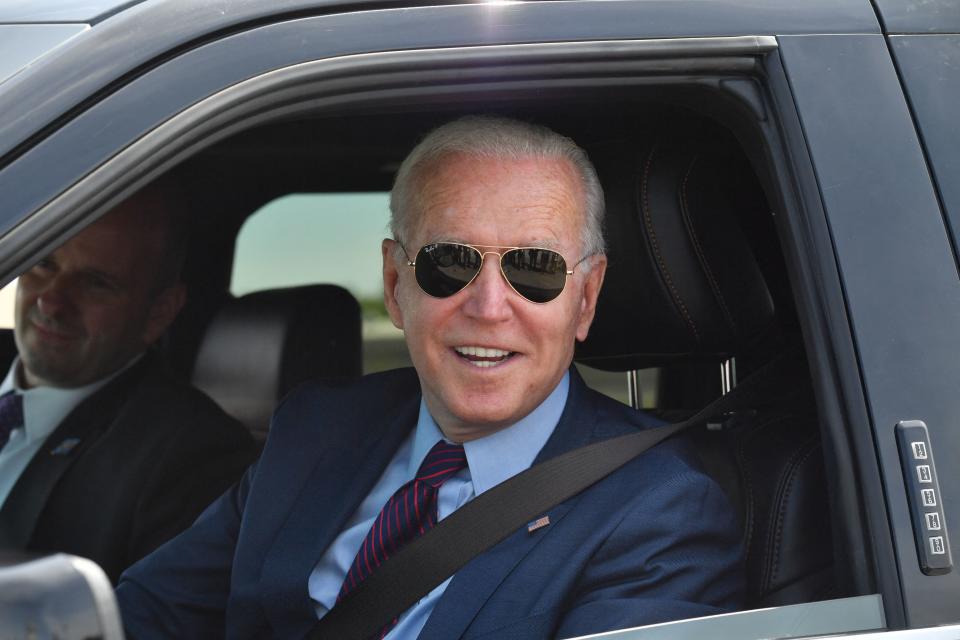

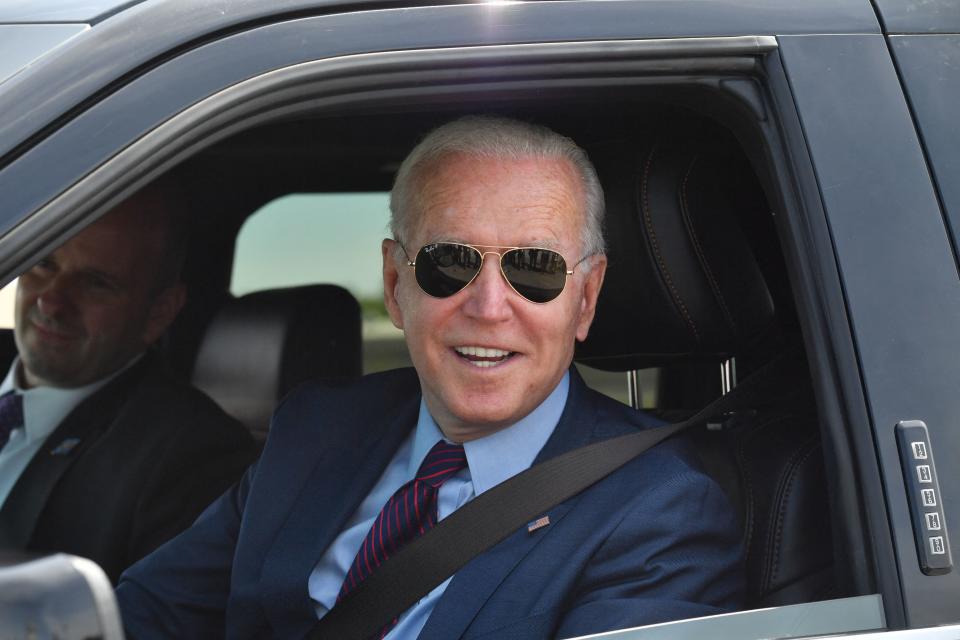

Why Biden’s tariffs on Chinese EVs will have little immediate impact on the US auto market

The big headline from President Biden’s new tariffs on Chinese goods announced Tuesday was the massive hit to electric vehicles made in China.

