Biden slaps tariffs on nonexistent Chinese EV imports

The Biden administration reportedly will slap a 100% tariff on Chinese electric vehicle (EV) imports, except that no Chinese cars presently are offered for sale in the United States.

If they were, they would crush the American competition, even with the present 25% tariff. Chevy’s Bolt, a starter EV with a US$29,000 sticker price, has the same size and less range than the Dongfeng Nammi 01 hatchback priced at just $11,000.

If China wanted to retaliate against the new American tariffs, it has a target-rich environment. General Motors last year sold 2.1 million cars in China. In most years, GM sells more cars in China than in the United States.

Chances are that China will ignore the American tariffs. China’s automotive industry association forecasts a 22% increase in the country’s auto exports during 2024, following a more than 60% increase in 2023, with the strongest growth in East Asia and the Middle East.

Henry Ford’s Model T sold for $850 in 1908, roughly the US per capita GDP at the time. By 1925, the price had fallen to $260 thanks to economies of scale. China’s EV makers are compressing this time scale into as many months as it took Ford years to bring down the price.

At a $10,000 or lower price point, demand for Chinese EVs in the Global South is effectively unlimited.

American, Japanese and South Korean automakers depend on Chinese automotive technology. GM meanwhile is negotiating with China’s largest battery maker CATL to license Chinese technology for its own EVs and build a joint mega-plant in the United States.

Ford last year announced a $3.5 billion joint venture with CATL with plans to build a Michigan plant but put the project on hold due to political pressure.

Tesla, Hyundai Motor and Kia meanwhile will partner with China’s leading Internet firm Baidu in geolocation and AI functionality for driverless cars, while Nissan Motor has allied with China’s Tencent for AI modeling.

With 3.4 million 5G base stations installed versus America’s 100,000, China is also well positioned for autonomous driving.

Low latency (nearly instant response) and high data capacity on 5G networks—ubiquitous in all Chinese cities—support artificial Intelligence applications for AVs as well as accident prevention. Chinese cities, moreover, feature new roadways amenable to autonomous driving.

Economies of scale through automated manufacturing as well as standardization of parts allow Chinese automakers to sell cars at much lower prices than their American counterparts.

Labor costs comprise just 7% of the cost of an American car, so the difference between American and Chinese labor costs explains a negligible part of the price differential.

Although more than 100 automakers are fighting for market share in China, most of them use standardized parts that reduce costs.

According to a LinkedIn post by automotive engineer Alan Smith, “All automobiles manufactured or sold in the United States today (except for Tesla and a very small number imported from China by GM) are produced using a parts churn manufacturing method, in which parts are used for approximately 1 to 6 years before they are replaced with new, non-interchangeable parts which offer no benefit over the previous part.”

“Western automobile makers churn parts – use proprietary, non-standard, non-interchangeable parts which are churn producing vehicles that are more expensive, more prone to defects and become manufacturer specific mini-monopolies,” Smith explains.

That used to be called planned obsolescence. Henry Ford in 1922 complained that his competitors would “change designs so that old models will become obsolete and new ones will have to be bought either because repair parts for the old cannot be had, or because the new model offers a new sales argument which can be used to persuade a consumer to scrap what he has and buy something new.”

By contrast, Ford—who in 1922 sold Model T’s at just 30% of the 1980 starting price—insisted that “the parts of a specific model are not only interchangeable with all other cars of that model, but they are interchangeable with similar parts on all the cars that we have turned out.”

Chinese automakers as well as Tesla follow the original Ford approach that made the Model T everyman’s car, Smith explains.

Biden’s tariffs protect the monopoly practices of the American auto industry at the expense of American consumers. Former president Donald Trump on March 18 also proposed a 100% tariff on Chinese-made EVs, including imports from Chinese manufacturers in Mexico, but added that Chinese automakers would be welcome to build plants in the United States.

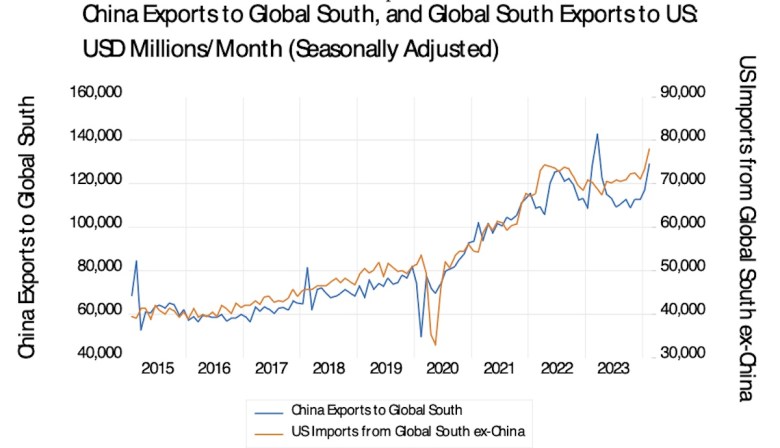

American tariffs on Chinese goods have redirected global supply chains to third countries. As the chart shows, China’s exports to the Global South move in lockstep with American imports from the Global South. America’s trade deficit in goods is at a record of around $1 trillion a year.

Chinese manufacturers invest in Vietnam, Mexico, Indonesia, Brazil and other venues, and assemble Chinese parts with Chinese capital goods into finished products for the US market.

Follow David P Goldman on X at @davidpgoldman