SentinelOne: Revisiting This Fast-Growing Cybersecurity Name (Rating Upgrade) (NYSE:S)

Yagi Studio

The recent market volatility has allowed me to re-enter some previously favored tech names. SentinelOne, Inc. (NYSE:S) is a notable one, as I had previously named it a top pick of 2023 before downgrading it earlier this year. The last handful of years have not gone in the company’s favor, as its closest competitor appears to have widened its competitive edge. However, S remains compelling given the rapidly improving cash burn profile, net cash balance sheet, and reasonable valuation. The company’s recent acquisitions appear to be the beginning of a transformation to have more of a platform-like offering. I am upgrading the stock to buy.

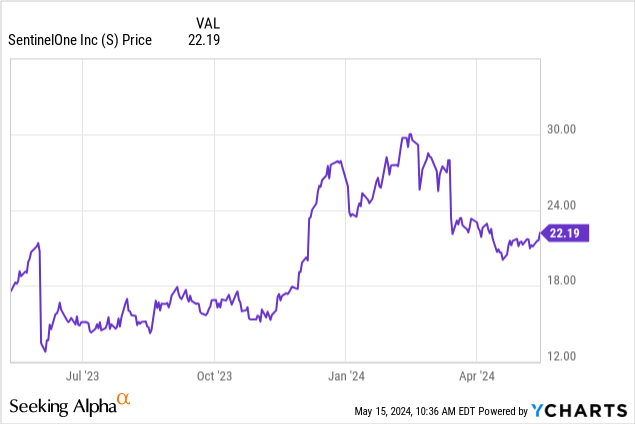

SentinelOne Stock Price

I last covered S in January where I explained why I was downgrading the stock on account of valuation. It has since underperformed the broader market by around 15%.

This underperformance offers an opportunity.

SentinelOne Stock Key Metrics

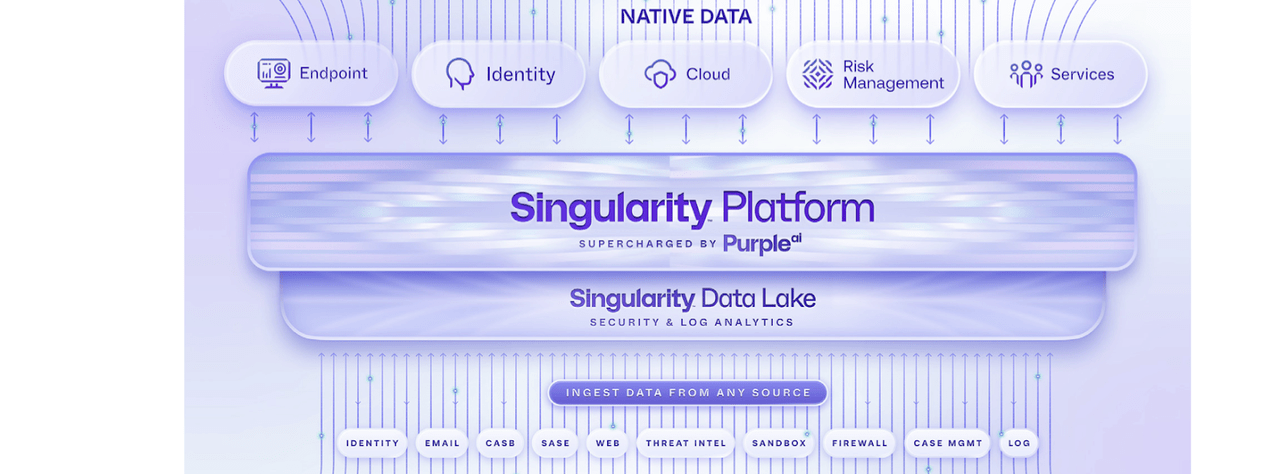

SentinelOne is a cybersecurity company most well known for its endpoint protection product. The company came public in 2021 as offering AI-driven products, though post the generative AI craze it seems that all of its competitors are now boasting similar AI connections.

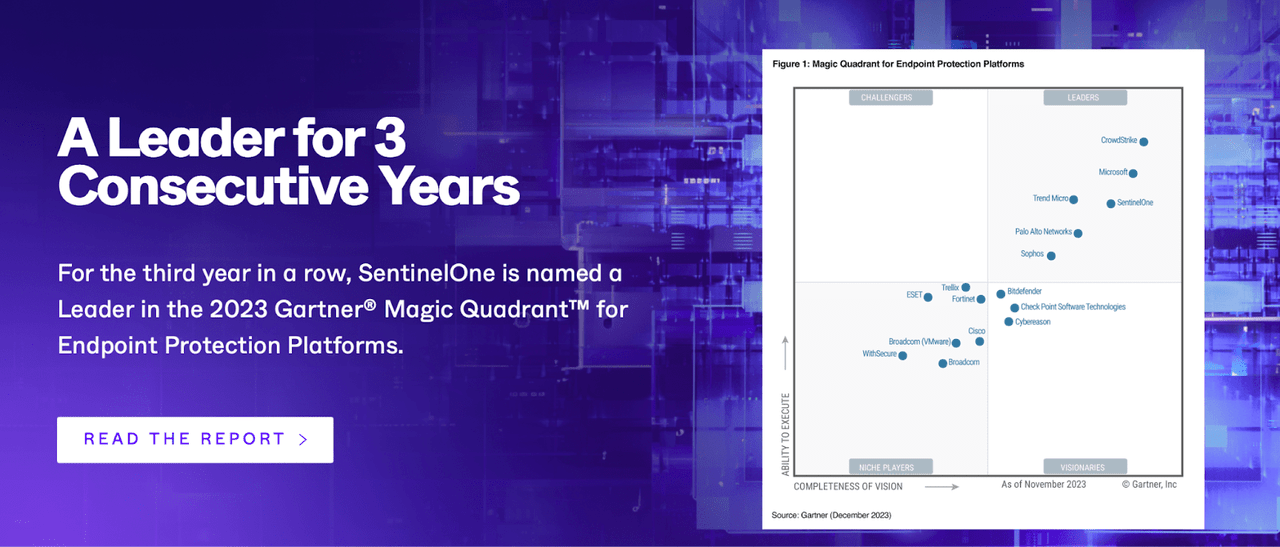

S has done a great job in taking endpoint market share, and it is notable that Gartner has consistently given greater credit to the company in its Magic Quadrant analysis. Just several years ago, Microsoft Corporation (MSFT) was the clear leader but S and CrowdStrike Holdings, Inc. (CRWD) have made great inroads. The rise of generative AI has only increased the demand for cybersecurity products and S stands to benefit.

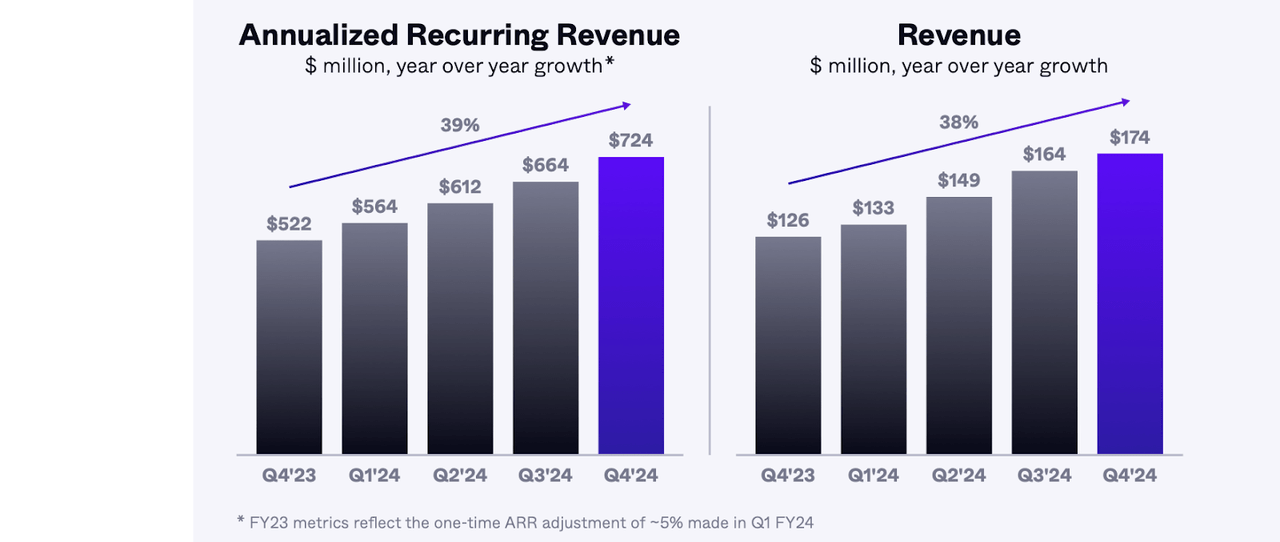

In its most recent quarter, SentinelOne generated 38% YoY revenue growth to $174 million, surpassing guidance for $169 million.

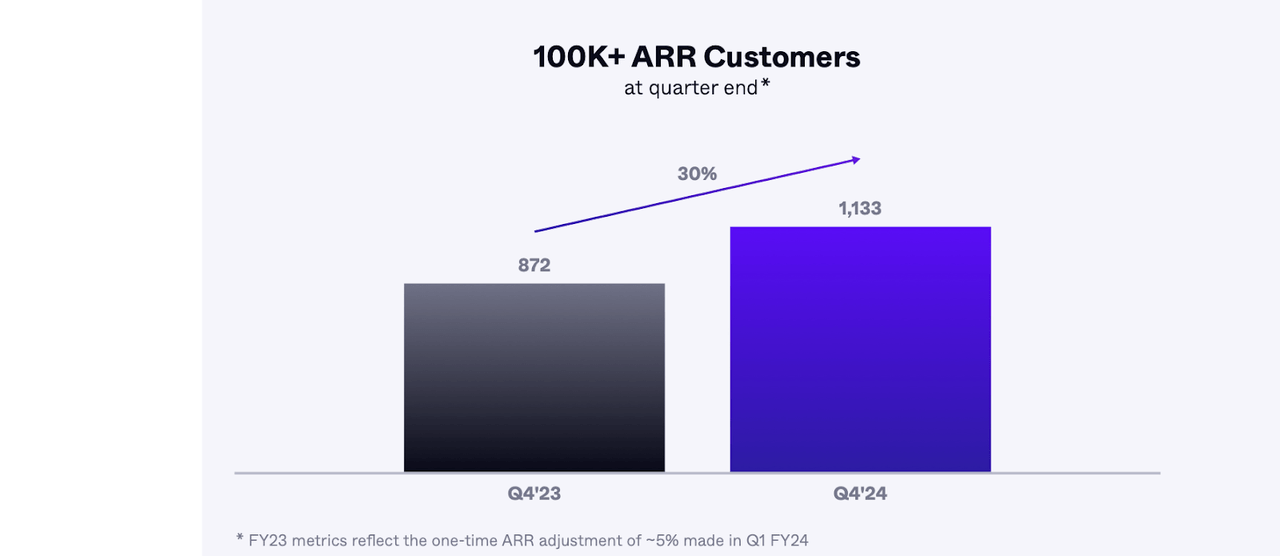

The company posted solid growth in large customers though the growth rate has moderated to the 30% level, down from 60% just several quarters ago.

