Best Car Warranty Companies, Reviewed By Experts (2024)

Best Extended Car Warranty Companies

We’ve extensively researched auto warranty companies throughout the industry. In addition to cost and coverage options, the factors we use to determine the best car warranty companies on the market heavily focus on industry reputation and customer experience.

The table below showcases our research team’s top 9 picks for the best car warranty companies in addition to the overall rating for each:

#1 Endurance: Most Comprehensive Coverage

#2 Olive®: Convenient Online Process

#3 CarShield: Affordable Monthly Payments

#4 Carchex: Great Industry Reputation

#5 Omega Auto Care

#6 autopom!: Excellent Customer Service

#7 Toco

#8 Concord Auto Protect: Most Luxury Makes Covered

#9 MPP

Compare Car Warranty Companies

Our team polled 1,000 consumers who had experience with car warranty companies, either through buying coverage or shopping for coverage. See below for some of the highlights we found in our extended warranty survey:

- Almost 76% of respondents purchased a dealership extended warranty.

- Over 23% of respondents purchased a third-party extended warranty.

- The most popular provider among respondents was CarShield.

- Respondents said pricing was the most important factor when considering a warranty.

- 64% of respondents were satisfied with their extended auto warranty.

- 13% of respondents were neither satisfied nor dissatisfied.

Car Warranty Company Reviews

Here’s how the five best car warranty companies in this review stack up against each other:

Car Warranty Companies List

If you don’t see your provider in our list of the best car warranty companies, look below for other options that we’ve thoroughly researched and awarded ratings to:

| Extended Car Warranty Provider | Overall Rating |

|---|---|

| MPP | 8.3 out of 10.0 |

| Ally | 8.3 out of 10.0 |

| ASC Warranty | 8.3 out of 10.0 |

| CornerStone United | 8.3 out of 10.0 |

| EasyCare Warranty | 8.1 out of 10.0 |

| Fidelity Warranty Services | 8.1 out of 10.0 |

| Century Warranty Services | 8.1 out of 10.0 |

| National Auto Care | 8.1 out of 10.0 |

| American Auto Repair Coverage | 8.0 out of 10.0 |

| Old Republic Insured Automotive Services | 8.0 out of 10.0 |

| Warranty Solutions | 8.0 out of 10.0 |

| Zurich | 7.9 out of 10.0 |

| National Vehicle Protection Services | 7.9 out of 10.0 |

| Vehicle Assurance | 7.9 out of 10.0 |

| AutoAssure | 7.9 out of 10.0 |

| Gold Standard Automotive Network | 7.8 out of 10.0 |

| MasterTech | 7.7 out of 10.0 |

| GWC Warranty | 7.7 out of 10.0 |

| Select Auto Protect | 7.6 out of 10.0 |

| CNA National Warranty Corporation | 7.6 out of 10.0 |

| Elite Warranty | 7.6 out of 10.0 |

| Assurant | 7.6 out of 10.0 |

| Route 66 Warranty | 7.6 out of 10.0 |

| NVP | 7.4 out of 10.0 |

| CARS Protection Plus | 7.4 out of 10.0 |

| Members Choice Warranty (CUNA Mutual Group) | 7.4 out of 10.0 |

| Allstate | 7.3 out of 10.0 |

| Wholesale Warranties | 7.3 out of 10.0 |

| Safe-Guard | 7.3 out of 10.0 |

| Carvana | 7.3 out of 10.0 |

| Fenix Protect | 7.2 out of 10.0 |

| Smart AutoCare | 7.2 out of 10.0 |

| AutoNation | 7.1 out of 10.0 |

| Carefree Auto | 7.1 out of 10.0 |

| Autoplex Extended Services | 7.1 out of 10.0 |

What To Know About Car Warranty Companies

Along with affordable rates and strong coverage, it’s best to look for reputable extended car warranty companies when shopping for vehicle protection. In the following sections, we’ll touch on how the best car warranty companies are determined, according to consumers.

What Is a Car Warranty Company?

While any group that provides extended car warranties could be considered a car warranty company, the term usually refers to a third-party provider that specializes in brokering or administering aftermarket vehicle service contracts.

Car warranty companies shouldn’t be confused with car insurance providers. While car insurance companies often offer mechanical breakdown insurance (MBI) as an add-on to consumers, these plans rarely have the extensive coverage of the best car warranty companies.

