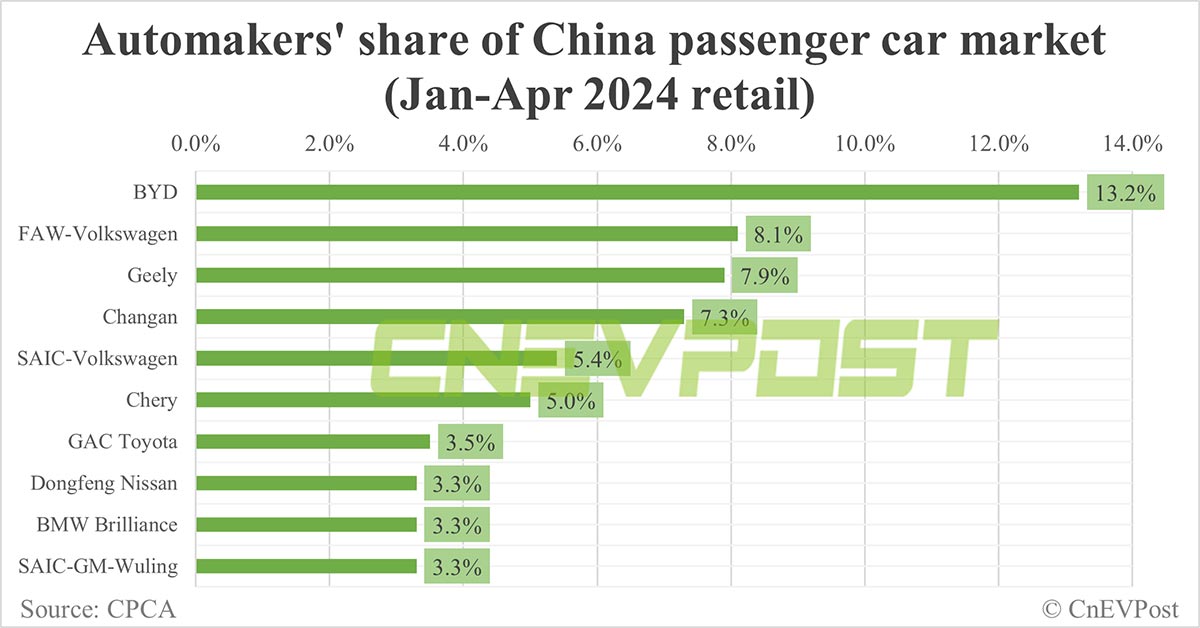

In the January-April period, BYD was No. 1 in China’s passenger car market with a 13.2 percent share, FAW-Volkswagen was No. 2 with an 8.1 percent share and Geely was No. 3 with a 7.9 percent share.

China NEV retail falls to 674,000 in Apr, penetration reaches record 43.7%