Dell Technologies: The Generative AI Market Should Support Growth

Michael Vi

Investment Thesis

Dell Technologies (NYSE:DELL) may be undervalued, given a perceived disconnect in the expectations of future free cash flow growth and the company’s consensus revenue and profit growth. Additionally, the markets that Dell does business in are either growing rapidly or are near a bottom in their cycle. Combined, these factors may make Dell a great investment opportunity by way of free cash flow growth and/or the stock gaining a premium P/FCF multiple reserved for a moderate-growth AI company.

Analysts have been revising the growth outlook for Dell upwards in recent months. However, growth in free cash flows may be underestimated. When I analyze the potential free cash flow growth for Dell, I see a potential disconnect between the stock’s current valuation and the opportunity that Dell has in the generative AI market. This could provide an opportunity for investors. I have laid out two paths for Dell to achieve market-beating returns for shareholders potentially. In the first scenario, I laid out a path for Dell to be valued more like an AI stock and less like a traditional PC and server supplier stock. In the second scenario, I estimated potential growth in Dell’s end markets and laid out Dell’s path to growing free cash flows at a high enough rate to deliver great returns.

The Business

Dell offers products and services for enterprises, businesses, and consumers. It operates in two segments, Infrastructure Solutions Group (ISG), and Client Solutions Group (CSG).

ISG offers servers, networking and storage solutions geared towards enterprises. Artificial intelligence (AI), and machine learning (ML) are currently front-and-center within the group and represent emerging opportunities for the company.

CSG is geared to both commercial and consumer users, and includes PCs, laptops, workstations, and accessories for these products, as well as software and services.

Full disclosure, I’m not an expert in this field, but knowing that Dell (as a business) is a market leader in its operating segments and that it appears to be ready to ride the AI wave higher, I’m most interested in determining if the company has a large enough market to enable the stock to outperform the S&P 500 and to offer an outsized risk/reward profile skewed towards greater potential rewards.

Let me take you through my process. First, I want to understand the company’s opportunity.

The AI Opportunity

During the Q4 earnings call in February, CEO Jeff Clarke and CFO Yvonne McGill discussed Dell’s potential in the AI market. After first outlining Dell’s near-term outlook, they went on to lay out the possibilities for the future.

McGill said she expects CSG and ISG to grow a combined 8% YoY at the midpoint, with total revenue at 5% growth. ISG revenue is expected to, “grow in the teens driven by traditional and AI services”. CSG is expected to decline until H2 of fiscal 2025, before increasing. Importantly, Dell reported that AI-optimized server deliveries increased 40% sequentially (not year-over-year) to $800 million, which only represents 3.8% of combined CSG and ISG revenue. Its backlog nearly doubled between Q3 and Q4 to $2.9 billion. Dell expects to ship more AI-optimized servers in Q1, according to Jeff Clarke.

Beyond the short term, Dell has an incredible opportunity to shift from a slow-growth company known for hardware into a faster-growing AI company, with its ecosystem is a valuable commodity as generative AI shifts from predominant hyperscaler adoption into a phase of enterprise and commercial adoption. This is where Dell excels. In the CEO’s opening remarks during the Q4 call, he said that Dell has:

just started to touch the AI opportunities ahead of us, including broader adoption of AI by enterprise customers and the projected growth in unstructured data where we are well-positioned with industry-leading storage solutions.”

When describing the opportunity that lies ahead for Dell’s AI ambitions, McGill and Clarke made these comments that I think are very telling:

On the topic of the AI opportunity, McGill said,

as we move more and more into the enterprise and get more richly configured, more services, etcetera, attached to that.”

To which Clarke added:

That’s the path. There’s storage, deployment services, pro support, our consulting services, networking, so in the entire basket of the solution.”

My takeaway from this exchange is that Dell has many different levers to pull in the generative AI buildout, and some of these, such as services and the refreshing of servers and continued need for storage, should persist, with continuous revenue opportunities, both repeat in nature and recurring in nature.

Later, Clarke stated again that Dell has many opportunities:

I need to mention we got a storage opportunity in there, that we have a networking opportunity in there, and we have a services opportunity in there and to go for the last of the bunch of financing opportunities. So those, how could you not be excited about that given the demand environment?”

Further adding to the AI hopes for Dell, Citi announced its bullish view on Dell’s potential to gain share in the AI market, and raised its price target from $125 to $170. According to the news, Citi said:

currently models about $2.50+ in earnings power by CY26 (about 25% total EPS contribution) on AI-related revenues, though it noted that upside scenario could be much higher.”

The potential is there for Dell, and the second phase of AI adoption is only beginning as Enterprises begin to build out their AI platforms. The question then becomes, will Dell end up revising estimates higher, as many other AI companies have? Well, this week we learned more about Dell’s ecosystem as it seeks to strike a mutually beneficial partnership with Nvidia (NVDA) to build AI Factories.

Developments at Dell’s World Conference

On Monday, at the Dell Technologies World Conference in Las Vegas, the company made several announcements, such as introducing a comprehensive portfolio of Copilot+ AI PCs, expanding its AI Factory in partnership with Nvidia, unveiling its Dell PowerStore advancements, and offering new Blackwell GPUs.

The integration of Dell’s AI products and Nvidia’s Enterprise software platform could be a catalyst for growth, particularly if enterprise AI adoption increases as Dell expects it to. Bolstering its portfolio of AI products should position Dell to maintain pace in the AI verticals in which it serves its customers.

For coverage of the Dell Technologies World Conference, I recommend reading Bob O’Donnell’s article. For a deeper dive into Dell’s technical prowess and AI market-leading potential, I recommend you read the analysis by Khaveen Investments.

In this article, I will examine the possible market opportunities for Dell to grow and estimate how much the AI market can influence the growth potential for Dell.

Reverse DCF

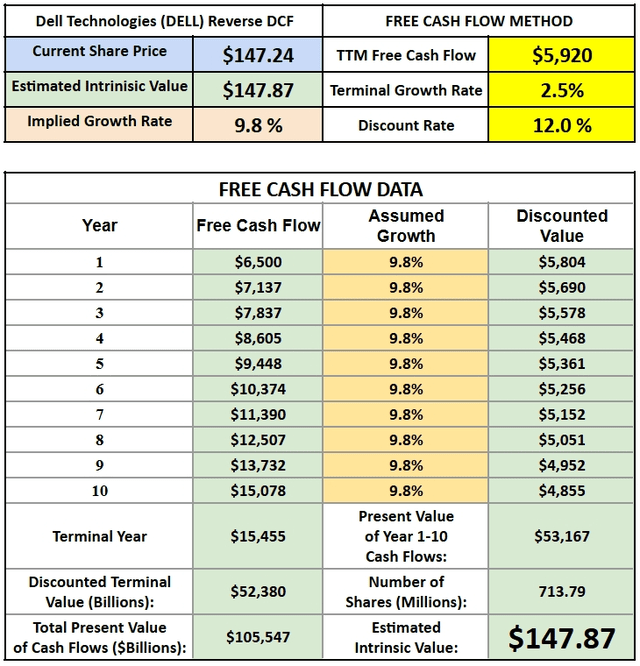

The next step in my analysis process is to use a reverse DCF to determine what kind of growth assumptions might be baked into the current stock price. In the case of Dell this works out to a 9.8% free cash flow CAGR over ten years.

Reverse DCF (price at market close on 5/22/2024) (Author-generated reverse DCF)

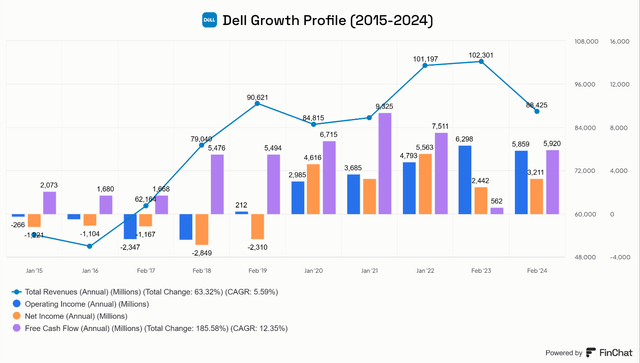

From here, I try to determine how reasonable this growth rate is. Past results show us that Dell can grow FCF significantly greater than revenue. The company grew free cash flow at a CAGR of 12.4% between 2015 and 2024 while revenue grew at just 5.6%. But future growth is all that matters, and FCF can be lumpy.