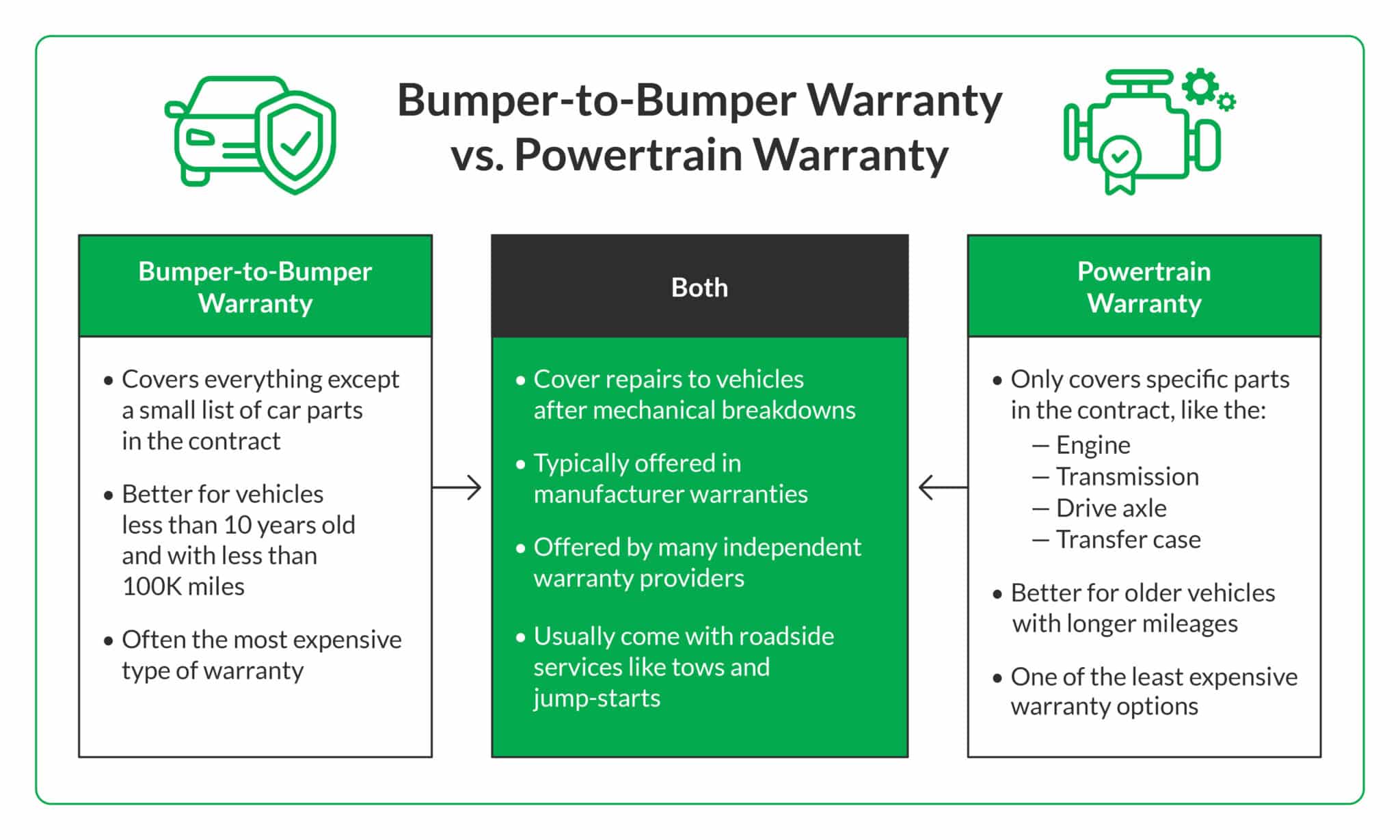

Types of Extended Auto Warranty Providers

Drivers have two main options for getting extended coverage: through a dealership or through an independent provider. There are pros and cons to buying coverage from each provider type, which we’ll discuss further in the following sections.

