Automate 2024 Heavy on Smart Warehouse Robotics

Last week was the Automate show in Chicago, the premier trade show and conference in North America for robotics, put on by the Association for Advancing Automation (A3). After two full days at the show, my first observation is that it was a successful event, with total registratios topping 40,000 by Tuesday, according to A3, which constitues a record.

One key trend readily apparent on the exhibit hall floors is that there continue to be more exhibitors focused on robotics solutions aimed at materials handling tasks and warehouse fulfillment operations. Automate’s historical strength is in robotics solutions for manufacturing production efficiencies, like robotic assembly or welding, particularly in the automative sector, which has used robotics for decades.

Automate continues to feature plenty of outsized industrial robots for manufacturing tasks, but in recent years, the show’s exhibit floor has added more autonomous mobile robot (AMR) providers, as well as exhibitors who offer artificial intelligence (AI) and vision software platforms that enable fixed industrial robots, without pretraining, to handle the the level of variability found in warehousing.

The software platforms of these AI/vision specialists are key to enabling industrial robots to handle processes like ecommerce picking, or other complex pick-and-place tasks, like singulation of parcels jumbled together on a conveyor line. There are multiple factors like end-effector design, cell design, and remote monitoring methods and technology that go into reliable warehouse robotic solutions, but AI/vision platforms are perhaps the most critical element.

Combine the presence of various vision and AI software companies with the many AMR providers increasingly found at Automate, as well as some exhibitors in robotic automation storage & retrieval (AS/RS) solutinos market, as well as integrators and consultancies with warehouse automation expertise, and Automate was heavy on interesting warehosue robotics solutions this year.

A3’s own data on orders of industrial robots shows that sale of robotics slowed a bit in 2023 after two record years of growth, as noted in this article from February. Last year, robotics orders or sales declined less in non-automotive sectors.

At the show, I got to speak with Jeff Burnstein, president of A3. Burnstein called the show turnout “fantastic,” and said the long-term growth for robotics remains strong, with more industries adopting solutions.

“You know–these things go up and down a little bit with the economy with the fact that people bought a lot during those strong years. 21 and 22. Logistics is pretty good right now. Manufacturing is pretty good. But there’s so many other industries out there that are automated. So if you look at food and beverage or consumer goods, life sciences or even agriculture and construction are now starting to automate, so there is growth potential in many sectors. I don’t get really caught up to much in the latest annual trend—I look at the long term, and the outlook on robotics is that sales will be heading significantly higher over the long term.

Last Monday at Automate, research company Interact Analysis, which is a research partner to A3 and its members, presented its outlook for the global manufacturing economy overall, as well as data on the AMR and computer vision markets. Interact foresees only slight growth for manufacturing globally in 2024 (forecasted growth of 0.2%) but picking up steam in 2025 with a forecast of 4% growth, with 15% growth overall from 2023 to 2028.

If this multi-year up cycle in global manufacturing holds true, the hope among exhibitors is that stronger growth for robotics in manufacturing will return soon, while sales will also be grown by expansion into more industries and processes, including warehouse tasks like robotic picking and palletizing.

Additionally, Interact Analysis noted growing use of technologies like AMRs and computer vision in logistics and warehouses. Interact Analysis shared that in 2024, about 1 in 10 fulfillment centers already use AMRs, though that penetration rate is much lower (about 1 in 100) for the typical DC. When it comes to vision technology, Interact Analysis predicts rapid growth in logistics centers from 2022 through 2028, growing at a CAGR of 16.4% over the study period.

In warehousing and logistics, Burnstein agreed that numerous exhibitors now specialize in AI and vision solutions that work with industrial robots to enable solutions for pick and place automation. He also noted many AMR providers whose robots are used for materials transport or assistive picking, can also be found at the event.

Many of the exhibitors I met with over two days said they have worked to make their solutions easier and faster to deploy. For providers of industrial robots, this includes partnering with vendors with vision and AI platforms for advanced pick and place tasks like mixed case palletizing and depalletizing. And nearly evey exhibitor offering cobot arms, were showing how well suited cobots, which can now handle higher payloads, are to automating end-of-line palletizing in manufacturing.

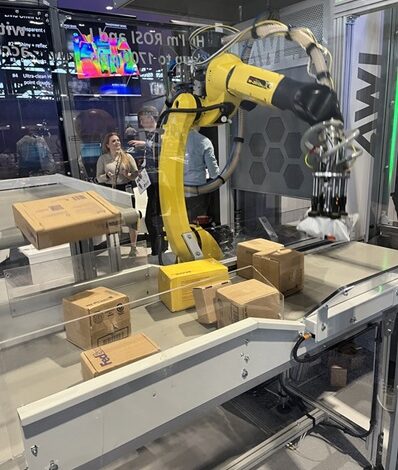

Anthony Cantrell, executive director of Global Accounts, Warehouse and Logistics, Fanuc America Corp., says Fanuc partners with AI and vision platform providers including OSARO, Mujin, Plus One, and Covariant to enable material handling solutions capable of processes like mixed-SKU palletizing, or smart each picking from bins coming out of an automated storage system. “We have streamlined communications with third-party AI/vision companies enabling robotics to be utilized for complicated tasks without sacrificing reliability,” Cantrell says.

There are several factors driving warehouses and fulfillment centers to consider automation & robotic, including labor shortages, supply chain disruptions, and rise in direct to consumer. The business case will vary by company and site, he adds. “With these growing challenges the biggest barrier to automate is still cost/ROI. Warehouse automation decisions must not only take into account the price of the system, but must include costs like turnover, safety, training, and labor availability,” Cantrell says.

Alex Boffi, manager of general industry sales, Kawasaki Robotics, says mixed case robotic palletizing and depalletizing is a growth application, not only in warehousing, but also for end-of-line palletizing of consumer goods, since major omnichannel retailers, major grocers, and ecommerce companies are increasingly asking to be supplied with more packaging variations, which leads to more mixed SKU pallets. At Kawasaki’s booth, one its demos featured a mixed SKU palletizing solution from one its integrator partners, CRG Automation, which also featured a remote monitoring solution to quickly resolve exceptions and improve uptime, from OLIS.

“Robotic palletizing presents many opportunities for growth,” says Boffi. “And I think what is driving it is all the changes brought about by major companies in ecommerce and retailing, where they have enough volume and pull to say, ‘we don’t want it packaged like this any more. We want it packaged differently. So the manufacturers of goods that typically get palletized, they have to be on their toes. They’ve got to be flexible and agile with their mixed SKU palletizing, and that’s presenting a lot of opportunities for us and our partners in material handling of consumer goods.”

Other robotics exhibitors showcased AI/vision materials handling solutions in their booth, including Yaskawa, which was showing smart robotic parcel singulation/induction from Plus One Robotics. At the booth of machine vision provider Zivid, the main demo featured robotic parcel singulation/induction solution from systems integrator AWL called ROSI, which leverages a Zivid camera, and an AI/vision platform from Fizyr.

Automate is an exciting show to visit, as the demos are eye catching, such as robotic arms which can deftly pour a beer, or the robotic-enabled rock band that Doosan Robotics featured at its booth. Those are fun to watch, but if your role is finding efficiencies in materials handling and fulfillment operations, Automate had all types of smart pick and place and AMR solutions on hand, and will probably have even more next year when the show returns to Detroit May 12-15, given that industrial robots and cobots aren’t yet widely deployed in warehousing and fulfillment centers, present a ripe market for vendors.