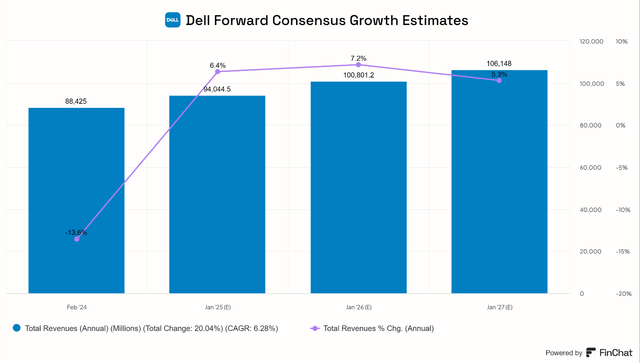

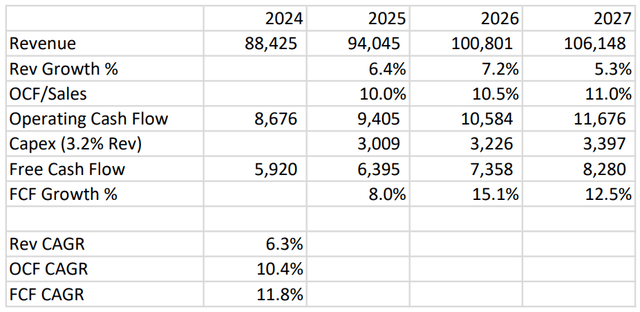

My next step is to see what the professionals have to say. I checked in to determine Dell’s consensus growth estimates for fiscal 2025-2027.

Something funny happened while writing this article, Dell’s consensus forward revenue growth estimates were updated between the time I made my first chart and the time I recreated the chart for clarity. Analysts expected revenue to grow at a 5.8% CAGR over the next three years, but this was updated to a 6.3% 3-year CAGR after fiscal 2027 revenue estimates were increased from $104 billion to $106.1 billion.

Dell Forward Revenue Growth – Analyst Consensus (www.FinChat.io)

Future Free Cash Flow Growth Appears Disconnected From Reality

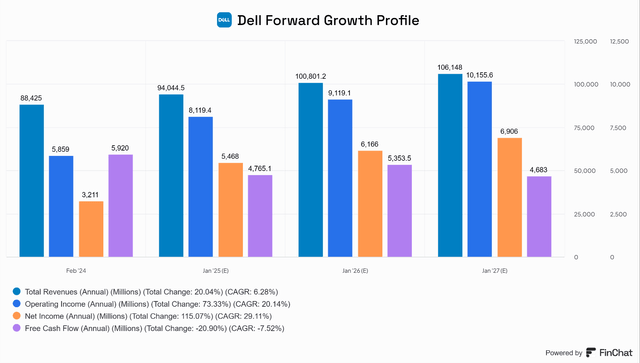

Below are forward estimates for Dell’s operating income, net income, and free cash flow. Curiously, analysts’ consensus estimates give Dell the benefits of its operating leverage for operating and net income but not for free cash flow.

Dell’s Consensus outlook lacks FCF growth (Dell forward Growth Estimates)

The forward estimates for free cash flow growth (negative 7.5% CAGR) appear to be rather low for the company. Common sense would tell us that free cash flow should grow faster than revenue when the outlook improves. At first glance, it appears that there is a disconnect between the amount of revenue growth, profit growth, and FCF growth one would expect in a company with any amount of operating leverage.

I will attempt to project a reasonable FCF growth rate given the estimated top-line growth for the company.

