Navigating the shift towards quality in China’s electric vehicle market

Understanding China’s evolving EV market

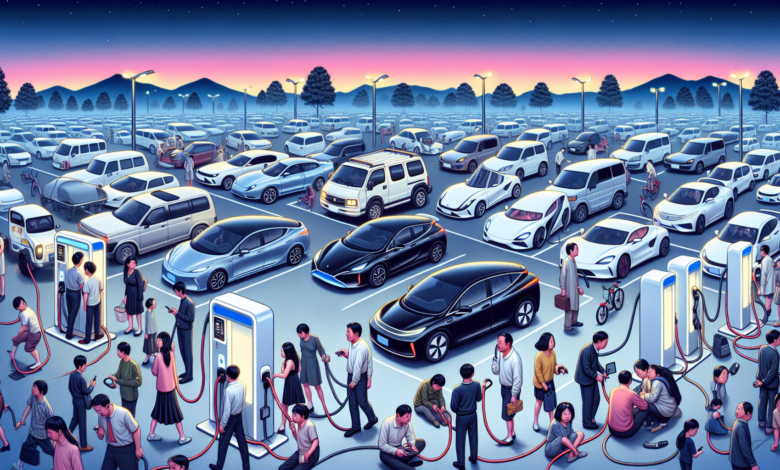

China’s Electric Vehicle (EV) market is without question one of the most substantial and fastest-growing globally. The country’s emphasis on building a clean and modern transportation infrastructure has spurred the proliferation of electric vehicles, shaping not just the auto industry but also the country’s broader socio-economic landscape.

However, recent market trends suggest a fascinating shift. Consumers in China are no longer focusing solely on lower prices, but more on quality and brand reputation. This shift reflects the maturation of the market and the increased sophistication of Chinese EV consumers, highlighting opportunities for manufacturers committed to the production of high-quality vehicles.

Opting for quality over price

For years, Chinese EV consumers bought electric vehicles primarily for their low costs, supported by substantial government subsidies. But as the government gradually scales back these subsidies, consumers have begun to prioritize better performing and better designed electric vehicles. They’re more conscious of owning a vehicle that is not just beneficial to the environment but is also of high quality, reliable and stylish.

Stocks to watch in China’s EV market

As the trends shift, several companies stand to benefit. Firstly, established manufacturers like Tesla and NIO, known for their quality and high performance, could see increased demand. In addition, smaller local manufacturers with a strong focus on quality and performance may find their moment to shine.

Several key points should be noted for these companies as potential investment opportunities. Firstly, emerging trends denote a trajectory of sustained growth for the quality-conscious market segment. Secondly, the commitment of the Chinese government to building a green economy supports these businesses. The growth of charging infrastructure will also play a critical role. Choosing the right investment requires careful observation of these factors, along with the company’s profitability, product roadmap and competitive environment.

Investing in EV market stocks can be a wise decision if done right. Always remember to diversify your portfolio to mitigate risk and don’t forget to factor in your investment goals and risk tolerance. No matter how promising a stock seems, it’s always important to do extensive research before investing your hard-earned money.

Notably, the evolution of the Chinese EV market presents not only an opportunity for investors but also a lesson: that markets evolve and consumer needs change. As investors, staying on top of such shifts allows us to adapt our strategies in response and, ultimately, better secure our financial futures.

The Chinese EV market’s shift towards high-quality vehicles offers an exciting time for investors, as it signifies the maturing of the market and opens up multiple avenues for new and potentially profitable investment paths. The shifting trend may bring about higher volatility and risks in the short term, but it also promises long-term growth and gains for investors diligent in choosing the right stocks.

William Crowler is a finance writer with a keen eye for the stock market, investment strategies, and personal finance management. At 35 years old, William’s blend of professional experience and academic background, including a Bachelor’s degree in Finance from a reputable university, has equipped him with the insights and knowledge to guide his readers through the complexities of the financial world.

Before transitioning into writing, William worked as a financial analyst for a mid-sized investment firm, where he honed his skills in market analysis and investment portfolio management. This practical experience has been invaluable in his writing career, allowing him to offer actionable advice and predictions that resonate with both seasoned investors and those new to the world of finance.

As a regular contributor to a leading online finance news outlet, William covers a wide range of topics, from emerging market trends to tips for budgeting and saving. His articles are celebrated for their clarity, depth, and relevance, helping readers navigate the often-intimidating realm of finance with confidence.

William is particularly passionate about demystifying the stock market for his audience, breaking down complex financial instruments and strategies into understandable concepts. His series on investment fundamentals and market analysis techniques are reader favorites, praised for their informative and empowering content.

Beyond his written work, William is also a frequent speaker at financial seminars and webinars, where he shares his expertise on financial literacy and investment strategies. His approachable manner and ability to translate financial jargon into plain language have made him a trusted figure in the finance community.

Through his writing and speaking engagements, William aims to inspire a more financially savvy public, equipped with the knowledge to make informed decisions and achieve their financial goals.