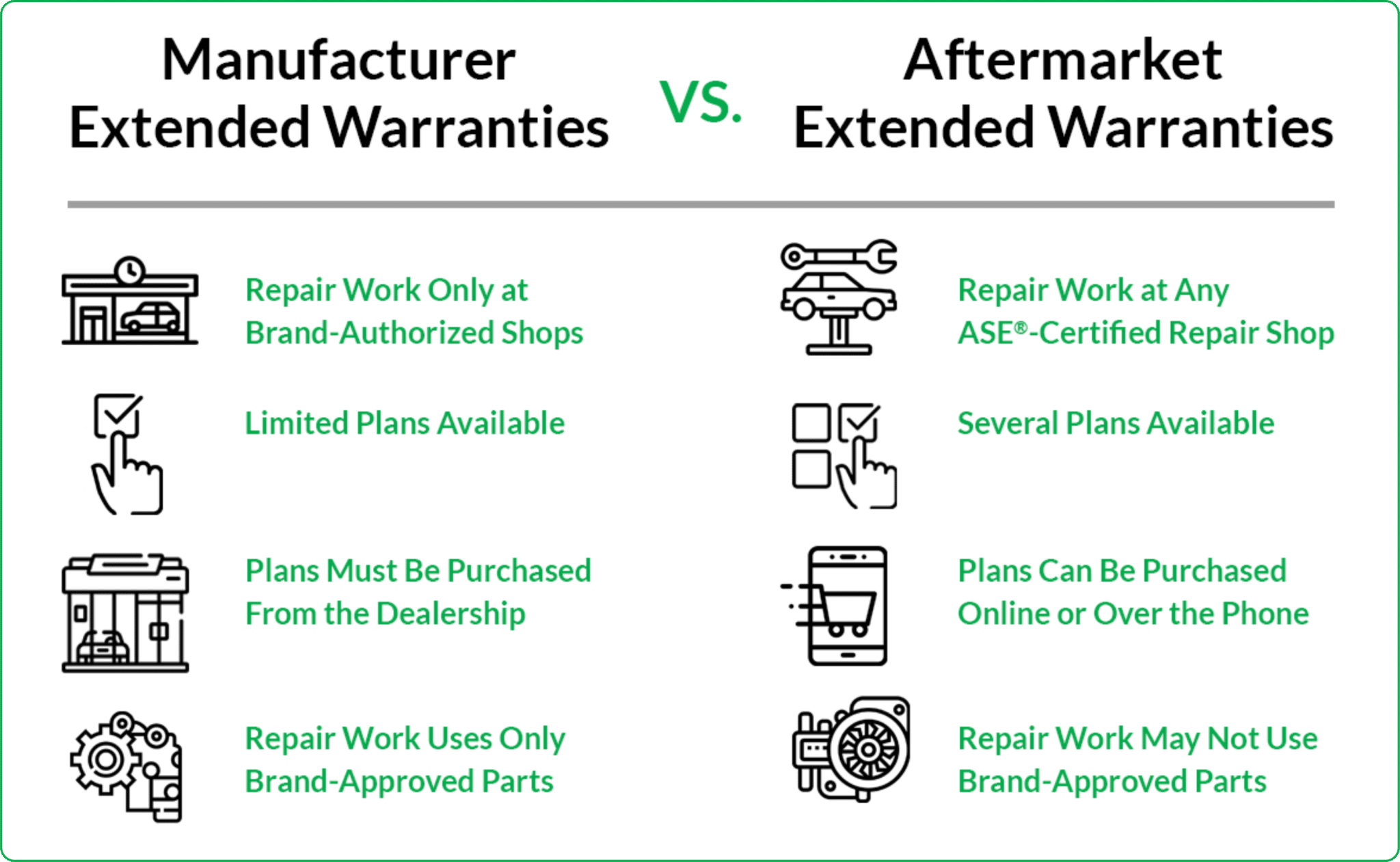

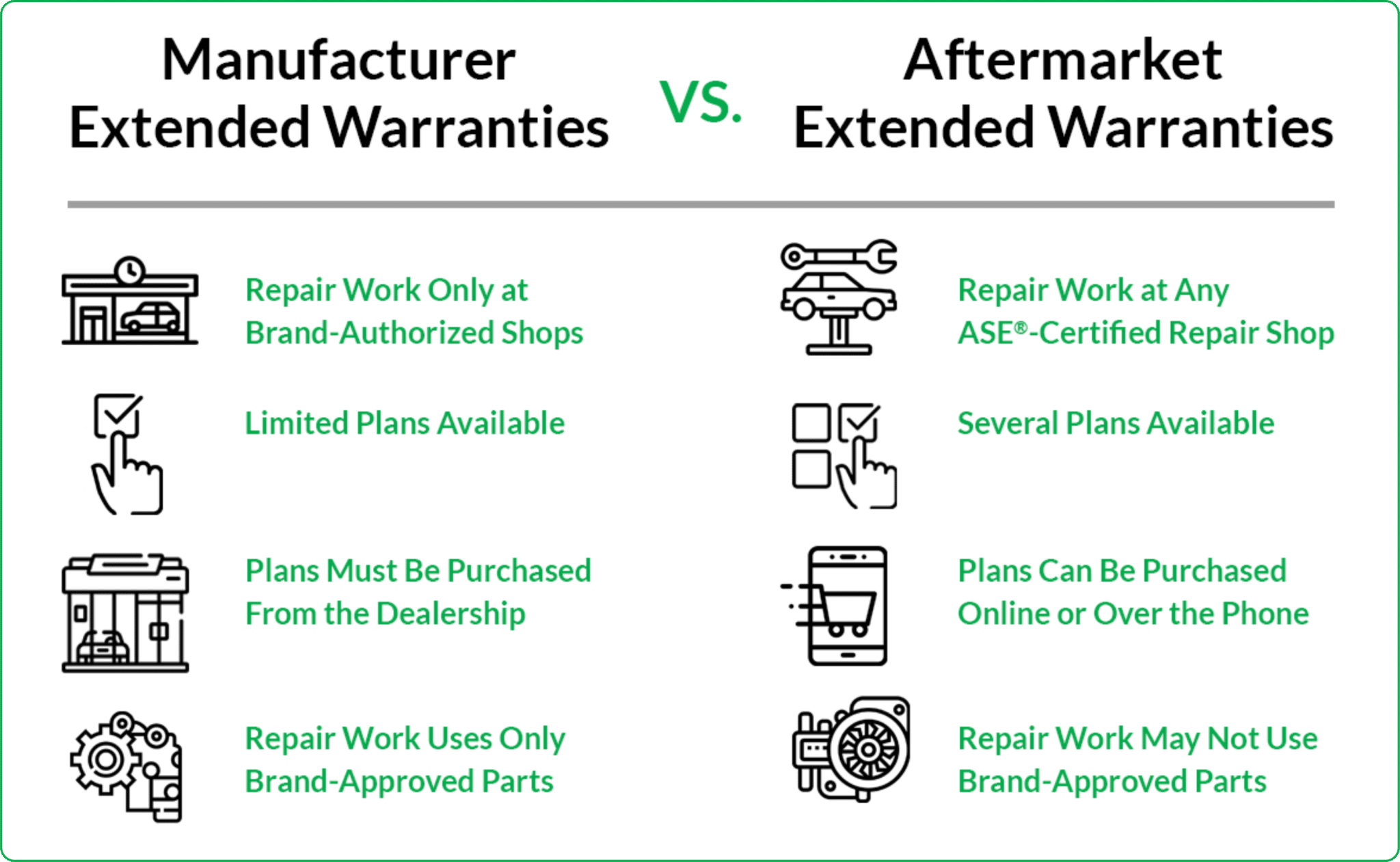

Extended Car Warranties From an Automaker

While automakers aren’t generally known as car warranty companies, drivers can buy coverage from their vehicle manufacturers. Since these contracts are usually backed by the automakers themselves, they can reduce buyer anxiety about reputability. Their costs are also typically rolled into the overall cost of the vehicle itself.

A benefit of buying extended coverage from an automaker is the guaranteed use of genuine parts for auto repairs and factory-trained technicians for repair work. However, these warranties typically come with the following drawbacks:

- Limited repair shop choices: Most manufacturers require drivers to go to the dealership or a branded repair center for service.

- Expensive vehicle service contracts: You may face dealership markups on top of the contract’s price if you buy manufacturer-backed protection.

- Fewer coverage options: Typically, manufacturers only offer one to three vehicle protection plans. You may end up purchasing less coverage than you need or paying for unnecessary coverage.

- Strict purchasing periods: Some dealerships will let you add an extended warranty before your factory auto warranty expires, while others require you to get it at the time you buy a new vehicle.

Aftermarket Extended Auto Warranty Companies

With plans from a third-party warranty company, a provider apart from your car’s manufacturer covers certain repairs. While these companies may not always provide original-manufacturer replacement parts, there are some advantages of aftermarket car warranty companies:

- Cheaper coverage: You’re much more likely to find more affordable rates from certain extended warranty companies, especially if your automaker is a luxury brand.

- More repair shop choices: Most independent warranty companies will let you take your vehicle to any certified repair shop after a mechanical breakdown.

- More coverage options: You can easily find third-party warranty providers sporting five to six different coverage levels which often fit different drivers’ needs. Some even offer coverage that includes routine maintenance services for your vehicle.

- Open purchasing periods: Almost all third-party providers sell plans for used vehicles that are outside of the factory warranty period.

Along with a small monthly payment, you may be required to pay a portion of the repair costs if you choose a third-party warranty company. Though some providers may require you to pay for repairs upfront and submit receipts for reimbursement, the best car warranty companies pay the repair shop directly. All you have to cover is a small deductible.

Car Warranty Company Cost

Though cost data isn’t available directly from car warranty companies, our recent survey of 1,000 respondents found that warranty customers pay a median of $2,458, with costs ranging from $1,615 to $3,208.

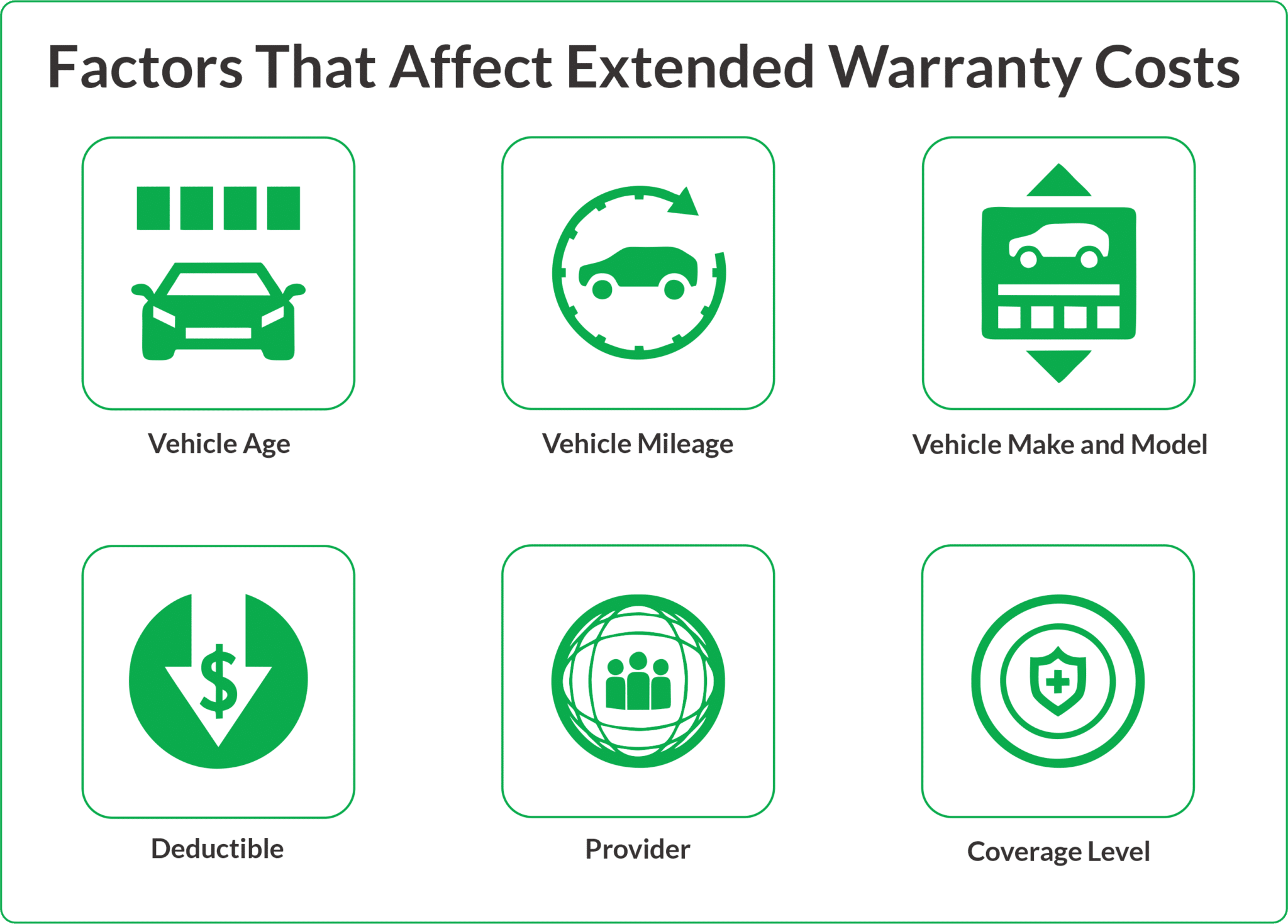

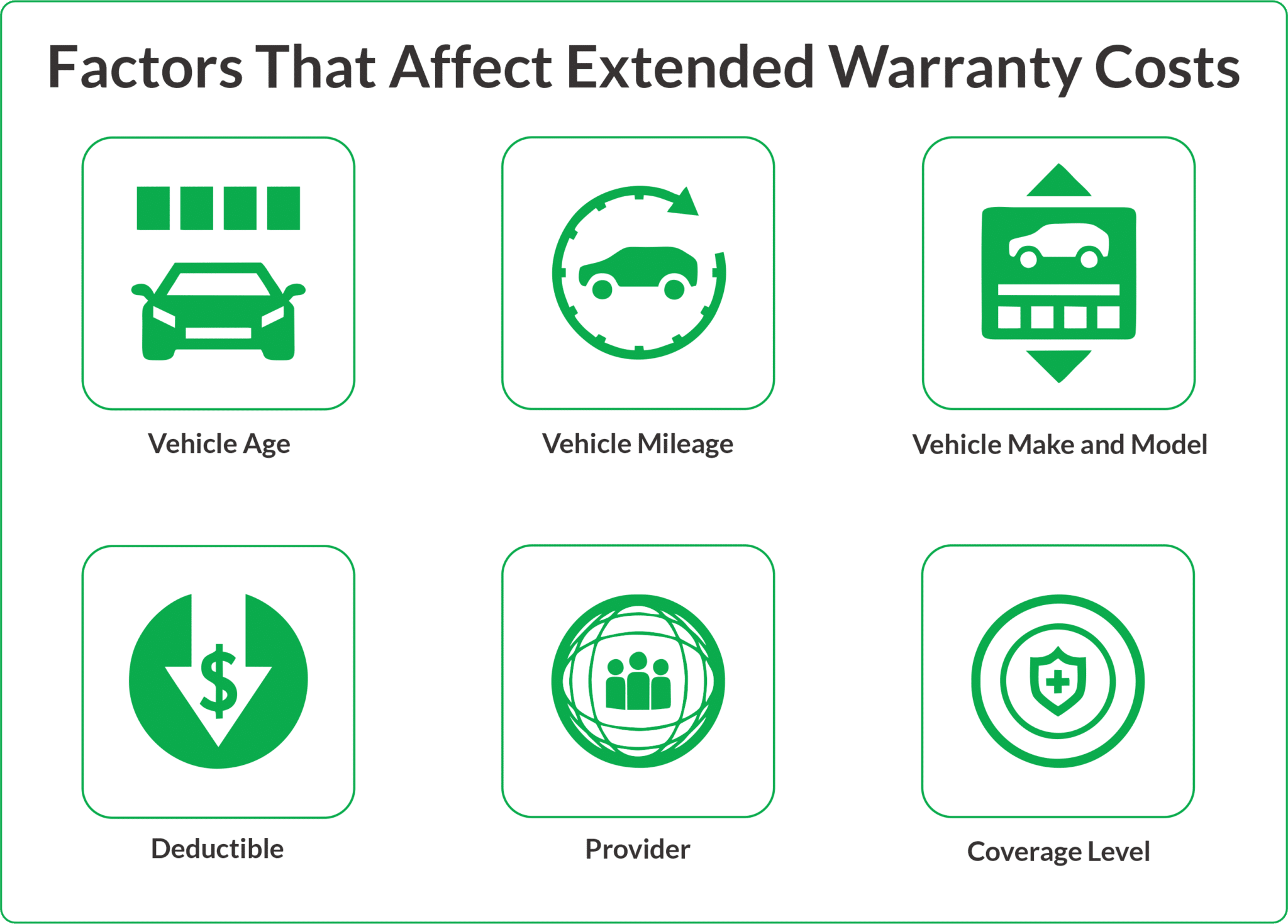

Keep in mind that your exact extended warranty costs may look different than those above due to many factors, including vehicle age, vehicle mileage, vehicle make and model, the specific car warranty company, deductible costs, and the plan you choose.

See the infographic below for a closer look:

If you’d like to purchase an extended warranty but are worried about costs, Jesse Bellamio, a warranty sales consultant with Sonic Automotive, urges customers to “think about how much you’re willing and able to spend on an unforeseen repair for your vehicle if you didn’t have a warranty.” This can help you make an informed decision on protection that will fit your budget.

Average Repair Costs by Manufacturer

The average cost of repairing a vehicle can vary significantly depending on which company makes it, both in terms of the price of services and how frequently a car needs repairs. Parts and labor tend to come at a premium for European imports and luxury vehicles, making the average repair more expensive. In addition, some brands of cars are more likely to suffer breakdowns than others.

