SoundHound AI: Should Investors Buy This Artificial Intelligence (AI) Stock After 160% Gains?

SoundHound AI’s latest results have given the company’s stock price a shot in the arm.

SoundHound AI (SOUN -3.95%) stock has witnessed a roller-coaster ride on the market so far this year, gaining terrific momentum in February after it was revealed that Nvidia has a small stake in the company that’s known for providing artificial intelligence (AI)-powered voice solutions.

However, things soon started going south. Shares of the company are down 38% since hitting a 52-week high in mid-March. SoundHound AI stock has lost ground over the past couple of months thanks to weaker-than-expected earnings and a stock sale that wasn’t received well by investors.

Even so, shares of the company are up an impressive 160% so far in 2024. What’s more, SoundHound’s roller-coaster ride witnessed another upswing after the company released first-quarter results on May 9.

Let’s see why Wall Street cheered SoundHound’s latest earnings report and check if investors should be buying the stock now in anticipation of more gains.

Delivering impressive growth once again

SoundHound AI is a small company with a market capitalization of $1.8 billion. It went public just over two years ago after merging with a special purpose acquisition company (SPAC). SoundHound currently has a very small revenue base and is operating in the fast-growing voice AI market. This explains why its top line has been growing rapidly.

SOUN Revenue (TTM) data by YCharts

This trend of fast growth continued in the first quarter as well. SoundHound’s revenue shot up 73% year over year to $11.6 million, beating the consensus estimate of $10.1 million. Its non-GAAP (generally accepted accounting principles) net loss per share fell by a penny to $0.07 per share and was smaller than the Wall Street estimate of a loss of $0.09 per share.

The company has also increased the midpoint of its full-year revenue guidance to $71 million from the earlier estimate of $70 million. The upgraded guidance suggests that SoundHound’s top line could jump nearly 55% from last year, which would be an improvement over the 47% revenue growth the company clocked in 2023.

Another metric to note is that SoundHound AI reported an impressive 80% year-over-year increase in its cumulative subscriptions and bookings backlog to $682 million. The bookings backlog is the amount of money SoundHound AI expects to receive from “committed customer contracts,” while the subscriptions backlog is the “potential revenue achievable for the company with current customers where the company is the leading or exclusive provider.”

SoundHound AI, therefore, seems to have a solid revenue pipeline. However, the cumulative subscriptions backlog assumes that its existing customers ramp up the implementation of its offerings over a four-year period. The metric also assumes “a successful full rollout of our technologies over a total five-year duration.” So, while SoundHound’s revenue pipeline seems solid at first, a part of it assumes that its existing customers will continue to use its services for a long time.

That’s why investors may consider taking its backlog with a grain of salt. However, the good news is that SoundHound AI’s AI voice solutions are being deployed by restaurants to upgrade their ordering systems, and the company is also gaining traction in the automotive market, where Stellantis is integrating its generative AI-powered voice assistant. SoundHound AI claims that a few electric vehicle (EV) manufacturers will start deploying its software and voice assistants later this year.

In all, there seems to be a strong case for SoundHound AI to continue growing at a nice clip, especially considering that the AI voice and speech recognition market was worth $27 billion last year, and it could grow at an annual rate of 17% over the next five years.

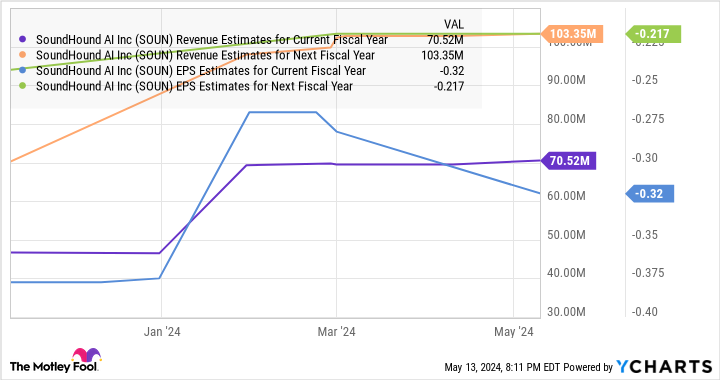

As SoundHound AI currently has a very small revenue base and a huge addressable market, it is easy to see why analysts are expecting the company’s top line to jump nicely next year, along with a reduction in its losses.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts

But is the stock worth buying?

We have already seen that SoundHound AI stock has shot up 160% this year despite the volatility it has experienced on the market. That’s the reason why it is currently trading at 25 times sales, which is double the company’s sales multiple at the end of 2023. Moreover, SoundHound is trading at a hefty premium to the U.S. Technology Sector’s price-to-sales ratio of 7.1 as well.

SoundHound needs to keep growing at a phenomenal pace to justify that valuation. We have already seen that the stock witnessed a big sell-off when it missed estimates earlier this year, and something similar in the future could trigger another plunge. That’s why conservative investors would do well to look at other AI stocks trading at cheaper valuations.

However, growth-oriented investors with bigger risk appetites could be attracted to SoundHound AI, considering its impressive growth, as well as the fact that the stock’s median 12-month price target of $7 points toward a 27% jump from current levels. But they should also be prepared for volatility, as SoundHound’s stock price action this year suggests that it is prone to big swings.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.