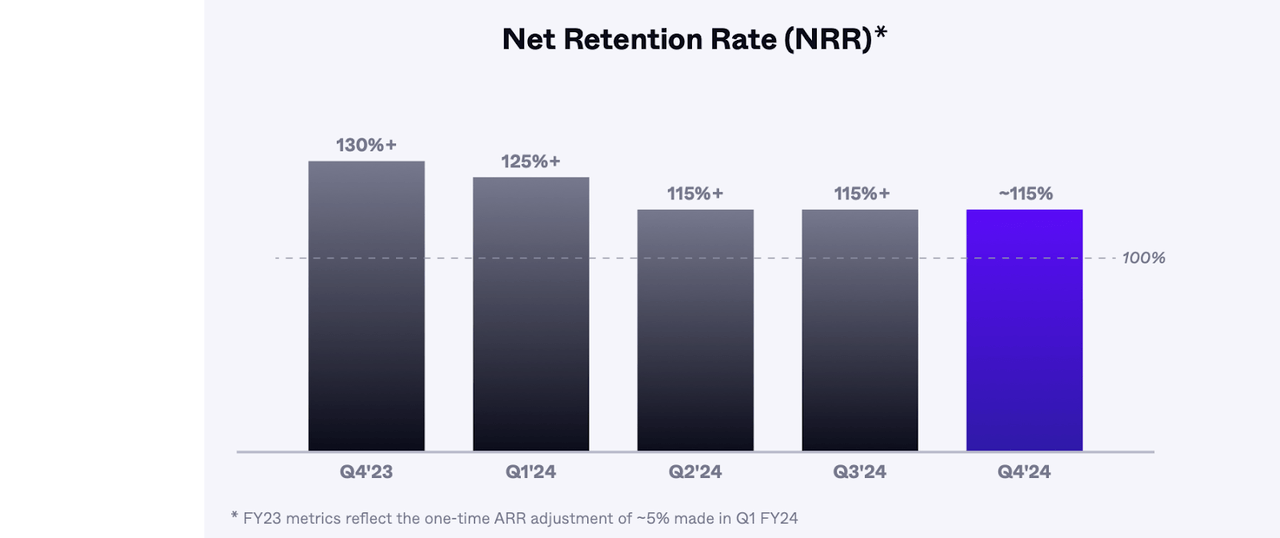

The company has also seen its dollar-based net retention rate slow down as well, though the 115% figure is still impressive given that this is an environment with increased scrutiny on IT expenses.

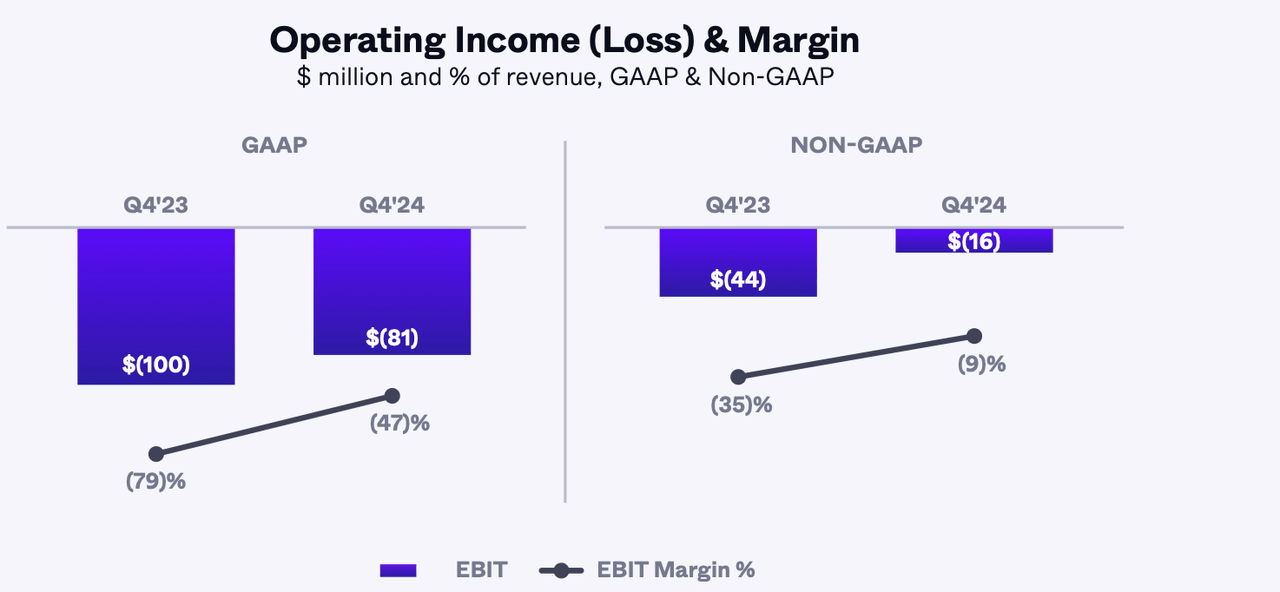

SentinelOne remains unprofitable even on a non-GAAP basis, but, like many tech peers, the company has shown an increased commitment to boosting profitability given the higher interest rate environment. S saw its non-GAAP operating margin loss improve 2,600 bps to 9%, beating guidance of 14%.

S ended the quarter with $1.1 billion of cash versus no debt. I view the company’s financial position as being quite strong given the modest cash burn and ample cash position. I note that the company spent $115 million on its acquisitions of PingSafe and Stride which should show up next quarter.