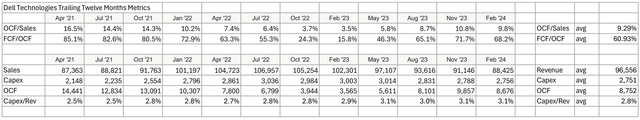

Normalizing Free Cash Flow

To estimate FCF growth potential, I’ve run a simple model incorporating some trailing metrics for the company. Dell’s average OCF/Sales ratio of 9.3% could improve to over 10.0% as it returns to revenue growth. I modeled a 10.0% OCF Margin in 2025, rising to 11.0% in 2027. This margin would be below its OCF margin from the TTM periods during the April to October period of 2021, as seen below. This appears to be a reasonable assumption. Dell’s Capex margin has risen consistently but not significantly over the last year. I am modeling a 3.2% ratio of capex-to-sales. Capex may rise as an absolute figure, but with increased revenues, Dell could maintain a capex margin in the low-3% range.

Dell Free Cash Flow Normalization Table (Author-generated table with data from SEC filings)

Using our consensus analyst’s revenue growth rates and my assumptions to determine free cash flow, we see that Dell could grow OCF at a 10.4% CAGR, and FCF at an 11.8% CAGR over three years.

Free Cash Flow Projection (Author-generated table)

Considering that our reverse DCF hurdle rate for the stock was 9.8% FCF growth, Dell could be undervalued. If the company can generate this kind of free cash flow growth and maintain it for the next ten years, the stock could be quite a bargain at the current price.

Now, we need to determine the likelihood of this happening. What are Dell’s drivers for growth, and what are the keys to Dell as a market-beating investment idea? This is all that matters to me.

Scenario Number One – Better Growth and Multiple Expansion

AI Investing Opportunity At A Reasonable Price

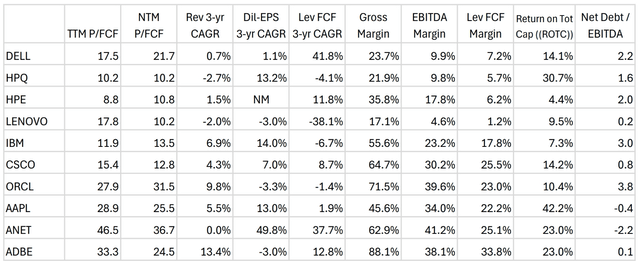

Dell trades at lower valuation multiples compared with higher-growth companies with either more exposure to AI products or with higher margins and growth profiles. The company has plenty of room to capture AI revenues in the years ahead, but will have to improve its growth outlook in order to justify a multiple expansion. Part of my thesis is that Dell could deserve multiple expansion if its ambitions in building out its AI Factory come to fruition.

Dell currently holds a trailing P/FCF ratio of 17.5x, and a forward multiple of 21.7x. With a greater FCF margin, Dell justifies its greater P/FCF multiples than HPQ, HPE, and Lenovo. Dell’s superior trailing FCF growth justifies a greater multiple than IBM and CSCO.

Further down the list are companies with greater growth profiles and margins, operating in different segments. We shouldn’t expect Dell to command a multiple as high as ANET and ADBE, but attaining something closer to AAPL’s or ORCL’s P/FCF multiple could happen if Dell is able to grab AI market share and maintain or expand its share in its more traditional server and consumer markets.

Dell Valuation Comparison with Hardware and Software Companies (P/FCF data from FinChat, Valuation Multiples from Seeking Alpha)