New duties on EVs from companies like BYD (BYDDY), Geely (GELYF), and NIO (NIO) are set to quadruple in 2024, to 100% from 25% of the cost of the vehicle.

But the question remains — will Biden’s EV tariff move make any difference for EV sales in America?

The White House’s sweeping array of new tariffs will raise duties on $18 billion in Chinese imports from steel and semiconductors to medical products. But it is the focus on EVs and manufacturing that stands out.

The White House earmarked billions via the Inflation Reduction Act and Bipartisan Infrastructure Law to boost EV adoption and charging and create an American manufacturing industrial complex to support EV production.

Biden’s move to protect his EV bet is not surprising. And the overall effect on the American consumer will initially be slim to none, as there are very few Chinese-made EVs for sale in America.

Currently, only Buick (GM), Lincoln (F), Lotus, Polestar (PSNY), and Volvo (VOLCAR-B.ST) ship vehicles made in China into the US, Sam Fiorani of AutoForecast Solutions noted to Yahoo Finance.

Of those cars, only Polestar imports a Chinese-made EV to the US. Lotus just started shipping its luxury EV in extremely limited quantities. In a statement, Polestar said it was “evaluating” Tuesday’s announcement from the White House, noting that its upcoming Polestar 3 SUV will begin production in South Carolina this summer.

According to KBB, 1.2 million EVs were sold in America in 2023. Polestar does not break out its overall global sales by territory, but the company delivered 54,600 cars across territories like China, the EU, and the US last year. Even if a generous half of those vehicles are counted as US sales, the percent of Chinese-made EVs sold in America makes up just over 2% of all EV sales.

“The duty is unlikely to significantly impact the US auto market as relatively few Chinese EVs are being imported, and this new level will only further discourage buyers from turning to Chinese EVs,” Beacon Policy Advisors said in a note to clients.

“The value for Biden, though, is the attention that nearly quadrupling the tariff grabs and provides the president a clear campaign talking point.”

And the auto industry’s main lobbying arm is, not surprisingly, backing the move.

“[China has] got a major EV overcapacity problem. They’re building too many EVs — too many heavily subsidized EVs — for the domestic market and have no choice but to look abroad to offload those vehicles at budget prices. It’s happening already in Europe,” said John Bozzella, president and CEO of Alliance for Automotive Innovation (AAI) in a statement Tuesday morning.

“It’s appropriate for the White House to be looking at tools to prevent the US from becoming a dumping ground for subsidized Chinese EVs.”

The United Auto Workers (UAW), which endorsed Biden’s reelection campaign earlier this year, also applauded the president’s “decisive” action, calling it “a major step in the right direction.”

Ohio Senator Sherrod Brown is even pushing Biden to go further, posting last week that tariffs aren’t enough and “we need to ban Chinese EVs from the US.”

Nonetheless, quadrupling import tariffs to 100% could severely dampen even those minimal sales. And the new duties may ultimately hurt the American consumer in ways beyond dealership sales.

“Chinese EVs and batteries, along with solar products, will be excluded from the US market,” free trade expert Gary Hufbauer, senior fellow at the Peterson Institute for International Economics, told Yahoo Finance. “The result will be higher US prices and slower uptake of climate-friendly technology. This is a regrettable price of the US-China Cold War and US presidential political dynamics.”

AutoForecast Solutions’ Fiorani also believes these new tariffs will slow the advance of Chinese-made EVs in America, but there could be a backdoor.

“Congress is looking to control the importation of vehicles by Chinese brands, but that will be difficult when they’re not made in China,” Fiorani said.

“Establishing production facilities outside of China, especially in Mexico or South Korea, will be one of the possible methods of getting around basic legislation.”

Later this week, for instance, BYD will debut a new plug-in hybrid EV pickup that will be assembled in Mexico

Advocates for tariffs believe protection from Chinese EV imports is necessary. Otherwise, American automakers will be overwhelmed by the competition, and a backdoor through Mexico could be the trigger.

Hufbauer also believes, however, that the tariffs are too extreme and likely overkill.

“The US auto industry could certainly survive and even prosper if, say, Chinese EVs and batteries were limited to 15% of the market, rather than excluded,” Hufbauer said.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance