dLocal: A Diversified Emerging Market Fintech

Around 85% of the world’s people live in what’s broadly referred to as “emerging markets.” This giant ecosystem contains 158 countries, all of which are distinctly different places to operate. The fifth largest country in the world, Pakistan, is very different from the sixth largest, Nigeria. Both represent nearly half a billion customers.

If you’re the owner of a large multinational brand, it makes sense to sell your goods in as many jurisdictions as possible. In each country, you’ll need to accept and process payments using their preferred methods of payment. Figuring out each culture starting from scratch would be a nightmare. Why not find someone who has already built a payments platform that supports the world’s largest emerging markets? That’s dLocal (DLO).

Our one single direct API payment platform empowers global enterprises to reach billions of customers, accept payments, send payouts, and settle funds in emerging markets.

Credit: dLocal

Short End of the Stick

Several years ago, dLocal stock was beaten and battered after a short report accused them of various indiscretions, something we covered in an aptly titled piece, “dLocal Stock Demolished by Short Report.” After two independent investigations and the biggest existing shareholders increasing their investments, we concluded that there probably wasn’t much merit to the report. dLocal’s client list includes names like Amazon, Microsoft, Uber, Meta, and Spotify. Firms of this caliber are likely to vet services providers, especially for anything finance related.

With growth continuing unabated, it seems like these short accusations are behind the company now. One nail in the short thesis grave was the announcement that former MercadoLibre CFO Pedro Arnt left his employer of 25 years to join dLocal as co-CEO. Leaving an $88 billion ecommerce firm to join a $4 billion payments firm requires a leap of faith, and shares of DLO were up as much as 49% on the news. Three months after Mr. Arnt joined, dLocal’s CFO stepped down. Today, Mr. Arnt is the only CEO and last month he brought in a new CFO who spent 30 years at General Electric. If there was any accounting hanky panky going on, it’s probably been uncovered, rectified, and buried with the old CFO’s departure.

Key Metrics

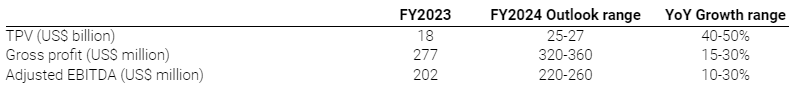

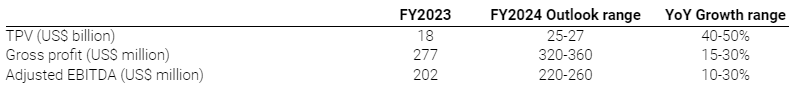

A tenured executive like Mr. Arnt knows the importance of KPIs and his company now provides three that investors will be provided guidance for. (TPV stands for total payment volume.)

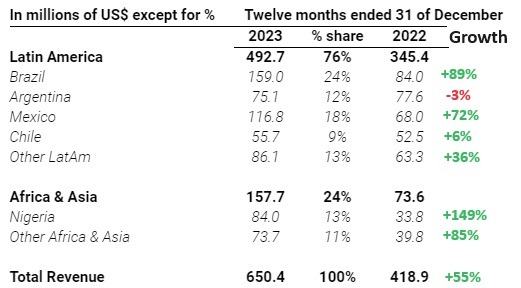

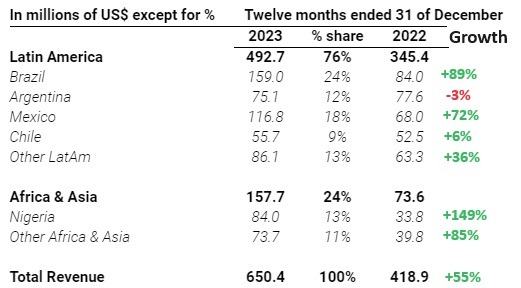

Says the company, “we are including TPV guidance this year, as we believe this is the most relevant operational metric for the company and the cleanest indicator of market share.” That’s because TPV simply measures the amount of money flowing through dLocal’s platform for which they take a cut – also called a “take rate” in industry parlance – and this becomes the company’s revenues. In 2023 dLocal had $17.7 billion flow through their platform for which they collected $650 million in revenues – a take rate of about 3.7% (that’s down from 3.96% the year prior). By not providing revenue guidance, the company doesn’t have to commit to a target take rate, though we can expect it to continue decreasing per the below statement.

Our expectations for TPV and gross profit assume increased mix coming from “Tier 0” merchants as we continue to ramp-up those global relationships, driving incremental TPV and wallet share from the world’s leading tech companies, but at lower take rates.

Credit: Nanalyze

The bigger dLocal gets, the more they can afford to lower prices to potentially capture more market share provided they keep growing volume at a strong pace. When it comes to the second metrics we’re provided guidance for, “gross margin,” it’s not expected to grow as fast as TPV which points to cost pressures. The third metric, “adjusted EBITDA,” points to how profitable the company expects to be. Our focus is on TPV as a proxy for market share captured. Last year dLocal had positive operating cash flows of $166 million bringing their cash balance to $326 million. If they can maintain this trajectory then raising capital becomes a thing of the past, unless of course they look to grow through M&A which the CEO talked about in the last earnings call.