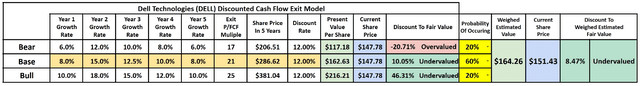

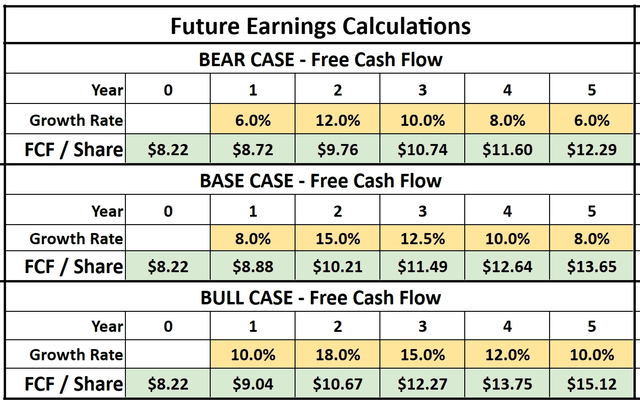

If the AI Factory takes off, and Dell is able to grow FCF in the double digits, the market may grant an expansion in valuation to Dell. Let’s assume that higher growth leads to an expansion of P/FCF to 21x for our base case. Using a trailing twelve-month FCF of $5.92 billion and a discount rate of 12.0%, we can model what the stock might trade at with a multiple expansion under different scenarios. In the base case scenario, I have taken our estimated FCF growth rates calculated from analysts’ top-line projections for the next three years (seen earlier). Then I’ve modeled a reduction in growth to 10.0% in year 4, and 8.0% in year 5. The Bear and Bull cases are reduced or expanded as shown, with the bear case factoring in a 17x P/FCF exit multiple, the base case a 21x multiple, and the bull case a 25x multiple.

Dell DCF with Exit Multiple (Author-Generated DCF Model) Dell DCF Calculations with Exit Multiple (Author-Generated DCF Model)

In this case, Dell could be undervalued by 8.5% as of market close on May 22, 2024.

Scenario Number Two – End Markets Drive Free Cash Flow Inflection

Sector Performance Dictates Company Performance

Empirical research has shown that the performance of individual companies is heavily influenced by its sector performance. When a market-leading business is in a sector that is expected to perform very well, it should be expected that the business will also perform very well. Dell holds leading market share positions in the verticals in which it does business. With its scale advantages and its focus on enterprises in need of technological advancement, including artificial intelligence infrastructure and data storage, and now its expanded partnership with Nvidia, Dell looks like a stock to watch or potentially invest in.

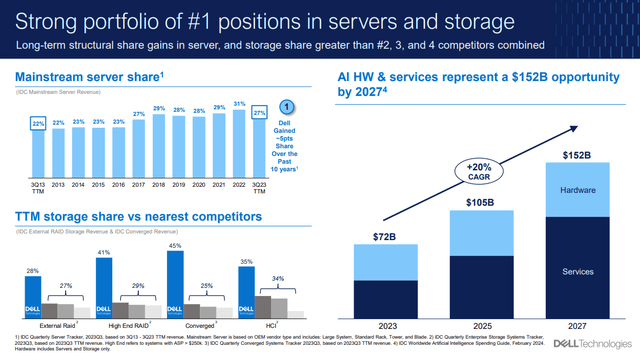

High Growth AI Products And Services Market

Dell’s ISG end markets are primed for high growth for the foreseeable future. The AI hardware and services market is currently projected to grow at a 20% CAGR, but this continues to be revised up by IDC.

Dell Market CAGR (Dell Q4 Earnings Presentation)

Running a scan of various market growth estimates for the segments that Dell operates in shows that Dell has plenty of opportunities to accelerate revenue growth as the market growth for AI infrastructure and services accelerates and continues to grow for traditional servers, networking, and data storage.

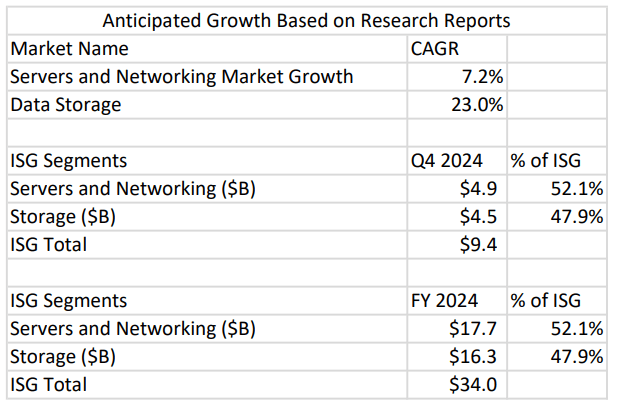

If we aggregate and average the data above, we get a potential CAGR of 7.2% for Servers and Networking market growth (using lines 1-6 in the table above). I will use the average of the next two lines to estimate growth in Dell’s addressable market for Data Storage, which amounts to a 23.0% CAGR.

Servers and Networking revenue was $4.9 billion in Q4 and $17.7 billion for the full year. Storage revenue was $4.5 billion in Q4 and $16.2 billion for the full year. In both Q4 2024 and FY 2024, Servers and Networking amounted to 52.1% of ISG revenue and Storage amounted to 47.9% of revenue.

Dell Market and Revenue Projections (Author-Generated Chart with aggregated market growth data)

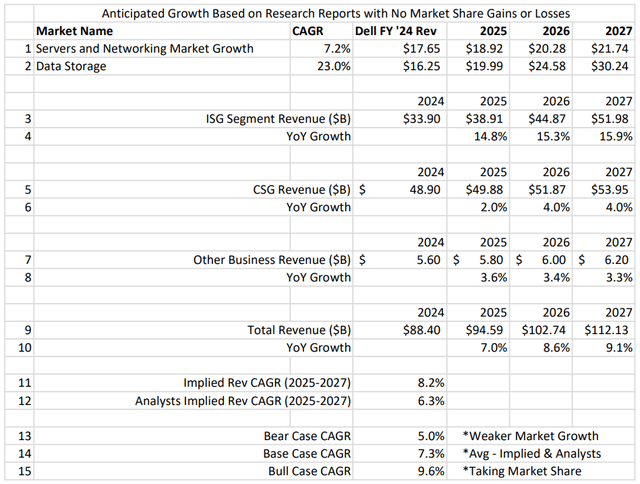

Applying my projected market growth to Dell’s ISG segments, in the table below, gets us the following revenue figures for the years 2025 (current fiscal year) through 2027 (lines 1 & 2). With these assumptions, total ISG revenue would grow 14.8%, 15.3%, and 15.9% in the years 2025-2027 (lines 3 & 4).

Using management’s guidance of improving CSG growth in H2 and past track records from financial statements, I have modeled a 2.0% CSG growth rate for 2025, then 4.0% for 2026 and 2027 (lines 5 & 6). Other business revenue is a separate figure that includes Dell Financial Services and its APEX offering, I ballparked an amount that is represents mid-3% growth YoY (lines 7 & 8).

Based on these assumptions, total revenue growth (lines 9 & 10) would equate to a 3-year CAGR of 8.2% (line 11). Given that analysts have implied a lower CAGR of 6.3%, I will split this difference and factor a 7.3% revenue CAGR for my base case. In case the market growth is weaker than anticipated or Dell loses market share, I will reduce the revenue CAGR to 5.0% for my bear case, which is 2.3% less than the base case. For my bull case, I will add that same 2.3% to make it a 9.6% revenue CAGR. My bull case assumes that Dell takes market share and its end markets grow as presumed.

Dell Revenue Growth Projections (Author-Generated Chart with aggregated market growth data)

Given operating leverage, I will assume that free cash flow grows at a higher rate than revenue (shown in the table I have created below).

|

Rev CAGR |

FCF CAGR |

|

|

Bear Case CAGR |

5.0% |

8% |

|

Base Case CAGR |

7.3% |

13% |

|

Bull Case CAGR |

9.6% |

18% |

Long-Term Debt Is A Risk

The FCF growth looks good to me, but a main risk to any investment thesis in Dell lies in the significant amount of long-term debt the company has. This creates concern about discounting free cash flows without adjusting for debt.