The table below shows the average annual repair costs for 48 of the top auto manufacturers, based on data from RepairPal.

| Manufacturer | Average Annual Repair Cost |

|---|---|

| Acura | $501 |

| Alfa Romeo | $834 |

| Audi | $987 |

| Bmw | $968 |

| Buick | $608 |

| Cadillac | $783 |

| Chevrolet | $649 |

| Chrysler | $608 |

| Dodge | $634 |

| Eagle | $634 |

| Fiat | $538 |

| Ford | $775 |

| Genesis | $524 |

| Geo | $744 |

| Gmc | $744 |

| Honda | $428 |

| Hummer | $662 |

| Hyundai | $468 |

| Infiniti | $638 |

| Isuzu | $386 |

| Jaguar | $1,123 |

| Jeep | $634 |

| Kia | $474 |

| Land Rover | $1,174 |

| Lexus | $551 |

| Lincoln | $879 |

| Mazda | $462 |

| Mercedes-Benz | $908 |

| Mercury | $775 |

| Mini | $854 |

| Mitsubishi | $535 |

| Nissan | $500 |

| Oldsmobile | $311 |

| Plymouth | $634 |

| Pontiac | $460 |

| Porsche | $1,192 |

| Ram | $858 |

| Saab | $908 |

| Saturn | $553 |

| Scion | $397 |

| Smart | $751 |

| SRT | $527 |

| Subaru | $617 |

| Suzuki | $503 |

| Tesla | $832 |

| Toyota | $441 |

| Volkswagen | $676 |

| Volvo | $769 |

How To Find the Best Car Warranty Companies

While cost was the most important factor customers considered when choosing a car warranty company, claim denial was the primary reason customers were unhappy.

Of the 13% of customers who said they were dissatisfied with their car warranty company, some said the vehicle warranty didn’t cover expected repairs. Others said they thought the company tried to get out of paying for repairs they were contractually obligated to cover.

Before making a purchase, look at sample contracts to know what’s covered. You should also read customer reviews and industry ratings to find a car warranty company that’s reliable and trustworthy. You don’t want to work with a company with poor business practices or a spotty customer service record.

When considering a car warranty company, a reputable provider should tick off the following boxes:

Strong Industry Reputation

We turn to the BBB and AM Best when considering a warranty company’s industry standing. The BBB grades companies on their ability to respond to and settle customer issues. If a provider holds a high BBB rating, there’s a good chance it effectively communicates with contract holders in a timely manner.

Some providers work with vehicle service contract underwriters to guarantee claims payouts. To check these underwriters’ financial strength ratings, we look to AM Best, which rates a business’ financial ability to pay claims and manage risk.

Some extended warranty providers like Carchex are also endorsed by industry-leading companies. Prominent partnerships are a good sign of a reputable provider.

High Customer Satisfaction Ratings

The BBB, Google and Trustpilot all provide customer review ratings for the best car warranty companies. We recommend browsing through multiple review sites when deciding on a provider. Keep in mind that it’s common to see low customer review scores on the BBB, as customers looking to resolve complaints are more likely to post reviews on this platform.

Positive customer reviews are an important way to gauge how you’ll be treated by an extended warranty provider. Look for companies with reviews that mention a quick claims process and helpful service representatives. Also, beware of companies that customers say practice poor habits like scam calls and misleading advertisements.

Transparent Business Practices

Many reputable extended car warranty companies offer sample contracts so customers can read coverage details before signing on the dotted line. This is to help prospective customers get a clearer understanding of what to expect. Sample contracts are especially important to third-party warranty companies because the most common complaint they get in bad reviews pertains to claims denials.

By choosing a provider that readily offers information about its contracts, you’ll be better equipped to understand what is and isn’t covered. However, you should always read the fine print regardless of the provider you choose.

Long-Standing Company History

In our research, we’ve found that the best and most reputable providers have been in business for more than a few years. The warranty industry is highly competitive, making it easy for companies to come and go. This is especially true if they have negative customer reviews and shady business practices.

Ease of Use

It’s also important to find a vehicle service plan that’s easy to use. To know if a company will be simple to work with, consider these questions when picking out a provider:

- Does the company pay the repair facility directly?

- Are there extra benefits like roadside assistance, trip interruption coverage and rental car reimbursement?

- Is there a 30-day money-back guarantee in case you change your mind?

All of our best car warranty company recommendations offer these benefits. Sometimes, a company doesn’t pay for what should have been a covered repair. But in many situations, the contract clearly excludes the repair in question. Read all of the fine print, and don’t count on a salesperson to mention every exclusion to you.

Should You Buy Coverage from an Extended Car Warranty Company?

There are several strong reasons to consider an extended warranty for your vehicle. Warranty coverage, especially from a third-party provider, can provide several key benefits, including:

- No surprises: If you suffer a breakdown, you could end up facing a repair bill of thousands of dollars without having the time or opportunity to prepare for that expense. Buying an extended warranty allows you to reduce the risk of unexpected repair costs for a one-time or regular monthly fee.