We’ll continue to look at three potential vectors; one is commercial distribution; the other one is product innovation; and the third one is geographic footprint. Ideally, we’ll combine all three of those.

dLocal Earnings Call Q4-2023

Emerging Markets Growth

One use case in dLocal’s 2023 deck stands out. An unnamed “leading global internet satellite provider” needed a fast and easy way to expand into LATAM, APAC, and EMEA with the goal of “becoming a utility” in each locale. Using dLocal, they integrated 11 countries in one go, launching all at once in less than a month. The unnamed client is now planning on launching in 20+ countries using dLocal’s platform. The below tweet buried in the dLocal 2023 investor deck points to Starlink being a client, and probably the one the use case referred to.

The irony is that the more people become connected to the Internet via Starlink, the larger the potential pool of customers becomes for companies that use dLocal’s solution. When we look at TPV growth across each locale we see countries like Brazil, Mexico, and Nigeria driving tremendous growth bringing dLocal’s revenue growth to 55% last year.

Some of the world’s largest companies find these markets to be the lowest hanging fruit when it comes to selling goods and services to 85% of the world’s population. Revenue diversification across all markets will help dLocal navigate the inevitable storms that will arise in these volatile and unpredictable environments.

Valuation

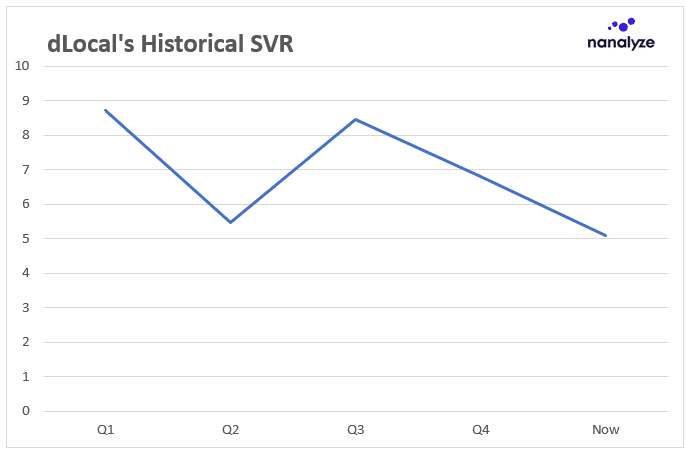

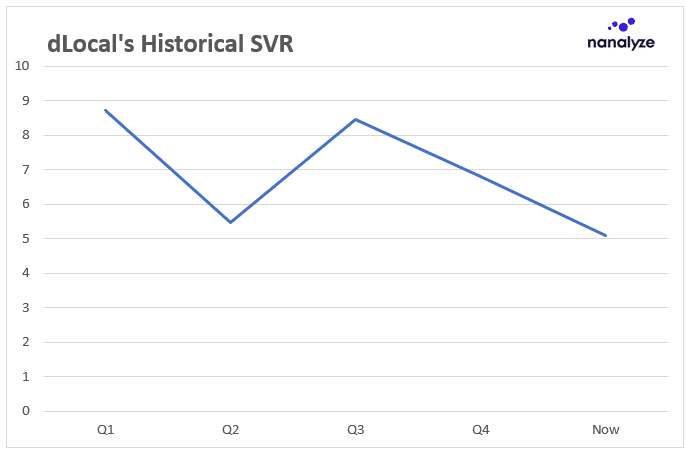

When a company become profitable it’s then eligible for different valuation methods such as price-to-earnings. Even though dLocal is profitable, we’ll still use our simple valuation ratio (SVR) so we can examine their relative valuation over time. The last time we added shares was at an SVR of 5.6, below our catalog average of 6.3. Here’s how dLocal’s SVR has been trending over the past year.

With a current SVR around 5, dLocal seems reasonably priced considering the tremendous growth they’ve experienced and the opportunities that lie ahead. The company plans to invest heavily this year and increase headcount by around 50% (mostly in engineering) so that means they’re likely working on being able to scale and address a population of 2 billion potential customers that’s being sold to by 600 merchants and growing.

In the past, people in emerging markets had to jump through all kinds of hoops to purchase products and services that developed markets enjoy. VPNs, prepaid cards, virtual phone numbers, and virtual addresses are all methods that don’t need to be used anymore. dLocal’s platform is solving pain points on both sides of the transaction, and some of the world’s biggest companies can’t seem to get enough.

Conclusion

dLocal now serves 5 of the 6 largest tech companies in the world. A net retention rate of 150% means that existing clients are using their platform more each year. A tenured leader at the helm helps alleviate any remaining concerns surfaced by the short report. It all sounds good on paper, but experience tells us this volatile stock will whipsaw investors around regardless of how “fairly valued” we might think it is. Just when you’re convinced you found the perfect growth stock, company-specific risk thwarts your plan. With earnings just days away, let’s hope dLocal’s growth streak continues.