According to the 10-K, during 2024 Dell paid down $3.1 billion of its core net debt, leaving $14.9 billion in core net debt on its balance sheet. It’s important to understand that Dell has some debt associated with its financial services, which is not included in its core net debt figure. The company reached its core leverage ratio of 1.5x in doing so. Dell returned over $7 billion to shareholders by way of increasing its annual dividend by 20%, paying down debt and repurchasing roughly $2.1 billion of its own shares over the last twelve months. I expect debt repayments to continue, which will improve enterprise value-based valuation ratios. Some of its FCF will be devoted to paying down the remainder or part of its long-term debt.

In the DCF model below, I factor in a reduction of FCF (debt prepayment) to paint a more complete picture of potential returns for shareholders.

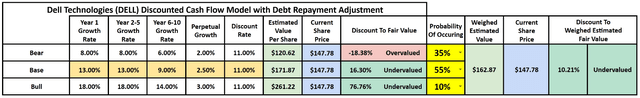

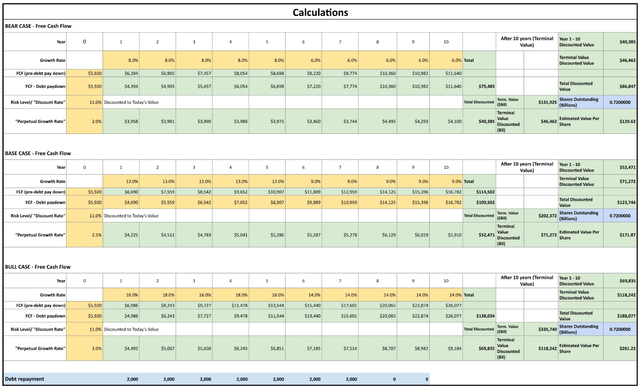

Debt-Adjusted Discounted Cash Flow Model

To better model Dell’s effective intrinsic valuation using a DCF, I adjusted for this significant amount of debt on its balance sheet by reducing the FCF for each of the first seven years by $2.0 billion in debt repayments. For my base case, I use the base FCF growth assumption outlined above for years 1-5, a reduction in growth in years 6-10, a 2.5% terminal rate thereafter, and an 11.0% discount rate. You can see the adjustments for my bear and bull cases and the associated weight given to each scenario below.

Dell DCF with Debt Prepayment Reductions (Author-Generated DCF) Dell DCF Calculations (Author-Generated DCF Calculations)

If we value Dell based on this model, it could be undervalued by roughly 10.2%, given the stock price at market close on May 22, 2024.

Risks

In addition to debt being a risk for Dell, the main risk is its valuation being stretched and AI revenue either taking longer to ramp up or it falling flatter than expected. In this case, we could see Dell begin to trade more in line with its pre-AI hype valuation. That might cause the stock to drop significantly. However, that seems hard to imagine at this point given the expectations for recovery in the PC market and the partnerships it has developed in the generative AI space.

Perhaps the biggest risk for investors will be chasing the stock if it pops following its own or Nvidia’s earnings. At the time of finishing writing this, Dell appears to be up around 5% after hours, following Nvidia’s blow-out report on May 22 nd. I caution investors to view Dell as a more moderate-growth AI company that is in the early stages of its potential AI cycle. The full hype may not have hit the stock yet, and might do so over the next twelve months, as the cycle shifts in its favor and towards enterprise spending in genAI. But, the stock has already more than tripled in the last year, so any disappointment in earnings could be met with heavy selling.

Conclusion

An investment in Dell right now requires a small leap of faith that the company will be able to increase its AI revenue contribution from the 3.8% it currently stands at. If Dell can simply maintain its market share in the segments it operates in, it should be able to grow into its valuation with ease.

Using an analytical approach to market potential and associated revenue and free cash flow growth potential, I have laid out two scenarios where Dell can be a great investment opportunity. 1) The FCF growth potential could be grossly misunderstood, and; 2) Dell could become more valued like an AI stock if the company can accelerate growth over the next few years. Though there are risks, I think Dell is as low-risk an AI play that I have looked at, with ample upside if the growth in AI surprises to the upside.

I rate Dell as a buy, but caution investors to monitor price action and be careful about chasing breakouts.