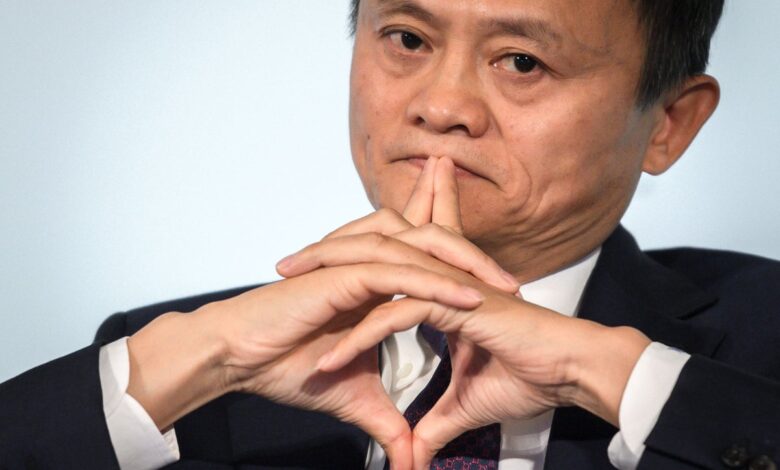

Billionaire Jack Ma-owned London fintech WorldFirst faces tribunal over harassment claim

AN employee of billionaire Jack Ma-owned WorldFirst is taking it to an industrial tribunal over claims of harassment and discrimination after the London fintech was contacted by the information regulator over issues with data practices, the Standard can reveal.

The manager in the HR department, who suffers from a physical disability, claims that the company was negligent in its duty of care towards her after details about her condition were inappropriately shared with other employees and third parties.

The six-figure legal claim marks the latest challenge facing Ma’s Ant Group, which acquired WorldFirst in 2019 in a deal thought to be worth more than $700 million (£550 million).

In July last year, Ant Group was fined around £800 million by the Chinese financial regulator after it was accused of violating rules on corporate governance, financial consumer protection, payment and settlement business as well as anti-money laundering obligations.

Since the Ant acquisition, WorldFirst, which turns over more than £100 million annually, has seen the exit of a string of senior UK leaders including its CEO, finance director, managing director, head of risk, chief information security officer, and group general counsel and compliance officer. Staff at Ant Financial have been among those brought in to replace them.

The fresh legal claim alleges that a Singapore-based senior manager at WorldFirst demanded that an employee continue to work while she was on leave to receive medical treatment, prompting a letter to the company from her doctor warning that the firm had “seemingly not been compliant with her legal right to sick leave… contacting her frequently during this period [which] caused her stress and mental health to deteriorate.”

Separately, staff in the Ant Group-owned company’s legal team admitted to screening her personal social media channels in an apparent bid to track her activity and whereabouts while she was away from the office. After complaining about the incident, WorldFirst told her: “The checking of publicly accessible data, for legitimate reasons during an investigation process, does not amount to harassing and intimidating behaviour.”

The employee also complained to the Information Commissioner’s Office over the company’s handling of her personal data.

In a letter seen by the Evening Standard, the ICO said: “It is our view that World First Ltd has infringed its data protection obligations.

“This is because a member of staff inappropriately disclosed personal information about you to other employees. This information was then further shared with other third parties, without your knowledge or consent.

“Organisations must ensure they have appropriate security measures in place to protect the data they hold… personal information breaches can adversely affect individuals’ rights and freedoms.”

The ICO said it had written to WorldFirst concerning its information rights practices. The employee told the Standard: “The behaviour of certain employees towards me during this difficult period has been severely distressing.

“I believe I have a duty to make anyone who’s contemplating joining this company aware of the challenges I have faced and the treatment I have received from Ant Group and WorldFirst. I hope I empower victims of discrimination to voice their rights.”

A date for a tribunal hearing has yet to be determined. WorldFirst declined to comment.

Last year the fintech began shifting its Asia business away from UK oversight in a major restructuring. WorldFirst Asia, a business unit which accounted for around two-thirds of the company’s revenues and 70% of its profits, has been transferred to an Asian subsidiary of billionaire Ma’s Ant Group. WorldFirst said it took the decision in January last year based on “the strategic alignment of the legal entities.”

WorldFirst’s accounts for 2022, prior to the WorldFirst Asia offload, show the fintech’s turnover near-doubled to £103.6 million, while pre-tax profits surged to £25 million, up from a £6.4 million loss in the prior year.