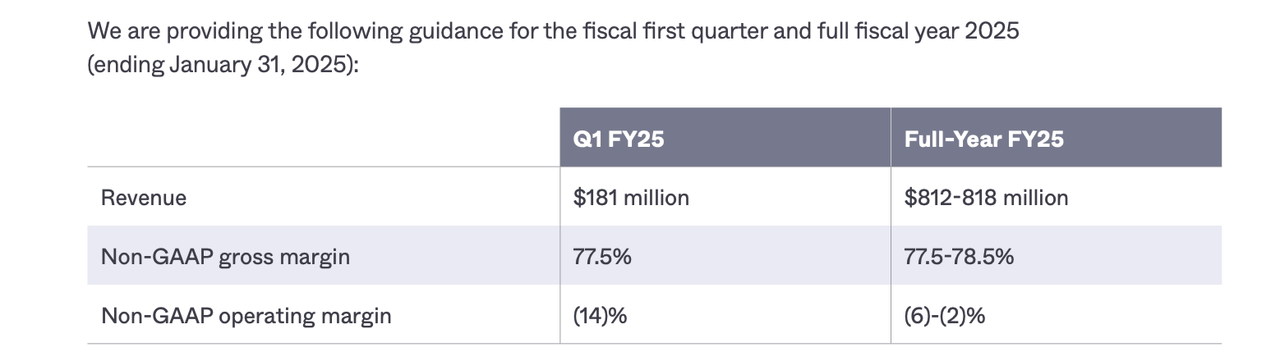

Looking ahead, management has guided for the first quarter to see 35.7% YoY revenue growth to $181 million, and for the full year to see up to 31.7% YoY revenue growth to $818 million (consensus estimates call for $817 million). Management expects the non-GAAP operating margin loss to improve from 19% to 4% at the midpoint.

On the conference call, management described the guidance as being “prudent” but not one that allows for “massive beat and raise quarters.” Management did note that the PingSafe and Stride acquisitions are expected to have a “de minimis impact” on first quarter revenues and that they expect to sell PingSafe’s cloud-native application protection platform (‘CNAPP’) product by the third quarter. The PingSafe acquisition in theory should help bolster SentinelOne’s product offerings to be more complete. But it is notable that this is more like an “acqui-hire,” as the PingSafe co-founder and CEO Anand Prakash is famous for being a top 5 whitehacker in the world.

Management reiterated expectations to achieve positive free cash flow generation and non-GAAP operating income by the end of this year. This would be an important milestone as I view the poor profitability metrics as being one of the drivers of the huge relative discount to cybersecurity peers on a growth-adjusted basis. Management stated their belief that “a platform is only as good as the sum of its parts,” in an apparent dig at CRWD which has found great success in having a wide product portfolio of at least “very good” quality (that latter point may obviously be the opinion of SentinelOne). My personal take is that customers probably can not (or more accurately, do not care to) differentiate between slight differences in product quality and may continue to prefer operators with a wider platform offering, but it is promising to see SentinelOne continuing to execute despite still being mainly a “point product” company.

Is SentinelOne Stock A Buy, Sell, or Hold?

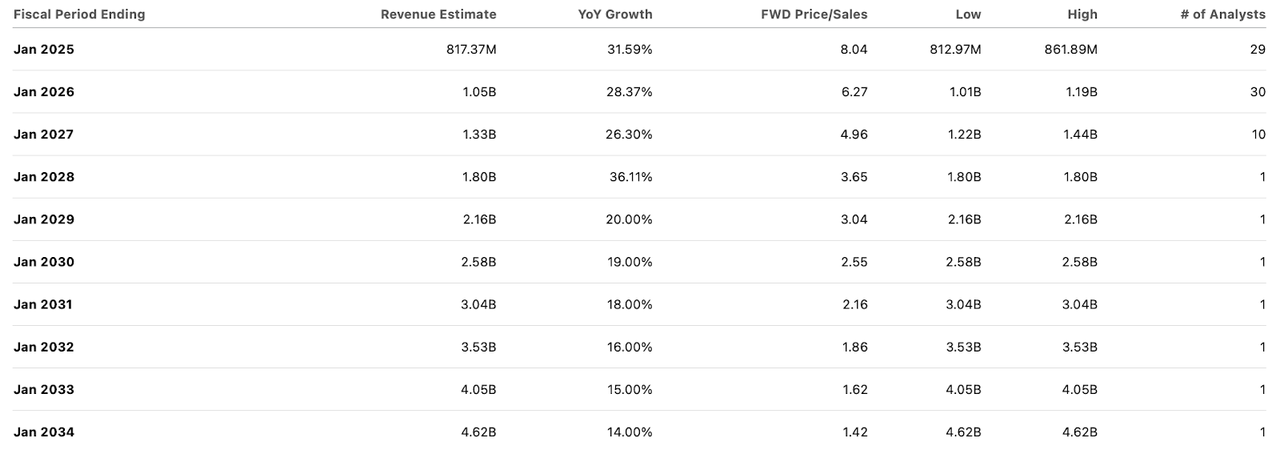

Cybersecurity stocks tend to trade at a relative premium to tech peers, though SentinelOne appears to trade at some discount to its cybersecurity peers. The stock traded at 8x this year’s sales estimates, despite consensus estimates projecting near-30s growth over the coming years. In contrast, CRWD trades at 19x sales with a similar projected top-line growth profile, and names like Palo Alto Networks, Inc. (PANW) trade at around 11x sales despite having around half the projected forward growth rate.