- Manageable costs: For many car owners, spending $100 – $200 per month for extended warranty coverage is more manageable than having to fork out thousands of dollars at once for repairs. Depending on how you manage money, a vehicle service contract may just be easier.

- Peace of mind: Driving an older car can feel a bit like a ticking time bomb, especially if you’re worried about having to cover the cost of an unexpected repair out of pocket. Keeping your car covered with a warranty plan can eliminate the anxiety that comes with wondering when the next big thing will happen to your vehicle and how you’ll pay for it.

- Longevity: Without warranty coverage, the cost of your next repair bill could have you making a difficult decision about whether to repair your vehicle or opt for a replacement. In most cases, repairing your current vehicle is cheaper than buying another one. However, with new and used car prices having seen a significant increase in recent years, now is an especially good time to keep your car in good running shape and avoid having to replace it.

Additional Benefit of Car Warranty Coverage: Locked-In Repair Costs

One substantial — yet overlooked — benefit of an extended car warranty is that, for the most part, the rates you pay stay the same for the duration of your contract. That’s true regardless of changes to the cost of repairs.

The cost of repairing and maintaining a vehicle, like most things, tends to go up over time. But over the last four years, the U.S. has seen a sharp increase in these costs.

According to data from the U.S. Bureau of Labor Statistics (BLS), the consumer price index (CPI) has increased 32.2% since the start of 2020. However, someone who bought an extended warranty four years ago that has an active policy would still be paying what they agreed to when they signed the contract.

Matt Lofton, owner and president of Strut Daddy’s Complete Car Care in Roxboro, N.C. regularly works with extended warranty holders. He said that cost increases for vehicle care should be expected, giving car owners another reason to consider “locking in” repair costs with an extended warranty.

“Gone are the days of simple rules like ‘change the oil every 3,000 miles’ or, ‘rotate your tires every other oil change.’ Today’s vehicle maintenance landscape is far less cut and dry. Modern manufacturers tout features like lifetime transmission fluid and extended oil change intervals, leading to confusion for many drivers. One major consequence of these technological leaps is the significant increase in the cost of standard vehicle services and repairs over the last five years.”\

Best Auto Warranty Companies: The Bottom Line

In this article, we reviewed the best car warranty companies and found that Endurance is the top provider based on industry reputation, customer experience, cost and extended warranty coverage. In addition to discussing the top five providers, we touched on what determines the best car warranty companies based on customer perferences. We recommend keeping these determining factors in mind as you shop around for car warranty quotes.

Car Warranty Companies: FAQ

Below are some frequently asked questions about car warranty companies:

After comparing leading providers, we chose Endurance as the best coverage provider available. The company works with customers directly and offers six coverage plans – more than most competitors. Endurance contracts extend up to eight years or over 200,000 miles.

Extended warranties can be worth it for the peace of mind they provide. After your factory new car warranty expires, you’ll have to pay out of pocket for all car repairs. With a vehicle service contract, you’re only responsible for a deductible and the cost of the contract. Warranties are also worth it for drivers who want a predictable auto budget.

Extended warranties cover your vehicle mechanically, keeping you from paying out of pocket for expensive repairs due to a mechanical failure. Extended warranties don’t typically cover wear and tear items like brake pads or routine maintenance like oil changes. However, they usually do come with perks like rental car coverage and roadside assistance.

CarShield is not a rip-off. Generally speaking, we found it to be one of the most affordable providers overall. The company also offers benefits like towing and rental car reimbursement with its plans.

In the world of extended warranties, a manufacturer’s warranty is usually the most expensive option considering the time and mileage limits you receive. However, it also pays for dealership service and original equipment manufacturer (OEM) parts. Compare coverage terms from your dealer with free quotes from third-party providers to find out if it’s worth it for you.

Our Methodology

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best extended car warranty companies. We collected data on dozens of auto warranty providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the companies that scored the most points topping the list.

Here are the factors our ratings take into account:

- Reputation: Our research team considers availability, ratings from industry experts and years in business when conferring this score.

- Coverage: Companies that offer a variety of choices for warranty coverage, long contract terms and added benefits are more likely to meet consumer needs.

- Cost: Auto warranty companies with affordable rates and multiple deductibles scored highest in this category.

- Transparency: This score is based on contract transparency and the availability of a money-back guarantee.

- Customer experience: Based on customer satisfaction ratings and our extensive shopper analysis, we consider the responsiveness, friendliness and helpfulness of each warranty company’s customer service team.

Our credentials:

- 500+ hours researched

- 50 companies reviewed

- 2,000+ consumers surveyed

*Data accurate at time of publication.