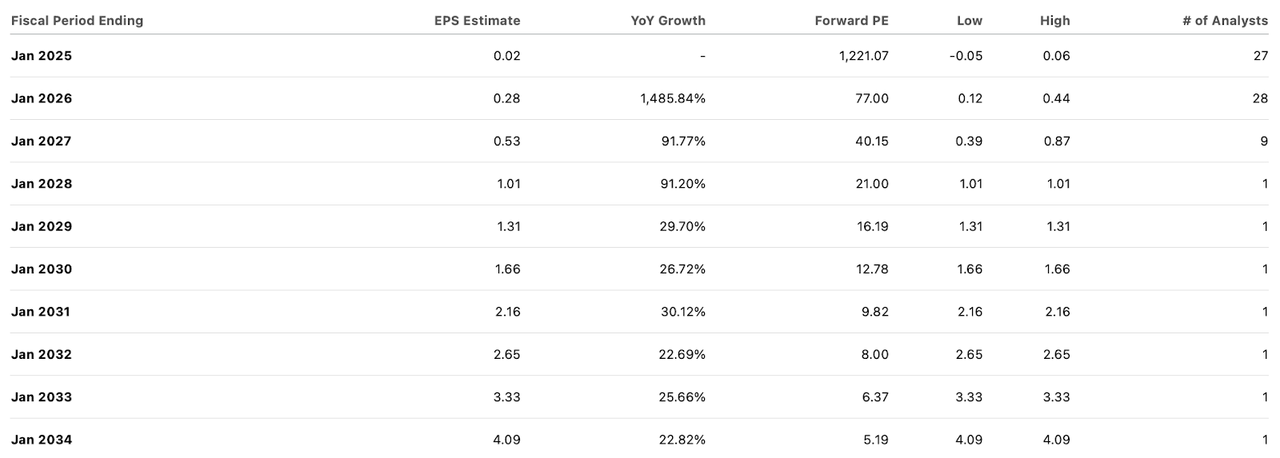

I see two drivers of the relative discount. First, SentinelOne is not yet quite a platform company and thus investors may perceive greater business model risk. Second, SentinelOne is not as profitable as cybersecurity peers which in general are profitable on a non-GAAP basis and even on a GAAP basis. Consensus estimates call for operating leverage to eventually take hold with SentinelOne eventually generating real cash over the coming years.

Consensus revenue estimates look quite achievable for the company to my naive eye. I can see the company sustaining at least 25% long-term net margins. A 25x earnings multiple would place the stock at a 6.3x sales multiple, which implies a 2034 stock price of around $95 per share. That implies around 17% annual return potential over the next 9.5 years. There may be even more upside if SentinelOne can trade in the 10x to 12x sales multiples that its peers currently trade at.

SentinelOne Stock Risks

SentinelOne is not currently profitable, and the ongoing operating losses may drag on the projected return profile. I am of the view that the net cash on the balance sheet helps to greatly offset those losses, but the fact remains that the company is not yet profitable even on a non-GAAP basis. SentinelOne is currently growing rapidly, but it is possible that there is a tipping point at which names like CRWD or MSFT are able to take market share at an accelerated pace due to their platform offerings. Perhaps customers suddenly begin preferring to consolidate their cybersecurity and IT spending, a scenario which would hurt point product companies like SentinelOne. The stock will likely face greater volatility due to the lack of profitability, a risk that remains worth mentioning given that the 2022 tech crash was still only a few years in the past.

SentinelOne Stock Conclusion

SentinelOne is one of the fastest-growing companies in the tech sector and market overall. The company is not yet profitable, but is projected to reach non-GAAP operating profitability by the end of this year. The company has over $1 billion in net cash and trades at reasonable valuations. I am upgrading the stock to buy as a higher risk – higher reward opportunity in the cybersecurity sector.